Molybdenum Market Size, Share, Trends and Forecast by Product Type, Sales Channel, End Use, and Region, 2025-2033

Molybdenum Market Size and Share:

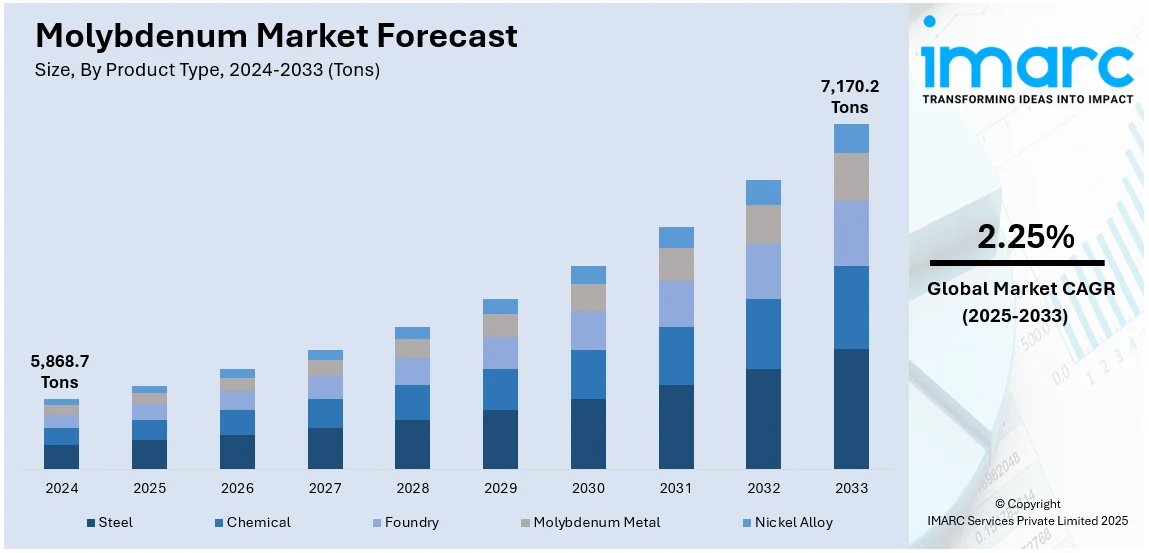

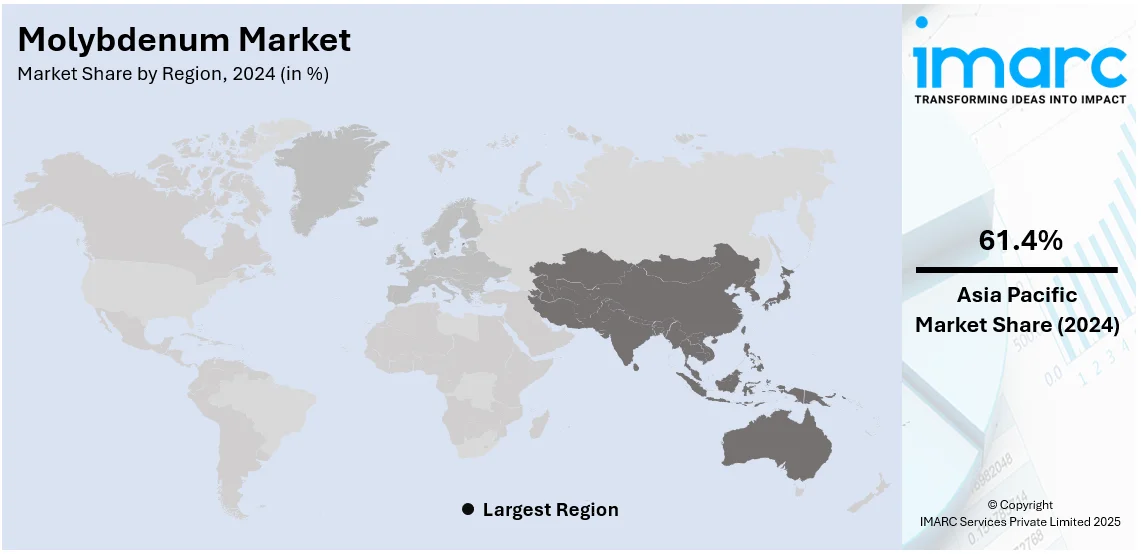

The global molybdenum market size was valued at 5,868.7 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 7,170.2 Tons by 2033, exhibiting a CAGR of 2.25% from 2025-2033. Asia Pacific currently dominates the molybdenum market share by holding over 61.4% in 2024. The market in the region is driven by the growing demand from the steel and alloy industries, increased adoption in electronics and energy sectors, ongoing technological advancements in production processes, and infrastructure development in emerging economies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

5,868.7 Tons |

|

Market Forecast in 2033

|

7,170.2 Tons |

| Market Growth Rate (2025-2033) | 2.25% |

The global molybdenum market growth is driven by the strong demand from the steel industry, particularly for high-strength, corrosion-resistant alloys. In addition, the increasing use of molybdenum in renewable energy (RE) technologies, such as solar panels and wind turbines, is expanding its application base, providing an impetus to the market. In July 2024, Freeport-McMoRan revealed plans to invest $7.5 billion in expanding its El Abra copper mine in Chile. This initiative is expected to boost annual production of copper and molybdenum, enhancing overall supply growth. Besides this, the rising infrastructure investments in developing regions are fueling the market. demand. Furthermore, ongoing technological advancements in molybdenum extraction and production efficiency contribute to supply expansion, thus impelling the market growth.

To get more information on this market, Request Sample

The United States holds a share of 96.70%, and the molybdenum market demand is driven by the rapid expansion of the aerospace sector, where molybdenum is essential for high-performance alloys.Similarly, the growing adoption of electric vehicles (EVs) in the automotive industry, along with the increasing demand for lightweight and high-strength materials, is fueling market growth. Concurrently, government initiatives to modernize infrastructure create demand for high-performance steel alloys, which is contributing to the market expansion. Additionally, the growing focus on defense and military applications, which require specialized materials, is fostering the market growth. Furthermore, the increased investment in nuclear energy, which utilizes molybdenum for reactor components, and advancements in 3D printing technology, are new thereby propelling the market forward.

Molybdenum Market Trends:

Rising demand for high-strength steel and superalloys

The rising demand for high-strength steel and superalloys is influencing the molybdenum market trends. According to reports, the steel market worldwide reached a value of USD 974.4 Billion in 2024. These materials find broad application in the aerospace sectors the automotive sector and the construction industry because of their resistance to extreme conditions and their durability requirements. The aerospace sector depends on molybdenum-based superalloys because these materials deliver essential performance reliability to aircraft engine components exposed to extreme heat and pressure. Furthermore, the automotive industry applies molybdenum for fabricating lightweight yet high-strength vehicle components that lead to better fuel efficiency and safety performance while showing promising market prospects. As a result, the industry has intensified its efforts to develop higher-quality industrial materials with enhanced durability, driving the market forward.

Increasing number of infrastructure projects

The increasing number of infrastructure development and construction projects across the globe is enhancing the molybdenum market outlook. In line with this, it plays a crucial role in ensuring the longevity and performance of critical infrastructure projects. For instance, the smart infrastructure market achieved an estimated worth of USD 179.08 Billion during 2024. Besides this, the resistance to high temperatures functions as a critical requirement for pressure vessels that are used in power plants and chemical processing facilities. The construction of bridges, skyscrapers, and highways depends on this material for both necessary strength and durability and weather resistance against harsh conditions. Apart from this, the market continues to grow because people worldwide are increasingly demanding residential renovation, which is strengthening the molybdenum market share.

Growing focus on renewable energy to reduce emissions

The growing focus on renewable energy (RE) to reduce carbon emissions and maintain environmental sustainability is significantly transforming the molybdenum market forecast. According to the International Energy Agency (IEA), global energy-related CO₂ emissions rose by 0.9% in 2022, reaching over 36.8 gigatonnes (Gt) with a total increase of 321 megatonnes (Mt). At the same time, wind turbines and solar panels represent vital elements of clean energy systems that depend heavily on molybdenum-based materials. Wind turbine shafts depend on this refractory material because it provides both toughness and durability against fatigue. The energy infrastructure development and cleaner energy sources also drive its widespread adoption. Furthermore, the material finds applications in drilling tools and equipment designed to operate successfully in harsh conditions of extreme temperatures and high pressure, providing an impetus to the market.

Molybdenum Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global molybdenum market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, sales channel, and end use.

Analysis by Product Type:

- Steel

- Chemical

- Foundry

- Molybdenum Metal

- Nickel Alloy

Steel dominates the molybdenum market, accounting for 67.3% of the total share. This segment is growing, as industries need rising quantities of steel that provide high strength alongside corrosion resistance. The production of essential alloys for automotive industries as well as construction and infrastructure sectors requires molybdenum-enhanced steel. Molybdenum also finds strong support from the increasing stainless steel requirements which fuel pipeline and chemical processing equipment and industrial machinery production. Moreover, the segment keeps growing because emerging economies invest in infrastructure development and industries like aerospace along defense require high-performance materials. Furthermore, the expansion of electric vehicle (EV) production and RE systems push the demand for molybdenum in steel manufacturing because they need advanced steel components. As a result, this sector is fueling the molybdenum market, driven by innovative manufacturing techniques that improve efficiency and reduce costs.

Analysis by Sales Channel:

- Manufacturer/Distributor

- Aftermarket

The manufacturer/distributor segment dominates the molybdenum market, accounting for 88.2% of the total sales. This dominance is driven by the central role manufacturers and distributors play in supplying molybdenum to key industries such as steel production, aerospace, and electronics. Manufacturers are increasingly focusing on streamlining their production processes to meet rising demand for high-performance alloys, with distributors serving as critical intermediaries to ensure efficient delivery to end-users. The growth of this segment is further fueled by the expansion of global trade networks, particularly in regions like the Asia Pacific, where the steel and automotive industries are flourishing. Additionally, the rise of online platforms and digital distribution models is improving market accessibility, driving greater sales volume. Besides this, the trend of building long-term supply agreements between manufacturers and large industrial clients is contributing to stability in this segment. Furthermore, manufacturers are exploring new partnerships with RE and defense sectors, which is boosting the market demand.

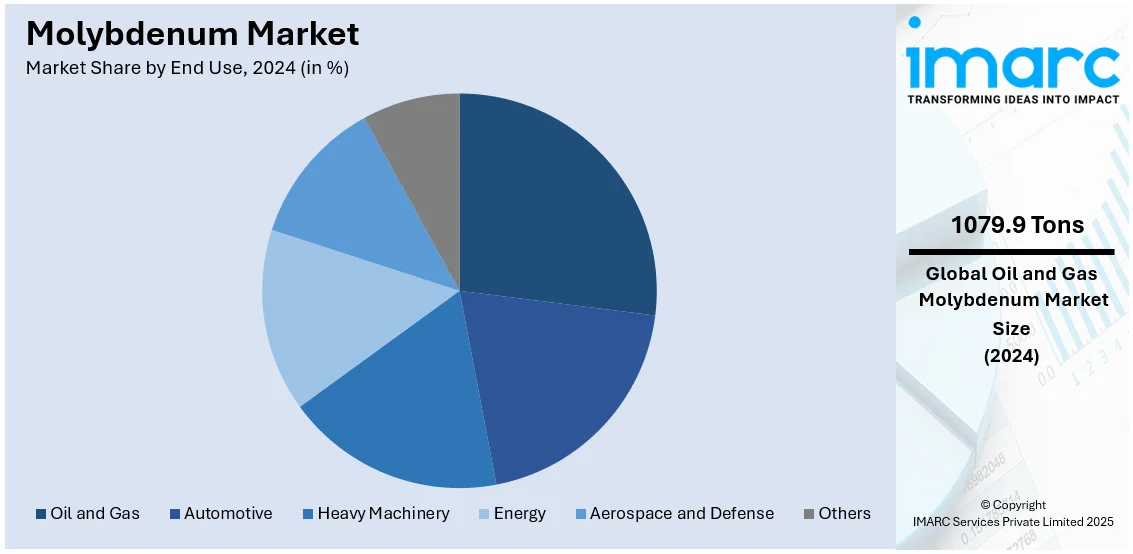

Analysis by End Use:

- Oil and Gas

- Automotive

- Heavy Machinery

- Energy

- Aerospace and Defense

- Others

The oil and gas sector represents 18.4% of the molybdenum market, with its growth driven by the demand for corrosion-resistant alloys and high-strength materials used in drilling, exploration, and refining operations. The production of pipes tanks and valves that function in extreme conditions of temperature pressure and corrosive environments occurs through molybdenum in offshore and deep-water drilling. The global energy requirement rise coupled with difficult oil reserve locations requires the development of specialized materials that provide operational assurance and extended lifespan. The expansion of refinery facilities through investments also creates an increased need for molybdenum-based alloy materials. Additionally, molybdenum functions as a catalyst for refining operations and renewable energy applications such as fuel cells which support the development of cleaner energy solutions. Concurrently, operations efficiency requirements within the oil and gas sector continue to boost molybdenum market demand for durable equipment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the molybdenum market, holding over 61.4% of the market share in 2024. This dominance is largely driven by the rapid industrialization of China, the world’s largest consumer of molybdenum, particularly in the steel sector. The region's strong demand for high-strength alloys used in construction, automotive, and machinery manufacturing also supports the market growth. Moreover, the infrastructure development, coupled with increased urbanization, continues to fuel molybdenum consumption. Additionally, the rise of RE projects, such as solar panels and wind turbines, is contributing to greater molybdenum use in the production of high-performance materials. Besides this, the booming electronics industry, particularly in countries like Japan and South Korea, enhances the market demand. Furthermore, the shift toward EVs and advancements in industrial manufacturing technologies provide long-term growth prospects for molybdenum in the region. As a result, the diverse industrial base and ongoing infrastructure investments of the region ensure strong and sustained market expansion.

Key Regional Takeaways:

North America Molybdenum Market Analysis

The North America molybdenum market is expanding because of the rising utilization of molybdenum in specialized energy and defense sector high-performance alloys. The region prioritizes energy independence through oil and gas exploration investments that create market demand for corrosion-resistant materials in challenging environmental conditions. Moreover, the boost for lightweight and high-strength materials in the automotive industry while working toward fuel-efficient and safe cars drives additional molybdenum market demand. For example, the U.S. Department of Transportation has allocated $635 million to expand zero-emission EV charging and hydrogen refueling infrastructure, which is expected to increase the demand for molybdenum. Besides this, the increased adoption of advanced manufacturing strategies such as additive manufacturing and three-dimensional (3D) printing throughout North America creates fresh molybdenum application prospects. Additionally, clean energy solutions including hydrogen production and nuclear energy receive a commitment from the region which drives market expansion. Also, the industrial development of refineries and chemical plants alongside their expansion creates a stable market demand for molybdenum-based alloys.

United States Molybdenum Market Analysis

The U.S. molybdenum market is experiencing growth driven by several key factors, notably the expanding demand from the steel industry, where molybdenum plays a critical role in strengthening alloys used in construction, automotive, and machinery sectors. The automotive industry leads to the market demand for molybdenum because of EVs gaining popularity. During the previous 48 months, U.S. EV market sales reached more than 2.5 Million units. The total sales numbers for 2023 exceeded 1,212,758 units which represented a 49% increase over 2022 statistics. The 2024 market saw 1,301,411 vehicles sold which resulted in a 7.3% increase and represented 8.1% of the total vehicle sales beyond the 2023 share of 7.8%, based on industry reports. The increasing sales of EVs result in amplified molybdenum requirements because this element serves as an essential component in batteries and electronics along with high-performance applications. Also, the Infrastructure Investment and Jobs Act supports U.S. infrastructure development that requires molybdenum-containing steel for building roads and bridges as well as other infrastructure constructions. The market also benefits from the rising RE technology sector because wind turbines need molybdenum in high-strength alloys for their operation. Furthermore, the improvement of domestic mining operations works towards establishing stable supplies while decreasing import dependence.

Europe Molybdenum Market Analysis

The Europe molybdenum market is experiencing growth due to rising needs for steel materials that perform at high levels across automotive sectors and aerospace along with construction industries. The steel alloy industry depends on molybdenum because it enhances steel durability so applications in these sectors become possible. The European Environment Agency (EEA) reported that in 2023, all EU Member States saw significant progress in EV adoption, with electric vehicles accounting for 22.7% of new car registrations and 7.7% of new van registrations across the 27 nations. Molybdenum use is also increasing because of electric mobility because the material finds applications in batteries as well as electronic and electric vehicle components. Besides this, the sustained European investment in wind and solar renewable projects for power generation requires more alloy materials that contain molybdenum for turbine manufacturing. Moreover, the aerospace industry demands molybdenum because its lightweight, yet strong materials need this element to meet their high-performance needs. Furthermore, molybdenum receives support from European efforts to develop sustainable and energy-efficient technologies that enable market expansion.

Asia Pacific Molybdenum Market Analysis

The Asia-Pacific (APAC) region, led by China, dominates the global molybdenum market due to its significant industrial output, particularly in steel production. The market for molybdenum in APAC remains extensive because the region consumes the metal in large quantities due to its rapid urbanization and industrialization. East Asia and the Pacific stand as the fastest urbanizing part of the world because it maintains a 3% average annual urbanization rate according to World Bank statistics. Additionally, molybdenum experiences rapid growth in the markets of China and India because it makes steel alloys that support construction projects as well as the automotive sector and heavy machinery production. Furthermore, the market demand also expands because East Asia-Pacific countries invest more resources into renewable energy technology development that includes wind turbine construction. Apart from this, the demand is driven by the electronics industry expansion especially in semiconductor manufacturing while electric vehicles represent another important factor. The fusion of these elements confirms that APAC will maintain its position as the leading molybdenum market.

Latin America Molybdenum Market Analysis

The Latin America molybdenum market receives support from the region's environmental dedication since 62% of its power comes from renewable sources as reported by Climate thinktank Ember. The demand increases due to growing renewable energy production since the metal serves as a critical component in high-strength alloys used for wind turbines alongside other clean energy equipment. Additionally, it receives additional support from Latin America's increasing steel industry activities, particularly within Brazil and Chile. The metal enables manufacturers to create corrosion-resistant steel that drives ongoing market development within the construction automotive and energy industries.

Middle East and Africa Molybdenum Market Analysis

The molybdenum market in the Middle East and Africa operates under the influence of rising construction developments particularly in Saudi Arabia because its construction market reached USD 97.8 Billion in 2024. The projection from IMARC Group indicates that the market value will increase to USD 135.6 Billion by 2033 with a predicted CAGR of 3.7% from 2025 to 2033. The rising construction market drives molybdenum usage because the metal enables steel manufacturers to create stronger materials that resist corrosion. The rising renewable energy sector which includes wind turbine development along with expanding industrial complexes drives up molybdenum demand in the region.

Competitive Landscape:

Market players in the global molybdenum sector are increasingly focused on enhancing production efficiency and expanding application areas. Several major mining companies are investing in advanced extraction technologies, such as hydrometallurgical processes, to improve yields and reduce environmental impact. Strategic mergers and acquisitions are also occurring as companies seek to strengthen their market position and access new reserves. There is a notable trend toward sustainability, with companies prioritizing environmentally friendly practices in mining and processing. Additionally, market players are forging partnerships with the aerospace, electronics, and RE sectors to secure long-term contracts. The rise of new technologies, such as 3D printing and additive manufacturing, is opening new avenues for molybdenum applications, encouraging players to explore these innovations to meet evolving market demands.

The report provides a comprehensive analysis of the competitive landscape in the molybdenum market with detailed profiles of all major companies, including:

- Absco Limited

- Antofagasta plc

- Centerra Gold Inc.

- Climax Molybdenum Company (Freeport-McMoRan Inc.)

- CMOC Group Limited

- Grupo México

- Jinduicheng Molybdenum Co., Ltd

- KGHM Polska Miedź SA

- Moltun International

- Moly Metal L.L.P

- Molymet S.A.

- Multi Metal Development Limited

Latest News and Developments:

- March 2025: Zeus North America Mining Corp. announced a significant copper-molybdenum soil anomaly at its Cuddy Mountain Project in Idaho. The 3 km x 3 km anomaly includes samples up to 0.38% Cu and 28.5 ppm Molybdenum. This discovery positions Zeus North America Mining Corp. as a promising player in a region gaining significant attention for copper and molybdenum exploration.

- February 2025: Greenland Resources secured a 10-year off-take agreement with Outokumpu, a major stainless steel producer. The deal involves the supply of approximately eight million pounds of molybdenum oxide annually, representing about 25% of Greenland Resources' projected production for the first decade. The agreement includes a price floor and cap, aiding Greenland in its long-term strategy and value-chain integration. Outokumpu will also assist Greenland in securing capital expenditure financing, subject to standard terms and conditions.

- January 2025: Almonty Industries signed an exclusive offtake agreement with SeAH Group, South Korea’s largest molybdenum processor and a major SpaceX contractor, to supply 100% of molybdenum from the Sangdong Molybdenum Project for its 60-year life. The fully permitted mine, near Almonty’s Sangdong Tungsten Project, will produce about 5,600 tons annually starting late 2026. The deal includes a US$19/lb floor price, enhancing financial stability. This partnership strengthens South Korea’s domestic supply, reduces reliance on imports, and supports local industries, including aerospace and defense.

- October 2024: China Molybdenum Co. planned to renew its product sales and procurement agreements with CATL and KFM before their expiration at the end of 2024. As these agreements involve high percentage ratios, they are classified as significant connected transactions under Hong Kong’s listing rules, requiring additional approvals and compliance with reporting regulations.

- September 2024: Molymet, a major molybdenum and rhenium producer, has launched the production of spheroidized rhenium, molybdenum, and alloy powders using plasma spheroidization at its San Bernardo, Chile facility. These powders are specifically designed for advanced manufacturing methods such as additive manufacturing and metal injection molding, allowing for the precise production of small, intricate components while reducing material waste.

- September 2023: MiRus announced the limited market release of its ATLAS™ MoRe® Foot and Ankle Plating System in the U.S., featuring the thinnest foot and ankle plate at 1.0mm thickness. The plates, made from a proprietary molybdenum-rhenium (MoRe®) superalloy, offer enhanced strength, durability, and biocompatibility without compromising performance.

Molybdenum Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Steel, Chemical, Foundry, Molybdenum Metal, Nickel Alloy |

| Sales Channels Covered | Manufacturer/Distributor, Aftermarket |

| End Uses Covered | Oil and Gas, Automotive, Heavy Machinery, Energy, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Absco Limited, Antofagasta plc, Centerra Gold Inc., Climax Molybdenum Company (Freeport-McMoRan Inc.), CMOC Group Limited, Grupo México, Jinduicheng Molybdenum Co., Ltd, KGHM Polska Miedź SA, Moltun International, Moly Metal L.L.P, Molymet S.A., Multi Metal Development Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the molybdenum market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global molybdenum market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the molybdenum industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molybdenum market was valued at 5,868.7 Tons in 2024.

IMARC estimates the molybdenum market to exhibit a CAGR of 2.25% during 2025-2033, expecting to reach 7,170.2 Tons by 2033.

Key factors driving the molybdenum market include strong demand from the steel and alloy industries, increased use in electronics and renewable energy technologies, advancements in extraction processes, growing infrastructure investments, rising automotive demand for lightweight materials, and the expanding aerospace sector requiring high-performance alloys.

Asia Pacific currently dominates the market, accounting for a share exceeding 61.4% in 2024. This dominance is fueled by the strong demand from the steel industry, increased infrastructure development, growing automotive production, and a robust electronics sector, alongside continuous advancements in renewable energy technologies.

Some of the major players in the molybdenum market include Absco Limited, Antofagasta plc, Centerra Gold Inc., Climax Molybdenum Company (Freeport-McMoRan Inc.), CMOC Group Limited, Grupo México, Jinduicheng Molybdenum Co., Ltd, KGHM Polska Miedz SA, Moltun International, Moly Metal L.L.P, Molymet S.A., Multi Metal Development Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)