Molten Salt Battery Market Size, Share, Trends and Forecast by Battery Type, End-Use, and Region, 2025-2033

Molten Salt Battery Market Size and Share:

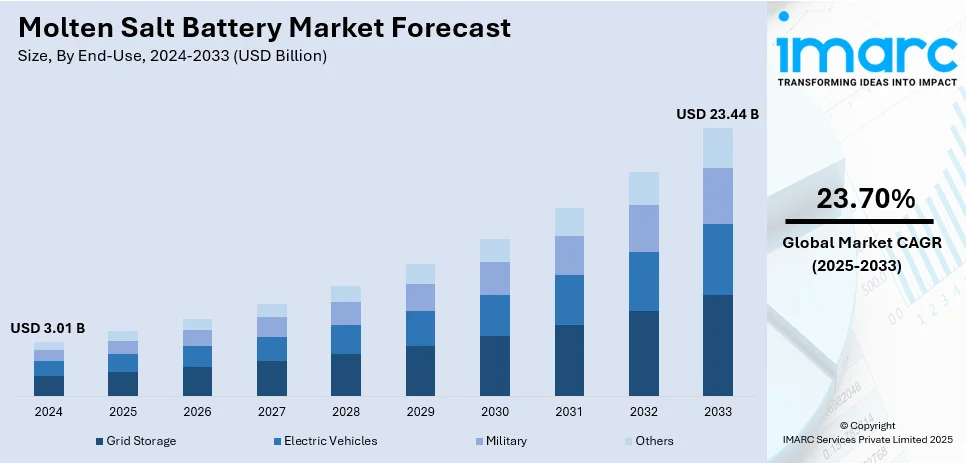

The global molten salt battery market size was valued at USD 3.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.44 Billion by 2033, exhibiting a CAGR of 23.70% from 2025-2033. North America currently dominates the market, holding a market share of over 33.5% in 2024. The market is fueled by the growing demand for efficient, long-duration energy storage solutions for renewable energy and grid stability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.01 Billion |

| Market Forecast in 2033 | USD 23.44 Billion |

| Market Growth Rate (2025-2033) | 23.70% |

One of the major factors influencing the market is the rising use of renewable energy sources such as wind and solar creates a need for reliable, large-scale energy storage systems to balance intermittent power generation. Molten salt batteries are well-suited for this role due to their high energy density, long duration, and scalability. The need for grid stability and backup power in the face of rising electricity demand is fueling interest in long-duration storage solutions. Additionally, the potential for lower operational costs, coupled with long cycle life, makes molten salt batteries an attractive option for utilities and industrial applications. The ongoing advancements in technology, such as improved thermal stability and efficiency, are further driving the molten salt battery market growth.

The molten salt battery market in the United States is driven by the widespread adoption of renewable energy sources like solar and wind, which require efficient, long-duration energy storage solutions to address intermittency. The government’s push for clean energy through policies and incentives further supports the market's growth. Increasing demand for grid stability, energy resilience, and reliable backup power in response to rising electricity consumption also plays a significant role. Advancements in molten salt battery technology, including enhanced energy density and thermal stability, combined with the need for sustainable and scalable storage options, drive adoption across utility, industrial, and commercial sectors. For instance, a study published in 2023 in Energy Storage Materials implies that a novel battery architecture employing metals found on Earth could assist and decrease the expenditure of integrating renewable energy sources into the nation's electrical grid. The new grid energy storage battery architecture, which was developed using the inexpensive metals sodium and aluminum, displayed promise for a safer and more scalable stationary energy storage system, as per the team headed by the Department of Energy's Pacific Northwest National Laboratory.

Molten Salt Battery Market Trends:

Growing Adoption of Renewable Energy

There is a growing need for effective energy storage technologies to control the intermittent generation of renewable energy sources like wind and solar . Molten salt batteries, with their long-duration storage capabilities and ability to handle large-scale energy storage, are ideal for this purpose. Their high energy density and thermal stability make them a preferred choice for renewable integration. Governments and utilities are investing heavily in renewable energy projects, further boosting the adoption of molten salt batteries to ensure grid reliability and energy efficiency. For instance, in April 2024, Hyme Energy, a Danish business, started the first energy storage project in history that uses molten hydroxide salt to store renewable energy. The energy storage facility at Esbjerg, Denmark, is part of a project known as Molten Salt Storage, or MOSS. At a ceremony sponsored by Semco Maritime, the facility was formally launched by Søren Gade, chairman of the Danish Parliament and Port Esbjerg.

Need for Grid Stability and Backup Power

As electricity demand rises, the need for stable and reliable grids has become critical. Molten salt batteries provide long-term energy storage, helping to stabilize grids by storing surplus energy and releasing it during peak demand. Their ability to supply backup power during outages makes them valuable for energy security. These batteries are particularly effective in regions prone to power disruptions, ensuring continuous supply and grid resilience, representing one of the major molten salt battery market trends. For instance, in December 2024, Infinity Turbine LLC subsidiary Salgenx is pleased to announce the release of its ground-breaking saltwater redox flow battery, which provides a viable and affordable substitute for conventional lithium-ion batteries in grid-scale energy storage. The Salgenx system is perfect for utility companies and the integration of renewable energy sources because it is designed for large-scale energy storage. Its adaptable modular architecture makes it possible to expand easily, meeting a range of energy needs while enhancing grid resilience and stability.

Technological Advancements

Ongoing research and innovation in molten salt battery technology are improving their efficiency, durability, and cost-effectiveness. Enhancements in materials, such as the use of low-cost and Earth-abundant metals, are reducing manufacturing costs. Improved thermal management systems and extended cycle life make these batteries more competitive for large-scale applications. Such advancements are expanding their commercial viability and market appeal. For instance, in November 2023, AES Andes was granted environmental review certification for a 560MW project in Chile that uses molten salt-based technology to convert an old coal plant to renewable energy and energy storage. The Environmental Evaluation Service of the Antofagasta regional government, which is home to the facility, approved the project's environmental impact assessment (EIA).

Molten Salt Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global molten salt battery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on battery type, and end-use.

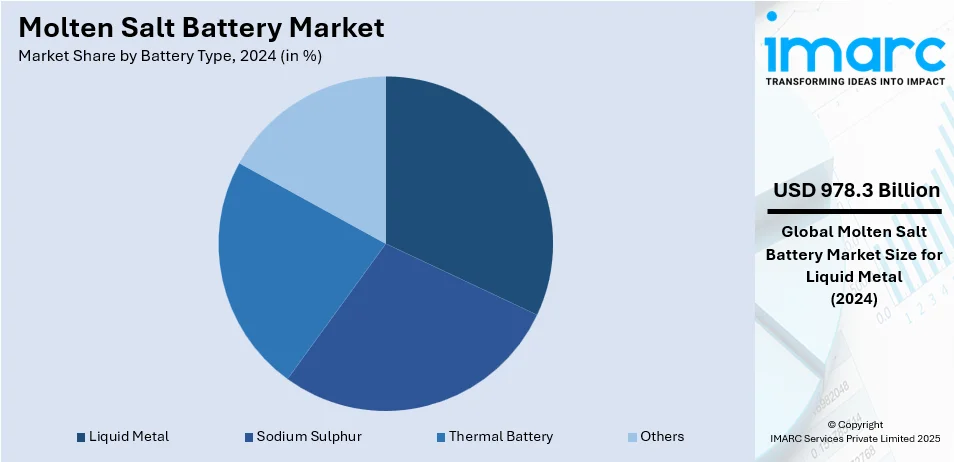

Analysis by Battery Type:

- Sodium Sulphur

- Liquid Metal

- Thermal Battery

- Others

Liquid metal battery leads the market with around 32.5% of the total molten salt battery market share share in 2024. Liquid metal batteries dominate the market because they deliver high energy efficiency along with the ability to scale and maintain long battery cycles. Molten salt battery technology stores electrical energy through electrodes made from sodium and antimony metals while using a molten salt electrolyte to boost energy density and preserve effective thermal control. This temperature operation capability delivers superior performance and fits large-scale energy storage requirements including grid-based applications needing extended discharge capabilities and low maintenance needs. The commercial viability and lower manufacturing costs of these devices were possible through recent developments in material sciences and manufacturing approaches.

Analysis by End-Use:

- Grid Storage

- Electric Vehicles

- Military

- Others

Grid storage holds the largest share of the molten salt battery market due to the growing demand for efficient, large-scale energy storage solutions. Because of their ability to store electricity over long periods, molten salt batteries serve best for renewable energy storage. Molten salt batteries support electrical grid stability with extended energy storage capabilities and high energy density levels. The storage capabilities of molten salt batteries enable reliable backup power delivery which increases grid stability for ongoing energy transition initiatives. Their scalability, long lifespan, and low operational costs further contribute to their dominance in grid storage.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.5%. The molten salt battery market in North America is driven by several key factors. The growing adoption of renewable energy sources, like wind and solar, has created a need for efficient and large-scale energy storage solutions to manage intermittent energy generation. Molten salt batteries are ideal for this, offering high energy density and long-duration storage. Additionally, increasing electricity demand and the need for grid stability and backup power further boost their adoption, especially in regions prone to outages. Government initiatives and policies supporting decarbonization, clean energy projects, and investments in energy storage infrastructure also contribute significantly. Technological advancements, such as the use of cost-effective and Earth-abundant materials, have improved the affordability and efficiency of molten salt batteries, enhancing their commercial viability across industrial, utility, and renewable applications.

Key Regional Takeaways:

United States Molten Salt Battery Market Analysis

In 2024, the United States accounted for the largest market share of over 89.5% in North America. The molten salt battery market in the United States is driven by several significant factors. The growing adoption of renewable energy sources, such as solar and wind, creates a rising demand for energy storage solutions to address intermittency and ensure grid reliability. Molten salt batteries, with their high energy density and long-duration storage capabilities, are ideal for large-scale renewable integration. Additionally, increasing electricity demand and the need for grid stability and backup power, particularly in regions prone to natural disasters and outages, drive the adoption of molten salt battery systems. Supportive government policies, including tax incentives, funding for clean energy projects, and mandates for grid decarbonization, further encourage their use. Technological advancements in molten salt battery design, such as improved materials and thermal management, are making these systems more efficient and cost-effective. These factors collectively position the United States as a growing market for molten salt battery solutions.

Europe Molten Salt Battery Market Analysis

The molten salt battery market in Europe is driven by the region's strong focus on renewable energy adoption and decarbonization. With increasing reliance on solar and wind energy, the demand for reliable energy storage systems to manage intermittent power generation is critical, making molten salt batteries a preferred choice. Government initiatives, such as the European Green Deal and renewable energy targets, further support the deployment of advanced energy storage technologies. Investments in grid modernization and energy security also play a key role, ensuring stable power supply and reducing dependency on fossil fuels. Technological advancements in molten salt batteries, coupled with the region's commitment to sustainability and reducing carbon footprints, drive their adoption across industrial and utility-scale applications.

Asia Pacific Molten Salt Battery Market Analysis

The molten salt battery market in Asia Pacific is driven by the region's rapid adoption of renewable energy and the increasing need for energy storage solutions to manage grid stability. Countries like China, India, and Japan are heavily investing in solar and wind power, creating demand for efficient, large-scale energy storage systems like molten salt batteries. Government policies promoting clean energy and reducing carbon emissions, along with financial incentives for renewable energy projects, are key drivers. Additionally, the growing industrialization and urbanization in the region contribute to rising electricity demand and the need for reliable backup power. Technological advancements and the availability of cost-effective materials further support the development and adoption of molten salt battery systems in the Asia Pacific.

Latin America Molten Salt Battery Market Analysis

The molten salt battery market in Latin America is driven by the region's growing investment in renewable energy, particularly solar and wind power, as countries aim to reduce dependence on fossil fuels. This shift towards clean energy creates a significant demand for efficient energy storage solutions, with molten salt batteries offering long-duration storage capabilities ideal for intermittent renewable energy. Government policies promoting sustainability and carbon reduction targets are also supporting the adoption of advanced energy storage systems. Additionally, the need for grid reliability in remote and underserved areas, as well as rising electricity demand, further accelerates the market. Technological advancements, cost reductions in materials, and increasing interest from both public and private sectors are also propelling the growth of molten salt batteries in Latin America.

Middle East and Africa Molten Salt Battery Market Analysis

The molten salt battery market in the Middle East and Africa is driven by the region's growing investment in renewable energy, particularly solar power, due to its abundant sunlight. Molten salt batteries and other energy storage technologies are crucial for controlling intermittent renewable energy generation as nations look to diversify their energy sources and lessen their dependency on fossil fuels. Additionally, rising electricity demand and the need for reliable grid stability in remote areas are pushing the adoption of energy storage systems. Government policies promoting sustainability, carbon reduction, and clean energy infrastructure further support the growth of molten salt battery technologies in the region.

Competitive Landscape:

The molten salt battery market is highly competitive, with key players focusing on technological advancements, scalability, and cost-efficiency. Companies like Ambri, SolarReserve, and Energy Dome lead in developing liquid metal and molten salt-based batteries for large-scale energy storage. These players emphasize research into improving the energy density, cycle life, and thermal stability of their products. Collaborations with utilities and governments help promote large-scale adoption, especially in grid storage applications. Key drivers include the rising demand for renewable energy storage and the need for reliable, long-duration solutions. Despite the market's growth potential, challenges such as high initial costs and regulatory hurdles remain. To maintain a competitive edge, firms are investing in innovations and reducing production costs for better commercial viability.

The report provides a comprehensive analysis of the competitive landscape in the molten salt battery market with detailed profiles of all major companies, including:

- Ambri Incorporated

- Kyoto Group AS

- NGK Insulators, Ltd

Latest News and Developments:

- In July 2023, Kyoto Group AS, a Norwegian thermal energy storage (TES) company, successfully connected its first full-scale molten salt thermal energy storage (TES) plant in northwest Denmark to the local grid.

- In May 2023, MicroNuclear©, LLC announced assigning Blackfoot, ID-based Premier Technology, Inc. with the task of producing its Molten Salt Nuclear Battery©. They have produced the ohmically heated prototypes in accordance with specific requirements and have significantly improved the design by applying their manufacturing experience.

Molten Salt Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Sodium Sulphur, Liquid Metal, Thermal Battery, Others |

| End-Uses Covered | Grid Storage, Electric Vehicles, Military, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ambri Incorporated, Kyoto Group AS, NGK Insulators, Ltd , etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the molten salt battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global molten salt battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the molten salt battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molten salt battery market was valued at USD 3.01 Billion in 2024.

The molten salt battery market is projected to exhibit a CAGR of 23.70% during 2025-2033, reaching a value of USD 23.44 Billion by 2033.

Key factors driving the molten salt battery market include the growing demand for renewable energy storage, advancements in battery technology, government support for clean energy initiatives, the need for grid stability, and the ability of molten salt batteries to offer long-duration, high-capacity storage, making them ideal for large-scale energy storage applications. The factors, collectively, are creating a molten salt battery market outlook across the globe.

North America currently dominates the molten salt battery market, accounting for a share of 33.5%. The major factors driving the molten salt battery market in North America include renewable energy growth, grid stability needs, and government support.

Some of the major players in the molten salt battery market include Ambri Incorporated, Kyoto Group AS, NGK Insulators, Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)