Molecular Spectroscopy Market Size, Share, Trends and Forecast by Product Type, Technology, Application, and Region, 2025-2033

Molecular Spectroscopy Market Size and Share:

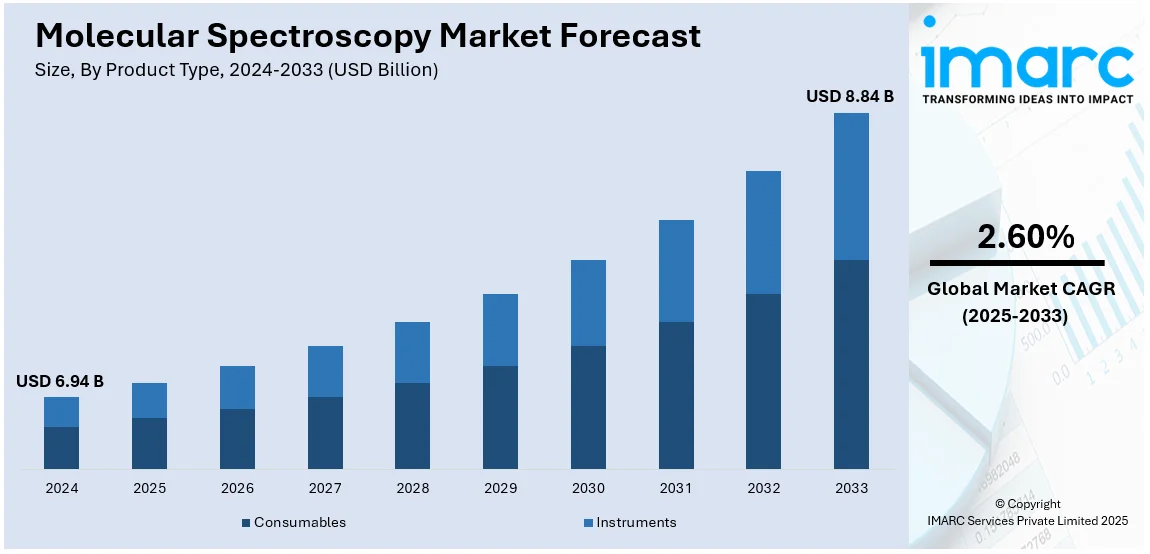

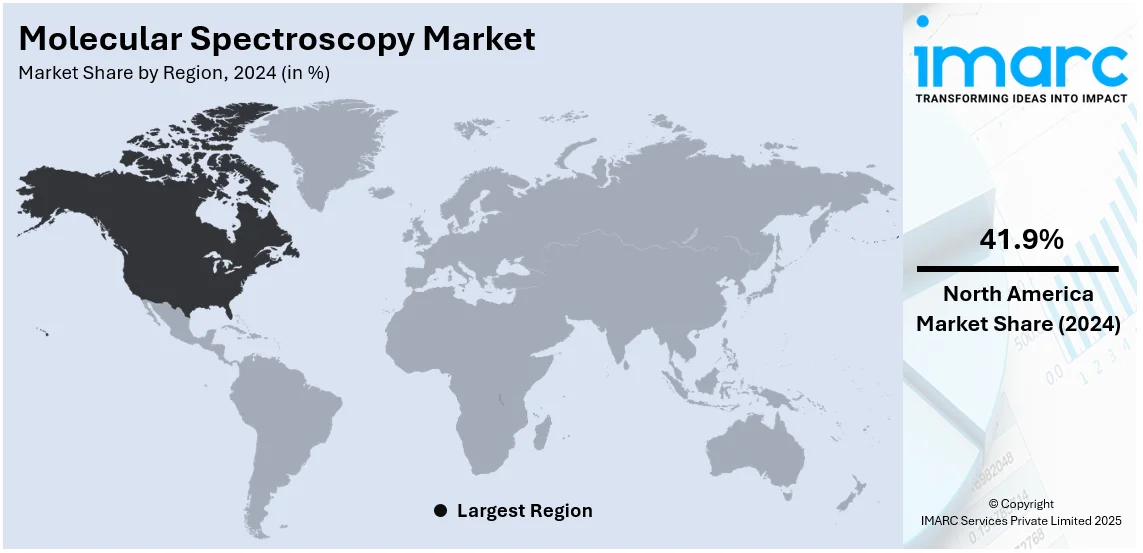

The global molecular spectroscopy market size was valued at USD 6.94 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.84 Billion by 2033, exhibiting a CAGR of 2.60% from 2025-2033. North America currently dominates the molecular spectroscopy market share by holding over 41.9% in 2024. The market is fueled by robust research infrastructure, substantial investments in research and development (R&D), rising adoption in the pharmaceutical and biotechnology sectors, and growth in environmental testing industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.94 Billion |

| Market Forecast in 2033 | USD 8.84 Billion |

| Market Growth Rate (2025-2033) | 2.60% |

The global molecular spectroscopy market growth is expanding due to continuous advancements in pharmaceutical and biotechnology fields, which rely on accurate analytical tools for drug development and discovery. Additionally, the growing need for food safety and quality testing has increased its application in the food and beverage (F&B) sector, further driving market growth. Moreover, the rising environmental concerns necessitate molecular spectroscopy for monitoring pollutants and ensuring regulatory compliance, providing an impetus to the market. Besides this, the growth in life sciences research, fueled by genomic and proteomic studies, is contributing to the market expansion. Furthermore, continuous technological innovations, including portable and hybrid spectrometers, enhance accessibility and performance, driving broader utilization across diverse industries, thus impelling the market growth. For example, in May 2024, RedShift BioAnalytics launched the Aurora TX, a cutting-edge instrument that revolutionizes Ribonucleic Acid (RNA) and protein analysis, using ultra-sensitive Microfluidic Modulation Spectroscopy (MMS) and thermal ramping to enhance precision and efficiency in biomolecular analysis, thus contributing to the market growth.

The US molecular spectroscopy market demand is propelled by substantial government funding supporting scientific research and innovation. The market currently holds a share of 86.20%. For instance, in 2024, the U.S. Department of Energy (DOE) allocated USD31 Million to support 42 research projects across 36 institutions to develop research capacity and infrastructure for molecular spectroscopy advances. Similarly, the growing prevalence of chronic diseases drives the need for advanced diagnostic tools, contributing to market growth. Concurrently, the expanding biopharmaceutical production facilities boost the need for precise analytical technologies, aiding in the market expansion. Besides this, the growth in personalized medicine and biomarker research fosters the adoption in clinical studies, which is providing an impetus to the market. Additionally, the increasing focus on renewable energy (RE) drives spectroscopy applications in developing and analyzing alternative energy materials, strengthening the market share. Apart from this, the presence of key market players and their continuous investment in product development ensures access to cutting-edge spectroscopy technologies, thereby propelling the market forward.

Molecular Spectroscopy Market Trends:

Adoption in Healthcare and Industrial Sectors

The increasing adoption of molecular spectroscopy technology across F&B industries, biotechnologies, and healthcare are acting as significant growth-inducing factors. This technology enables the development of advanced hybrid imaging systems including computed tomography (CT) and positron emission tomography (PET) devices which serve extensive diagnostic and research purposes. Moreover, the healthcare sector, in particular, relies heavily on spectroscopy for accurate and efficient imaging solutions. For example, Changi General Hospital and Shimadzu (Asia Pacific) established a mass spectrometry-based clinical testing facility and research center to demonstrate spectroscopy's expanding role in personalized medicine methods. Besides this, molecular spectroscopy demonstrates versatility and growing importance in meeting diverse analytical and diagnostic needs across different sectors, thus enhancing the molecular spectroscopy market outlook.

Technological Advancements and Pharmaceutical Applications

Continuous advancements in molecular spectroscopy technologies and their growing use in the pharmaceutical industry are shaping trends in the molecular spectroscopy market. These innovative techniques reveal new molecules by providing quick analysis with basic sample preparation steps that outperform traditional analytical methods. For instance, the global pharmaceutical market exceeded USD 1 trillion in 2023, according to the IBEF, highlighting spectroscopy's essential role in developing drugs and testing their quality. Furthermore, advanced spectroscopy methods adopted along with established pharmaceutical research efficiency enable the continued expansion of spectroscopy applications for industry analytical requirement compliance, which is providing an impetus to the market.

Environmental and Quality Control Applications

Rising environmental consciousness and government initiatives to promote sustainable practices are bolstering the adoption of molecular spectroscopy for environmental applications. This includes wastewater treatment, environmental screening, and monitoring polycyclic aromatic hydrocarbons (PAH) levels to conserve natural resources. For example, public research indicates that 62% of buying consumers will modify their shopping practices to support environmental conservation. Additionally, nuclear magnetic resonance (NMR) spectroscopy serves as a key tool for quality control assessments content purity measurements, and molecular structure determination of organic compounds. Besides this, the surging food safety concerns and biotechnology industry growth are significantly contributing to the market expansion.

Molecular Spectroscopy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global molecular spectroscopy market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, technology, and application.

Analysis by Product Type:

- Consumables

- Instruments

Instruments dominate the segment, accounting for 73.1% of the molecular spectroscopy market share. This segment's growth is fueled by technological advancements, including improved resolution, portability, and integration with artificial intelligence (AI) and machine learning (ML) for data analysis. The rising implementation of Nuclear Magnetic Resonance (NMR) instruments for drug development and quality control in the pharmaceutical and biotechnology sector strengthens the market demand significantly. Instruments serve a vital function within environmental testing programs to help industries meet the demanding requirements of pollution monitoring regulations. Moreover, research activities conducted in academia and industries, especially in life sciences and material sciences support the growth pattern of this segment. Furthermore, hybrid and modular instruments are boosting the market versatility because stakeholders increasingly choose these multi-purpose devices for different testing applications. Apart from this, continuous developments in emerging economy infrastructure coupled with manufacturing requirements for precise analytical tools are driving the market forward.

Analysis by Technology:

- NMR Spectroscopy

- Raman Spectroscopy

- UV-Visible Spectroscopy

- Mass Spectroscopy

- Infrared Spectroscopy

- Near-Infrared Spectroscopy

- Others

NMR spectroscopy accounts for 25.5% of the molecular spectroscopy market share, making it the largest technology segment. The technology is prominent because it delivers the most precise analysis of molecular structures which is essential for developing drugs. Healthcare needs for advanced diagnostic tools including metabolomics and biomarker research drive its increased adoption. Additionally, the non-invasive properties of NMR spectroscopy combined with its ability to handle complex mixtures increase its applications throughout pharmaceutical industries and food quality testing and material science fields. Market growth is further supported by increasing academic research funding and advancements in structural biology. Besides this, continuous technological improvements in cryogen-free systems and enhanced sensitivity enable greater accessibility and operational efficiency. As a result, its growing role in RE research, such as battery materials analysis, underscores its importance across diverse industries, thereby fostering the market growth.

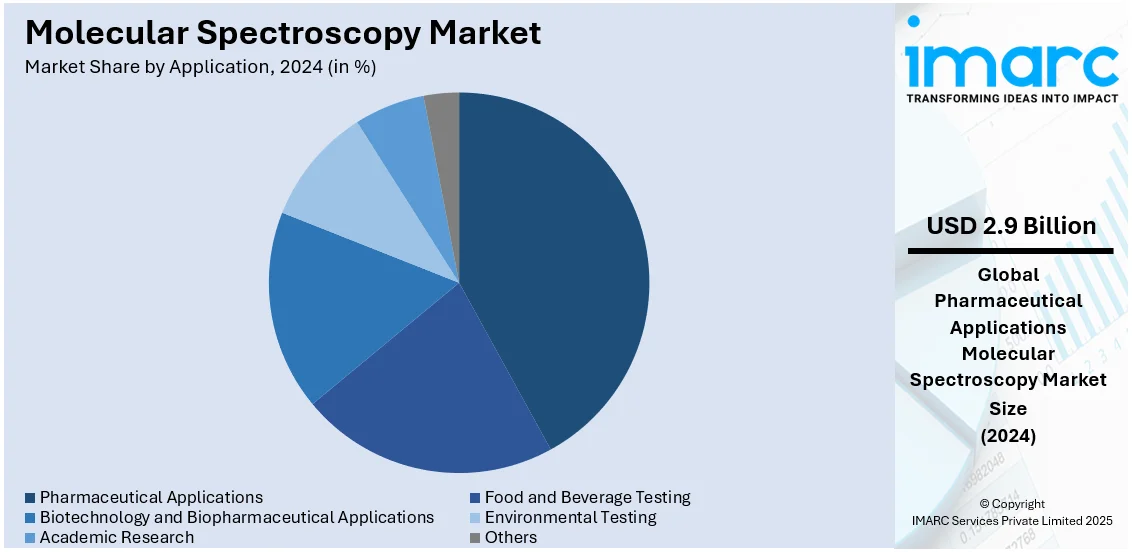

Analysis by Application:

- Pharmaceutical Applications

- Food and Beverage Testing

- Biotechnology and Biopharmaceutical Applications

- Environmental Testing

- Academic Research

- Others

Pharmaceutical applications lead the market with 41.5%. The dominance of this segment is fueled by the increasing requirement for exact analytical methods in drug discovery and development as well as quality control. Molecular spectroscopy techniques including Ultraviolet-Visible Spectroscopy (UV-Vis), NMR, and Infrared (IR) spectroscopy maintain their essential role in pharmaceutical manufacturing by verifying compound purity and identifying molecular structures while maintaining regulatory compliance. Furthermore, the shift toward chronic disease treatment and individualized medicine approaches has intensified R&D efforts, thus driving the increased adoption of spectroscopy methods. Market growth is further bolstered by increasing academic research funding and advancements in structural biology. Regulatory frameworks, including standards set by the Food and Drug Administration (FDA) and the European Medicines Agency (EMA), ensure strict compliance with pharmaceutical quality requirements. Apart from this, the widespread adoption throughout the pharmaceutical industry is due to spectroscopy equipment improvements that include portable and high-throughput systems that enhance analytical accuracy, fueling the market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the molecular spectroscopy market with 41.9% of the market share. The market demand in the region is spurred by its highly developed healthcare facilities with its strong pharmaceutical sector and significant R&D initiatives. In confluence with this, significant drug discovery investment and development occurs in the region that enables pharmaceutical companies and research institutions to utilize molecular spectroscopy for quality control tasks and compound identification and regulatory compliance applications. Moreover, the increase in chronic disease cases along with the expanding need for personalized medicine facilitates the adoption of advanced analytical methods. Besides this, the North American market is witnessing significant growth due to the increasing governmental funding of research and the location of key spectroscopy equipment manufacturers within the region. Furthermore, molecular spectroscopy market leadership in North America remains secure because of portable spectroscopy devices and AI-driven data analysis which boost the efficiency and accuracy of molecular spectroscopy applications.

Key Regional Takeaways:

United States Molecular Spectroscopy Market Analysis

The United States molecular spectroscopy market is primarily driven by the strong emphasis on R&D in various sectors, including pharmaceuticals, biotechnology, and environmental monitoring. The growing demand for precise and efficient analytical tools in these industries accelerates the adoption of molecular spectroscopy technologies such as IR, Raman, and UV-Vis spectrometers. In line with this, the pharmaceutical industry, particularly, uses molecular spectroscopy for drug development and quality control, propelling market growth. For example, In 2023 the U.S. pharmaceutical industry reached a value of USD 574.37 billion. The industry's substantial financial performance makes the United States dominate pharmaceutical markets, handling approximately 45% of total medication sales globally, as per reports. Spectroscopic techniques are used for analyzing biomolecules like proteins, nucleic acids, and lipids. This is important in protein folding studies, enzyme kinetics, and genetic research. Moreover, spectroscopy aids in analyzing drug absorption, distribution, metabolism, and excretion within the body, while also assessing potential toxicity. Furthermore, the increasing need for environmental analysis, including air and water quality testing, fuels the demand for spectroscopy instruments to detect trace chemicals and pollutants. Additionally, advancements in spectroscopy technology, such as miniaturization, portability, and automation, have expanded the applicability of molecular spectroscopy in clinical diagnostics and food safety testing. Government initiatives and funding for R&D in scientific research also enhance the market's expansion, supporting innovation in spectroscopy techniques.

Europe Molecular Spectroscopy Market Analysis

In Europe, the molecular spectroscopy market is bolstered by the region's strong emphasis on research, particularly in the fields of life sciences, environmental monitoring, and food safety. The pharmaceutical industry, especially in countries like Germany, Switzerland, and the UK, remains a key driver of demand for molecular spectroscopy equipment, as it is essential for quality control, drug formulation, and clinical research. Additionally, the growing regulatory framework for environmental protection in Europe, particularly regarding chemical pollution and emissions, is pushing the need for precise analytical instruments. Moreover, the analysis of greenhouse gases such as CO2 and methane is often carried out using spectroscopy to monitor climate change and its impact on global ecosystems. Increasing pollution levels in the region are driving the demand for molecular spectroscopy. Reports indicate that in the fourth quarter of 2023, greenhouse gas emissions in the EU economy reached approximately 897 million tons of CO2-equivalents (CO2-eq). Additionally, the growing need for diagnostic tools in healthcare, particularly for personalized medicine, is a key factor propelling market growth. Molecular spectroscopy enables the identification of biomarkers and molecular interactions, facilitating early diagnosis, monitoring, and tailored therapies, thereby improving patient outcomes and advancing modern healthcare practices. Furthermore, Europe’s well-established research organizations and funding initiatives facilitate technological advancements, making spectroscopy techniques more accessible and effective for a broader range of applications.

Asia Pacific Molecular Spectroscopy Market Analysis

The Asia Pacific molecular spectroscopy market is experiencing rapid growth due to a combination of increasing industrialization, rising healthcare expenditure, and significant investments in scientific research. India's industrial production increased to 3.8% in December 2023 as against 2.4% in November 2023, revealed the data provided by the Ministry of Statistics and Programme Implementation (MoSPI). In addition, the region's thriving pharmaceutical and biotechnology sectors are major consumers of molecular spectroscopy technologies, as they are critical in drug development, quality assurance, and diagnostics. Countries such as China and India are making significant investments in healthcare infrastructure, driving the demand for advanced analytical tools. Apart from this, the growing trend of environmental monitoring and the rising awareness of food safety are further driving the need for molecular spectroscopy instruments. Molecular spectroscopy is used to monitor pollutants in water bodies and soil. Techniques like atomic absorption (AA) spectroscopy and inductively coupled plasma (ICP) spectroscopy can detect heavy metals, pesticides, and other harmful substances. With advancements in technology, more affordable, user-friendly spectrometers are entering the market, increasing adoption rates across industries, including manufacturing and academia. In line with this, the ongoing development of research facilities in emerging economies is contributing to the region's growth in molecular spectroscopy.

Latin America Molecular Spectroscopy Market Analysis

In Latin America, the molecular spectroscopy market is experiencing growth due to the expansion of the pharmaceutical and biotechnology industries, particularly in Brazil and Mexico. These sectors increasingly rely on molecular spectroscopy for drug testing, quality control, and diagnostic purposes. The Brazilian Drug Market Regulation System (CMED) published a report in which the country’s pharmaceutical market peaked at a turnover of around USD 28.49 Billion in 2023. In addition, advancements in spectroscopy technology are making it more affordable and accessible for academic research and commercial applications. Besides this, government investments in healthcare and scientific research are further promoting the use of molecular spectroscopy in various industries.

Middle East and Africa Molecular Spectroscopy Market Analysis

The molecular spectroscopy market in the Middle East and Africa (MEA) is driven by the growing healthcare sector, especially in countries such as Saudi Arabia, the UAE, and South Africa. With rising investments in healthcare infrastructure, there is an increasing demand for diagnostic tools and laboratory equipment, including molecular spectrometers. Healthcare expenditure in the Gulf Cooperation Council (GCC) is projected to reach USD 135.5 billion by 2027, according to reports. Furthermore, environmental concerns, especially regarding oil and gas emissions, are pushing the need for more advanced spectroscopy technologies for monitoring and regulatory compliance. Increasing research activities in the region, backed by government funding, are driving market development, particularly in the pharmaceutical and environmental sectors.

Competitive Landscape:

The molecular spectroscopy market remains highly competitive, with key players emphasizing innovation, strategic partnerships, and acquisitions to enhance their market presence. Major companies are leading the market by introducing advanced spectroscopy solutions with enhanced accuracy, portability, and automation features. A significant trend is the integration of AI and ML to enhance data analysis and operational efficiency. Furthermore, market players are strengthening their presence in emerging markets through collaborations and localized manufacturing facilities. Furthermore, rising investments in R&D for developing novel applications, such as environmental monitoring and food safety testing, are also on the rise, reflecting the growing demand for versatile spectroscopy technologies across industries.

The report provides a comprehensive analysis of the competitive landscape in the molecular spectroscopy market with detailed profiles of all major companies, including:

- ABB Ltd.

- Agilent Technologies Inc.

- Bruker Corporation

- Hitachi Ltd.

- Horiba Ltd.

- JASCO Inc.

- JEOL Ltd.

- Medtronic plc

- Merck KGaA

- PerkinElmer Inc.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- VIAVI Solutions Inc.

Latest News and Developments:

- August 2024: Research engineers at The Hong Kong Polytechnic University (PolyU) created a quantum microprocessor chip that simulated molecular spectroscopy patterns of real complex large molecules through their first worldwide breakthrough.

- May 2024: Thermo Fisher Scientific created a semi-quantitative analysis instrument for identifying unknown samples to assist ICP-OES operations and support global environmental safety initiatives.

- April 2024: The Spectra Manager™ Suite of Molecular Spectroscopy Software received its new addition 'BeStSel' from Jasco. Dr. József Kardos and Dr. András Micsonai from ELTE collaborated with the Jasco team to develop this innovative application software. The experimental structural characterization of biomolecules depends heavily on Circular Dichroism (CD) spectroscopy.

- October 2023: trinamiX GmbH introduced a revolutionary consumer spectroscopy solution based on Snapdragon® 8 Gen 3 Reference Design technology at its recent announcement. The solution of trinamiX announced at Qualcomm Technologies’ annual Snapdragon Summit represents the world's first NIR spectrometer integrated into a smartphone reference design that spans wavelengths from 1-3µm.

Molecular Spectroscopy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Consumables, Instruments |

| Technologies Covered | NMR Spectroscopy, Raman Spectroscopy, UV-Visible Spectroscopy, Mass Spectroscopy, Infrared Spectroscopy, Near-Infrared Spectroscopy, Others |

| Applications Covered | Pharmaceutical Applications, Food and Beverage Testing, Biotechnology and Biopharmaceutical Applications, Environmental Testing, Academic Research, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Agilent Technologies Inc., Bruker Corporation, Hitachi Ltd., Horiba Ltd., JASCO Inc., JEOL Ltd., Medtronic plc, Merck KGaA, PerkinElmer Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., VIAVI Solutions Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the molecular spectroscopy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global molecular spectroscopy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the molecular spectroscopy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molecular spectroscopy market was valued at USD 6.94 Billion in 2024.

IMARC estimates the molecular spectroscopy market to exhibit a CAGR of 2.60% during 2025-2033, expecting to reach USD 8.84 Billion by 2033.

Key factors driving the molecular spectroscopy market include increasing demand for high-precision analytical techniques in pharmaceuticals, environmental testing, and food safety. Besides this, ongoing advancements in spectroscopy technologies, such as near-infrared and Raman spectroscopy, along with growing applications in research and diagnostics, are boosting the market growth.

North America currently dominates the market, accounting for a share exceeding 41.9% in 2024. This dominance is fueled by the strong presence of key players, advancements in research and development, high healthcare spending, and increasing applications of molecular spectroscopy in pharmaceuticals, environmental monitoring, and diagnostics.

Some of the major players in the molecular spectroscopy market include ABB Ltd., Agilent Technologies Inc., Bruker Corporation, Hitachi Ltd., Horiba Ltd., JASCO Inc., JEOL Ltd., Medtronic plc, Merck KGaA, PerkinElmer Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., VIAVI Solutions Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)