Mold Release Agents Market Size, Share, Trends and Forecast Report by Product, Type, Application, and Region 2025-2033

Mold Release Agents Market Size and Trends:

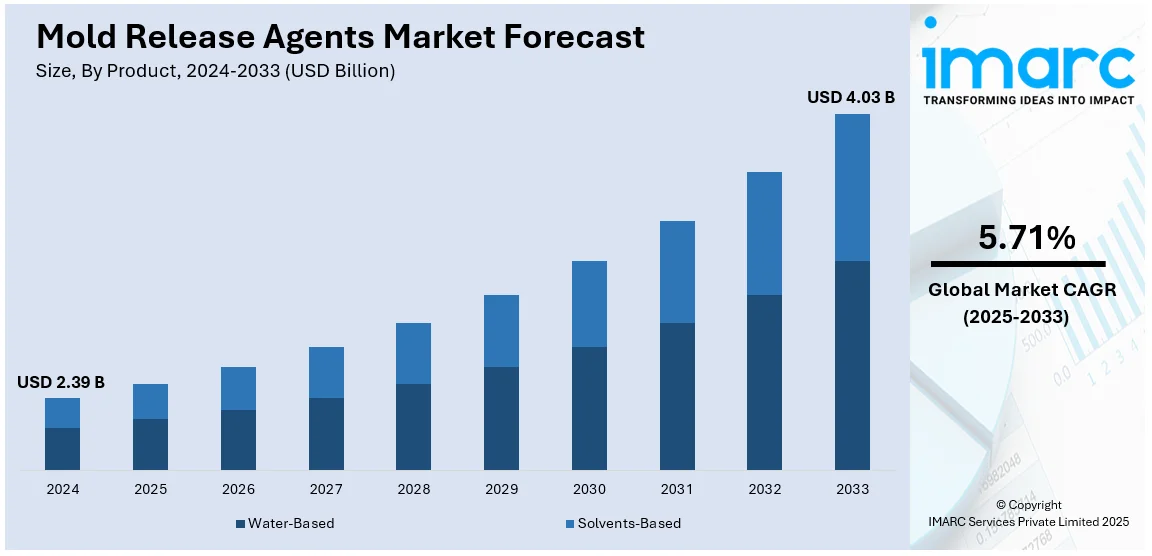

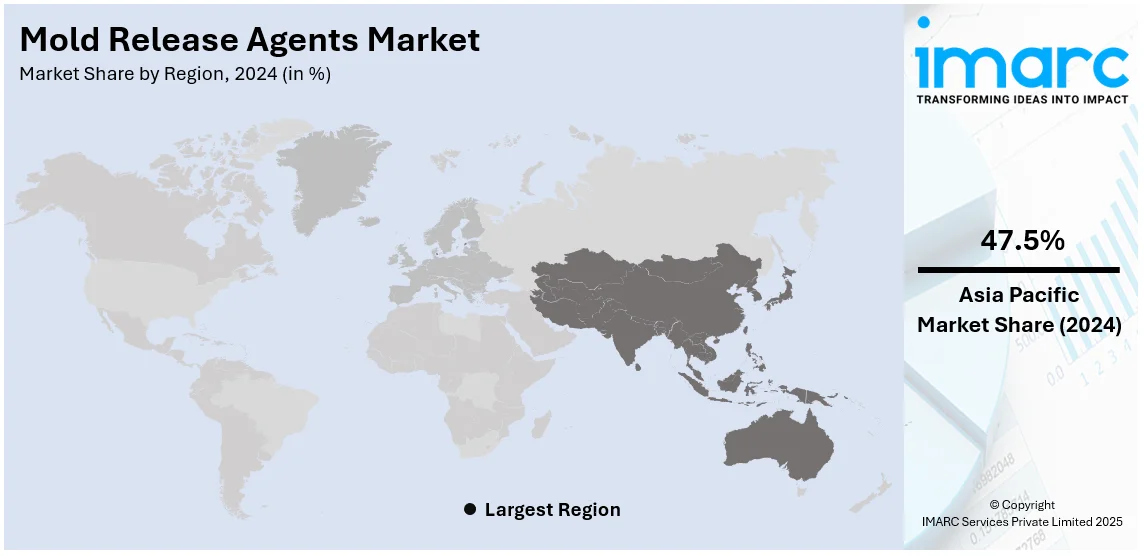

The global mold release agents market size was valued at USD 2.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.03 Billion by 2033, exhibiting a CAGR of 5.71% during 2025-2033. Asia Pacific currently dominates the mold release agents market share in 2024 with a significant share of 47.5%. The escalating demand for casting parts, rapid growth in the automotive industry, and the implementation of stringent government regulations represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.39 Billion |

|

Market Forecast in 2033

|

USD 4.03 Billion |

| Market Growth Rate (2025-2033) | 5.71% |

The global mold release agents market forecast is primarily driven by the increasing demand from various industries, such as automotive, construction, and consumer goods, for effective manufacturing processes. Moreover, expansion in lightweight materials, such as composites and plastics, intensifies the requirements for high-performance mold release agents, thereby fostering market growth. Also, environmentally friendly and non-toxic formulation developments also sustain the growth momentum of the market. Rising industrial automation, stringent quality requirements, and an expansion of manufacturing activities in the emerging economies form a big contributory element toward the growing global demand for mold release agents. For instance, a Nuvama report, published in August 2024, emphasized that India’s manufacturing sector, accounting for 17% of its GDP, ranks the nation as the world’s sixth-largest manufacturing economy. The report emphasizes that recent government reforms, including the Make in India initiative, the Goods and Services Tax (GST), and the Production Linked Incentives (PLI) scheme, have strengthened balance sheets and increased capital availability, creating grounds for investment opportunities across diverse sectors.

The United States stands out as a key regional market, which is mainly driven by the increased emphasis on manufacturing precision and efficiency in several end-use industries such as aerospace, packaging, and electronics. Moreover, the growing adoption of advanced molding technologies has also increased demand for specialized release agents that can guarantee superior surface finish and lower downtime during production, which is fueling the market. In addition, increasing stringency in regulatory standards for product quality and worker safety have further increased demand for innovative high-performance solutions, which is creating a positive mold release agents market outlook. For instance, on December 9, 2024, the U.S. Environmental Protection Agency finalized rules under the Toxic Substances Control Act (TSCA) to ban all uses of trichloroethylene (TCE) and all consumer uses, along with many commercial uses, of perchloroethylene (PCE). The EPA's action aligns with President Biden’s Cancer Moonshot initiative, aiming to reduce cancer incidence by eliminating exposure to these hazardous chemicals. In addition to this, rising investments in automation and technological advances in molding processes are providing a boost to the market.

Mold Release Agents Market Trends:

Growing Adoption of Eco-Friendly Solutions

With the increased push from all over the world for sustainable manufacturing practices and the implementation of environmental regulations, demand for environmentally friendly mold release agents is rapidly growing. An industry report indicates that the global sustainable manufacturing market was valued at USD 203.65 billion in 2023 and is projected to expand at a CAGR of 11.6% from 2024 to 2030. Traditionally, mold release agents have been solvents and chemicals that could be detrimental to both the environment and human health. However, as environmental impacts are better known, industries are shifting towards water-based, biodegradable, and non-toxic alternatives. These green agents diminish hazardous waste and meet the more stringent regulations imposed by REACH and OSHA, among others. Manufacturers readily embrace these greener solutions because they not only meet regulatory demands but also seek to attract those consumers who believe in environmental safety. The growing interest of "green" manufacturing and sustainability initiatives in the automotive, construction, and consumer goods sectors should continue to encourage the adoption of eco-friendly mold release agents. This trend represents a larger industry shift toward reducing the ecologic imprint of production.

Expanding Automotive and Construction Sectors

The automotive and construction sectors are the largest end-users of mold release agents, and their continuous expansion greatly affects market growth. For instance, according to an industrial report, in 2022, the U.S. produced about 9.2 million vehicles, representing approximately 76% of North America's total production of 12.1 million units. This robust automotive output underscores the significant use of mold release agents in processes such as die-casting, plastic molding, and component manufacturing. In the automotive industry, mold release agents play a critical role in the die-casting, injection molding, and production of plastic parts that constitute part of a vehicle manufacturing. As globalization in the production of cars continues to soar, mainly during the current increase in demand for electric vehicles (EVs) and lightweight materials to be used in enhancing fuel efficiency, advanced mold release agents are needed for high-quality production processes. The same sector of construction work, such as concrete molding as well as prefabricated construction components, also needs the mold release agents to ensure the smooth surfaces and formwork removal. Demand is likely to grow in these two industries due to the changing use of new technologies and new techniques in manufacturing calls for highly specialized mold release agents with superior performance for modern manufacturing requirements.

Advancements in High-Performance Mold Release Agents

Innovation and technological advancements contribute significantly to designing high-performance release agents for challenging, in-demand applications in today's industries. Those industries include but are not limited to aerospace, the automotive industry, and electronics among others. In the automotive sector, the demand for lightweight materials, particularly for electric vehicles (EVs), is expanding. According to the U.S. Department of Energy, EV production in the U.S. is expected to rise by 20% annually from 2024 through 2030. A lot of innovation is required regarding extreme temperatures or pressures and complexity in molding these products. Mold release agents play a significant role in aerospace wherein molds have to engage with advanced materials of composites while ensuring not to compromise any structural integrity. Similarly, automotive manufacturing requires high-performance release agents that can handle lightweight alloys and intricate molds for fuel-efficient vehicles. Advances in chemical formulations have led to the development of products that not only perform better under harsh conditions but also reduce residue and improve part quality. As the need for precision in manufacturing increases within various sectors, including electronics, where molds are used to make small but intricate components, there will be an increased demand for high-performance mold release agents to drive market innovation and growth.

Mold Release Agents Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mold release agents market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, type, and application.

Analysis by Product:

- Water-Based

- Solvents-Based

Water based leads the market with a significant share of 54.6% in 2024. Water-based solvents dominate the mold release agents market share due to their eco-friendliness, safety, and superior performance. Their nontoxic and biodegradable nature produces less VOC-emitting agents while maintaining strict standards set by strict environmental regulations. Furthermore, mold release is produced with no impairment of surface quality, making this suitable for any industry, especially in automotive, construction, or packaging. Their cost-effectiveness and user-friendliness further propel adoption, as manufacturers increasingly seek sustainable and high-performance solutions. The trend toward greener practices continues to underpin the demand for water-based mold release agents.

Analysis by Type:

- External

- Internal

- Semi-Permanent

External leads the market in 2024. This dominance is driven by its versatility and ease of application in different types of industry, including automobile, aerospace, and construction. Applied directly to the mold, they create a non-adherent barrier that allows for effortless release during molding. External mold release agents are cost-effective, do not wear out molds often, and work with a variety of materials in the manufacturing process, including rubber, plastic, and composites. Also, external agents’ lower production downtime and maintenance, gives a practical approach to manufacturers as they seek to achieve efficiency in high-quality output.

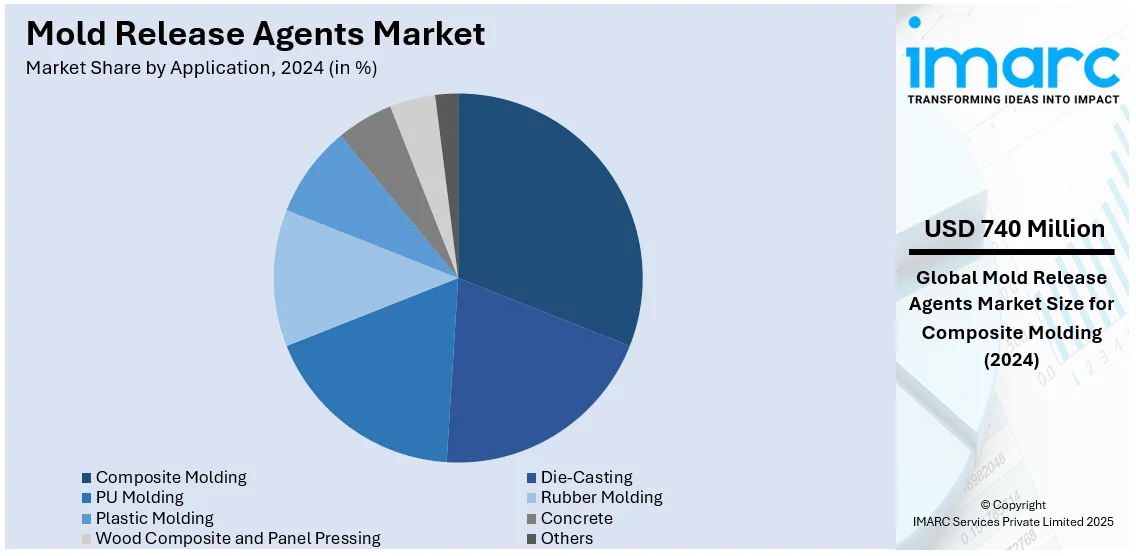

Analysis by Application:

- Die-Casting

- PU Molding

- Rubber Molding

- Composite Molding

- Plastic Molding

- Concrete

- Wood Composite and Panel Pressing

- Others

Composite molding leads the market in 2024, holding a share of 31.0%. This can be attributed to the increasing demand for high-performance materials in industries like automotive, aerospace, and renewable energy. Composite molding processes, such as resin transfer molding (RTM) and vacuum-assisted resin transfer molding (VARTM), require specialized mold release agents to prevent material adhesion, ensure smooth surface finishes, and enhance production efficiency. The growing trend toward lightweight, durable, and energy-efficient components drives the need for composites, which in turn boosts the demand for mold release agents. Additionally, the focus on improving manufacturing speeds and reducing defects contributes to the segment's market leadership.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share, with a significant share of around 47.5%. This dominance can be attributed to the booming manufacturing and industrial sectors of the region, especially in automotive, construction, and consumer goods. The rapid urbanization and growing infrastructure projects in countries like China and India drive demand for high-quality molded products, increasing the use of mold release agents. The robust electronics and packaging industries in the region also contribute to this growth. Asia Pacific has also been significant because of the large workforce, cost-effective production, and developments in manufacturing technologies, which will spur innovation and market expansion for mold release solutions.

Key Regional Takeaways:

United States Mold Release Agents Market Analysis

The U.S. mold release agents market demand is expanding as automotive, aerospace, and construction sectors grow. Based on CEIC statistics, in 2023, vehicle manufacturing in the U.S. has produced nearly 10.6 million units, strongly driving demand in automotive for the production of mold release agents. Similarly, with increasing utilization of advanced mold release agents in concrete manufacturing, construction drives demand in this sector as well. Companies such as Chem-Trend and Miller-Stephenson have a stronghold on the market through innovative and eco-friendly products. A thrust towards sustainability has also led to the development of water-based and bio-based agents that comply with federal regulations. The U.S.-based manufacturers are also using export opportunities to strengthen their global presence. Emerging trends, such as nanotechnology-enhanced mold release agents, further propel market innovation and ensure the country's leadership in the industry.

Europe Mold Release Agents Market Analysis

The European market for mold release agents is thriving due to technological developments in manufacturing and sustainability. ACEA reports that electric vehicles registered 22.7% of new car registrations in the EU in 2023, which continued to drive up demand for mold release agents in EV component manufacturing. Countries such as Germany, France, and Italy lead, driven by their automotive and construction sectors. The strict regulations imposed by the EU to promote environment-friendly solutions have motivated the development of water-based mold release agents. The market leaders are REXCO and Wacker Chemie, which have developed innovative solutions that cater to industrial needs. The government-backed R&D initiatives and collaborations with academia ensure continuous technological advancements, thereby ensuring Europe's position as a key market for mold release agents.

Asia Pacific Mold Release Agents Market Analysis

Asia Pacific is rapidly expanding with industrial growth and technological development. Reuters states that India's defense spending was budgeted at INR 5.94 trillion (about USD 72.6 billion) for the financial year 2023-2024, 13% higher than the estimates for the beginning of the last period. It helps domestic industries, thus, indirectly raising the demand for mold release agents in construction and manufacturing sectors. Meanwhile, the Chinese automotive industry was on the rolls in 2023. As reported by People's Daily, about 30.16 million vehicles were produced. For the first time, it had surpassed the 30 million mark. The number of vehicles sold also hit a record of 30.09 million units. This indicates high demand for mold release agents in the automotive industry. Local manufacturers and international players are working together on innovations such as eco-friendly and nanotechnology-based solutions, further driving growth, and positioning the Asia Pacific as a leader in the mold release agents market.

Latin America Mold Release Agents Market Analysis

Industrial and aesthetic development drive the Latin America mold release agents market growth. As per industrial reports, Mexico has performed about 848,126 cosmetic procedures in 2022, including surgical and nonsurgical interventions. Such strong activity indirectly increases the demand for mold release agents used in medical device manufacturing, especially aesthetic and reconstructive surgery tools. Besides, Brazil's defense budget was USD 21.8 billion in 2022, according to Stockholm International Peace Research Institute (SIPRI). This is an increase of 3.1% from last year. Investment in defense does boost industrial development and increases demand for mold release agents in sectors such as automobile and aerospace. The region's shift towards local production and collaboration with international manufacturers helps in innovation in the development of eco-friendly and high-performance mold release agents, cementing Latin America's place in the global industrial landscape as a growing market.

Middle East and Africa Mold Release Agents Market Analysis

In the Middle East and Africa, growth in the market for mold release agents is happening due to steady growth in the construction and manufacturing sectors. According to the UAE Government's official portal, the federal healthcare budget was AED 58.9 billion (approximately USD 15.8 billion) in 2022, supporting industries like medical device manufacturing. Vision 2030 by Saudi Arabia has been diversifying industries to further increase industrial output, therefore high-performance mold release agents in demand. The manufacturing sector is a driving factor for South African regional growth in firms like ChemSystems. Technology advancements, greater awareness of best practices to address environmental sustainability issues, and innovating solutions make way for increasing market shares across the region.

Competitive Landscape:

The market is characterized by numerous global and regional players vying for an increased market share. Key strategies include product innovation, focusing on environmentally friendly and sustainable solutions that meet regulatory standards. Companies have emphasized improving product performance for use in automotive, construction, and packaging industries. The players often invest in research and development for creating tailor-made solutions specific to certain molding processes. Additionally, partnerships, mergers, and geographical expansions are common strategies used to strengthen their presence and tap into emerging markets. For instance, On July 17, 2024, Henkel announced an additional investment in its largest manufacturing facility in India to strengthen its production capacity. The investment, aimed at expanding the capabilities of Henkel Adhesive Technologies India Private Limited, supports the company’s commitment to growing its presence in India and enhancing its innovation and sustainability initiatives. This development aligns with Henkel’s strategic goals to further its growth in emerging markets.

The report provides a comprehensive analysis of the competitive landscape in the mold release agents market with detailed profiles of all major companies, including:

- Ampacet Corporation

- Chem-Trend L.P. (Freudenberg Chemical Specialities SE & Co. KG)

- Chukyo Yushi Co. Ltd.

- Daikin Industries Ltd.

- Dow Inc.

- Henkel Adhesives Technologies India Private Limited (Henkel AG & Co. KGaA)

- McGee Industries Inc.

- Michelman Inc.

- Miller-Stephenson Chemical Company Inc.

- Moresco Corporation

- Rexco Inc.

- Shin-Etsu Chemical Co. Ltd.

- Sumico Lubricant Co. Ltd.

Recent Developments:

- August 2024: Chem-Trend continues to develop PFAS-free water-based release agents, such as Zyvax® 1070W and Mavcoat™, to improve molding of composites in aerospace, wind, and automotive. Such agents are very high in performance, sustainable, and lower health and environmental risk compared to their solvent-based counterparts. Chem-Trend continues to expand its global water-based offerings.

- May 2024: Shin-Etsu Chemical Co. Ltd announced plans to construct a new plant for silicone products in Zhejiang Province, China. The facility is expected to be completed in February 2026 and will produce general-purpose and functional silicone emulsions, such as environmentally friendly products. It will expand the production capacity of silicone products to meet growing demand in China.

- April 2024: Kao Corporation released LUNAFLOW RA, a water-based mold release agent using cellulose nanofibers (CNF). The product is intended for rubber and resin production and boasts superior demolding performance, durability, and eco-friendliness, with no solvents or fluorine. This new product improves the efficiency and safety of industrial use.

Mold Release Agents Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Water-Based, Solvents-Based |

| Types Covered | External, Internal, Semi-Permanent |

| Applications Covered | Die-Casting, PU Molding, Rubber Molding, Composite Molding, Plastic Molding, Concrete, Wood Composite and Panel Pressing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ampacet Corporation, Chem-Trend L.P. (Freudenberg Chemical Specialities SE & Co. KG), Chukyo Yushi Co. Ltd., Daikin Industries Ltd., Dow Inc., Henkel Adhesives Technologies India Private Limited (Henkel AG & Co. KGaA), McGee Industries Inc., Michelman Inc., Miller-Stephenson Chemical Company Inc., Moresco Corporation, Rexco Inc., Shin-Etsu Chemical Co. Ltd., Sumico Lubricant Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mold release agents market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global mold release agents market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the mold release agents industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mold release agents market was valued at USD 2.39 Billion in 2024.

The mold release agents market is projected to exhibit a CAGR of 5.71% during 2025-2033, reaching a value of USD 4.03 Billion by 2033.

The mold release agents market is mainly driven by rising demand in automotive and construction industries, the increasing product adoption in die-casting and injection molding processes, growing emphasis on product quality and precision, and continual technological advancements in environmentally friendly formulations.

Asia Pacific currently dominates the market, holding a share of 47.5% in 2024. The dominance can be attributed to the rapid industrialization, expanding automotive production, rising construction activities, and increasing manufacturing demand.

Some of the major players in the mold release agents market include Ampacet Corporation, Chem-Trend L.P. (Freudenberg Chemical Specialities SE & Co. KG), Chukyo Yushi Co. Ltd., Daikin Industries Ltd., Dow Inc., Henkel Adhesives Technologies India Private Limited (Henkel AG & Co. KGaA), McGee Industries Inc., Michelman Inc., Miller-Stephenson Chemical Company Inc., Moresco Corporation, Rexco Inc., Shin-Etsu Chemical Co. Ltd., and Sumico Lubricant Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)