Modular Construction Market Size, Share, Trends and Forecast by Type, Module Type, Material, End Use, and Region, 2025-2033

Modular Construction Market Size and Share:

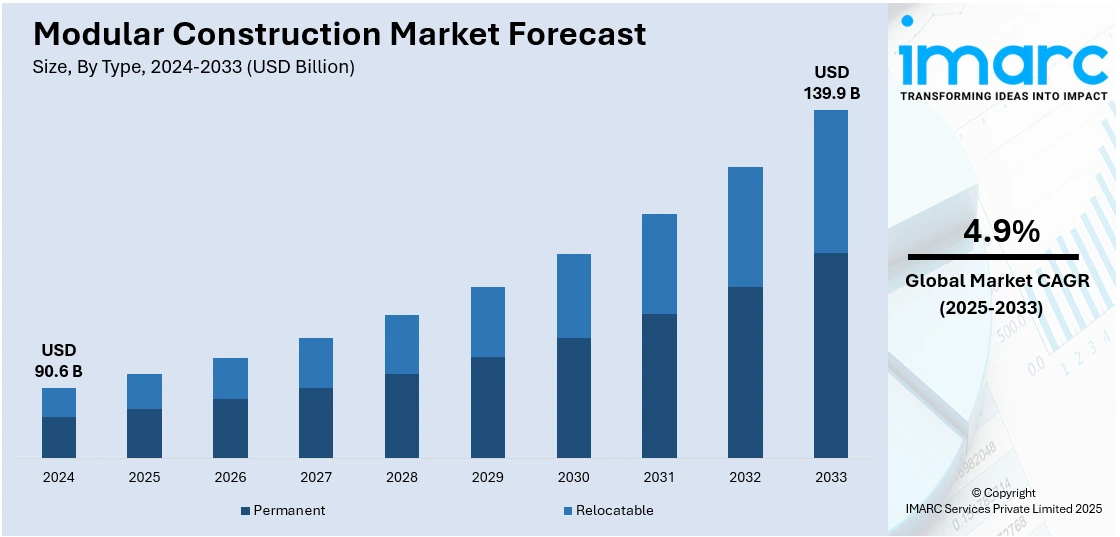

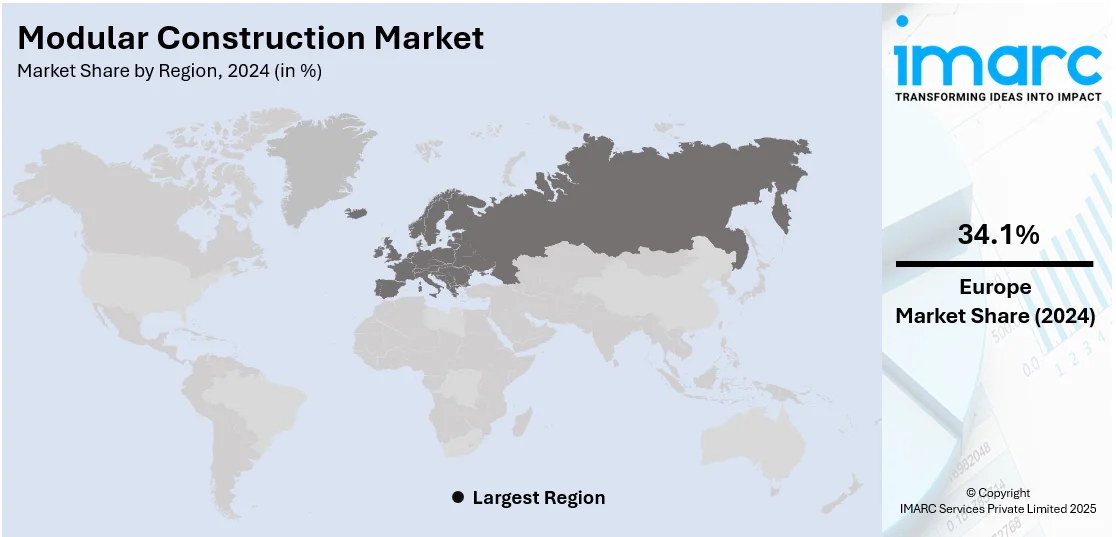

The global modular construction market size was valued at USD 90.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 139.9 Billion by 2033, exhibiting a CAGR of 4.9% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 34.1% in 2024. The rising demand for energy efficiency in construction, burgeoning need for disaster-resilient buildings, increasing cost efficiency and need for affordable housing, growing urgency for faster construction times, and heightened focus on sustainability are some of the factors driving the market in Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 90.6 Billion |

|

Market Forecast in 2033

|

USD 139.9 Billion |

| Market Growth Rate (2025-2033) | 4.9% |

The global modular construction market is fueled by the increasing demand for cost-effective and time-saving methods of construction. The capacity of modular construction to minimize on-site labor and materials waste makes it a viable option for green building projects. Urbanization and housing affordability needs are also driving the adoption. As per Worldometers, 57.5% of the entire world population resides in urban regions in 2024. Moreover, technological innovations, such as 3D printing and advanced materials, are improving design flexibility and construction quality. Apart from this, government policies encouraging green buildings and infrastructure development are favoring market growth. The growing application of modular methods in healthcare, education, and commercial sectors also enhance industry growth, catering to varied construction requirements globally.

The United States has become a major regional market for modular construction. It is spurred by the increasing demand for affordable and efficient construction methods to meet housing deficits and infrastructure needs. Urbanization and labor cost inflation are also driving the use of modular methods. According to a report by Worldometers, 82.4% of the entire population in the United States resides in urban cities. In addition, sustainability projects and strict building regulations are also favoring modular construction since it has the reputation of minimizing waste and maximizing energy efficiency. Advances in technologies, such as Building Information Modeling (BIM), are enhancing design accuracy and project administration. The market is also sustained through growing uses in healthcare, education, and commercial markets, where modular construction satisfies the need for fast and scalable building solutions.

Modular Construction Market Trends:

Rising Demand for Energy Efficiency in Construction

The modular construction market demand is rising due to the increased emphasis on energy efficiency. Several nations are aiming to meet stringent energy-saving targets, which is encouraging the adoption of construction activities that reduce energy consumption. For instance, the European Union (EU) adopted Directive 2012/27/EU on energy efficiency. This directive was revised in 2023 and has set its goal of final energy consumption of 763 Mtoe and primary energy consumption of 992.5 Mtoe. The adoption of modular construction facilitates better insulation and energy control, as it offers precision in manufacturing and assembly within controlled environments. This results in structures with enhanced thermal performance and a marked reduction in energy consumption for heating and cooling.

Increasing Need for Disaster-Resilient Buildings

The rising incidences of natural disasters, such as earthquakes, hurricanes, and floods, are propelling the demand for buildings that can withstand such events. As per The National Earthquake Information Center, 20,000 earthquakes occur around the globe each year, or approximately 55 per day. This alarming data has highlighted the need for efficient buildings made using modular construction that are specifically designed to tackle earthquakes. This kind of construction offers solutions that are often more resilient than traditional structures on account of their rigid frame construction and the ability to include specific design features to improve durability and resistance to extreme forces.

Escalating Demand for Affordable Housing

The demand for affordable housing, particularly in densely populated urban areas and emerging economies, represents a significant impetus for the modular construction market growth. In 2020, it was reported that around 44% of the population globally lived in cities, 43% in towns and suburbs, and 13% in rural areas. This makes the total urban share 87%, which is more than 6.8 Billion people. Moreover, 10 billion people will be there on this planet by 2050. Out of which, more than 66% of the world will live in urban areas. This data has highlighted the need for affordable housing among the masses. Modular construction is consequently becoming popular as it offers cost savings without compromising quality. With urbanization rates steadily rising, the demand for housing solutions that balance cost, quality, and speed is at an all-time high.

Modular Construction Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the modular construction market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, module type, material, and end use.

Analysis by Type:

- Permanent

- Relocatable

Permanent stands as the largest component in 2024, holding around 71.0% of the market share. This segment is driven by the increasing need for lasting structures that match conventional buildings in terms of durability and strength. Moreover, the assurance of long-term stability with a shorter construction timeframe is enhancing its appeal for use in residential and commercial applications, contributing to market growth. Along with this, the rising preference for structures that stand the test of time without compromising quality or aesthetics is boosting this segment, increasing the modular construction market revenue.

Analysis by Module Type:

- Four Sided

- Open Sided

- Partially Open Sided

- Mixed Modules and Floor Cassettes

- Modules Supported by a Primary Structure

- Others

Modules supported by a primary structure lead the market with around 32.2% of market share in 2024. They are components or sections of a building that rely on an existing main framework to provide structural integrity and support. This approach is highly favored in urban development projects and renovations where integrating new construction into existing buildings is required. Moreover, its rising popularity due to its versatility and efficiency, as it allows for significant architectural flexibility and faster construction times by utilizing the strength of an existing structure, is favoring the modular construction market share.

Analysis by Material:

- Steel

- Concrete

- Wood

- Plastic

- Others

Wood represents the leading market segment with around 59.2% of market share in 2024. The prominence of wood in modular construction is largely due to its sustainability, affordability, and versatility. As a renewable resource, wood aligns with the growing demand for eco-friendly construction practices. Its lightweight nature facilitates easier transportation and assembly of prefabricated modules, reducing construction time and costs. Moreover, the thermal and acoustic properties of wood make it an ideal choice for residential and commercial buildings, enhancing energy efficiency and comfort. Additionally, advancements in engineered wood products, such as cross-laminated timber (CLT), provide increased strength and durability, enabling the construction of multi-story structures. These attributes make wood a preferred material in the modular construction industry.

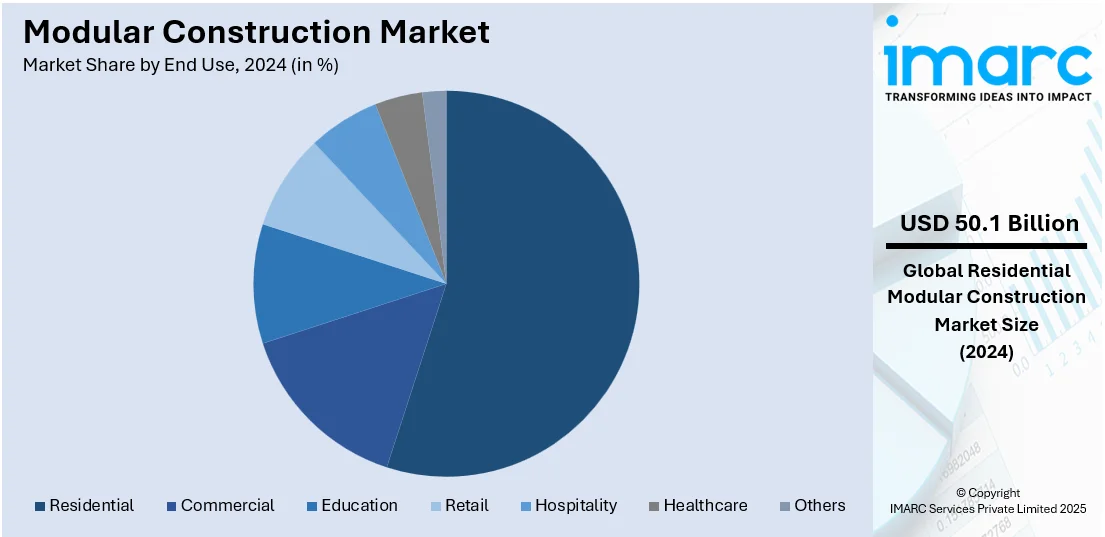

Analysis by End Use:

- Residential

- Commercial

- Education

- Retail

- Hospitality

- Healthcare

- Others

Residential exhibits a clear dominance in the market with around 55.3% of market share in 2024. This segment is driven by the increasing demand for affordable, scalable, and quickly deployable housing solutions across the globe. Modular construction caters to this need by offering efficient, cost-effective, and high-quality housing units that can be assembled on-site in substantially less time than traditional construction methods. Moreover, the method's ability to adapt to various architectural styles and local building codes is propelling its market growth. Additionally, the environmental benefits of reduced waste and the efficient use of materials align with the growing consumer preference for sustainable living solutions, further augmenting industry expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 34.1%. This prominence is driven by a strong focus on sustainability, energy efficiency, and advanced construction practices. The stringent building regulations in the region and its policies promoting green construction drive the adoption of modular techniques. Growing urbanization and increasing demand for affordable housing further boost the market. Advanced technologies such as Building Information Modeling (BIM) and high-quality prefabrication methods are widely utilized, enhancing construction speed and efficiency. Additionally, the emphasis on reducing carbon emissions and material waste aligns with the eco-friendly benefits of modular construction, making it a preferred choice for residential, commercial, and infrastructure projects across the region.

Key Regional Takeaways:

United States Modular Construction Market Analysis

In 2024, the United States accounts for over 91.70% of the modular construction market in North America. The United States modular construction market has witnessed tremendous growth owing to several key factors. According to ICC, from 2015 to 2018, modular construction in new real estate projects has increased by 50% in terms of market share. Such growth is supported by an increase in R&D spending, as the top global construction companies have increased investment by 77% since 2013. In the United States, affordable housing demand has led cities to adopt modular construction for multifamily residential projects as it offers a faster, more cost-effective alternative to traditional building methods. Around 1.29 million new privately owned houses were started in 2019, and this number grows based on the need for housing. Other factors driving market demand include construction costs that increase everyday coupled with the urgency in timely delivery. In addition, modular construction helps solve the housing deficit issues, particularly in urban zones, as it allows for efficient manufacturing and reduced on-site construction time. These trends illustrate the increasing growth of the modular construction market in the United States, with more off-site building techniques being adopted in residential and commercial sectors.

Asia Pacific Modular Construction Market Analysis

The modular construction market in the Asia-Pacific (APAC) region is booming with strategic alliances, increased investments, and government initiatives. For instance, in 2022, Gammon, Balfour Beatty's joint venture, won a contract of USD 0.17 Billion for a residential project in Yau Tong, Hong Kong. Such collaborations show the increasing trend for modular construction to meet housing and urbanization needs in the region. Infrastructure investment is another significant impetus. Singapore intends to invest more than USD 2.7 Billion in infrastructure and housing projects, and this will be one of the major demand sources for modular construction solutions, given their efficiency and cost-effectiveness. Likewise, India's 'National Infrastructure Pipeline' will be channelling USD 1.4 Trillion into infrastructure development over five years, and the demand for modular construction in the residential, commercial, and public infrastructure sectors will increase. These developments reflect the growth in dependence on modular construction to overcome rapid urbanization, housing shortage, and demands for environmentally friendly building practices.

Europe Modular Construction Market Analysis

The modular construction market in Europe is growing rapidly, fueled by acquisitions, rising urbanization, and strategic partnerships. In 2021, Modulaire Group acquired Procomm Site Services Ltd to strengthen its market presence across the region. Such moves underline the increasing adoption of modular solutions to meet evolving construction demands. Urbanization in developed nations is another significant driver. For instance, in 2021, Laing O’Rourke, ISG, Wates, and Kier were commissioned by the UK Ministry of Justice for a EUR 1 Billion (USD 1.06 Billion) project to build 6,000 new, modern prison spaces, emphasizing security and rehabilitation. This highlights the role of modular construction in addressing large-scale public infrastructure needs efficiently. Strategic partnerships further drive growth. In 2022, Lendlease formed a joint venture to develop a EUR 215 Million (USD 226 Million) office block in Stratford, East London. Such collaborations showcase the ability of modular construction to deliver fast, sustainable solutions for the expanding infrastructure demands in Europe.

Latin America Modular Construction Market Analysis

The modular construction market is expanding in Latin America, driven by strategic acquisitions, sustainability trends, and industrialization. In 2019, ATCO diversified its operations in Mexico with the acquisition of one of the country's premier manufacturers of modular buildings under the brand name ATCO Espaciomovil, subsequently fueling demand for modular solutions. Sustainability also remains a significant driver. In 2018, Brazilian start-up SysHaus introduced sustainable, smart modular homes in partnership with architect Arthur Casas. They included air conditioning, heated floors, smart lighting, remote control electronic locks, and virtual assistants according to the customer's interest. These add-ons fall between 6,000 –12,000 Reais (USD 1,500– USD 3,063) per square metre and are in line with the population's desire for green, futuristic living. Industrialization is further enhancing the growth rate. In 2022, Chinese company Vessel announced its plan to open a mega-factory for modular housing in Mexico, highlighting increasing demand for efficient and scalable construction solutions across Latin America.

Middle East and Africa Modular Construction Market Analysis

The modular construction market in Middle East and Africa is experiencing rapid growth due to increasing urbanization, industrialization, and strategic initiatives. In 2019, Al Shafar Steel Engineering LLC, a leading GCC steel fabrication company, launched its prefabricated modular buildings at The Big 5, showcasing the rising demand for innovative construction methods in the UAE. Population growth is another significant driver in the region. For instance, Dubai-based LINQ began constructing modular homes in 2021 to cater to housing demands, emphasizing the efficiency of modular construction. Industrialization further propels market expansion. In 2023, Korean contractor Samsung C&T signed an MoU with Saudi Arabia’s sovereign wealth fund to establish a modular building factory, signaling a growing focus on advanced construction technologies in MEA. The deal oversaw the management of USD 620 Billion in assets. Such factors drive the modular construction market in the region.

Competitive Landscape:

Key players in the global modular construction market are driving growth through strategic actions such as technological advancements and innovative product offerings. Companies are increasingly investing in automation and robotics to streamline manufacturing processes, enhancing efficiency and scalability. Partnerships and collaborations with architects, contractors, and government bodies are enabling the development of large-scale projects, particularly in urban housing and commercial sectors. Leading firms are also prioritizing sustainable practices, incorporating eco-friendly materials and energy-efficient designs. Expansion into emerging markets is further broadening their customer base. Additionally, modular construction providers are utilizing digital tools such as Building Information Modeling (BIM) to improve project accuracy, reduce timelines, and enhance client satisfaction, boosting market demand.

The report provides a comprehensive analysis of the competitive landscape in the modular construction market with detailed profiles of all major companies, including:

- Algeco

- Balfour Beatty plc

- Bouygues

- Etex Group

- Guerdon LLC

- KLEUSBERG GmbH & Co KG

- Laing O'Rourke

- Larsen & Toubro Limited

- Lendlease Corporation

- Red Sea International

- Skanska AB

- Taisei Corporation

Latest News and Developments:

- November 2024: Module-T Prefabrik, a global leader in modular construction, has announced its entry into the U.S. market. The company will offer a diverse portfolio of modular solutions, including office, sanitary, locker, and dormitory containers, and modular office buildings. A key focus will be on providing labor accommodation complexes designed to meet the permanent and temporary office space requirements of various industries, ensuring rapid and efficient deployment.

- August 2024: EIR Healthcare has announced the groundbreaking of a new modular commercial property in Brooklyn, NY, developed with Skylight Development, Coughlin Scheel Architects, Enlighted (a Siemens company), and FullStack Modular. EIR led a modular feasibility study, opting for modular construction for its cost and time efficiency. The company also managed vendor selection and assembled the project’s design team.

Modular Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Permanent, Relocatable |

| Module Types Covered | Four Sided, Open Sided, Partially Open Sided, Mixed Modules and Floor Cassettes, Modules Supported By a Primary Structure, Others |

| Materials Covered | Steel, Concrete, Wood, Plastic, Others |

| End Uses Covered | Residential, Commercial, Education, Retail, Hospitality, Healthcare, Others |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Algeco, Balfour Beatty plc, Bouygues, Etex Group, Guerdon LLC, KLEUSBERG GmbH & Co KG, Laing O'Rourke, Larsen & Toubro Limited, Lendlease Corporation, Red Sea International, Skanska AB, Taisei Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the modular construction market from 2019-2033.

- The modular construction market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the modular construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Modular construction is a building process where structures are constructed off-site in prefabricated modules before being transported and assembled on-site. This method offers time and cost efficiency, reduces material waste, and enhances quality control. Modular construction is widely used in residential, commercial, and industrial projects, providing scalable and sustainable solutions tailored to diverse building needs.

The global modular construction market was valued at USD 90.6 Billion in 2024.

IMARC estimates the global modular construction market to exhibit a CAGR of 4.9% during 2025-2033.

The rising demand for cost-efficient and time-saving construction methods, growing urbanization and affordable housing needs, government initiatives promoting green buildings and sustainability, and expanding applications in healthcare, education, and commercial sectors are the primary factors driving the global modular construction market.

According to the report, permanent represented the largest segment by type due to its ability to deliver high-quality, durable structures comparable to traditional buildings while offering time and cost efficiencies.

Modules supported by a primary structure lead the market by module type as they offer enhanced stability and allow for greater design flexibility, accommodating complex architectural requirements.

Wood exhibits a clear dominance in the market by material due to its sustainability, affordability, and ease of assembly, aligning with the demand for eco-friendly building solutions.

Residential represents the leading market segment by end use due to the rising demand for affordable housing and rapid urbanization.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global modular construction market include Algeco, Balfour Beatty plc, Bouygues, Etex Group, Guerdon LLC, KLEUSBERG GmbH & Co KG, Laing O'Rourke, Larsen & Toubro Limited, Lendlease Corporation, Red Sea International, Skanska AB, Taisei Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)