Mobile Wallet Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mobile Wallet Market Size and Share:

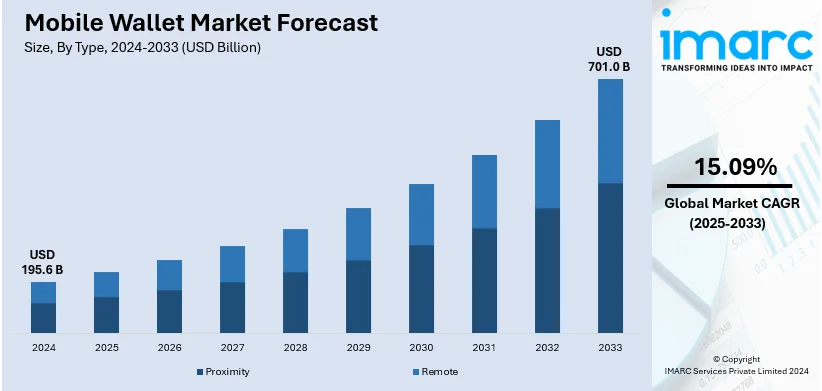

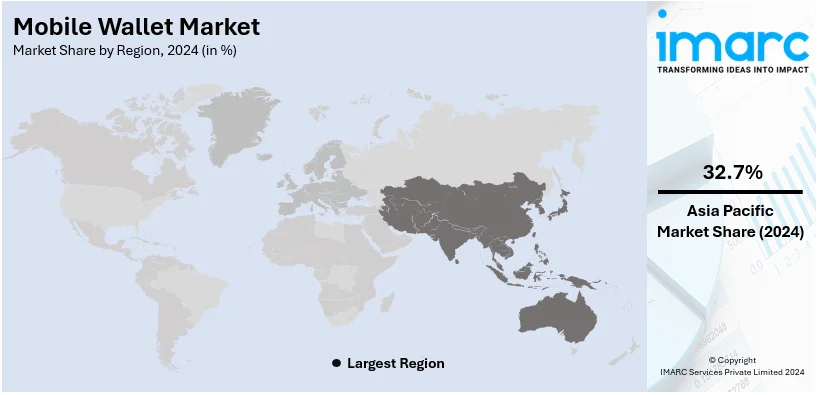

The global mobile wallet market size was valued at USD 195.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 701.0 Billion by 2033, exhibiting a CAGR of 15.09% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 32.7% in 2024. This is due to the increasing adoption of smartphones and easy availability of internet facilities, rising focus on contactless payments, and growing security issues related to monetary loss and a smoother checkout process.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 195.6 Billion |

|

Market Forecast in 2033

|

USD 701.0 Billion |

| Market Growth Rate (2025-2033) | 15.09% |

The global mobile wallet market is driven by increasing smartphone penetration and widespread internet accessibility. Convenience and security for cashless transactions offered by mobile wallets have made them highly popular in consumers' and businesses' minds. The growth of e-commerce platforms, together with increased digital payment preference, has further accelerated expansion in the market. Integration of NFC and QR codes at retail and transportation stages and even for simple peer-to-peer payments make these mobile wallets efficient products. The support through government initiatives toward digital payments and cash-less economies is also driving demand, mainly in emerging economies. In addition to this, an increased interest in financial inclusion and increasing mobile banking application usage help boost the market's growth. Increased awareness about secure payments and loyalty rewards of mobile wallets further encourages users to sustain growth in the global mobile wallet market.

The United States has emerged as a key regional market for mobile wallet. The market is driven by growing demand for consumer convenience and security. Increasing smartphones and high-speed internet connectivity are widely allowing mobile wallets to be used to make digital transactions. Leaders in retailing and commerce are increasingly taking mobile wallets as a means of enhancing accessibility and usability. Integration with technologies such as NFC and biometric authentication promotes seamless and secure transactions, encouraging adoption. Growth in the e-commerce space, contactless payments, and innovations in financial technologies have contributed to rapid growth in the markets, given the new preferences being developed amidst the pandemic wave. Innovations in technology, in conjunction with the loyalty programs and cash-back offers available through mobile wallets, widen the base of potential users. Along with the expansion of peer-to-peer payment platforms and increasing awareness about digital financial tools, this market strongly contributes to growth, making the United States a valuable player in the global mobile wallet landscape.

Mobile Wallet Market Trends:

Growing adoption of smartphones

A growing adoption of smartphones at the mass level, along with the ease of internet facilities throughout the world, is resulting in increasing the market. Following this, smartphones are easily reachable as well as affordable to almost everybody. According to the industrial report, worldwide, nearly 90% of mobile phones are smartphones. And most of the global population now possess one. Currently, more than 7.2 Billion smartphones exist globally and are anticipated to be up in the future. Additionally, this widespread ownership of smartphones greatly increases the number of potential users for mobile wallet services. Besides, the rising smartphone is considered a core tool for daily life, especially financial transactions. Moreover, increasing acceptance of digital payment methods since they can provide better convenience for users leads to growing growth for this market. In addition, key players are investing in user-friendly apps and services that cater to the diverse needs of smartphone users, ensuring that these platforms remain an integral part of the digital lives of individuals.

Rising focus on contactless payments

The increasing focus on contactless payments is providing a positive market outlook due to the growing demand for mobile wallets. Moreover, people are looking for safer alternatives to physical cash and card payments and are opting for touchless payment options. Apart from this, mobile wallets are equipped with near-field communication (NFC) technology that allows users to make secure and quick contactless transactions by simply using their smartphones at payment terminals. This swift payment enhances the overall convenience of individuals with busy lifestyles. People are increasingly preferring contactless payments to maintain hygiene standards and avoid the spread of infections. In this regard, the organization is investing in NFC-enabled terminals based on user preference, and that is driving the growth of the market. Contactless payment replaced card payments as cards replaced cash however are not yet at complete penetration in all markets. Many markets are already at 90%+, and countries like the UK at 93.4%, Australia at 95%, and Singapore at 97%. Nearly 90% of US customers use contactless payments now, and this market will continue to grow at a CAGR of 19.1% by 2030, according to industrial data.

Increasing security concerns

Mobile wallet service providers are emphasizing security as the primary element of their service. They are including improved security measures such as biometric authentication and tokenization to receive enhanced trust among the customers. According to an industrial survey report, 88% of banking leaders consider contactless as their main payment focus. Biometric authentication methods also provide a strong layer of security that ensures only authorized users can access and use their mobile wallets. Moreover, tokenization replaces sensitive card information with unique tokens, thus reducing the risk of data breaches. These security measures help enhance confidence in the minds of users that their financial data is securely stored and thus can be used freely for making mobile payments. In addition, leading players are focusing on developing next-generation security technologies that allow users to experience better peace of mind during the transaction process via such services.

Streamlined checkout process

Mobile wallet apps allow users to store multiple payment methods, including credit cards, debit cards, and even loyalty cards, all in one place. This eliminates the need to carry physical cards, making payments quick and hassle-free. Mobile wallets also make it easier to check out for both in-person and online purchases. Consequently, individuals could finalize some transactional processes with a handful of smartphone touches instead of waiting in the queue or typing payment details. An industrial report states that downloads of financial services applications worldwide have grown from 4.6 Billion in 2020 to an estimated 7.7 Billion in 2024, with India at the forefront of this growth, achieving 1.7 Billion downloads in 2024, rising from 1.5 Billion in 2022. Mobile wallets also feature transaction history tracking and budgeting tools. The market is benefiting from easily trackable expenditures by users, along with insightful information regarding spending behavior.

Mobile Wallet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mobile wallet market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Proximity

- Remote

In 2024, remote leads the market with 62.4% share. Remote mobile wallets are an electronic form of payment products designed to help users make their transactions without physically interacting with the payment terminal or the device. This allows users to make online payments or, more likely, mobile-app-based payments without having physical access to the point of sale (POS) terminal. These transactions normally require the entry of card details or the use of saved payment information. Additionally, users can safely save their card information in the app or website and easily make online purchases. They provide online shopping enthusiasts with greater convenience since they do not have to enter card details repeatedly.

Proximity mobile wallets are in-person and contactless wallets. They enable the user to make payments using their smartphone, smartwatches, or other NFC-enabled devices close to a compatible POS terminal. This is based on proximity interaction and can be used for contactless and quick transactions. In addition, they are mostly for in-store purchases. With NFC-equipped payment terminals, the user only needs to tap his device to complete a transaction, which makes them great for busy people.

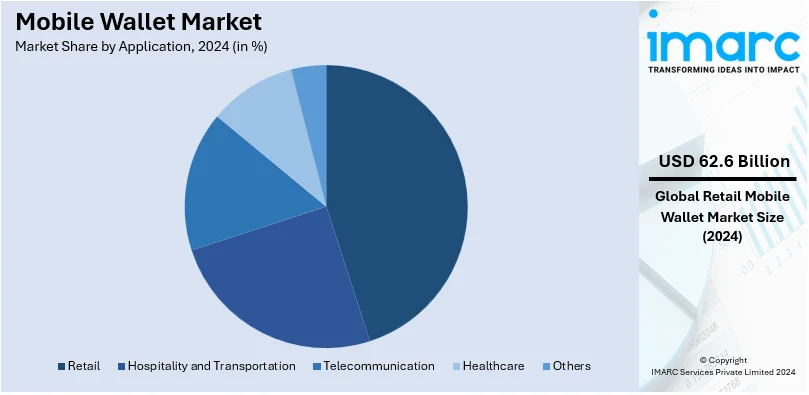

Analysis by Application:

- Retail

- Hospitality and Transportation

- Telecommunication

- Healthcare

- Others

Retail represents the leading segment holding around 32.0% of the market share. In the retail segment, mobile wallets are used for physical retailer's store payment and online shopping. Customers can easily make a transaction with their smartphones or other mobile devices at their convenience and safety. The use of the mobile wallet also expands in online shopping. Users may save their different modes of payments in a mobile wallet and easily make online payments. Mobile wallets also enhance the overall shopping experience by providing speed, convenience, and security. They reduce the need for physical cash and cards, allowing individuals to make payments with a simple tap or scan.

Mobile wallets in hospitality and transportation facilitate several transactions associated with travel, accommodation, and dining. They are used for booking hotel rooms, making restaurant reservations, and processing payments. Besides that, they are used to buy tickets, boarding passes, and other in-flight purchases. Mobile wallets allow travelers and diners to have a smooth experience as they consolidate payments, reservations, and loyalty programs in one app.

Mobile wallets are used in the telecommunication industry for billing and recharging mobile services and buying additional services or add-ons. They enable users to pay their phone bills, buy data packages, and add minutes to their prepaid mobile plans. They make it easier for mobile service users to pay. Additionally, mobile wallets make bill payments easier and enable users to manage their mobile services through a digital platform with a relatively low requirement of physical recharge cards.

Mobile wallets in healthcare have applications such as payment for health services, management of health insurance, and storage and access to health information securely. A patient may be able to pay for appointments, procedures, or prescriptions using a mobile wallet. Mobile wallets may also help manage and access health insurance. This will facilitate billing and claims. In addition, mobile wallets in healthcare enhance efficiency, transparency, and access when managing medical expenses and data related to health.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia Pacific region leads the market with 32.7% share in 2024, mainly driven by the adoption of smartphones by the masses. Furthermore, the growing demand among individuals for mobile wallets for purchase purposes is driving the market ahead. Moreover, their growing usage as mobile wallets helps reduce cash dependency and promote transparency, which creates a highly favorable outlook for the market. Additionally, governing agencies in the region are focally promoting digital payments, which further supports the growth of the market.

North America is the other important region in the market, which is fueled by the ease of internet facilities. In that regard, the growing inclination of people toward digital transactions is further boosting the market. Moreover, the development of innovative features and enhanced security measures in mobile wallets is boosting the market growth.

Europe continues to dominate the market due to the growing trend of advanced security and data protection in mobile wallets. Besides this, the usage of mobile wallets for contactless ticketing and payments during transit is positively contributing to the market. Furthermore, the cashless payment trend has been gaining momentum in the region, which is encouraging market growth.

Latin America is showing the most promising growth in the mobile wallet market with smartphone adoptions, coupled with easy availability of the internet facility. In line with this, the growing focus on secure and convenient online transactions is boosting the market growth. At the same time, the positive government initiatives for digital payments are helping the market grow in this region.

The Middle East and Africa region presents a developing market for mobile wallets, mainly driven by the increasing use of mobile wallets for online shopping. Moreover, the increasing demand for mobile wallet solutions for secure and seamless transactions to maintain transparency is also positively influencing the market in the region.

Key Regional Takeaways:

United States Mobile Wallet Market Analysis

In 2024, the United States accounts for 82.0% share of mobile wallet market in North America. Contactless payments, increased penetration of smartphones, and the preferences of consumers for secure and convenient payment systems are factors boosting the U.S. mobile wallet market. As of 2023, more than 85% of Americans have a smartphone, so there is a large base for mobile wallets such as Apple Pay, Google Pay, and Samsung Pay. Contactless payments increased by more than 100% between 2020 and 2023 due to the acceleration of the shift toward cashless commerce during the pandemic. The retail and e-commerce industries mainly drive the market, in 2022, U.S. e-commerce sales surpassed USD 1 Trillion. As they are easy to link with reward programs and offer one-click payment options, mobile wallets are gaining acceptance among customers. Moreover, using biometric identification techniques such as fingerprint scanning, and facial recognition enhances security and helps gain consumer confidence. The industry has risen due to the growth in BNPL services, which is always associated with mobile wallets. Reportedly, the industry noted that BNPL transactions in the United States during the year 2023 were as high as USD 100 Billion. Other factors that have also helped maintain such growth in this industry include favorable government initiatives toward making digital payments and cooperation between banks and Internet businesses.

Europe Mobile Wallet Market Analysis

The mature digital infrastructure of the region, along with a high smartphone penetration rate and increasing propensity toward contactless payments, has driven the mobile wallet market in Europe. Over 90% of point-of-sale terminals in Europe were contactless by 2023, making it easy for users to adopt mobile wallets on a wide scale. The top markets are the UK, Germany, and France, where Google Pay and Apple Pay have maximum adoption. According to industry players, with a valuation of over Euro 708 Billion (USD 743 Billion) in 2022, the European e-commerce market has enabled the pushing forward of mobile wallets through efficient payments, amongst others. Digital wallets have increased with COVID-19 and further, as convenience along with hygiene remains on top consideration both for consumers as well as for businesses. PSD2, or the payment Services Directive 2, and the regulation for open banking have been encouraging, thereby driving interoperability innovation and further mobile payments, due to the aspect that it's now integrated into your life and as mobile wallets support loyalty programs besides well-coordinating public transportation like what exists in Berlin and London for higher involvement of its clients.

Asia Pacific Mobile Wallet Market Analysis

Asia-Pacific now leads the worldwide mobile wallet market, owing to the high penetration of smartphones, rapid digital change, and growing urbanization in the region. Industry statistics point out that the Asia-Pacific area accounts for more than 52% of all paperless transactions globally. With Trillions of Dollars in mobile wallet transactions in China alone in 2023, China and India are significant contributors. The companies with a clear lead are Alibaba and Tencent with Alipay and WeChat Pay, respectively. This pair totally holds over 90% market share, as reported by the Asia Pacific Foundation of Canada data. The value of digital payments has gone up at a 44% CAGR from 2,071 crores (USD 244.01 Million) in FY 2017–18 to 18,737 crores (USD 2,207.60 Million) in FY 2023–24, as per data from the Ministry of Finance of the Government of India. Growth has also been spurred by increasing government initiatives such as India's "Digital India" program and QR-code-based payments. The Mega applications are the other main growth drivers for the Asia-Pacific markets, as they give access to more than one service on one platform.

Latin America Mobile Wallet Market Analysis

Mobile wallet market in Latin America is growing due to the high penetration of smartphones and financial inclusion. In 2023, more than 60% of people remain unbanked or underbanked, and mobile wallets give them access to financial services easily. Platforms like Mercado Pago and PicPay are now becoming extremely popular, while the top three leaders in the region are Brazil, Mexico, and Argentina. E-commerce is also one factor that is on the rise when it comes to mobile wallet usage. A report by Digital Payment Solutions stated that the region experienced a growth of 3.1X in transactions between 2019 and 2023, from USD 117 Million to USD 364 Million. Private investments in fintech innovation and government programs for paperless economies have grown the market even faster. For instance, the immediate payment system, PIX, of Brazil made over 30 billion transactions in 2023, most of which were done via mobile wallets.

Middle East and Africa Mobile Wallet Market Analysis

The growth of the mobile wallet industry in MEA is motivated by increasing numbers of smartphones and initiatives that encourage financial inclusion. According to World Economic Forum statistics, 84% of Kenyan and 60% of Nigerian internet users often made payments using their phones in 2021. Furthermore, mobile transactions hit an all-time high of USD 55.1 Billion in 2021, nearly 20% higher than 2020, according to the Economic and Financial Affairs Council. The United Arab Emirates and Saudi Arabia lead the Middle East in adopting due to government initiatives to adopt cashless transactions. Examples of digital wallets include STC Pay and PayBy, which profit from the expanding e-commerce industry.

Competitive Landscape:

Key players in this market are investing in advanced security measures like biometric authentication, tokenization, and encryption technologies to ensure safe transactions and the protection of information of the users. Toward this, companies are offering diversified mobile wallet services across loyalty programs, rewards, cashback offers, as well as peer-to-peer (P2P) money transfer services to extend value for the users' benefit. Many mobile wallet providers are now expanding their services to cross-border and international transactions. It allows users to make payments and transfers around the world, which would be helpful for travelers and international organizations. Moreover, manufacturers are keeping themselves compliant with financial regulations and data privacy laws.

The report provides a comprehensive analysis of the competitive landscape in the mobile wallet market with detailed profiles of all major companies, including:

- Alipay.com (Alibaba Group Holding Limited)

- Amazon Web Services Inc. (Amazon.com Inc)

- American Express Company

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Mastercard Incorporated

- Paypal Holdings Inc.

- Samsung Electronics Co. Ltd.

- Squareup Pte. Ltd.

- Visa Inc.

Latest News and Developments:

- October 2024: SWIFT has partnered with Thunes, a global payments network, to enable seamless bank-to-mobile wallet transfers. This program allows cross-border transactions in more than 130 countries by connecting digital wallets with traditional banking institutions. Banks can now send money directly to mobile wallets by integrating Thunes' infrastructure with SWIFT's international messaging features, making financial services faster, cheaper, and easier to access.

- May 2024: Visa has partnered with leading Vietnamese payment systems MoMo, VNPay, and ZaloPay to enhance Vietnam's digital payments environment. The secure and reliable payment solutions from Visa will be integrated into these platforms, which together cater to millions of users across the country to encourage cashless transactions.

Mobile Wallet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proximity, Remote |

| Applications Covered | Retail, Hospitality and Transportation, Telecommunication, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alipay.com (Alibaba Group Holding Limited), Amazon Web Services Inc. (Amazon.com Inc), American Express Company, Apple Inc., Google LLC (Alphabet Inc.), Mastercard Incorporated, Paypal Holdings Inc., Samsung Electronics Co. Ltd., Squareup Pte. Ltd., Visa Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mobile wallet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mobile wallet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mobile wallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A mobile wallet is a digital application enabling users to store their payment information securely and then make transactions through a smartphone or other device. This supports features like contactless payments, QR code scanning, and peer-to-peer transfers for a convenient, fast, and secure alternative to cash or cards.

The global mobile wallet market was valued at USD 195.6 Billion in 2024.

IMARC estimates the global mobile wallet market to exhibit a CAGR of 15.09% during 2025-2033.

The market is growing steadily due to the adoption of smartphones and easy availability of internet facilities, increasing focus on contactless payments, rising security issues related to monetary loss, and a smoother checkout process.

In 2024, remote represented the largest segment as they enable users to make transactions without physically interacting with the payment terminal or device, enabling online or mobile-app-based payments.

Retail leads the market, providing convenience and safety for customers for both physical store payments and online shopping.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global mobile wallet market include Alipay.com (Alibaba Group Holding Limited), Amazon Web Services Inc. (Amazon.com Inc), American Express Company, Apple Inc., Google LLC (Alphabet Inc.), Mastercard Incorporated, Paypal Holdings Inc., Samsung Electronics Co. Ltd., Squareup Pte. Ltd., Visa Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)