Mobile Phone Insurance Market Size, Share, Trends and Forecast by Phone Type, Coverage, Distribution Channel, End-User, and Region, 2026-2034

Mobile Phone Insurance Market Size and Share:

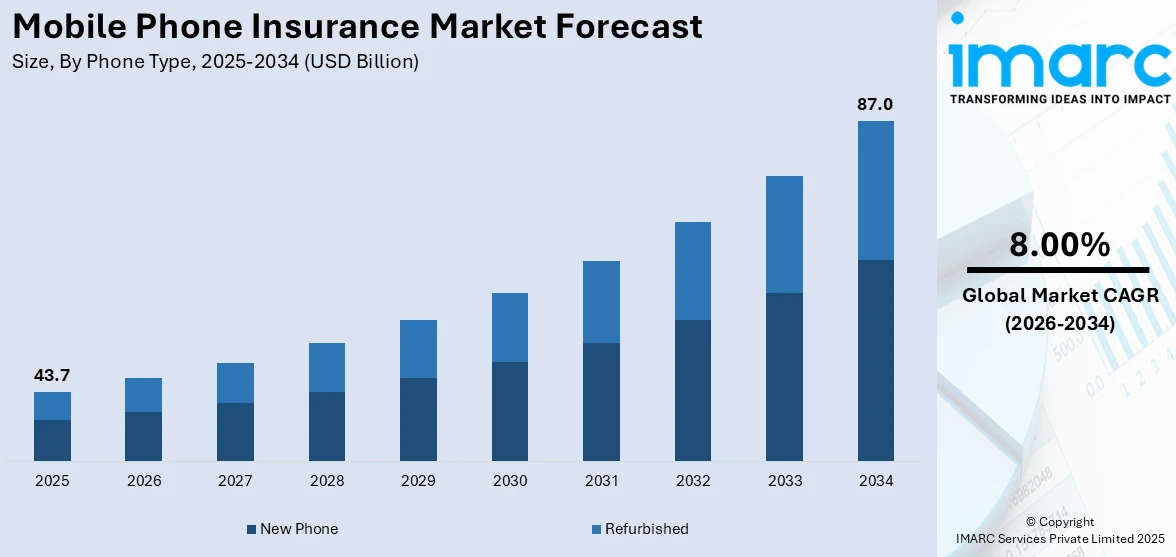

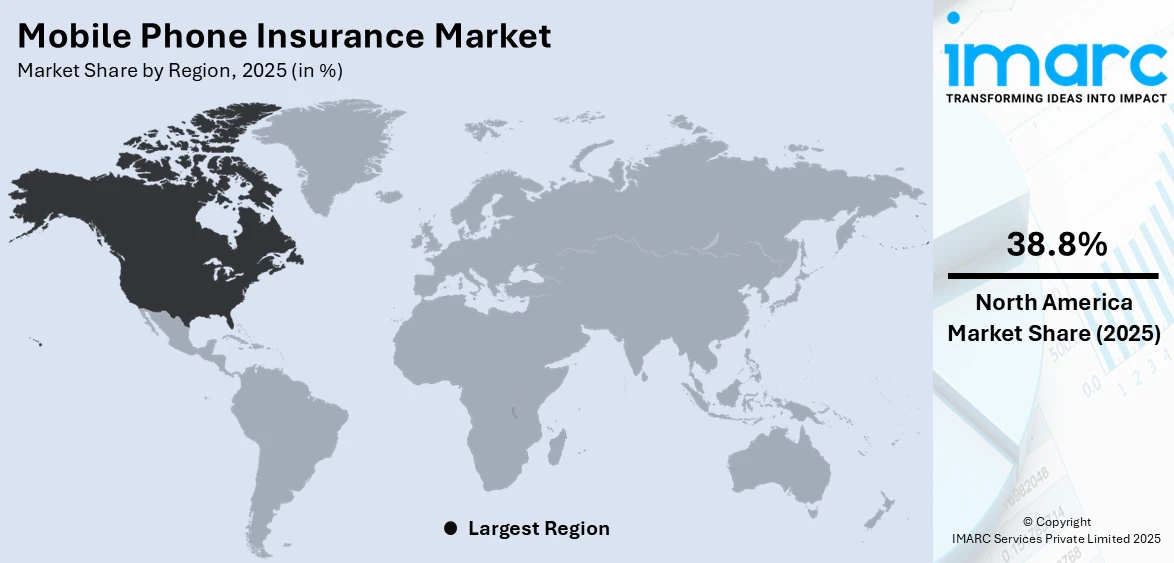

The global mobile phone insurance market size was valued at USD 43.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 87.0 Billion by 2034, exhibiting a CAGR of 8.00% during 2026-2034. North America currently dominates the market, holding a significant market share of 38.8% in 2025. Expanding digital platforms, rising smartphone thefts, and integration with mobile operators are driving the mobile phone insurance market share. E-commerce platforms simplify insurance purchases, increasing accessibility for customers. Growing theft incidents encourage users to seek financial protection. Telecom providers bundle insurance with mobile plans, ensuring seamless adoption and broader market penetration across various user segments.

Market Size & Forecasts:

- Mobile phone insurance market was valued at USD 43.7 Billion in 2025.

- The market is projected to reach USD 87.0 Billion by 2034, at a CAGR of 8.00% from 2026-2034.

Dominant Segments:

- Phone Type: New phone dominates the mobile phone insurance market, accounting for 69.6% of the share. Their widespread adoption is attributed to higher value, advanced features, and increased vulnerability to damage or theft.

- Coverage: With a commanding 58.6% share, physical damage leads the market, driven by its high frequency, costly repairs, and impact on phone functionality.

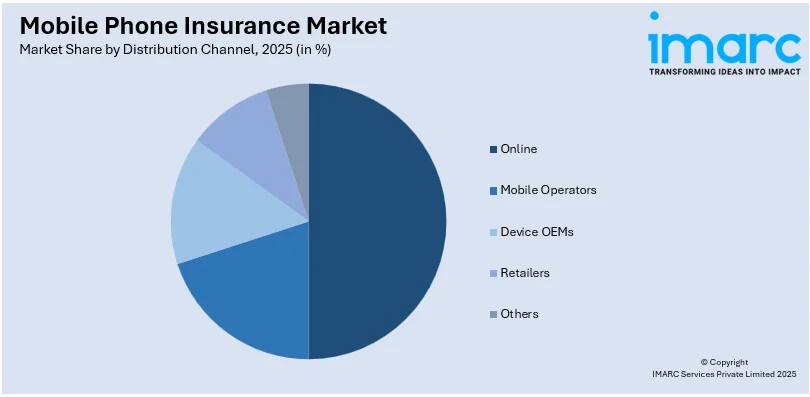

- Distribution Channel: Online represents the largest market share, accounting 49.8% in 2025. The dominance of the segment is driven by its convenience, wider reach, and easy comparison of policies.

- End-User: With a 74.7% of market share, personal dominates the market, owing to its widespread adoption, high device ownership, and individual protection needs.

- Region: North America leads the market, holding a dominant 38.8% share. This regional advantage is driven by its high smartphone penetration, disposable income, and strong technological adoption.

Key Players:

- The leading companies in mobile phone insurance market include American International Group, Inc, Allianz SE, AmTrust International Limited, Apple Inc., AT&T Inc., AXA Group, Deutsche Telekom AG, Liberty Mutual Insurance Group, Pier Insurance Managed Services Ltd., Samsung Electronics Co. Ltd., SoftBank Group Corp., Sprint Corporation, Telefónica Insurance S.A., Verizon Communications Inc., Vodafone Group Plc, Xiaomi Corporation and Orange S.A.

Key Drivers of Market Growth:

- Smartphone Penetration: As smartphone prices, especially for high-end models, rise, mobile phone insurance is becoming a crucial choice to manage repair or replacement costs. The growing dependency on these devices and their fragility increases the demand for financial protection.

- Subscription-Based Models: The increase in subscription-based models for mobile phone insurance allows users to pay premiums in manageable installments, improving accessibility and attracting a wider user base, particularly in developing markets.

- Convenient Claims and Services: Convenient claims and services are vital in mobile phone insurance, offering users quick claim processing, user-friendly apps, and responsive support, ensuring minimal downtime. Streamlined services enhance client satisfaction and ease of use.

- Heightened Awareness: Growing knowledge about risks, digital literacy, and the rising cost of repairs are encouraging more people to adopt mobile phone insurance. Social media, insurance campaigns, and easier access to bundled plans are further motivating users to invest in protection.

- Theft and Accidental Damage: Increasing instances of theft and unintentional damage are driving the need for mobile phone insurance as users look for financial safeguards. Due to elevated repair expenses and convenient bundled plans, a growing number of clients are choosing insurance to protect their devices.

Future Outlook:

- Strong Growth Outlook: The market is anticipated to see sustained expansion, attributed to increasing smartphone adoption, rising repair costs, and growing user awareness about protection plans.

- Market Evolution: The market is likely to transition from a supplementary service to a mainstream offering, as individuals prioritize protection against device damage, theft, and malfunction. Providers are focusing on offering more tailored, accessible, and flexible policies.

Telecom providers bundle insurance plans with mobile subscriptions, ensuring seamless adoption and enhanced customer convenience. Retailers offer insurance coverage at the point of sale, simplifying the purchase process for customers. Mobile carriers leverage existing customer relationships to promote insurance plans, increasing awareness and policy uptake. Bundled insurance plans provide cost-effective protection, encouraging more users to invest in mobile coverage. Retailers and operators collaborate with insurers to offer customized policies suited for different device models. Subscription-based insurance models ensure automatic premium payments, reducing policy lapses and improving customer retention. Mobile operators provide exclusive insurance benefits such as priority repairs and device replacements, enhancing user satisfaction. Retailers integrate insurance options into online and offline purchase channels, improving accessibility for smartphone users. Digital platforms streamline insurance activation, allowing users to register policies instantly after purchasing a new device, thereby strengthening the market growth.

To get more information on this market Request Sample

Expanding digital and e-commerce platforms are significantly driving the United States mobile phone insurance market demand. Online marketplaces provide seamless access to insurance policies, simplifying the purchase process for smartphone users. Customers prefer digital channels for comparing coverage options, ensuring informed decisions based on personal requirements. E-commerce platforms integrate insurance options at checkout, encouraging instant policy adoption alongside smartphone purchases. Telecom operators leverage online platforms to promote bundled insurance plans, increasing accessibility for mobile users. Mobile applications enable users to manage policies, file claims, and renew insurance conveniently from their devices. Insurers utilize artificial intelligence (AI) and chatbots to streamline customer queries, enhancing overall service efficiency. Digital marketing campaigns generate awareness about insurance benefits, driving higher user engagement and policy adoption. The rapid growth of e-commerce is further fueling the market, with total e-commerce sales in the U.S. reaching $1,192.6 billion in 2024, marking an 8.1% increase from 2023, according to the U.S. Census Bureau. E-commerce now contributes 16.1% of total retail sales, up from 15.3% in 2023, reflecting its expanding role in customer purchasing behavior. Subscription-based models on digital platforms provide flexible premium payments, attracting a broader customer base. As e-commerce grows, insurers continue expanding online distribution channels, making mobile phone protection plans more accessible and cost-effective.

Mobile Phone Insurance Market Trends:

Rising awareness and customer willingness

Customers are becoming more aware about potential risks, driving increased adoption of mobile phone insurance. Rising digital literacy is helping users understand the financial benefits of protecting their expensive smartphones. Frequent incidents of accidental damage, theft, and cyber threats are making insurance coverage a priority. Social media and online platforms are educating users about mobile phone insurance benefits and available plans. Insurance providers are actively conducting awareness campaigns, ensuring customers recognize the value of comprehensive mobile coverage. The growing trust in insurance companies is increasing user willingness to invest in protection plans. Transparent claim processes and quick settlements are further encouraging customers to purchase mobile phone insurance. Smartphone manufacturers and telecom operators are promoting bundled insurance plans, enhancing accessibility and adoption rates. Individuals are also recognizing the high cost of repairs and replacements, making insurance a crucial financial safeguard. Reflecting this awareness, 17% of US adults run antivirus programs on their mobile phones, while around 121 million rely on third-party antivirus software for device protection. This highlight increasing concerns about cybersecurity and device safety, further supporting the demand for comprehensive mobile insurance solutions. As digital threats and repair costs rise, more customers are seeking reliable protection for their smartphones.

Growing incidences of theft and accidental damage

Rising cases of theft and accidental damage are significantly driving the expansion of the mobile phone insurance market. Smartphones are prime targets for theft due to their high resale value and widespread global usage. Urban areas experience frequent smartphone thefts, encouraging users to seek insurance coverage for financial protection. Accidental damage cases including screen cracks and water exposure are increasing as smartphone dependency grows. Repairing premium smartphones is costly, making users opt for insurance policies to reduce their financial burden. Many insurance providers offer instant claim settlements, ensuring quick device replacement or repair for policyholders. Public awareness campaigns highlight theft and damage risks, encouraging users to invest in mobile phone insurance. Insurance companies are introducing comprehensive coverage plans addressing theft, accidental damage, and device malfunctions. Retailers and telecom operators bundle insurance with new phone purchases, simplifying access to protection plans. Businesses and professionals ensure work phones have insurance to prevent productivity loss from theft or accidental damage. Highlighting the severity of theft, Telangana leads India in mobile phone recoveries, achieving a 67.98% success rate through the CEIR portal. Since April 2023, police have recovered 5,038 lost or stolen devices in 110 days, with Karnataka and Andhra Pradesh following at 54.20% and 50.90% recovery rates. These efforts enhance mobile security and reinforce the importance of insurance in mitigating financial risks.

Mobile Phone Insurance Market Growth Drivers:

Rising Device Costs

With the ongoing increase in prices of smartphones, especially high-end models, mobile phone insurance is becoming a more appealing choice for people looking to alleviate repair or replacement costs. The growing use of expensive devices equipped with advanced features makes insurance crucial for financial protection. As users depend on smartphones for communication, banking, and work, seamless functionality is essential. The rising cost of fixing or replacing these fragile devices, susceptible to accidental damage, screen breaks, and hardware malfunctions, is catalyzing the demand for insurance. This trend is further driven by the low cost of smartphones, promoting adoption among different economic groups. Moreover, regular software updates and hardware improvements are increasing user awareness about repair expenses. Insurers are capitalizing on this demand by providing tailored plans for various models, while telecom operators and retailers combine insurance with device sales. The worldwide smartphone market experienced a 2% increase in shipments, totaling 307 million units, indicating this rising demand for protection.

Growing Popularity of Subscription-Based Models

The increase in subscription-based models on digital platforms is offering a favorable mobile phone insurance market outlook. These models provide people the option to pay premiums in manageable, repeated installments instead of a single payment, enhancing accessibility to insurance. This framework specifically attracts a wider range of client, including individuals in developing markets where financial flexibility is essential. The ease of handling and renewing policies via mobile applications and websites increases the attraction even more. Subscription payments resonate with the rising popularity of digital subscriptions across multiple services, familiarizing users with the model. A case illustrating this trend is Truecaller’s 2024 introduction of a fraud insurance plan in collaboration with HDFC Ergo, providing coverage of up to ₹10,000 for call/SMS fraud. Accessible to Android and iOS users who have an active annual premium subscription, claims can be conveniently submitted through the app, alongside automatic policy renewal.

Convenient Claim Services

A key element propelling the growth of the mobile phone insurance sector is the ease provided by efficient claim processes. Insurance companies are placing greater emphasis on streamlined and rapid claim procedures, greatly improving the client experience. Numerous insurers provide digital platforms, enabling claims to be submitted easily via mobile apps or websites, helping clients to bypass lengthy wait periods. Immediate claim approvals and quick repairs or replacements motivate individuals to purchase mobile phone insurance. The increase in convenient services, such as online document submission, instant status updates, and attentive client support, is making insurance more reachable and attractive. This ease minimizes the perceived difficulty of managing insurance, building trust and motivating more people to buy coverage for their devices.

Mobile Phone Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mobile phone insurance market, along with forecasts at the global and regional levels from 2026-2034. The market has been categorized based on phone type, coverage, distribution channel, and end-user.

Analysis by Phone Type:

- New Phone

- Refurbished

New phone stand as the largest component in 2025, holding 69.6% of the market. Customers prefer insuring newly purchased smartphones to safeguard against accidental damage, theft, and technical failures. High-end flagship devices come with expensive components, making users opt for insurance coverage as a protective measure. Manufacturers and retailers bundle insurance policies with new phones, simplifying the purchase process for customers. Many telecom operators offer insurance as part of subscription plans, driving policy adoption among new phone buyers. Customers recognize the high cost of repairs and replacements, making insurance an attractive option for financial security. The rising trend of trade-in programs encourages users to insure new devices for better resale value. Mobile phone financing options often require insurance coverage, further supporting the market growth in this segment. Extended warranty and protection plans provided by manufacturers contribute to higher insurance penetration for new phones. Promotional offers and discounts on insurance policies at the time of purchase influence customer decisions. The increasing shift toward premium smartphones with advanced technology is encouraging more users to insure their devices.

Analysis by Coverage:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

Physical damage coverage dominates the market with 58.6% of market share in 2025. Smartphone users frequently experience screen cracks, hardware failures, and water damage, making protection essential. Modern smartphones feature delicate glass bodies and larger screens, increasing vulnerability to breakage from drops or impacts. Repairing physical damage is costly, leading users to opt for insurance as a cost-effective solution. Insurance providers focus on physical damage coverage since it represents the most common claim type among users. Many manufacturers and telecom operators offer bundled insurance plans covering accidental damage, encouraging policy adoption. Physical damage insurance enhances user confidence in smartphone longevity, ensuring uninterrupted device functionality. Waterproof and shock-resistant smartphones remain limited, making users reliant on insurance for protection. The increasing usage of smartphones in outdoor and workplace settings raises the risk of accidental damage. Smartphone owners prioritize physical protection coverage over other insurance options, ensuring strong market demand. Insurance companies are expanding coverage options, including cracked screens and accidental drops, to attract more customers.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

The online distribution channel leads the market with 49.8% of market share in 2025. Customers prefer purchasing insurance online for convenience, transparency, and instant policy issuance. Many insurance providers, smartphone manufacturers, and telecom companies offer exclusive online-only insurance plans with competitive pricing. Digital platforms enable easy comparison of policies, helping users choose suitable coverage based on their needs. The rise of mobile applications and websites allows insurers to provide quick and seamless policy management. E-commerce platforms integrate mobile insurance options at checkout, encouraging users to secure their purchases instantly. Online platforms offer flexible payment options, making premium payments and renewals convenient for users. The increasing use of artificial intelligence (AI) in online insurance platforms streamlines policy customization and claim processing. Online distribution eliminates paperwork, making the process faster, more efficient, and eco-friendly for users. Discounts and promotional offers on online insurance plans attract a larger customer base. Insurers leverage social media and digital marketing to educate users about mobile phone insurance benefits. The expansion of fintech solutions further supports online premium payments and claim settlements.

Analysis by End-User:

- Corporate

- Personal

The personal segment holds 74.7% of the market share in 2025. Customers rely heavily on smartphones for communication, entertainment, work, and financial transactions, increasing their need for protection. Personal users prioritize mobile phone insurance to safeguard against unexpected damages, theft, and malfunctions. The growing affordability of smartphones encourages more individuals to purchase insurance policies for their devices. High repair and replacement costs make insurance a practical choice for users seeking financial security. Many insurers offer flexible and affordable insurance plans tailored to personal users, ensuring broader market penetration. The increasing trend of premium smartphones with advanced features is prompting users to opt for coverage. Telecom operators and e-commerce platforms promote personal insurance policies alongside smartphone purchases, ensuring higher adoption. Digital payment options and simplified claim processes make personal insurance policies more appealing to users. Young users and working professionals prefer insuring their devices due to their high dependency on smartphones. Promotional campaigns and awareness initiatives encourage individuals to secure their mobile phones against unforeseen risks.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

In 2025, North America accounted for the largest market share of 38.8%. Customers in the region prefer high-end smartphones, catalyzing the demand for insurance coverage against damage and theft. The presence of major insurance providers and telecom operators ensures a well-established mobile phone insurance ecosystem. Leading smartphone manufacturers offer bundle insurance plans, enhancing accessibility and customer trust. Strong regulatory frameworks and consumer protection laws promote transparency, encouraging more users to purchase mobile insurance. The high cost of smartphone repairs and replacements drives users to opt for insurance as a financial safeguard. E-commerce platforms and digital insurers simplify policy purchases, making mobile insurance more accessible in the region. Advanced technological integration including AI-driven claim processing, enhances the efficiency of insurance services. Telecom operators in the region actively promote mobile phone insurance through postpaid plans and contract-based sales. The rising adoption of 5G-enabled smartphones further contributes to the market growth by increasing device costs. North American customers are highly aware about insurance benefits, ensuring strong market demand for coverage plans. Overall, well-developed infrastructure, high disposable income, and digital advancements fuel North America’s market dominance.

Key Regional Takeaways:

United States Mobile Phone Insurance Market Analysis

The United States hold 82.80% of the market share in North America. The US mobile phone insurance market is experiencing significant growth as users prioritize device protection. Rising incidents of theft, accidental damage, and hardware malfunctions are catalyzing the demand for insurance coverage. Reports indicate that 1 in 10 American smartphone owners fall victim to phone theft, with 68% unable to recover their stolen device. The growing cost of high-end smartphones and their essential role in communication, entertainment, and work make insurance an attractive option for users seeking financial security. Insurance providers offer various plans covering accidental damage, theft, loss, and manufacturer defects. Many policies are available through direct purchases, bundled mobile service packages, or retailer partnerships. Increasing awareness about mobile insurance options and the growing reliance on smartphones are fueling the market expansion. Frequent device upgrades further drive the overall demand, as users seek continuous protection for their investments. Additionally, strategic collaborations between mobile operators, retailers, and insurers are improving accessibility and affordability. These partnerships enable seamless policy integration with smartphone purchases, encouraging wider adoption. As mobile phone dependency rises, insurance coverage is becoming an essential safeguard against unforeseen losses, ensuring uninterrupted device usage for American customers.

Europe Mobile Phone Insurance Market Analysis

The Europe market is witnessing steady growth as smartphone dependency increases for communication, work, and entertainment. With mobile device values rising, customers seek robust protection against accidental damage, theft, loss, and manufacturing defects. Insurance plans in Europe typically offer comprehensive coverage including screen damage, liquid spills, and even cyberattack protection. The market is expanding due to the growing adoption of mobile phone insurance by network operators, retailers, and third-party insurers. These providers offer tailored packages to meet diverse user needs, ensuring accessible and flexible insurance options. As mobile usage rises, particularly with the proliferation of high-end smartphones and 5G technology, demand for mobile phone insurance is expected to grow further. By 2030, mobile subscribers in Europe are projected to reach an 89% penetration rate, reflecting increasing smartphone adoption. Moreover, rising awareness about insurance benefits and the integration of value-added services like data protection and extended warranties are further driving market expansion across the region.

Asia Pacific Mobile Phone Insurance Market Analysis

The Asia Pacific market is expanding rapidly due to rising smartphone adoption, especially in emerging markets like India, China, and Southeast Asia. In India, smartphone penetration has reached 46.5%, with 660 million users, according to Invest India, highlighting the region’s growing mobile user base. As smartphones become essential for daily life, demand for insurance is increasing to protect devices from accidental damage, theft, and other risks. Rising disposable incomes and the increasing cost of premium smartphones are further strengthening market growth. Users, particularly in urban areas, are becoming more aware of mobile insurance benefits, leading to higher adoption rates. The market is also witnessing an increase in partnerships between mobile phone manufacturers, service providers, and third-party insurers, offering bundled insurance packages for seamless coverage. Additionally, e-commerce platforms and the growing digital ecosystem are making mobile phone insurance more accessible. Digital innovations like AI-driven claims processing and online policy management, are further enhancing service efficiency and user convenience across the Asia Pacific region.

Middle East and Africa Mobile Phone Insurance Market Analysis

The market in the Middle East and Africa (MEA) is expanding rapidly, driven by unique regional factors. Rising smartphone adoption in urban areas and increasing disposable incomes are fueling demand for mobile phone protection. In Saudi Arabia, 84.95% of the population lives in urban areas, reflecting strong smartphone penetration and insurance adoption. In Gulf Cooperation Council (GCC) countries, where high-end smartphones are prevalent, customers prefer insurance to protect against theft, accidental damage, and malfunctions. Besides this, growing reliance on mobile phones for communication, banking, and online transactions has made device protection essential. As smartphones become integral to both personal and business activities, the demand for insurance coverage is surging. Users seek comprehensive plans that safeguard against loss, damage, and potential data breaches. With expanding digital ecosystems and increasing awareness regarding insurance benefits, the MEA mobile phone insurance market is expected to experience sustained growth in the coming years.

Latin America Mobile Phone Insurance Market Analysis

The Latin America mobile phone insurance market is growing steadily, driven by rising smartphone ownership and increasing awareness about device protection. As smartphones become essential in daily life, demand for insurance against theft, accidental damage, and malfunctions is rising. In Brazil, per capita household earnings have reached USD 2,069, supporting increased spending on premium smartphones and insurance plans. The high cost of premium devices is further encouraging users to invest in protection plans. Insurance providers in the region are offering diverse coverage options tailored to different customer needs. The market is also benefiting from strong partnerships between insurers and mobile carriers, improving accessibility and adoption rates. Additionally, the expansion of e-commerce platforms is making mobile phone insurance more widely available online, offering customers a convenient way to secure their devices. As digital adoption grows across Latin America, mobile phone insurance is expected to see continued expansion, driven by affordability, accessibility, and growing customer trust in insurance solutions.

Competitive Landscape:

Key insurance providers are developing comprehensive policies covering accidental damage, theft, and hardware or software malfunctions. Smartphone manufacturers are partnering with insurers to offer built-in protection plans, enhancing customer convenience and adoption. Telecom operators are integrating insurance services with mobile plans, ensuring seamless access and a wider customer base. Retailers and e-commerce platforms are simplifying policy purchases, making mobile phone insurance more accessible to users. Claim management companies are improving the reimbursement process, ensuring quick settlements and enhanced customer satisfaction. Fintech firms are introducing digital payment solutions, enabling hassle-free premium payments and policy renewals. Technology companies are leveraging artificial intelligence (AI) and blockchain to enhance fraud detection and streamline claim processing. Regulatory bodies are enforcing consumer protection guidelines, ensuring fair practices and strengthening confidence in insurance services. Marketing agencies are actively raising awareness through advertisements and campaigns, educating users about mobile insurance benefits. Demonstrating innovation in digital security, Allianz Partners launched the 'allyz' mobile app in Germany, France, and the Netherlands. The app offers travel insurance, cyber protection, and digital assistance, with six months of free cyber care services, including VPN, antivirus, and identity protection. Such advancements strengthen digital security, improving user experience and reinforcing trust in mobile insurance solutions.

The report provides a comprehensive analysis of the competitive landscape in the mobile phone insurance market with detailed profiles of all major companies, including:

- American International Group, Inc

- Allianz SE

- AmTrust International Limited

- Apple Inc.

- AT&T Inc.

- AXA Group

- Deutsche Telekom AG

- Liberty Mutual Insurance Group

- Pier Insurance Managed Services Ltd.

- Samsung Electronics Co. Ltd.

- SoftBank Group Corp.

- Sprint Corporation

- Telefónica Insurance S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- Xiaomi Corporation

- Orange S.A.

Latest News and Developments:

- May 2024: Econet Insurance introduced Moovah Mobile Phone Insurance in Harare, providing coverage for accidental damage, including cracked screens and impact damage. Customers can register their devices by dialing *901# and completing verification at Moovah agents or Econet shops. Premium payments are made through the EcoCash USD Wallet, with approved claims eligible for repair or device replacement.

- February 2024: Verizon Business introduced Total Mobile Protection for Business (TMP for Business), covering loss, theft, damage, and post-warranty malfunctions. The plan features same-day device repairs, battery replacements, and 24/7 tech support, ensuring seamless device protection and support for businesses.

Mobile Phone Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End-Users Covered | Corporate, Personal |

| Region Covered | Europe, North America, Asia Pacific, Middle East and Africa, Latin America |

| Companies Covered | American International Group, Inc, Allianz SE, AmTrust International Limited, Apple Inc., AT&T Inc., AXA Group, Deutsche Telekom AG, Liberty Mutual Insurance Group, Pier Insurance Managed Services Ltd., Samsung Electronics Co. Ltd., SoftBank Group Corp., Sprint Corporation, Telefónica Insurance S.A., Verizon Communications Inc., Vodafone Group Plc, Xiaomi Corporation and Orange S.A |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, mobile phone insurance market outlook, and dynamics of the market from 2020-2034.

- The mobile phone insurance market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile phone insurance market was valued at USD 43.7 Billion in 2025.

The mobile phone insurance market is projected to exhibit a CAGR of 8.00% during 2026-2034, reaching a value of USD 87.0 Billion by 2034.

The mobile phone insurance market growth is driven by rising smartphone penetration and the increasing cost of premium devices, making protection essential. Growing incidences of theft, accidental damage, and cyber threats are catalyzing demand for comprehensive coverage. Expanding digital and e-commerce platforms are improving accessibility, while partnerships with mobile operators and retailers are enhancing distribution across the globe.

North America currently dominates the mobile phone insurance market, accounting for a share of 38.8% in 2025. The region experiences frequent thefts, accidental damage, and cybersecurity threats, increasing demand for insurance. Strong partnerships between insurers, telecom operators, and retailers enhance accessibility. The presence of leading insurance providers and advanced digital infrastructure enables seamless claim processing and policy management.

Some of the major players in the mobile phone insurance market include American International Group, Inc, Allianz SE, AmTrust International Limited, Apple Inc., AT&T Inc., AXA Group, Deutsche Telekom AG, Liberty Mutual Insurance Group, Pier Insurance Managed Services Ltd., Samsung Electronics Co. Ltd., SoftBank Group Corp., Sprint Corporation, Telefónica Insurance S.A., Verizon Communications Inc., Vodafone Group Plc, Xiaomi Corporation and Orange S.A, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)