Mobile Payment Market Size, Share, Trends and Forecast by Mode of Transaction, Application, and Region, 2025-2033

Global Mobile Payment Market Size & Share:

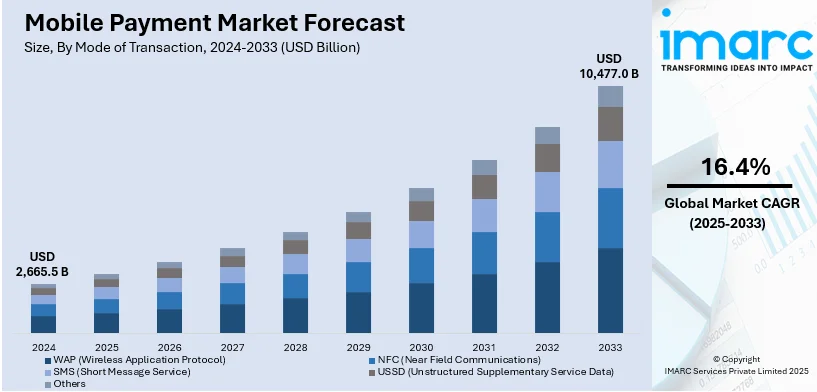

The global mobile payment market size was valued at USD 2,665.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,477.0 Billion by 2033, exhibiting a CAGR of 16.4% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 35.6% in 2024. The market is rapidly expanding driven by the increasing smartphone penetration, the implementation of supportive government policies, rapid technological advancements in payment methods, significant growth in the e-commerce sector, and the ongoing shift in consumer preferences towards digital and contactless transactions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,665.5 Billion |

|

Market Forecast in 2033

|

USD 10,477.0 Billion |

| Market Growth Rate (2025-2033) | 16.4% |

The major drivers of the mobile payment market are increased adoption of smartphones, growing contactless transactions and advancements in secure payment technologies such as biometric authentication and tokenization. Furthermore, ecommerce growth, integration with digital wallets and government initiatives for cashless economies are driving mobile payment market growth. According to the report published by the Press Information Bureau, in October 2024, UPI processed 16.58 billion transactions worth ₹23.49 Lakh Crores marking a 45% increase from October 2023. Launched in 2016 UPI connects 632 banks facilitating secure and round-the-clock payments that empower individuals and businesses significantly advancing India’s cashless economy and redefining the digital payment landscape. Consumer demand for ease, speed in transactions and security also accelerates the migration towards mobile payments as the internet connectivity expands and mobile broadband becomes available.

The key United States mobile payment market trends include the widespread adoption of smartphones, consumer preference for convenient, secure and contactless payment methods and the growth of digital wallets like Apple Pay and Google Pay. According to industry reports, ninety-eight percent of U.S. adults own a cellphone with 91% owning smartphones a significant rise from 35% in 2011. Among demographics smartphone ownership varies: 98% for ages 18-29 99% for those earning over $100,000 and 15% of adults are “smartphone-only” internet users. Enhanced security features such as biometrics and tokenization build trust among users. Ecommerce expansion and increasing mobile commerce contribute significantly to market growth. Further support from major financial institutions and retail partnerships has encouraged the adoption of mobile payments among U.S. consumers.

Mobile Payment Market Trends

Increasing Penetration of Smartphones

The widespread availability and utilization of smartphones are acting as growth-inducing factors. More than half of the world's population approximately 4.3 billion people now have smartphones significantly boosting the mobile payments market, according to the GSMA. The rising affordability and accessibility of smartphones leading to their heightened adoption is favoring the market growth. Besides this, the integration of various advanced features like near-field communication (NFC), biometric security and enhanced connectivity options to make smartphones an ideal platform for executing mobile payments is creating a positive outlook for market growth. Rapid technological advancements enabling a more seamless and secure transaction experience thereby encouraging users to adopt mobile payment methods are fostering market growth. Furthermore, smartphone applications have become more user-friendly offering intuitive interfaces, easy navigation and lowering the barrier to entry for new users.

Implementation of Various Government Initiatives

The imposition of various government policies and frameworks that encourage digital transactions is acting as a growth-inducing factor. The introduction of favorable policies like the promotion of cashless economies, initiatives to enhance financial inclusion and the establishment of standardized protocols for digital transactions are contributing to the market growth. The increasing adoption of initiatives by governments to digitize government payments including subsidies, salaries and other public payments thereby encouraging citizens to adopt digital payment methods is positively impacting the market growth. The rising regulatory support that ensures a secure and robust environment for mobile payments are instilling confidence among users and providers and is anticipated to drive the market growth. The Central Bank of the Russian Federation often referred to as the Bank of Russia, announced its plans to submit a proposal to the Ministry of Finance in September 2024 aimed at discussing and amending certain laws. To simplify matters the Bank has already released a calendar outlining trade and service-related businesses in various subcategories for the upcoming years mandating the use of digital rubles for transactions.

Rapid Advancements in Payment Technologies

The continuous evolution of payment technologies is a major driver influencing the market growth. The development of contactless payment technologies, quick response (QR) code payments, blockchain and cryptocurrency integrations to offer enhanced security, speed and convenience is boosting the market growth. Moreover, the widespread adoption of contactless payments owing to their ease of use and hygienic benefits is favoring the market growth. The integration of blockchain technology offering increased transparency and reduced fraud is propelling the market growth. The increasing utilization of artificial intelligence (AI) and machine learning (ML) in payment systems to enable personalized experiences, fraud detection and predictive analysis are enhancing the overall efficiency and security of mobile payment platforms is anticipated to drive the market growth. In August 2021, American Express Co. launched Amex Pay, a web and mobile application designed for making payments on taxes, insurance, cable bills, internet bills and more. This new app also offers customers various promotional rewards.

Growing E-commerce Sector and Online Retail

The rising ecommerce sector and online retail are catalyzing the market growth. The rising convenience of shopping online coupled with the widespread availability of a wide range of products and services are encouraging consumers to make online purchases. The integration of mobile wallets and payment apps with ecommerce platforms facilitating seamless transactions and enhancing the customer experience is anticipated to drive the market growth. The rising popularity of social media commerce as purchases can be made directly through social media platforms is propelling the market growth. Along with this, the increasing demand for efficient and secure mobile payment solutions as businesses increase their online presence is enhancing the market growth. According to ITA, the global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027 at a steady compound annual growth rate of 14.4%.

Sudden Shift in Consumer Behavior and Preferences

The sudden shift in consumer behavior and preferences towards digital and cashless payment methods driven by the need for convenience, speed and enhanced security in transactions is providing a considerable boost to the market growth. Moreover, the rising preference among tech enthusiasts for digital interactions including financial transactions is positively impacting the market growth. The growing demand for integrated payment solutions that offer a seamless experience across various channels is creating a positive outlook for the market. Indians have spent more than USD 41 Billion on ecommerce in the fiscal year 2021. According to the reports, the projection is going to exceed USD 129 Billion by the fiscal year 2026. Apart from this, the rising preference for personalized and value-added services like loyalty programs and instant discounts linked to mobile payments is offering remunerative growth opportunities for the market.

Mobile Payment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on mode of transaction and application.

Analysis by Mode of Transaction:

- WAP (Wireless Application Protocol)

- NFC (Near Field Communications)

- SMS (Short Message Service)

- USSD (Unstructured Supplementary Service Data)

- Others

WAP (wireless application protocol) leads the market with around 37.8% of market share in 2024. Wireless application protocol (WAP) holds the largest market share due to its wide accessibility and compatibility with a range of mobile devices. It enables users to access the internet on mobile phones facilitating online transactions and mobile banking. Moreover, WAP supports a wide array of services such as utility payments and online shopping, making it a versatile and preferred choice for many users. Besides this, the widespread popularity of WAP attributed to its user-friendly interface and the ability to offer a secure environment for transactions is favoring the market growth.

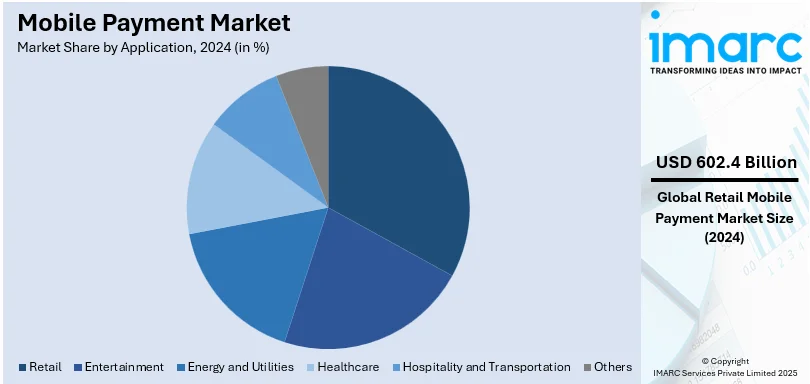

Analysis by Application:

- Entertainment

- Energy and Utilities

- Healthcare

- Retail

- Hospitality and Transportation

- Others

Retail leads the market with around 22.6% of market share in 2024. The retail sector represents the largest market share driven by the burgeoning ecommerce platforms and the heightened adoption of mobile wallets and contactless payments in physical stores. Moreover, retailers are integrating mobile payment solutions to offer customers a faster, more convenient and secure way to pay enhancing the overall shopping experience. Besides this, the proliferation of smartphones and the integration of advanced technologies like quick response (QR) codes and near field communications (NFC) propelling the use of mobile payments in retail is boosting the market growth.

Regional Analysis

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest mobile payment market share of over 35.6%. The Asia Pacific region represents the largest market share due to high smartphone penetration, a large population base and the rapid adoption of innovative payment technologies. Moreover, the widespread utilization of mobile wallets and quick response (QR) code-based payments in the region is favoring the market growth. Besides this, the strong presence of major players in the mobile payment industry along with the implementation of supportive government policies promoting digital transactions is acting as a growth-inducing factor. The increasing trend of ecommerce and the burgeoning startup ecosystem in the region are propelling the market growth.

Key Regional Takeaways:

North America Mobile Payment Market Analysis

The North American mobile payment market is growing rapidly driven by the increasing shift towards digital shopping and the demand for more convenient and secure payment methods. Consumers are increasingly relying on mobile wallets, contactless payments and digital transaction solutions for their daily purchases. Retailers are adapting to this change by integrating mobile payment options to cater to evolving consumer preferences for speed and security. With the growth of ecommerce especially in the retail sector mobile payments become a necessity to provide a smooth shopping experience. Growing secure payment technologies such as biometric authentication and tokenization increase the confidence of the consumer and this drives more adoption. High smartphone penetration along with well-established digital infrastructure across the region also supports the growth of mobile payments. As the demand for cashless transactions increases the North American mobile payments market is to be expected to be in continuous growth in the future years.

United States Mobile Payment Market Analysis

In 2024, the United States captured 88.60% of revenue in the North American market. The expansion of the United States mobile payments market is being driven mainly by the continued growth in retail e-commerce. The U.S. Census Bureau reported that retail e-commerce sales reached $300.1 billion in Q3 2024, a 2.6% increase from Q2 2024. Total retail sales were $1,849.9 billion, up 1.3%. E-commerce accounted for 16.2% of total sales and grew 7.4% year-over-year from Q3 2023. Consumers' increased reliance on digital shopping sites has further fueled the mobile payment market demand for streamlined and secure mobile payment alternatives. The growth has been driven mainly by the increased demand for mobile wallets, contactless payments and other methods of mobile transactions. The rise in mobile shopping convenience with mobile payment security enhancing consumer confidence has led to increased consumption. The speedy adaptation of mobile payment systems by retailers to address changing consumer shopping behaviours is also anticipated to spur growth in the market. With e-commerce continuing to soar the U.S. market for mobile payments is expected to continue growing strongly.

Europe Mobile Payment Market Analysis

The integration of mobile payment solutions with major digital platforms is the growth factor of the Europe mobile payments market. In February 2022, Soldo announced the launch of Google Pay enabling users in the UK and Italy to enjoy seamless online transactions and secure contactless payments in person. By leveraging Google's technology Soldo broadened its offerings to 30,000 clients facilitating mobile payment access via apps that support Google Pay according to reports. This is one of the recent trends in which mobile payment systems are being integrated into digital ecosystems to make payment more convenient and secure for both consumers and businesses. This growth can be further added to by the increasing adoption of mobile payment solutions as well as a preference for cashless transactions in several sectors. Given that European consumers are increasingly becoming dependent on mobile payment methods the market will continue to expand as digital wallet services become increasingly available and accessible to users.

Asia Pacific Mobile Payment Market Analysis

The Asia Pacific mobile payments market is growing significantly with India's growing smartphone and ecommerce markets. In Q3 2024, India has established itself as the second-largest smartphone market in the world by unit volume and the third largest by value capturing 15.5% of global smartphone shipments, as reported by IBEF. This growth in smartphone usage is directly fueling the growth of mobile payments as consumers increasingly use their smartphones for secure and convenient transactions. Moreover, India's e-commerce sector is projected to reach USD 200 billion by 2026 which will likely boost the demand for mobile payment solutions. With a large, tech-savvy population and robust digital infrastructure mobile payments are becoming an integral part of the consumer experience providing an efficient alternative to traditional payment methods. As both smartphone penetration and ecommerce flourish in the region the Asia Pacific mobile payments market is poised for sustained expansion driven by technological advancements and the growing preference for cashless transactions.

Latin America Mobile Payment Market Analysis

The Latin American mobile payments market is set to experience significant growth driven by the increasing adoption of smartphones and mobile internet. According to the GSMA, by the end of 2021, the number of smartphone users in Latin America reached 500 million resulting in a 74% adoption rate. Over the next four years this number is expected to increase by nearly 100 million raising the adoption rate to 80%. This will directly promote the widespread use of mobile internet which will enable more people to access digital services such as mobile banking. As more people in the region gain access to mobile payment solutions, demand for secure, convenient and efficient payment methods will increase. This trend is more important in those markets where traditional banking infrastructure is limited thereby opening an opportunity for mobile payments to be the primary mode of financial transactions. The increase in smartphone penetration and mobile internet adoption is one of the factors propelling the expansion of the Latin American mobile payments market.

Middle East and Africa Mobile Payment Market Analysis

Mobile payments are poised to explode in the Middle East and Africa with strategic partnerships continuing to fuel growth of the digital payment solutions across the regions. In February 2023, Mobly Pay announced its plans to broaden its services in Saudi Arabia by partnering with Ericsson's wallet platform to promote the widespread use of mobile payments in the country. Additionally, that same month Visa Inc. joined forces with Tingo Mobile to address the mobile payment needs of its 9.3 million users throughout Africa according to reports. Such collaborations are indicators of the increasing demand for seamless and secure mobile payment solutions in both regions where mobile penetration and internet connectivity are rapidly increasing. The growth of mobile payments in the region primarily depends on accessing mobile banking and payment services by more and more consumers in the Middle East and Africa which is broadening the market scope. Digital infrastructure development and smartphones are rapidly increasing in the area and mobile payments are becoming an indelible part of financial access and convenience.

Competitive Landscape:

The major players in the market are engaged in a variety of strategic initiatives to enhance their market position and meet the evolving needs of consumers and businesses. They are investing in technological advancements to ensure secure, fast, and user-friendly payment solutions. Moreover, the leading firms are focusing on integrating cutting-edge technologies like blockchain, artificial intelligence (AI), and biometric authentication to improve security and offer personalized services. Besides this, they are forming partnerships and collaborations with tech companies, financial institutions, and retailers to expand service offerings and reach.

The report provides a comprehensive analysis of the competitive landscape in the mobile payment market with detailed profiles of all major companies, including:

- FIS

- Gemalto (Thales Group)

- MasterCard

- Alipay (Ant Group)

- Visa

- Apple

- Samsung Electronics

- Bharti Airtel

- American Express

- Bank of America

- Citrus Payment Solutions

- LevelUp (Grubhub Inc.)

- MobiKwik

- One97 Communication

- Orange

- Oxigen

- Square

- Venmo (PayPal, Inc.)

- ZipCash Card Services

Latest News and Developments:

- In August 2024, Windcave a prominent payment technology provider in New Zealand announced partnership with Alipay+ to deliver seamless mobile payment solutions for businesses throughout Australia and New Zealand. This collaboration is designed to empower merchants to accept payments from international travelers arriving from various regions in Asia and Europe.

- In 2023, Visa announced a partnership with PayPal and Venmo to launch Visa+ a new service aimed at facilitating fast and secure money transfers between different person-to-person (P2P) digital payment applications.

- In 2021, Alipay (Ant Group) unveiled QR code payment methods allowing users to complete transactions without needing to enter the transaction amount.

- In 2021, American Express introduced a web version and mobile app of Amex Pay enabling users to pay for taxes, insurance, cable services, internet bills and more.

Mobile Payment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Transactions Covered | WAP, NFC, SMS, USSD, Others |

| Applications Covered | Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | FIS, Gemalto (Thales Group), MasterCard, Alipay (Ant Group), Visa, Apple, Google, Samsung Electronics, Bharti Airtel, American Express, Bank of America, Citrus Payment Solutions, LevelUp (Grubhub Inc.), MobiKwik, One97 Communication, Orange, Oxigen, Square, Venmo (PayPal, Inc.), ZipCash Card Services, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mobile payment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global mobile payment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the mobile payment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile payment market was valued at USD 2,665.5 Billion in 2024.

IMARC estimates the mobile payment market to reach USD 10,477.0 Billion by 2033, exhibiting a CAGR of 16.4% during 2025-2033.

Key drivers include the increasing adoption of smartphones, growing preference for contactless payments, advancements in secure payment technologies (e.g., biometric authentication, tokenization), the rise of e-commerce, and government initiatives promoting cashless economies.

Asia Pacific holds the largest share of the mobile payment market, accounting for over 35.6% in 2024. This dominance is driven by high smartphone penetration, rapid adoption of innovative payment technologies, and strong government support for digital transactions. The region’s booming e-commerce sector further fuels this growth.

Some of the major players in the mobile payment market include FIS, Gemalto (Thales Group), MasterCard, Alipay (Ant Group), Visa, Apple, Google, Samsung Electronics, Bharti Airtel, American Express, Bank of America, Citrus Payment Solutions, LevelUp (Grubhub Inc.), MobiKwik, One97 Communication, Orange, Oxigen, Square, Venmo (PayPal, Inc.), ZipCash Card Services, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)