Mobile Mapping Market Size, Share, Trends and Forecast by Component, Type, Application, End-User, and Region, 2025-2033

Mobile Mapping Market Size and Share:

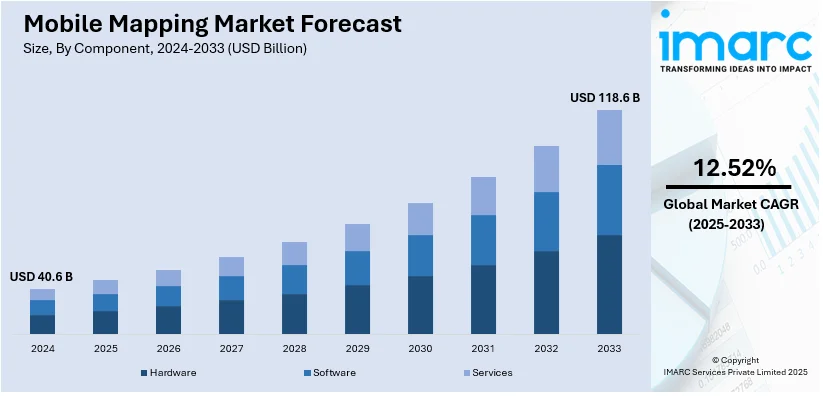

The global mobile mapping market size was valued at USD 40.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 118.6 Billion by 2033, exhibiting a CAGR of 12.52% from 2025-2033. North America currently dominates the market, holding the 36.5% market share in 2024. The widespread usage of smartphones, improved GPS and GIS technologies, growth in infrastructure development initiatives, location-based advertising, increased autonomous vehicle numbers, and emergency response requirements is propelling the mobile mapping market share across North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 40.6 Billion |

|

Market Forecast in 2033

|

USD 118.6 Billion |

| Market Growth Rate (2025-2033) | 12.52% |

The mobile mapping market is growing due to the rising demand for accurate geospatial data in urban planning, transportation, and construction. According to the mobile mapping market research report, governments and private organizations require precise mapping solutions for infrastructure development, traffic management, and land use planning, which fuel the adoption of mobile mapping technologies. Other growth-inducing factors are the rise in the development of autonomous vehicles and advanced driver-assistance systems. Mobile mapping helps to produce high-definition maps necessary for navigation, obstacle detection, and route optimization in self-driving technologies. Another reason for the increased demand for geospatial data is due to the widespread usage of AR applications in games, real estate, and tourism. Technological advancements such as LiDAR, GPS, and 5G connectivity have enhanced the accuracy and efficiency of mobile mapping systems. Such innovations enable real-time data collection and processing, which in turn enhances decision-making capabilities across sectors. The growth of smart cities has also increased the mobile mapping demand in urban areas, which supports applications such as utility management, public safety, and environmental monitoring.

The United States has emerged as a key regional market for mobile mapping due to its continuous technological progress and the vast application of geospatial solutions across all sectors. Strong infrastructure in the country, along with significant investments in research and development, has resulted in the swift innovation of mobile mapping technologies such as GPS, LiDAR, and high-resolution imaging systems. Mobile mapping is applied to key industries, such as transportation, construction, and utilities, in a wide range of applications, from urban planning to asset management. The further growth of smart city initiatives across the major metropolitan areas in the United States also drives the demand for mobile mapping solutions, as these initiatives depend on precise geospatial data for efficient urban development, traffic management, and utility optimization. Moreover, the application of mobile mapping is becoming increasingly prevalent in defense and homeland security industries for surveillance, reconnaissance, and disaster response.

Mobile Mapping Market Trends:

Growing adoption of smartphones and mobile devices

With a greater number of people owning smartphones, the demand for location-based services and applications has grown. Industry statistics indicate that 90% of all mobile phones are smartphones, and most of the global population now owns a smartphone. Mobile mapping applications offer users real-time navigation, accurate positioning, and geospatial information, which further enhances their experience. The portability and convenience of smartphones make them the perfect devices for accessing mobile mapping services, which is driving the growth of the market. Furthermore, the integration of mobile mapping with other applications, such as social media and e-commerce, further expands its reach and utility, attracting a larger user base.

Advancements in GPS and GIS technologies:

The growth of the GPS and GIS-based technologies is acting as one of the significant mobile mapping market growth drivers. In 2023, the market size of the GPS tracking device was USD 2.89 Billion. These are more accurate and reliable technologies used for precise positioning and mapping capabilities. The improved accuracy in GPS-based navigation, tracking, and location-based services are shaping the market trend. The ability to store, analyze, and visualize geospatial data with efficiency is provided by GIS technology. The combination of GPS and GIS technologies with mobile devices has increased the power and versatility of mobile mapping solutions, thereby fueling their application in various sectors, including transportation, logistics, and urban planning.

Increasing use of mobile mapping in disaster management and emergency response

Mobile mapping tools are increasingly playing a very critical role in disaster management and emergency response situations. During natural disasters or emergencies, accurate and up-to-date geospatial information is important for effective decision-making and resource allocation. In 2023, the Emergency Events Database (EM-DAT) reported 399 disasters associated with natural hazards. These events resulted in 86,473 deaths and affected 93.1 Million people. Mobile mapping solutions help authorities quickly assess affected areas, identify hazards, and plan evacuation routes. Real-time tracking and geolocation capabilities assist in coordinating rescue operations and resource allocation. Mobile mapping integration with communication systems allows for better situational awareness and coordination among response teams. With growing awareness in governments and organizations regarding the effective management of disasters, demand for mobile mapping solutions in this field is rising very rapidly and hence moving the market forward.

Mobile Mapping Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mobile mapping market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on component, type, application, and end-user.

Analysis by Component:

- Hardware

- Software

- Services

Hardware components lead the market with a share of 55.0% as they are needed to capture and collect geospatial data precisely. The specialized hardware devices that the mobile mapping system depends on for the acquisition of accurate location information, images, and other relevant data include GPS receivers, laser scanners, cameras, and sensors. These hardware components directly determine the quality and capabilities of mobile mapping. This is due to high-quality hardware affecting the accuracy and effectiveness of mobile mapping. In addition, the demand for advanced hardware in mobile mapping is driven by technological advancement. With technological advancements, hardware becomes more sophisticated and compact, capturing high-resolution data in real-time. This is driving the market as organizations and industries want to upgrade their mobile mapping systems to reap the benefits of new hardware developments. Besides this, the complexity of mobile mapping applications often demands a combination of hardware components for comprehensive data collection. For example, the integration of GPS receivers, laser scanners, and cameras helps in the production of detailed and comprehensive maps. This means that there will be a requirement for multiple hardware components, and thus, it leads to an increased market share. Furthermore, the hardware segment tends to be more expensive per unit than the software or services. Hardware components are tangible products that incur manufacturing, assembling, and distributing costs, thus making them relatively expensive. With the requirement of constant hardware maintenance and upgrading, the mobile mapping market revenue has increased even more.

Analysis by Type:

- 3D Mapping

- Licensing

- Indoor Mapping

- Location Based Services

- Location Based Search

3D mapping represents the largest segment with a share of 52.5%, as it offers a higher level of visual representation and accuracy compared to 2D mapping. It provides a three-dimensional view of the environment, allowing for more realistic and immersive mapping experiences. The demand for 3D mapping is driven by industries such as architecture, urban planning, and entertainment, where precise and detailed spatial information is crucial. Additionally, advancements in technology have made 3D mapping more accessible and cost-effective. Advances in LiDAR (Light Detection and Ranging) and increasing data processing ease have paved the way for a relatively easier method to capture high-definition detail 3D models, where it can gain popularity over any sector that applies to it, such as construction, real estate, and virtual reality for those specific purposes and other applications that rely on the strength of 3D mapping. Infrastructure planning, simulation, virtual tours, games, and augmented reality applications. Its large customer base contributes to its market dominance due to the flexibility and potential that 3D mapping solutions possess. In addition, 3D mapping allows for better data visualization and analysis. It integrates multiple datasets, including terrain elevation, building structures, and vegetation, and offers a more comprehensive view for decision-making and planning purposes. The ability to analyze spatial data in three dimensions gives more value and utility to the 3D mapping solutions.

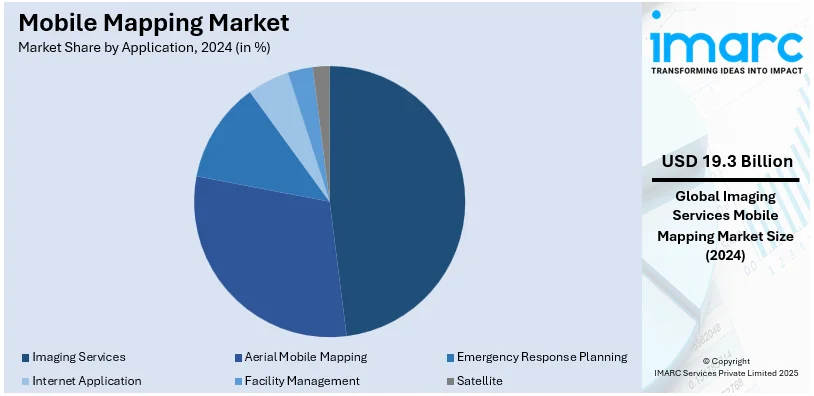

Analysis by Application:

- Imaging Services

- Aerial Mobile Mapping

- Emergency Response Planning

- Internet Application

- Facility Management

- Satellite

Imaging services dominate the market with a share of 47.5% as they can provide visual data highly valued in most industries. The mobile mapping solution with imaging can capture high-resolution images, street views, and panoramic views. Images are applied in applications like urban planning, environmental monitoring, infrastructure development, and real estate. This has the benefit of visualizing and analyzing the environment through the services of imaging, which can further boost decision-making processes. Improved camera technology, coupled with the advancement of algorithms in image processing, ensures quality and accuracy in imaging services. High-resolution cameras, software enhancement, and all these put together ensure detailed and precise image capture, guaranteeing the reliability of the data. This has led to increased adoption across industries relying significantly on visual information, such as architecture, construction, and tourism. Notable aside from this are the varied applications of imaging services. They can be adapted to different industry requirements and suited according to current needs. They are used in mapping urban areas, assessing infrastructure conditions, site surveying, and creating virtual tours. The versatility and flexibility of imaging services make them applicable in multiple sectors. Thus, through this, they can attract a larger customer base, which in turn helps in gaining dominance in the market. The higher demand for visual content and hence for better experiences resulted in the larger growth of imaging services. Businesses and consumers seek engaging and visually appealing content, and mobile mapping solutions offer the opportunity to create such content. Ad media and entertainment industries are creating a positive mobile mapping market outlook segment through compelling imagery and immersive experiences.

Analysis by End-User:

- Government

- Oil and Gas

- Mining

- Military

- Others

Government holds the leading position in the market with a share of 65.2% as they have significant demands for accurate geospatial data and mapping services. They employ mobile mapping technologies for urban planning, infrastructure development, disaster management, and environmental monitoring. Governments require reliable and up-to-date geospatial information to make informed decisions, allocate resources efficiently, and ensure the well-being of their constituents. The scale and scope of government operations and responsibilities make them a major consumer of mobile mapping solutions, driving the market size in this segment. Additionally, government agencies often have the financial resources to invest in mobile mapping technologies. Public sector budgets enable the procurement of high-end hardware, software, and services required for efficient mapping and data analysis. The financial muscle of governments makes them a major player in the market since they can afford to invest in and maintain mobile mapping systems. Apart from this, governments have regulatory and planning mandates that require the use of accurate and comprehensive geospatial information. They contribute significantly to the development of the urban area, management of lands, transportation, and emergency preparedness. These functions are highly facilitated by the mobile mapping solution for governments in discharging their work efficiently, thereby dominating the market segment in terms of end users.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America holds the largest market share of 36.5% as the region has already been developed technologically. The region is characterized by well-established, networked telecommunication, widespread utilization of smartphones, and highly advanced mapping technologies. As a result, a very solid ground is laid on the adoption and use of mobile mapping technology. North America features a host of diverse industry applications that call for heavy use of mobile mapping technology. Industries such as transport and logistics sectors, construction, as well as planning in urban sections, all demand high uses of accurate current geospatial data. In addition, such industries enjoy the efficiency, cost-effectiveness, and improved decision-making abilities offered through mobile mapping technologies. Apart from this, the region hosts key players in the mobile mapping business. According to the mobile mapping market forecast, the region houses many prominent companies, which specifically have expertise in mapping solutions, hardware, and services. This is a big boost for the North American mobile mapping market. Government initiatives and investments in infrastructure development, smart cities, and public safety are other factors that are driving the demand for mobile mapping in the region. The commitment of the public sector to using advanced mapping technologies is strengthening North America's position as the largest market for mobile mapping.

The infrastructure development, rapid urbanization, and smart city initiatives across China, India, and Japan are driving the Asia Pacific mobile mapping market. The use of mobile mapping technology has seen mass adoption in transportation, utility management, and construction for fueling growth in the market. Increased investment in geospatial technologies and the increased pervasiveness of 5G connectivity enhance the capability of mobile mapping systems. Moreover, a strong demand for precision agriculture and government efforts to modernize infrastructure planning and disaster management add further momentum to this market in the region.

Advanced technological infrastructure and smart city projects initiated in countries like Germany, the UK, and France have helped benefit Europe's mobile mapping market. High demand for geospatial data is a significant driver in environmental monitoring, urban planning, and public transport systems. The adoption of autonomous vehicles and drones requiring accurate mapping further boosts the market. Moreover, stringent government rules for data accuracy and safety, coupled with EU-wide initiatives for sustainable development of infrastructure in the region, support the adoption of mobile mapping technologies across the region.

Increasing urbanization rate and infrastructure development in countries such as Brazil, Mexico, and Argentina drive the Latin American mobile mapping market. Mobile mapping is used by governments for disaster management, land surveying, and urban planning. The growth in e-commerce and logistics has given rise to the demand for route optimization mapping solutions. At the same time, regional investment in GIS technology and partnerships with global technology firms are also driving innovation, while mobile mapping for agricultural applications is gaining traction as well, particularly in countries where agriculture takes up large swathes of land.

The Middle East and Africa mobile mapping market is driven by rising number of construction and infrastructure projects, especially in the Gulf Cooperation Council (GCC) countries. Smart city initiatives, such as NEOM in Saudi Arabia, rely heavily on advanced mapping technologies. The mining and oil and gas sectors also use mobile mapping for exploration and resource management. Additionally, governments across Africa are adopting mobile mapping for land surveys, agriculture, and disaster management. These developments, in particular, mobile internet penetration, coupled with the growing acceptance of drones, further support the market growth in this region.

Key Regional Takeaways:

United States Mobile Mapping Market Analysis

In 2024, the United States holds a market share of 80.0% in North America. The United States has long been a hub for innovation, particularly in the field of artificial intelligence (AI), which is driving the mobile mapping market. According to Edge Delta, between 2013 and 2022, the US saw the emergence of 4,633 AI startups, with 524 founded in 2022 alone, attracting USD 47 Billion in non-governmental funding. This energetic startup ecosystem gives birth to high-tech mobile mapping solutions, such as AI-based data acquisition and analytics in geospatial data. Furthermore, autonomous vehicle technology adoption, urban planning projects, and smart city initiatives create increased demand for precision mobile mapping. AI integrated with mobile mapping systems can improve the real-time processing of data and thus deliver actionable and accurate insights to different sectors. In addition, transportation, logistics, and construction are sectors whose growth is rapidly adopting mobile mapping technologies for applications in land surveying, infrastructure monitoring, and route optimization. The government initiatives on improving transportation networks and emergency response systems also support the growth of the market. Additionally, advancements in cloud computing, machine learning, and data analytics are making mobile mapping systems more efficient, thus opening vast opportunities for growth in the US market. This dynamic ecosystem of technological advancement and investment is positioning the US as a leader in mobile mapping solutions.

Europe Mobile Mapping Market Analysis

The European region's emphasis on digital transformation, specifically within sectors such as construction, transportation, and surveying, has influenced the region's mobile mapping market. As per the reports, in 2021, 29% of EU enterprises used Internet of Things (IoT) devices to secure their premises. This trend would reflect the continuous demand for complex geospatial solutions, such as mobile mapping tools, to supplement IoT applications concerning security, asset management, and infrastructure tracking. Governments are increasingly investing more in smart cities, which implies the need to have accurate urban planning and precise development. Since these projects necessarily require mobile geospatial devices like LiDAR, GPS, and photogrammetry, they improve decision-making power with real-time data accuracy. Moreover, the increasing development of autonomous vehicles in Europe is leading to a growth in demand for mobile mapping systems for navigation and safety purposes. Enhanced requirements for 3D models in land surveying, environmental monitoring, and asset management also drive the growth of this market. Moreover, European regulations on data privacy and security promote the usage of mobile mapping solutions for secure data collection with accuracy. Another driver for the market expansion in this region is the increased use of drones for mobile mapping, thereby allowing for a high level of detailed data capture of applications ranging from urban planning to infrastructure management.

Asia Pacific Mobile Mapping Market Analysis

The Asia-Pacific region's mobile mapping market is driven by rapid urbanization and technological advancements, especially in 5G connectivity. GSMA records show that 5G had 31.3 Million South Korea connections as of 2021, thus representing more than 48% of all the mobile connections available in the region. China accounts for more than 700 Million connections, with 41% of the overall mobile connections, which is massive. This allows widespread 5G adoption across regions, such as faster data transfer, geospatial analytics in real-time, and enhancing connectivity for more efficient autonomous vehicles and smart city projects. China, India, and Japan are seen significantly investing in smart cities, infrastructure development, and autonomous vehicle technologies—all heavily reliant on the accurate geospatial data provided by mobile mapping systems. The growing need for location-based services, construction, and transportation solutions is also encouraging more people to adopt mobile mapping technologies. The addition of IoT, AI, and 5G strengthens the growth of the market for more accurate, efficient, and scalable mapping solutions in the region.

Latin America Mobile Mapping Market Analysis

Latin America represents a significant mobile market in the world. The region had 326 Million mobile internet users in 2018, which is expected to rise to 422 Million by 2025, according to MGR. The increasing penetration of mobile internet is fueling the demand for mobile mapping technologies, especially in transportation, construction, and urban development. The increasing penetration of mobile internet will lead to more advanced mapping solutions for location-based services, infrastructure monitoring, and urban planning in industries. This expansion, driven by greater connectivity, is supporting the adoption of mobile mapping systems across the region.

Middle East and Africa Mobile Mapping Market Analysis

The Middle East and Africa market is seeing significant growth in mobile mapping technologies, with high 5G adoption driving growth. Reports indicate that Saudi Arabia tops the MEA market with more than 11.2 Million 5G subscriptions at the end of 2022, accounting for more than a quarter of the total mobile sector. This mass adoption of 5G is enhancing mobile mapping capabilities, allowing for real-time data transfer and supporting applications in smart cities, autonomous vehicles, and infrastructure development. Growing demand for the accurate geospatial data needed in urban planning, asset management, and location-based services also drives the uptake of mobile mapping technologies.

Competitive Landscape:

Mobile mapping players are actively pushing innovation and broadening their portfolios to address growing demands in various industries. The evolution of technologies like LiDAR, AI-driven analytics, and 5G-enabled solutions facilitates accuracy and efficiency among the key players investing in mobile mapping systems. Collaborations and partnerships are transforming into the dominant trend, where companies are collaborating with tech firms and automotive manufacturers as well as government agencies to develop solutions for autonomous vehicles, smart city planning, and environmental monitoring. The adoption of drone-based mapping solutions is also rapidly increasing as this technology facilitates data collection in tough terrains with high resolutions. The leading players in the market are moving ahead with cloud-based mapping platforms, making data integration possible for instantaneous decisions. Regional growth is occurring at a pace as well in the Asia-Pacific region and the Middle East, which witness rapid urbanization and infrastructure building projects, resulting in growing demands. Besides that, sustainability initiatives push companies to adopt energy-efficient systems according to global environmental agendas.

The report provides a comprehensive analysis of the competitive landscape in the mobile mapping market with detailed profiles of all major companies, including:

- Google LLC (Alphabet Inc.)

- Hexagon AB

- Trimble Inc.

- Topcon Corporation

- Javad GNSS Inc.

- OpTech LLC

- Mitsubishi Corporation

- Cyclomedia Technology B.V.

- EveryScape Inc.

Latest News and Developments:

- July 2024: GeoCue Corporation has released TrueView GO, a handheld geospatial solution that joins its lineup of drone and mobile mapping systems. The product is available in 116S (16-channel) and 132S (32-channel) models and integrates GNSS RTK, LiDAR, cameras, and visual SLAM to create real-time digital twins for indoor and outdoor applications.

- June 2024: Powys and Ceredigion mobile mapping project - Powys-based business Growing Mid Wales (GMW) is undertaking a mobile mapping project, in collaboration with waste collection vehicles and the major mobile network operators, to identify areas in Powys and Ceredigion where mobile coverage is poor. Funded by the UK Shared Prosperity Fund, the coverage checker tool aims to be completed for residents to use.

- March 2024: Trimble introduced the MX90 mobile mapping system, an all-in-one product combining GNSS, inertial technology, and Trimble's software. Ideal for mounting in a vehicle or on a train, the MX90 can map at highway speed, gathering the most detailed laser scans and high-resolution imagery along with the ability to generate efficient data-processing capabilities for jobs such as detecting cracks and performing asset inspections, the company reported. The device is built using high-resolution data and higher-accuracy workflows covering urban and isolated environments.

Mobile Mapping Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Types Covered | 3D Mapping, Licensing, Indoor Mapping, Location Based Services, Location Based Search |

| Applications Covered | Imaging Services, Aerial Mobile Mapping, Emergency Response Planning, Internet Application, Facility Management, Satellite |

| End-Users Covered | Government, Oil and Gas, Mining, Military, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Google LLC (Alphabet Inc.), Hexagon AB, Trimble Inc., Topcon Corporation, Javad GNSS Inc., OpTech LLC, Mitsubishi Corporation, Cyclomedia Technology B.V., EveryScape Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mobile mapping market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mobile mapping market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mobile mapping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile mapping market was valued at USD 40.6 Billion in 2024.

IMARC estimates the mobile mapping market to exhibit a CAGR of 12.52% during 2025-2033.

The market is driven by the widespread usage of smartphones, improved GPS and GIS technologies, growth in infrastructure development initiatives, location-based advertising, increased autonomous vehicle numbers, and emergency response requirements.

North America currently dominates the market due to the wide usage of smartphones, well-established, networked telecommunication, and advanced mapping technologies.

Some of the major players in the mobile mapping market include Google LLC (Alphabet Inc.), Hexagon AB, Trimble Inc., Topcon Corporation, Javad GNSS Inc., OpTech LLC, Mitsubishi Corporation, Cyclomedia Technology B.V., EveryScape Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)