Mobile Commerce Market Size, Share, Trends and Forecast by Transaction Type, Payment Mode, Type of User, and Region, 2025-2033

Mobile Commerce Market 2024, Size and Trends:

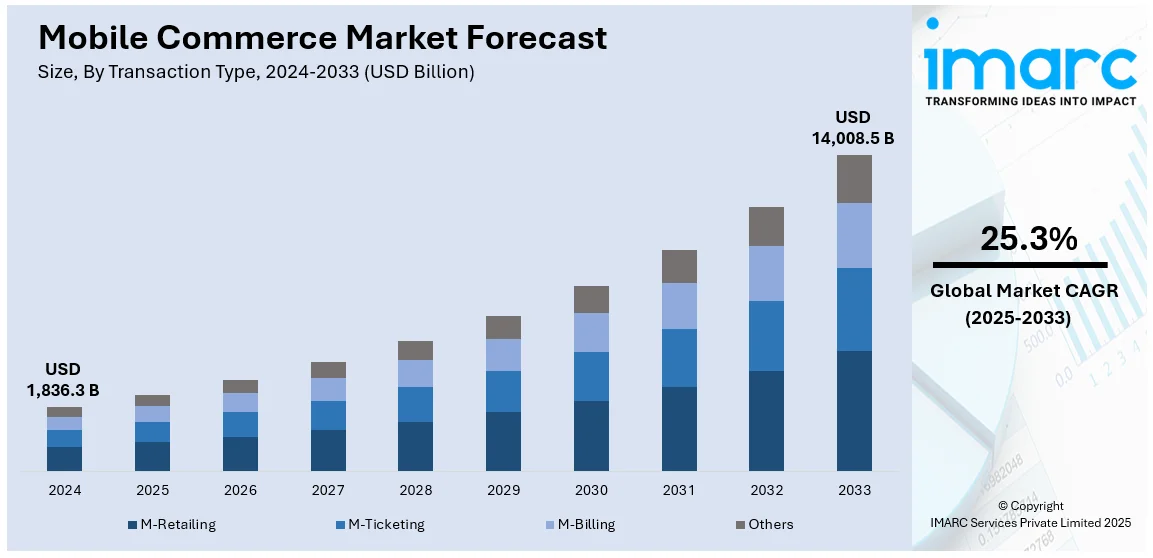

The global mobile commerce market size was valued at USD 1,836.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14,008.5 Billion by 2033, exhibiting a CAGR of 25.3% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 38.7% in 2024. The market is experiencing steady growth driven by the growing utilization of online payment methods to make cashless transactions and pay for products and services, increasing number of e-commerce businesses, and rising proliferation of smartphones across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,836.3 Billion |

|

Market Forecast in 2033

|

USD 14,008.5 Billion |

| Market Growth Rate (2025-2033) | 25.3% |

The rapid growth of mobile commerce (m-commerce) market stems from the massive smartphone customer base alongside technological developments in mobile technology. Ongoing advancements in mobile technology, combined with increasing smartphone adoption, lead consumers to use mobile devices for shopping maneuvers because of the convenience benefits. Additionally, better mobile internet speed and mobile payment innovations through digital wallets and contactless payments, serve as primary enablers. Furthermore, the market expansion benefits from consumer engagement improvements, which result from artificial intelligence and personalized marketing strategies.

In the United States, the mobile commerce market is thriving due to a highly connected and tech-savvy population. The nation boasts a robust digital infrastructure, with high smartphone penetration rates and widespread use of mobile payment systems. Furthermore, U.S. consumers have grown increasingly comfortable with mobile shopping, leading to greater adoption of mobile apps by major retailers. The market is also bolstered by trends in social commerce and direct-to-consumer business models, which enable brands to reach customers more effectively via mobile platforms. For instance, in June 2024, Elavon introduced the Cloud Payments Interface, an API simplifying payments for hospitality businesses. It enhances guest experiences, supports integrations, ensures security, enables scalability, and offers PCI-compliant solutions for seamless digital and in-person payments.

Mobile Commerce Market Trends:

Increasing smartphone penetration

The widespread proliferation of smartphones across the globe is propelling the growth of the market. GSMA reports that over 54% of the global population, roughly 4.3 billion people, now own a smartphone. This factor plays a pivotal part in shaping the mobile commerce landscape. People are gaining access to smartphones, making them a common and essential device for communication and various daily tasks. The convenience and accessibility of smartphones are making them an ideal platform for online shopping. As a result, businesses are increasingly investing in mobile commerce solutions to tap into this expanding customer base. This growing smartphone user demographic provides a substantial market opportunity for retailers and e-commerce businesses. Furthermore, the global shift towards mobile-first internet usage is positively influencing the market. Many individuals now prefer to browse and shop online through their smartphones, leading to a rise in mobile commerce transactions. Businesses that optimize their websites and applications for mobile devices stand to benefit from this trend. As more people acquire smartphones and integrate them into their daily lives, the potential customer base for mobile commerce continues to expand.

Improved mobile payment solutions

The improvement and innovation in mobile payment solutions are supporting the market growth. As people increasingly shift towards mobile shopping, the need for secure, efficient, and user-friendly payment options is becoming paramount. By 2027, digital payments are projected to surpass USD 25 Trillion in global transactions, making up 49% of combined online and POS sales. Mobile wallets, digital payment platforms, and contactless payment methods are emerging as the cornerstones of modern mobile commerce. These technologies provide users with convenient and secure ways to make transactions from their smartphones. The addition of biometric authentication, such as fingerprint and facial recognition, incorporates an extra layer of security and ease of use. People and businesses alike are embracing touchless transactions to minimize physical contact, contributing to the growth of mobile payment solutions. The trust and confidence individuals have in these payment methods are making them more willing to engage in mobile commerce.

Enhanced user experience and personalization

Rising efforts made by businesses to enhance user experiences and offer personalized shopping journeys are bolstering the market growth. In the competitive landscape, businesses understand that providing a seamless and enjoyable mobile shopping experience is essential for retaining and attracting customers. User-friendly interfaces, responsive design, and intuitive navigation are key elements that contribute to an enhanced mobile commerce user experience. Mobile apps and websites are optimized to load quickly, ensuring that customers can browse and make purchases effortlessly. The report indicates that 60% of millennials, 57% of Generation Z, and 52% of Generation X primarily rely on mobile banking apps. This focus on user-friendliness is resulting in increased customer satisfaction and loyalty. Personalization also plays a vital role in strengthening the market growth. Retailers leverage data analytics and machine learning (ML) algorithms to understand individual customer preferences and behaviors. This data-driven approach allows businesses to provide tailored product recommendations, discounts, and promotions, creating a more engaging and relevant shopping experience for each user. Moreover, push notifications and targeted marketing campaigns delivered via mobile apps enable businesses to reach customers directly and encourage repeat purchases. The ability to segment and target specific customer groups based on their preferences further enhances the effectiveness of these marketing efforts.

Mobile Commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mobile commerce market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on transaction type, payment mode, and type of user.

Analysis by Transaction Type:

- M-Retailing

- M-Ticketing

- M-Billing

- Others

M-retailing stand as the largest transaction type in 2024, holding around 43.8% of the market. M-retailing, or mobile retailing encompasses the buying and selling of a wide range of consumer goods and services through mobile devices. Consumer's rising preference for convenience in mobile apps enables them to shop for clothing, electronics, groceries, and more with simple smartphone taps. The massive uptake of M-retailing derives from consumer ease of access, along with unique shopping interactions and expanding mobile-first approaches across e-commerce operations. The global rise of mobile device utilization will drive m-retailing expansion while new features, including voice search and augmented reality, aim to deliver better user interactions.

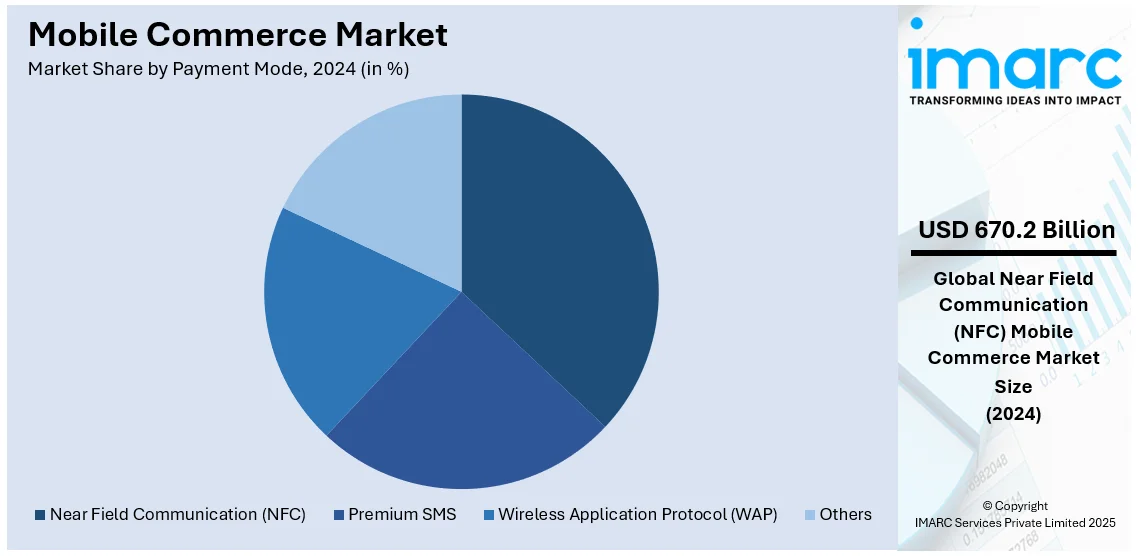

Analysis by Payment Mode:

- Near Field Communication (NFC)

- Premium SMS

- Wireless Application Protocol (WAP)

- Others

Near field communication (NFC) leads the market with around 36.5% of market share in 2024. NFC technology allows for contactless transactions by simply tapping or bringing a mobile device close to a payment terminal. This method is widely adopted for mobile payments in physical retail stores, public transportation systems, and for peer-to-peer payments. The convenience, speed, and security of NFC transactions are making it the preferred choice for many people and businesses, contributing significantly to the growth of the market. As consumer trust in NFC payments continues to increase, its adoption is expected to expand across more industries and regions, further solidifying its leading position in mobile commerce.

Analysis by Type of User:

- Smart Device Users

- Feature Phone Users

Smart device users lead the market in 2024. Smart device users have smartphones and other advanced mobile devices that provide them with internet connectivity, high-resolution displays, and access to a wide range of mobile applications. They enjoy the benefits of a seamless and feature-rich mobile commerce experience, including mobile app shopping, secure mobile payments, and personalized recommendations. Growth in this market segment continues to expand because of increasing global smartphone adoption, creating a key market entry point for businesses. The increasing number of consumer device upgrades contributes to higher mobile commerce solution demand, which builds opportunities throughout this market segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.7%. The Asia Pacific mobile commerce market is driven by rising internet penetration and increasing smartphone usage. Governments and businesses are promoting cashless transactions, and individuals are embracing digital wallets and contactless payments. Digital wallets and contactless payment solutions have caught on strongly with consumers because these secure and convenient payment methods represent attractive alternatives. The region’s young, tech-savvy population, coupled with escalating e-commerce solutions, further supports the mobile commerce market growth. The presence of digital platforms and mobile apps enhances purchasing experiences, contributing significantly to continuous market growth.

Key Regional Takeaways:

United States Mobile Commerce Market Analysis

In 2024, United States accounted for 84.50% of the market share in North America. Mobile commerce adoption in the United States has seen a notable rise as e-commerce continues to expand and more consumers transition to digital shopping platforms. In the first quarter of 2024, U.S. eCommerce sales grew by 2.8% from the previous quarter and saw a 7.2% rise compared to the first quarter of 2023. As a result, a large base of digital buyers is increasingly utilizing mobile devices for transactions. The convenience and accessibility of smartphones have made them a primary tool for online shopping, driving growth in mobile commerce. As e-commerce platforms optimize their mobile interfaces and tailor user experiences for smartphones, the seamless integration of payment gateways encourages more people to purchase products and services via mobile devices. The shift to mobile-centric shopping is also supported by improvements in network infrastructure and data security, further boosting consumer confidence. As digital buyers embrace mobile commerce, the trend is further reinforced by evolving consumer behaviors, as more individuals favor the convenience of shopping from their phones over traditional methods.

North America Mobile Commerce Market Analysis

According to the North American mobile commerce market outlook, the region is experiencing significant growth, driven by high smartphone penetration, advanced mobile payment solutions, and widespread internet accessibility. Market leaders within both the retail sector and technology field continue investing significantly in mobile infrastructure to supply users with improved applications and services and customized marketing approaches and payment technology solutions. The region's digital infrastructure, together with its technologically advanced customer base, drives mobile shopping adoption because of its practicality and time-saving potential. For instance, as per industry reports, AR usage in North America is expected to exceed 100 million users by 2025, enabling virtual try-ons and 3D product visualization, making augmented reality (AR) a key tool for online retailers, bridging physical and digital shopping experiences. Furthermore, mobile commerce innovations expand rapidly, primarily due to social commerce, along with omnichannel strategies, which position North America as a primary hub for developments.

Europe Mobile Commerce Market Analysis

The growing adoption of mobile payment options for shopping and booking in Europe has significantly contributed to the rise of mobile commerce. According to European Council, Council of the European Union, in 2023, 75% of internet users aged 16 to 74 bought goods or services online. The share of e-shoppers grew from 53% in 2010 to 75% in 2023, an increase of 22 percentage points (pp). With widespread access to mobile devices, consumers are increasingly using smartphones to make purchases and book services such as transportation, hotels, and event tickets. The introduction of secure mobile payment solutions, such as digital wallets and contactless payment methods, has made transactions faster, safer, and more convenient for shoppers. Moreover, many businesses are optimizing their websites and applications for mobile use, ensuring that the user experience is smooth and efficient. This shift towards mobile payment options has not only encouraged more people to adopt mobile commerce but has also led to the development of mobile-centric business models, with companies focusing on mobile-first strategies. As digital payment systems continue to innovate, mobile commerce in Europe is expected to grow rapidly, driven by the increasing use of mobile devices for various transaction types.

Asia Pacific Mobile Commerce Market Analysis

The adoption of mobile commerce in the Asia-Pacific region has been driven by increased investment in digital payment solutions, which facilitate smoother transactions and make mobile commerce more accessible. For instance, the total number of digital transactions have increased from a mere approximately USD 19.44 Million during Financial Year (FY) 2012-13 to over approximately USD 1.973 Billion transactions during FY 2023-24, showing a magnification of more than 129 times. Payment systems that cater to mobile users are evolving, with various mobile wallets, instant payment methods, and QR code systems becoming widely adopted. These payment technologies improve transaction speed and security, making digital shopping easier and more attractive. As consumers in this region show a growing preference for mobile devices to purchase goods and services, businesses are aligning their strategies with this trend by offering mobile-friendly payment options. The ongoing infrastructure development in payment systems and the growing availability of mobile-friendly payment platforms continue to drive mobile commerce growth in the region.

Latin America Mobile Commerce Market Analysis

Rising internet penetration and increasing smartphone usage are key factors driving the growth of mobile commerce in Latin America. According to GSMA, smartphone connections in Latin America will reach 500 Million at the end of 2021, an adoption rate of 74%. As affordable smartphones and mobile data become accessible to a larger population, internet connectivity is expanding to cover additional areas, including those in rural regions. This expanded connectivity enables individuals to shop, pay bills, and book services online through their mobile phones. As the number of smartphone users grows, so does the adoption of mobile commerce, as consumers seek the convenience of making purchases and transactions directly from their phones. Furthermore, the widespread use of social media and mobile apps has created a new platform for businesses to interact with consumers, driving more engagement and transactions. Mobile commerce is thriving as internet access becomes more widespread and the number of people using smartphones for everyday activities increases.

Middle East and Africa Mobile Commerce Market Analysis

The Middle East and Africa region has experienced increased mobile commerce adoption due to the growing number of tourists visiting the region. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. With tourists relying heavily on mobile phones for travel planning, booking accommodations, and ordering services, the demand for mobile payment and booking options has risen. The availability of mobile payment solutions makes it easier for visitors to pay for services directly from their phones. Furthermore, tourism-driven events such as festivals, conferences, and sporting events have prompted businesses in the region to optimize their digital platforms for mobile commerce. This, in turn, has led to greater adoption of mobile payment methods, enhancing the overall tourism experience and contributing to the rise of mobile commerce across the region.

Competitive Landscape:

The mobile commerce market displays strong competition between multiple organizations, including retail, payment systems, and technology sector players. The main focus of companies is to optimize their mobile platforms through the implementation of modern options that provide payment convenience, coupled with individualized service delivery and enhanced performance for users. For instance, in August 2024, Worldline introduced India’s first Omnichannel Payments Platform, 'One Commerce,' at the Global Fintech Fest. This modular platform unifies in-store and online payments, offering businesses seamless payment integration and enhanced customer experiences across all channels. Additionally, market rivalry persists due to continuous progress in areas like artificial intelligence, virtual reality innovations, and strategies focused on social commerce. Furthermore, as consumer demand for secure and convenient mobile shopping grows, companies are differentiating themselves through efficient, user-friendly platforms, prioritizing security, and leveraging emerging technologies to maintain customer loyalty and capture mobile commerce market share.

The report provides a comprehensive analysis of the competitive landscape in the mobile commerce market with detailed profiles of all major companies, including:

- Amazon.com Inc

- Apple Inc.

- ASOS.com Limited

- eBay Inc.

- Ericsson Inc.

- Gemalto (Thales Group)

- Google LLC

- International Business Machines (IBM) Corporation

- Mastercard Inc.

- mopay Inc.

- Netflix Inc.

- PayPal Holdings Inc.

- SAP ERP

- Visa Inc.

Latest News and Developments:

- January 2025: Swiggy is set to launch Instamart as a separate app, focusing on a multi-app strategy to tap into the growing quick commerce sector. While Instamart will remain on the main Swiggy app, this move aligns with mobile commerce trends seen in China with companies like Meituan and Alibaba. The strategy aims to provide specialized experiences for users.

- January 2025: Recur Club introduced a fund of approximately USD 18 Million to support D2C brands in the quick commerce sector, aiming to enhance growth and working capital. The initiative focuses on empowering ‘Make-in-India’ start-ups and fostering mobile commerce, aligning with the growing demand for quick commerce platforms. The fund targets rapid loan disbursal within seven days to help brands scale inventory and enhance marketing efforts.

- December 2024: Myntra has launched a new quick commerce vertical, M-Now, enabling 30-minute deliveries for fashion, beauty, and lifestyle products through its app. Initially available in Bengaluru, the service will expand to cities like Mumbai, Delhi, and Pune. This move aligns with Myntra’s push into mobile commerce, enhancing shopping convenience with rapid order fulfilment.

- October 2024: Reactiv, a mobile commerce startup, has emerged from stealth mode with the announcement of a USD 5 Million seed funding round. The company aims to revolutionize mobile commerce by providing innovative solutions for seamless transactions on mobile platforms. The funding will support its growth and technology development. Reactiv is poised to disrupt the mobile commerce landscape with its new offerings.

- August 2024: Amazon India is exploring the launch of a separate app for its digital payments service, Amazon Pay, to boost visibility and usage beyond its main e-commerce platform. This move follows a recent investment of approximately USD 72 Million in Amazon Pay India. The strategy aligns with Amazon's ongoing commitment to expanding its presence in the Indian mobile commerce market. The initiative could further strengthen Amazon Pay's role in India's growing digital economy.

Mobile Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transaction Types Covered | M-Retailing, M-Ticketing, M-Billing, Others |

| Payment Modes Covered | Near Field Communication (NFC), Premium SMS, Wireless Application Protocol (WAP), Others |

| Type of Users Covered | Smart Device Users, Feature Phone Users |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon.com Inc, Apple Inc., ASOS.com Limited, eBay Inc, Ericsson Inc., Gemalto (Thales Group), Google LLC, International Business Machines (IBM)Corporation, Mastercard Inc., mopay Inc., Netflix, Inc., PayPal Holdings, Inc., SAP ERP, Visa Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mobile commerce market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mobile commerce market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mobile commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global mobile commerce market was valued at USD 1,836.3 Billion in 2024.

IMARC estimates the global mobile commerce market to reach USD 14,008.5 Billion in 2033, exhibiting a CAGR of 25.3% during 2025-2033.

The market is driven by several key factors, including the widespread use of smartphones, advancements in mobile payment technologies, and improved internet speeds. Additionally, consumers’ growing preference for convenient, anytime access to shopping, along with personalized experiences and the rise of social commerce, is accelerating market expansion.

Asia Pacific currently dominates the market, holding a significant share of 38.7% in 2024. This leadership can be attributed to widespread smartphone adoption, affordable internet access, and a tech-savvy population. High urbanization rates, growing middle-class purchasing power, and innovative payment systems further boost adoption. Localized platforms and government support for digital economies also drive significant growth in this dynamic, rapidly expanding market.

Some of the major players in the keyword market include Amazon.com Inc, Apple Inc., ASOS.com Limited, eBay Inc, Ericsson Inc., Gemalto (Thales Group), Google LLC, International Business Machines (IBM)Corporation, Mastercard Inc., mopay Inc., Netflix, Inc., PayPal Holdings, Inc., SAP ERP, Visa Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)