Mixed Signal IC Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Mixed Signal IC Market Size and Share:

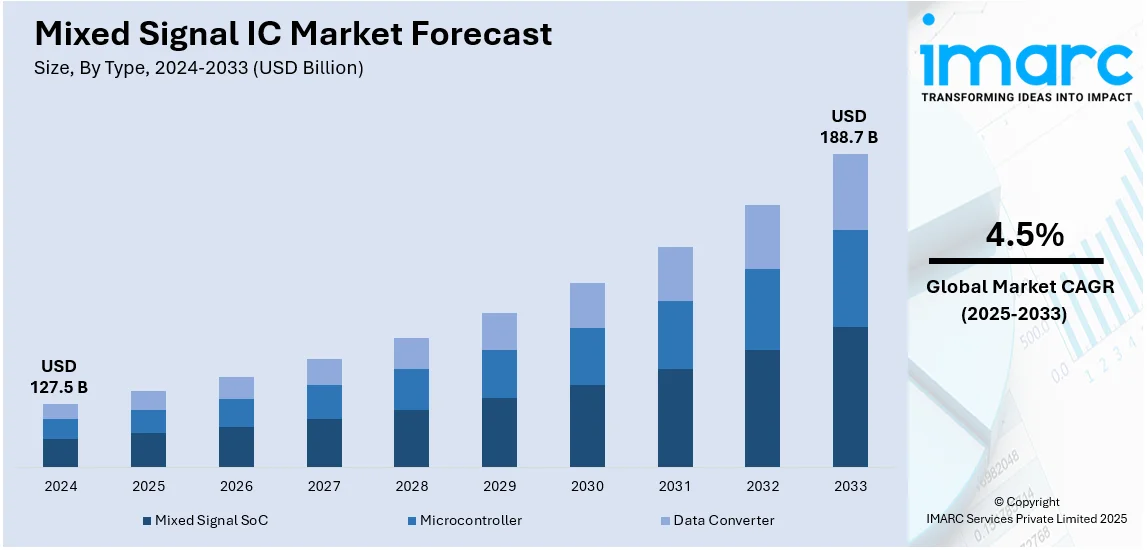

The global mixed signal IC market size was valued at USD 127.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 188.7 Billion by 2033, exhibiting a CAGR of 4.5% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.8% in 2024, driven by innovations in semiconductor, the rising demand from key industries, advanced manufacturing capabilities, and government initiatives supporting domestic chip production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 127.5 Billion |

|

Market Forecast in 2033

|

USD 188.7 Billion |

| Market Growth Rate 2025-2033 | 4.5% |

The main accelerators of the mixed-signal IC market are the rapid growth in the consumer electronics industry. The widespread adoption of smartphones, tablets, wearables, and IoT-enabled devices has increased the need for integrated circuits that are highly performance and power-efficient, able to seamlessly process both analog and digital signals. This represents one of the key mixed signal IC market trends. Mixed-signal ICs facilitate primary functions like sensor interfacing, wireless capability, and efficient power management in compact electronic devices. In addition to this, the further necessity for high-speed data transmission, enhanced audio processing, and real-time computing adds a push to the growth of the market. For instance, in February 2024, Accellera Systems Initiative announced the launch of the SystemVerilog Mixed-Signal Interface Types (MSI) Working Group to develop a SystemVerilog-compatible extension, enhancing connectivity and efficiency for analog and mixed-signal models in upcoming Verilog-AMS and UVM-MS standards. As consumer electronics continue evolving with AI and 5G integration, the demand for mixed-signal ICs will increase significantly.

To get more information on this market, Request Sample

The United States plays a crucial role in the global mixed-signal IC market through technological innovation, advanced semiconductor manufacturing, and a strong ecosystem of leading chipmakers. Companies such as Texas Instruments, Analog Devices, and Broadcom drive market growth by developing high-performance mixed-signal ICs for applications in telecommunications, automotive, industrial automation, and consumer electronics. For instance, in November 2024, onsemi announced the launch of the Treo Platform, a 65nm BCD-based analog and mixed-signal solution enabling high-efficiency power management, advanced sensing, and communications, accelerating product development and market responsiveness for diverse applications. The U.S. government’s strategic investments in semiconductor research and domestic production, including initiatives under the CHIPS Act, further strengthen the industry. Additionally, collaborations between U.S. technology firms and global electronics manufacturers ensure a steady supply of cutting-edge mixed-signal ICs to meet rising market demand.

Mixed Signal IC Market Trends

Integration of Mixed-Signal ICs for Enhanced Smartphone Connectivity

The growing demand for advanced smartphones that are internet-enabled as compared to mobile phones is one of the key factors responsible for market growth. According to the International Telecommunication Union (ITU), in 2024, the total number of internet users is projected to reach 5.5 Billion and account for 68% of the total population. This is driving the use of mixed-signal integrated circuits (ICs). These ICs are able to support 5G, Wi-Fi 6, and Bluetooth for seamless wireless communications, faster data processing, and improved power efficiency in the devices that they are installed in. Thus, mixed-signal ICs are gaining acceptance and usage from smartphone manufacturers in RF signal processing, power management, and sensor integration for ensuring all-around design optimization. Increasing trends towards Internet of Things (IoT) applications and edge computing would continue to require more advanced mixed-signal IC architecture that would work towards overall network efficiency and better user experience on modern smart devices, which is facilitating the overall mixed signal IC market demand.

Rapid Urbanization and Rising Income

The market is also being driven by an increasing number of sales for rapid and modern miniature consumer electronics, owing to unbelievably quick urbanizations and rising disposable income levels of individuals. According to the World Bank, about 56 percent of the entire world ranged at 4.4 billion - comprising individuals living in urban areas in 2023. This number is today expected to exceed that by an extremely great margin by 2050. Apart from this, mixed-signal ICs are used in equipment within cars for providing the basic function of things such as climate control, airbags, and entertainment systems. All of these features and regulatory pressures on efficiency have made the need for alternative fuel vehicles grow in many countries-the other market forces affecting it positively.

Adoption of Mixed Signal IC in Healthcare

Apart from this, mixed-signal ICs play a significant role in the healthcare industry as they find extensive applications in modern implantable medical devices and imaging systems that are essential for the diagnosis, treatment, management, and monitoring of patients. According to the IMARC Group, the global implantable medical devices market is expected to reach USD 209.1 Billion by 2033, growing at a CAGR of 4.5% during 2025-2033. Additionally, the rising demand for diagnostic tools and techniques on account of the growing prevalence of chronic diseases is driving the adoption of mixed-signal ICs across the globe. Furthermore, the development of innovative mixed-signal ICs is projected to expand their utilization as essential tools in industrial fields worldwide.

Mixed Signal IC Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mixed signal IC market, along with forecast at the global, regional, and country levels from 2025-20333. The market has been categorized based on type and end use.

Analysis by Type:

- Mixed Signal SoC

- Microcontroller

- Data Converter

Mixed signal SoC stands as the largest type in 2024, holding around 68.5% of the market. This dominance is driven by the increasing adoption of SoCs in applications requiring both analog and digital signal processing, such as consumer electronics, automotive systems, telecommunications, and industrial automation. Mixed-signal SoCs enable efficient power management, seamless connectivity, and enhanced performance in compact designs, making them essential for modern integrated circuits. Additionally, the rapid expansion of 5G networks, IoT devices, and AI-driven applications is further fueling demand. Continuous advancements in semiconductor fabrication technologies, including smaller nodes and improved integration, are also strengthening the position of mixed-signal SoCs as the preferred solution for high-performance electronic systems.

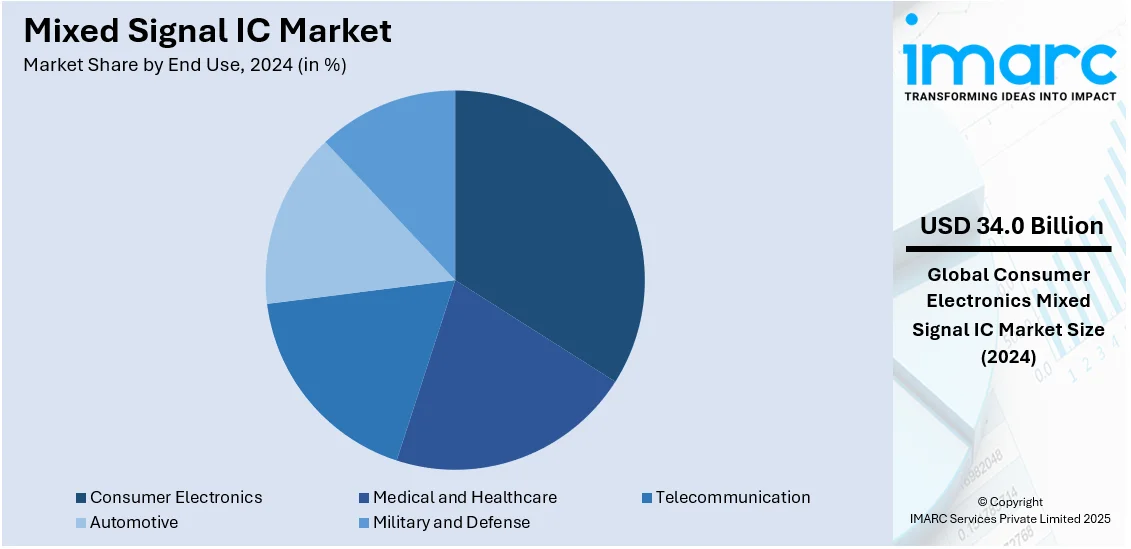

Analysis by End Use:

- Consumer Electronics

- Medical and Healthcare

- Telecommunication

- Automotive

- Military and Defense

Consumer electronics leads the market with around 26.7% of the mixed signal IC market share in 2024. The increasing demand for smartphones, tablets, wearables, smart home devices, and other personal electronics is driving significant adoption of mixed-signal ICs. These integrated circuits enable efficient power management, high-speed data processing, and seamless connectivity, which are critical for modern electronic devices. The rise of 5G technology, AI-powered applications, and IoT-enabled devices further accelerates the need for advanced mixed-signal IC solutions. Additionally, continuous innovations in semiconductor technology, including miniaturization and improved energy efficiency, enhance product performance and battery life. With growing consumer demand for high-performance smart devices, the dominance of consumer electronics in the mixed-signal IC market is expected to persist.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.8%. This dominance is driven by strong technological advancements, a robust semiconductor manufacturing ecosystem, and high demand from key industries such as consumer electronics, automotive, telecommunications, and healthcare. The presence of leading semiconductor companies, including Texas Instruments, Analog Devices, and Broadcom, further strengthens the region’s market position. Additionally, growing investments in 5G infrastructure, IoT adoption, and AI-driven applications are fueling demand for high-performance mixed-signal ICs. Government initiatives, including funding for domestic semiconductor production under the CHIPS Act, are enhancing North America's competitiveness. With ongoing R&D and strategic industry collaborations, the region is expected to maintain its leadership in the mixed-signal IC market.

Key Regional Takeaways:

United States Mixed Signal IC Market Analysis

US accounts for 93.20% share of the market in North America. The United States mixed signal IC market is primarily driven by the rising demand for high-performance, power-efficient semiconductor solutions across industries such as automotive, telecommunications, consumer electronics, and healthcare. The increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is also driving the need for mixed signal ICs in battery management systems, power converters, and sensor interfaces. According to industry reports, by 2030, there will be 26.4 Million electric vehicles (EVs) on American roadways, accounting for more than 10% of all automobiles. Moreover, consumer electronics manufacturers are integrating these chips into smartphones, wearables, and smart home devices to enable efficient data conversion and processing. The healthcare sector is also leveraging mixed signal ICs in medical imaging, remote patient monitoring, and portable diagnostic devices. Additionally, the defense and aerospace industries are adopting mixed signal ICs for radar, navigation, and communication systems. Technological advancements in semiconductor manufacturing, including smaller node processes and improved integration techniques, are enhancing performance and reducing power consumption. Other than this, increasing investments in research and development (R&D), government support for domestic semiconductor production, and growing demand for automation and robotics further support market expansion. The rise of artificial intelligence (AI) and edge computing is also propelling the need for mixed signal ICs in data acquisition and processing applications.

Asia Pacific Mixed Signal IC Market Analysis

The Asia Pacific mixed signal IC market is expanding due to rapid industrialization, increasing demand for consumer electronics, and strong semiconductor manufacturing capabilities in countries such as China, Taiwan, South Korea, and Japan. The expansion of 5G networks and the Internet of Things (IoT) is also driving the integration of mixed signal ICs in wireless communication, smart devices, and automotive applications. For instance, as per the Press Information Bureau (PIB), 5G network connections account for 16.9% of total internet connections in India. Additionally, rising investments in smart manufacturing and automation are propelling the adoption of mixed signal ICs in industrial control, robotics, and factory automation. The medical technology sector is also utilizing mixed signal ICs for diagnostic imaging, remote patient monitoring, and portable medical devices. Besides this, government initiatives supporting semiconductor self-sufficiency, as well as increasing research and development (R&D) investments in AI and edge computing, further contribute to overall industry expansion.

Europe Mixed Signal IC Market Analysis

The Europe mixed signal IC market is growing, fueled by the increasing adoption of advanced semiconductor solutions across automotive, telecommunications, consumer electronics, industrial automation, and healthcare sectors. The robust automotive sector in the region, emphasizing electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is fueling the need for mixed signal ICs in battery management, power electronics, and sensor interfaces. According to the International Council on Clean Transportation (ICCT), in 2023, there were approximately 10.6 Million new automobile registrations in the EU, recording a 14% increase from the previous year. Of these, 15% of newly registered vehicles were battery-electric. Moreover, in industrial automation, mixed signal ICs are widely used in motor control, factory automation, and robotics, supporting the transition of the EU toward smart manufacturing and Industry 4.0. The expansion of high-speed data centers and cloud computing infrastructure is also increasing demand for mixed signal ICs in signal integrity management, networking, and high-speed data transmission. Additionally, the increasing focus on sustainable energy solutions, including smart grids and renewable energy systems, is propelling the adoption of mixed signal ICs in power management, energy conversion, and smart metering applications. Other than this, the proliferation of augmented reality (AR) and virtual reality (VR) applications in gaming, training, and simulation is further expanding the market.

Latin America Mixed Signal IC Market Analysis

The Latin America mixed signal IC market is significantly benefiting from the increasing adoption of IoT devices and connected technologies in industries such as healthcare, agriculture, and logistics. The region's growing focus on smart cities is also driving demand for mixed signal ICs in traffic management, surveillance, and public infrastructure automation. Moreover, rising investments in telecommunications infrastructure, including 5G deployment, are further boosting market growth. As per recent industry reports, in Q3 2024, there were 11 Million new 5G connections in Latin America, rising to a total of 67 Million and exhibiting a robust growth rate of 19%. Besides this, the rising demand for digital banking and fintech solutions is further boosting the use of mixed signal ICs in secure authentication and transaction processing.

Middle East and Africa Mixed Signal IC Market Analysis

The Middle East and Africa mixed signal IC market is being increasingly propelled by the growing adoption of consumer electronics, including smartphones, wearables, and smart home devices, which require efficient signal conversion and power management solutions. Moreover, the defense and aerospace industries are adopting these ICs for secure communication, radar, and navigation systems. Smart city initiatives across the Gulf countries are also propelling the adoption of mixed signal ICs in traffic control, surveillance, and energy management systems. According to a report published by the IMARC Group, the GCC smart cities market is forecasted to grow at a CAGR of 15.9% during 2025-2033. Additionally, government initiatives supporting semiconductor design, AI research, and local electronics manufacturing are fostering innovation and reducing dependency on imported chips, further propelling market expansion.

Competitive Landscape:

The mixed-signal IC market is highly competitive, with leading semiconductor companies focusing on innovation, miniaturization, and power efficiency to gain market share. Major players dominate the industry through extensive R&D investments and strategic acquisitions. For instance, in March 2025, Texas Instruments announced the launch of the world’s smallest MCU, the 1.38mm² MSPM0C1104, enhancing space efficiency for medical wearables and personal electronics while maintaining high performance within its Arm® Cortex®-M0+ MSPM0 portfolio. These companies cater to diverse applications, including automotive, consumer electronics, telecommunications, and industrial automation. Emerging startups and fabless semiconductor firms are also entering the market, driving competition with specialized solutions. Additionally, advancements in AI, IoT, and 5G are intensifying competition, prompting companies to develop next-generation mixed-signal ICs with enhanced integration and performance capabilities.

The report provides a comprehensive analysis of the competitive landscape in the mixed signal IC market with detailed profiles of all major companies, including:

- Analog Devices, Inc.

- Cirrus Logic, Inc.

- Diodes Incorporated

- EnSilica

- Infineon Technologies AG

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Semiconductor Components Industries, LLC

- Silicon Laboratories

- STMicroelectronics

- Texas Instruments Incorporated

Latest News and Developments:

- November 2024: Renesas Electronics Corporation, a world leader in providing cutting-edge semiconductors, announced the new AnalogPAK mixed-signal integrated circuits (ICs), which have the first customizable 14-bit SAR ADC in the industry and equipment with less power consumption, automotive qualified. These NVM-programmable electronics are affordable and enable designers to integrate several system functions, reducing component count, board space, and energy consumption.

- July 2024: Eggtronic launched its EPIC mixed-signal power conversion regulator integrated circuits (ICs) featuring reprogrammable flash storage. The EPIC 2.0 Flash range is aimed at accruing OEMs greater versatility in design and permitting one mixed signal IC to serve in a variety of applications.

- June 2024: The Solido Simulation Suite solution was officially launched by Siemens Digital Industries Software. This software is a complete family of AI-accelerated SPICE, Fast SPICE, and mixed-signal simulation tools developed to help customers fast-track their design and validation processes for cutting-edge analog, custom, and mixed-signal ICs.

- November 2023: Siemens Digital Industries Software acquired Insight EDA Inc., which is an EDA software firm providing circuit reliability services with revolutionary approaches, including analog and mixed-signal ICs, for the various IC engineering teams throughout the globe. This acquisition is a major step in speeding up Siemens's strategic roadmap for circuit reliability authentication and also reflects its commitment to providing excellent EDA services.

- August 2023: California-based semiconductor manufacturer AMD established research and development centers in New York at Dutchess County and Monroe County. The centers are focussing on mixed-signal IC development and packaging evaluations. Both sites are fully operational as of now.

Mixed Signal IC Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment::

|

| Types Covered | Mixed Signal SoC, Microcontroller, Data Converter |

| End Uses Covered | Consumer Electronics, Medical and Healthcare, Telecommunication, Automotive, Military and Defense |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices, Inc., Cirrus Logic, Inc., Diodes Incorporated, EnSilica, Infineon Technologies AG, Microchip Technology Inc., Renesas Electronics Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, STMicroelectronics, Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mixed signal IC market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mixed signal IC market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mixed signal IC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mixed signal IC market was valued at USD 127.5 Billion in 2024.

IMARC estimates the mixed signal IC market to reach USD 188.7 Billion by 2033, exhibiting a CAGR of 4.5% during 2025-2033.

Key factors driving the mixed-signal IC market include rising demand for consumer electronics, increasing adoption of IoT and smart devices, advancements in automotive electronics, growth in telecommunications and 5G infrastructure, and the need for energy-efficient solutions. Continuous innovation in semiconductor technology and miniaturization further propel market expansion across various industries.

North America currently dominates the market with a 35.8% share. This leadership is driven by strong semiconductor innovation, advanced manufacturing capabilities, and high demand from industries such as telecommunications, automotive, healthcare, and consumer electronics. Government initiatives and strategic investments further strengthen market growth.

Some of the major players in the mixed signal IC market include Analog Devices, Inc., Cirrus Logic, Inc., Diodes Incorporated, EnSilica, Infineon Technologies AG, Microchip Technology Inc., Renesas Electronics Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, STMicroelectronics, Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)