Mineral Cosmetics Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Mineral Cosmetics Market Size and Share:

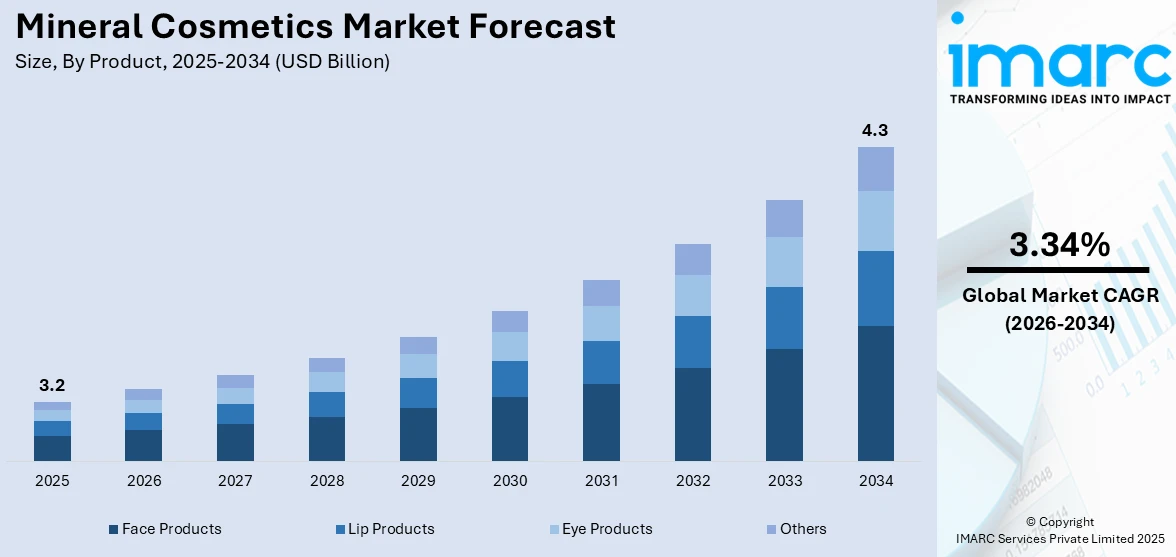

The global mineral cosmetics market size was valued at USD 3.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.3 Billion by 2034, exhibiting a CAGR of 3.34% from 2026-2034. North America currently dominates the market, holding a market share of over 35.7% in 2025. The mineral cosmetics market share is expanding, driven by rising preferences for clean and skin-friendly makeup products owing to the increasing incidence of skin issues, along with the expansion of e-commerce sites, enhancing the accessibility of organic items to a wider audience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.2 Billion |

|

Market Forecast in 2034

|

USD 4.3 Billion |

| Market Growth Rate 2026-2034 | 3.34% |

As more people are preferring natural and skin-friendly makeup, the demand for mineral cosmetics is rising. People avoid harsh chemicals and look for products that prevent irritation and allergies. Many individuals also deal with sensitive skin or acne, making gentle and non-comedogenic options more popular among the masses. Besides this, beauty influencers promote clean beauty trends, catalyzing the demand for mineral cosmetics. In addition, vegan and cruelty-free items attract ethically conscious buyers, while improved formulations offer better texture, pigmentation, and lasting power. With inflating disposable incomes, people are spending more on high-quality makeup that benefits their skin. Stringent regulations lead brands to employ safer ingredients, further supporting the market growth.

To get more information on this market Request Sample

The United States has emerged as a major region in the mineral cosmetics market owing to many factors. People are becoming aware about the harmful effects of synthetic chemicals and choosing makeup that is gentle on their skin, which is impelling the mineral cosmetics market growth. With the rising usage of social media, individuals are being encouraged to follow clean beauty trends, driving the demand for mineral-based products. According to the DataReportal, in January 2024, the USA had 239.0 Million social media users, representing 70.1% of the overall population. Apart from this, innovations in item texture, pigmentation, and longevity assist in improving user appeal, thereby bolstering the market growth. Moreover, the increasing adoption of online shopping is making mineral cosmetics more accessible, helping brands reach a wider audience.

Mineral Cosmetics Market Trends:

Increasing demand for natural and organic products

The rising need for natural and organic items is fueling the market growth. People are becoming aware about the harmful effects of synthetic ingredients. They are consequently employing makeup items with clean, natural, and skin-friendly formulations. According to a study by the Chemical Abstracts Service (CAS), in 2023, 40% of individuals indicated a preference for beauty and personal care items made with natural ingredients. Many people have sensitive skin, making mineral cosmetics a go-to choice for gentle and non-irritating coverage. These products often contain natural minerals, such as zinc oxide, which offer added skincare benefits like sun protection and soothing properties. The ongoing clean beauty trend, supported by social media and influencers, further driving the demand for mineral cosmetics. Brands respond by expanding their mineral-based product lines and refining formulations to attract more customers. As people prioritize health and sustainability, natural and organic mineral cosmetics continue to gain popularity.

Expansion of e-commerce sites

The expansion of e-commerce portals is offering a favorable mineral cosmetics market outlook. Online shopping allows people to browse, compare, and purchase mineral-based makeup from the comfort of their homes. Many brands sell directly through their websites and major e-commerce platforms, offering exclusive deals, comprehensive product descriptions, and customer feedback that assist purchasers in making better decisions. Social media and influencer marketing also boost online sales, as people discover new mineral cosmetics through digital ads and beauty tutorials. Subscription boxes and personalized recommendations further enhance the online shopping experience. Moreover, with free shipping, easy returns, and virtual try-on tools, individuals feel more confident buying makeup online. As e-commerce sites continue to broaden, more brands are focusing on their digital presence, making mineral cosmetics more available and popular worldwide. According to industry reports, the global retail e-commerce market is set to hit USD 8.1 Trillion by 2026.

Rising incidence of dermatological issues

The increasing incidence of dermatological issues like acne, eczema, and skin sensitivity is driving the demand for mineral cosmetics. A research study revealed that as of October 2024, eczema, encompassing intrinsic and atopic dermatitis, impacted as many as 20% of children and 3% of adults worldwide. Many traditional cosmetics contain harsh chemicals and synthetic ingredients that can worsen skin conditions, leading people to seek safer alternatives. Mineral-based makeup is often free from parabens, fragrances, and preservatives, making it a popular choice for those with skin issues. It also contains natural items, such as titanium dioxide, which offer anti-inflammatory and soothing benefits. Dermatologists often recommend mineral cosmetics for people with skin concerns, further encouraging their usage. As more people are suffering from skin conditions, brands are developing advanced mineral formulas that provide good coverage while being kind to the skin. This growing need for gentle and non-comedogenic products continues to move the market forward.

Mineral Cosmetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mineral cosmetics market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Face Products

- Lip Products

- Eye Products

- Others

Face products held 44.0% of the market share in 2025. They are the most essential part of any makeup routine. Foundations, powders, and concealers are in high demand, as people look for skin-friendly alternatives that provide good coverage without clogging pores. Many people have sensitive or acne-prone skin, making non-comedogenic and lightweight mineral formulas a popular choice. These products often contain natural ingredients like zinc oxide and titanium dioxide, which offer sun protection and help to soothe the skin. With the rise of clean beauty trends, more people prefer makeup that not only enhances their look but also benefits their skin. Brands focus on improving texture, longevity, and shade ranges to attract a wider audience. Face products are also marketed as multi-functional, combining skincare benefits with makeup, which adds to their appeal. Since foundation and powder are crucial items for many individuals, they naturally dominate the market compared to other product categories.

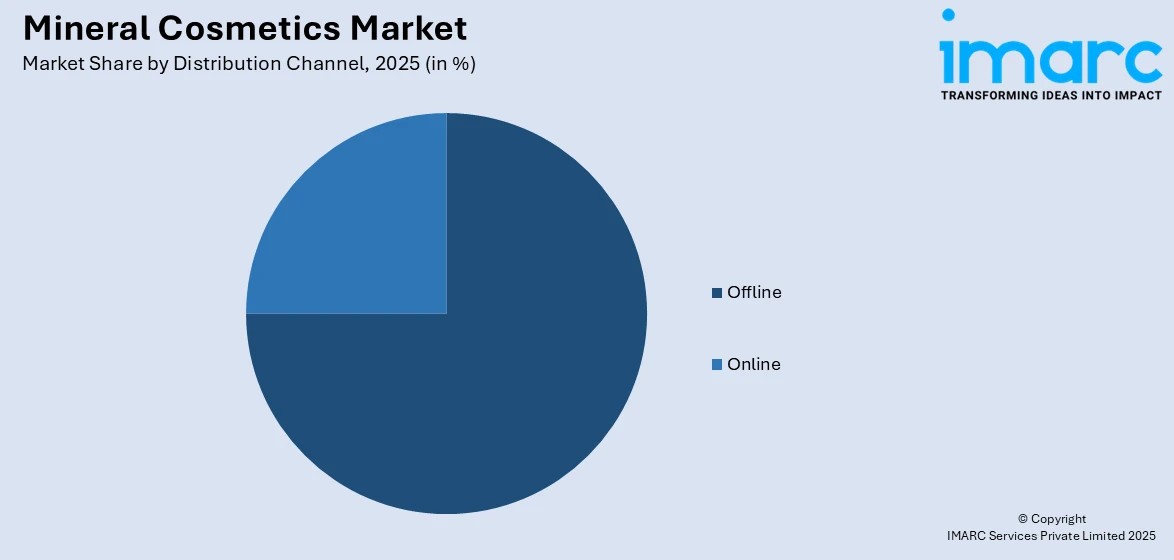

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline accounts for 75% of the market share. Offline channels are gaining popularity because many people prefer to see, touch, and test products before buying. Stores like beauty retailers, department stores, and pharmacies allow customers to try different shades and textures to find the perfect match for their skin. In-person shopping also provides expert guidance from sales representatives, which helps people to choose items based on their skin type and concerns. Many shoppers trust physical stores more since they can verify the authenticity of products and avoid the risk of buying fakes online. Additionally, premium and luxury mineral cosmetic brands often focus on high-end retail outlets to enhance their brand image. Promotional activities, in-store discounts, and exclusive item launches further attract users. The experience of testing and instantly purchasing products in physical stores keeps offline sales strong.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 35.7%, enjoys the leading position in the market. The region is recognized because of the strong demand for clean beauty products and high user awareness about skincare. People are more becoming conscious about what they apply to their skin and prefer makeup with natural and non-toxic ingredients. The region, including the United States and Mexico, has a well-established beauty and personal care industrial base with many big firms constantly launching innovative and high-quality mineral-based items. According to the IMARC Group, the Mexico beauty and personal care market size was valued at USD 10.6 Billion in 2024. The rise of vegan, cruelty-free, and eco-friendly cosmetics also fuels the market growth, as many individuals prioritize ethical shopping. Social media and influencer marketing play a huge role in promoting mineral cosmetics, making them more mainstream. The presence of major beauty retailers, specialty stores, and extended e-commerce networks ensures easy access to these products. Additionally, high disposable incomes allow individuals to spend more on premium and dermatologist-recommended makeup items.

Key Regional Takeaways:

United States Mineral Cosmetics Market Analysis

The United States holds 86.80% of the market share in North America. The United States market is experiencing growth owing to the increasing demand for clean-label and skin-friendly beauty products that align with health-conscious and environmentally aware lifestyles. Mineral cosmetics, formulated without synthetic dyes, fragrances, parabens, or preservatives, appeal to individuals with sensitive or acne-prone skin, as they reduce the risk of irritation and clogging. Social media has also amplified item visibility, allowing niche brands to reach targeted audiences who prioritize ingredient transparency and cruelty-free formulations. The rising influence of dermatologists and beauty influencers promoting non-comedogenic and hypoallergenic products has further enhanced their appeal. According to industry reports, as of August 2024, 41% of individuals under 30 years old, 33% of those between 30 and 49 years old, and 22% of respondents aged 50 and older indicated that they bought a product because of an influencer’s endorsement. Additionally, the ongoing trend of multifunctional beauty items that offer coverage, ultraviolet (UV) protection, and skincare benefits in one product is catalyzing the demand for mineral-based foundations, powders, and blushes. Furthermore, increasing regulations and retailer-oriented clean beauty standards are motivating mainstream brands to broaden their mineral cosmetic item lines.

Europe Mineral Cosmetics Market Analysis

The Europe market is witnessing robust growth on account of the combination of rising user preference for natural ingredients, stringent regulatory standards, and the growing environmental consciousness. European users are increasingly scrutinizing product labels and shifting towards cosmetics free from synthetic additives, parabens, and talc. These factors align with the appeal of mineral formulations. The region’s strong regulatory framework under REACH and the EU Cosmetics Regulation has also motivated brands to reformulate offerings with safer and skin-friendly ingredients, driving the demand for mineral-based alternatives. Moreover, rising awareness among the masses about skin sensitivities and conditions, such as rosacea and eczema, has further contributed to the popularity of gentle and non-irritating mineral products. In parallel, the increasing focus on sustainability and ethical beauty has heightened interest in brands that offer eco-friendly packaging, cruelty-free certifications, and ethically sourced minerals. Additionally, the rising aging population in Europe seeks items that offer skin benefits along with coverage, with mineral cosmetics seen as advantageous due to their inclusion of ingredients like zinc oxide and titanium dioxide. As per the information provided on the official website of the Eurostat, as of 1 January 2024, the EU population was estimated to be 449.3 Million, with over one-fifth (21.6%) of this group being 65 years old and above.

Asia-Pacific Mineral Cosmetics Market Analysis

The Asia-Pacific market is expanding due to rising skincare awareness, increasing urban populations, and high demand for natural beauty products. People residing in countries, such as Japan, South Korea, China, and India are seeking cosmetic solutions that are natural, gentle, non-comedogenic, and suited for humid climates, making mineral-based formulations appealing. For instance, in India, 71% of users indicated a preference for beauty items made from natural ingredients, as per a survey done in 2024. The cultural emphasis on healthy and radiant skin also encourages the use of products with supplementary skincare benefits, such as sun protection and anti-inflammatory properties, which are inherent in many mineral ingredients. Additionally, the growing disposable incomes and the rise of online beauty platforms have improved access to both international and local mineral cosmetic brands. Increasing concerns about skin sensitivity, pollution, and ingredient transparency are also enabling individuals to favor formulations with fewer synthetic additives and more breathable compositions.

Latin America Mineral Cosmetics Market Analysis

In Latin America, the market is significantly influenced by the increasing popularity of multifunctional beauty products and the penetration of worldwide wellness trends. People are seeking makeup that enhances appearance and also offers skincare benefits, such as hydration, sun protection, and anti-inflammatory effects, attributes that are commonly associated with mineral formulations. Moreover, local influencers and content creators are promoting the advantages of skin-first makeup routines, encouraging clean beauty trends, showcasing natural looks, and endorsing skin-friendly products, all of which are catalyzing the demand for such items. In 2022, 41% of makeup users in Brazil reported purchasing products due to influencer recommendations, as per the International Trade Administration. Additionally, the rising awareness about hormone-disrupting chemicals in conventional items is motivating the shift towards simpler mineral-based cosmetic alternatives that are perceived as safer and more natural for everyday use across diverse skin tones and conditions.

Middle East and Africa Mineral Cosmetics Market Analysis

The Middle East and Africa market is being greatly impacted by the increasing awareness about skin health, high demand for halal and clean beauty products, and rising disposable income. Individuals in the region are becoming more ingredient-conscious, favoring items free from parabens, talc, and synthetic dyes, which aligns with the appeal of mineral cosmetics. The expansion of organized retail and e-commerce channels and beauty specialty stores has also improved access to mineral-based brands, both internationally and regionally. According to the Kingdom’s Central Bank, in 2024, e-commerce transactions utilizing Mada cards in Saudi Arabia hit SR197.42 Billion (USD 52.64 Billion). Besides this, cultural preferences for modest and skin-nurturing makeup have made mineral products popular among individuals seeking natural finishes.

Competitive Landscape:

Key players work on developing innovative items to meet the high mineral cosmetics market demand. They are launching products with better formulations, texture, and lasting power. They are investing in research to create skin-friendly, non-toxic, and dermatologically tested makeup that suits various skin types. Many brands focus on marketing clean beauty through influencers and social media, increasing awareness and requirement. They also expand their item lines to include foundations, lipsticks, and skincare-infused cosmetics to attract more customers. Sustainability is a big focus, with companies using eco-friendly packaging and cruelty-free ingredients. Major brands partner with retailers and e-commerce platforms to improve accessibility and reach a wider audience. Compliance with stricter regulations ensures safer products, boosting user trust. For instance, in February 2024, IDUN Minerals, a premier clean beauty brand from Sweden, debuted in India, introducing its innovative mineral cosmetic offerings to the Indian beauty and retail market. This broadening signified a key achievement in the company’s collection, underscoring its dedication to ethical and clean beauty standards.

The report provides a comprehensive analysis of the competitive landscape in the mineral cosmetics market with detailed profiles of all major companies, including:

- Ahava Dead Sea Laboratories

- BASF SE

- Clariant AG

- Glo Skin Beauty

- L'Oréal S.A

- Merck KGaA

- Mineralissima

- Neelikon

- Revlon

- Shiseido Co.Ltd.

- The Estée Lauder Companies Inc.

Latest News and Developments:

- March 2025: Neutrogena introduced the Ultra Sheer Face Liquid Mineral Sunscreen SPF 70, the new addition to their sun protection range. The updated mineral blend offered a light finish while featuring a high SPF level. To advertise the item, the brand initiated a marketing campaign featuring famous Hollywood actor and WWE champion John Cena.

- July 2024: SOL LABS revealed two groundbreaking products, the ‘On-The-Go SPF 30 Mineral Sun Defense’ and ‘Natural Mineral SPF 50 Sheer Mist Sun Spray’, transforming portable sun protection and enhancing eco-friendly skincare practices. The items represented the latest introduction in SOL LABS' creative collection that merged the precision of K-Beauty with California's attitude towards wellness.

- July 2024: Mineral Fusion, a frontrunner in mineral cosmetics, was purchased by Seaweed Bath Co., a prominent natural beauty company. Through this acquisition, the latter sought to enhance operational efficiency and accelerate product development.

Mineral Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Face Products, Lip Products, Eye Products, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Ahava Dead Sea Laboratories, BASF SE, Clariant AG, Glo Skin Beauty, L'Oréal S.A, Merck KGaA, Mineralissima, Neelikon, Revlon, Shiseido Co.Ltd., The Estée Lauder Companies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mineral cosmetics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mineral cosmetics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mineral cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mineral cosmetics market was valued at USD 3.2 Billion in 2025.

The mineral cosmetics market is projected to exhibit a CAGR of 3.34% during 2026-2034, reaching a value of USD 4.3 Billion by 2034.

The rising cases of sensitive skin, acne, and allergies are driving the demand for gentle and non-comedogenic formulations. Besides this, the increasing popularity of vegan and cruelty-free cosmetics is fueling the market growth, as ethical shopping becomes a priority for many people. Moreover, advancements in formulations offer improved texture, coverage, and longevity, making mineral cosmetics more appealing.

North America currently dominates the mineral cosmetics market, accounting for a share of 35.7% in 2024, because of high user awareness, strong demand for clean beauty products, and a well-established beauty industry. Ethical shopping, influencer marketing, the high presence of premium brands, and the implementation of strict regulations are further positively influencing the market.

Some of the major players in the mineral cosmetics market include Ahava Dead Sea Laboratories, BASF SE, Clariant AG, Glo Skin Beauty, L'Oréal S.A, Merck KGaA, Mineralissima, Neelikon, Revlon, Shiseido Co.Ltd., The Estée Lauder Companies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)