Millimeter Wave Technology Market Report by Component (Antennas and Transceivers, Amplifiers, Oscillators, Control Devices, Frequency Converters, Passive Components, and Others), Product (Telecommunication Equipment, Imaging and Scanning Systems, Radar and Satellite Communication Systems, Services), Frequency Band (30 GHz - 57 GHz, 57 GHz - 96 GHz, 96 GHz -300 GHz), License Type (Light Licensed Frequency Millimeter Wave, Unlicensed Frequency Millimeter Wave, Fully Licensed Frequency Millimeter Wave), Application (Telecommunication, Military and Defense, Automotive and Transport, Healthcare, Electronics and Semiconductor, and Others), and Region 2025-2033

Millimeter Wave Technology Market Size:

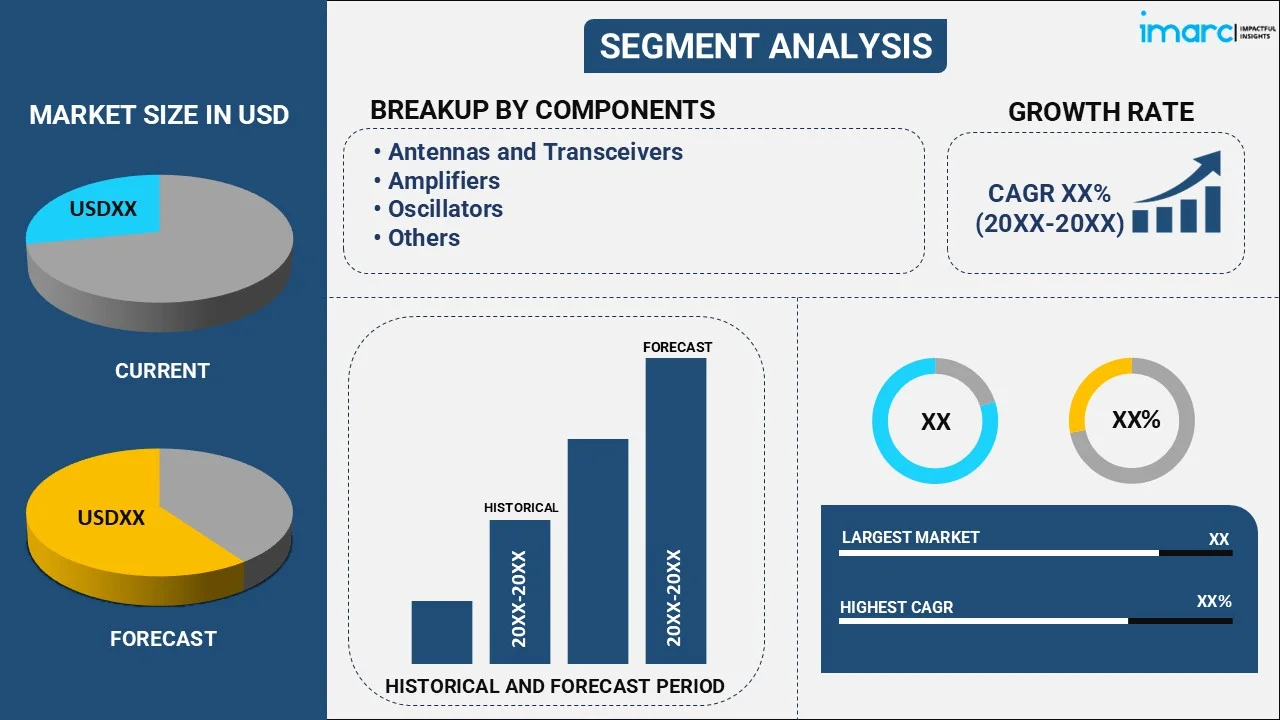

The global millimeter wave technology market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.2 Billion by 2033, exhibiting a growth rate (CAGR) of 17.58% during 2025-2033. The market is experiencing rapid growth, due to escalating demand for high-speed internet and heightened data traffic, rapid advancements in fifth-generation (5G) technology, increasing adoption of advanced driver assistance systems (ADAS) and autonomous vehicles, proliferation of the Internet of Things (IoT) devices, and the rising need for enhanced security and surveillance systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 14.2 Billion |

| Market Growth Rate 2025-2033 | 17.58% |

Millimeter Wave Technology Market Analysis:

- Major Market Drivers: The millimeter wave technology market report highlights that the rising deployment of fifth-generation (5G) networks is propelling the market growth. Along with this, the increasing need for high-speed internet and data-intensive applications, such as the Internet of Things (IoT) and streaming services, coupled with heightened innovations in advanced driver assistance systems (ADAS) and autonomous vehicles, are expanding the growth of this industry.

- Key Market Trends: Major investments in research and development (R&D) by leading players to stimulate technological improvements and novel applications of millimeter wave technology in a variety of sectors, together with strategic partnerships and collaborations among enterprises, are promoting the market growth. Furthermore, the integration of this technology into telecommunications infrastructure and smart city initiatives is broadening its appeal.

- Geographical Trends: North America is dominating the market due to the early adoption of 5G technology, major investments, and a strong technological infrastructure. Other regions are also witnessing market expansion as a result of increased urbanization, rising demand for modern communication technology, and the imposition of supportive government initiatives.

- Competitive Landscape: Some of the major market players in the millimeter wave technology industry include Aviat Networks Inc., AXXCSS Wireless Solutions Inc., Farran Technology Ltd., Fastback Networks Inc., Keysight Technologies Inc., L3 Technologies Inc., Millimeter Wave Products Inc., Mistral Solutions Pvt. Ltd. (AXISCADES Engineering Technologies Ltd.), NEC Corporation, Siklu Communication Ltd., Smiths Group Plc, Vubiq Networks Inc., among many others.

- Challenges and Opportunities: The millimeter wave technology market growth is majorly affected by the high implementation costs, technical complications, and regulatory barriers. However, the increasing need for high-speed connectivity, expanding applications across industries, and advancements in technology are acting as growth-inducing factors.

Millimeter Wave Technology Market Trends:

Growing Demand for High-Speed Internet and Increased Data Traffic

According to the millimeter wave (mmWave) technology market forecast, the rising demand for high-speed internet and an exponential increase in data traffic are driving the growth of the industry. The increasing pace of digital transformation across various industries, including telecommunications and entertainment, is creating a demand for faster and more reliable internet connections. According to the IMARC Group, the market for digital transformation in the United States is expected to rise by 22.2% between 2024 and 2032. Video streaming, cloud computing, online gaming, and the Internet of Things (IoT) are all promoting the generation and consumption of massive amounts of data by consumers and enterprises. Millimeter wave technology enables seamless streaming of high-definition (HD) content, real-time data analytics, and the integration of numerous connected devices.

Rapid Advancements in Wireless Communication and fifth-generation (5G) Technology

The substantial advancements in wireless communication and the rollout of 5G technology are driving the millimeter wave technology market dynamics. As per the Global System for Mobile Communications (GSMA) reports, by 2025, 5G networks are likely to cover one-third of the world's population, with as many as 1.2 billion connections. Millimeter wave technology is a critical component of 5G infrastructure as it provides the necessary bandwidth to support high-speed data transfer, ultra-reliable low-latency communication, and massive connectivity for a multitude of devices. Additionally, the advancements in wireless connectivity also enable a range of new applications and services, including augmented and virtual reality (AR/VR), remote surgery, smart factories, and immersive entertainment experiences that make use of millimeter wave technologies.

Increasing Adoption of Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles

The automobile industry's shift toward advanced driver assistance systems (ADAS) and autonomous vehicles is a major component contributing to the millimeter wave technology market share. ADAS technologies improve vehicle safety and performance by relying on precise and fast data transmission for functions like collision avoidance, lane-keeping assistance, and adaptive cruise control. According to industry reports, it has been found that ADAS technologies could prevent 14 million injuries and 37 million crashes over the next three decades. Millimeter wave technology plays a crucial role in this respect as it offers high-frequency signals and superior resolution. It enables the precision and speed required for real-time data processing and communication among vehicles, infrastructure, and other road users.

Millimeter Wave Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, product, frequency band, license type, and application.

Breakup by Component:

- Antennas and Transceivers

- Amplifiers

- Oscillators

- Control Devices

- Frequency Converters

- Passive Components

- Others

Antennas and transceivers accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes antennas and transceivers, amplifiers, oscillators, control devices, frequency converters, passive components, and others. According to the report, antennas and transceivers represented the largest segment.

As per the millimeter wave technology market analysis and outlook, antennas and transceivers represented the largest segment due to their critical role in enabling high-frequency communication and data transmission. Antennas are essential for capturing and transmitting millimeter wave signals, while transceivers facilitate the conversion of these signals into usable data. Moreover, the rising demand for advanced antennas and transceivers, driven by their application in 5G networks, as they ensure high-speed, low-latency communication for sectors such as telecommunications, automotive, and defense, is bolstering the market growth.

Breakup by Product:

- Telecommunication Equipment

- Imaging and Scanning Systems

- Radar and Satellite Communication Systems

- Services

Telecommunication equipment holds the largest share of the industry

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes telecommunication equipment, imaging and scanning systems, radar and satellite communication systems, and services. According to the report, telecommunication equipment accounted for the largest market share.

The millimeter wave technology market segmentation and overview predict that telecommunication equipment accounted for the largest market share. This dominance is attributed to the extensive use of this technology in enhancing telecommunication infrastructure, particularly with the deployment of 5G networks. Moreover, telecommunication equipment, including base stations, small cells, and backhaul equipment, leverage the frequencies of these waves to deliver ultra-fast data speeds and increased network capacity, thereby addressing the growing demand for high-bandwidth applications and services. Additionally, the rapid expansion of mobile data traffic, driven by the proliferation of smartphones, the Internet of Things (IoT) devices, and high-definition (HD) video streaming, is boosting the millimeter wave technology market size.

Breakup by Frequency Band:

- 30 GHz - 57 GHz

- 57 GHz - 96 GHz

- 96 GHz -300 GHz

57 GHz - 96 GHz represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the frequency band. This includes 30 GHz - 57 GHz, 57 GHz - 96 GHz, and 96 GHz -300 GHz. According to the report, 57 GHz - 96 GHz represented the largest segment.

Based on the millimeter wave technology market research report and trends, the 57 GHz - 96 GHz range represented the largest share of the market due to its optimal balance between performance and regulatory support. Frequencies within this range are extensively used in 5G networks, providing the necessary bandwidth for ultra-fast data transmission and low-latency connections essential for next-generation mobile services. Additionally, the 57 GHz - 96 GHz band is crucial for advanced radar and imaging systems, including those used in automotive ADAS, industrial automation, and security surveillance.

Breakup by License Type:

- Light Licensed Frequency Millimeter Wave

- Unlicensed Frequency Millimeter Wave

- Fully Licensed Frequency Millimeter Wave

Fully licensed frequency millimeter wave exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the license type have also been provided in the report. This includes light licensed frequency millimeter wave, unlicensed frequency millimeter wave, and fully licensed frequency millimeter wave. According to the report, fully licensed frequency millimeter wave accounted for the largest market share.

The millimeter wave technology market value is set to rise due to the ability of fully licensed frequency millimeter waves to offer reliable, interference-free communication, which is critical for applications requiring high security and stable connectivity. Moreover, these frequencies are allocated and regulated by governmental and international bodies, ensuring that users have exclusive rights to a specific portion of the spectrum, thereby minimizing the risk of signal interference from other users. Along with this, the increasing investments in 5G and the growing need for dependable and secure communication channels are bolstering the millimeter wave technology market growth.

Breakup by Application:

- Telecommunication

- Military and Defense

- Automotive and Transport

- Healthcare

- Electronics and Semiconductor

- Others

Telecommunication dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes telecommunication, military and defense, automotive and transport, healthcare, electronics and semiconductor, and others. According to the report, telecommunication represented the largest segment.

The telecommunication sector accounted for the largest market segment, attributed to the critical role millimeter wave technology plays in advancing telecommunication infrastructure. The technology enables the provision of ultra-fast data speeds and substantial bandwidth that are essential for supporting the growing demands of modern telecommunications, including high-definition (HD) video streaming, virtual reality (VR), and the Internet of Things (IoT). Moreover, the enhanced capabilities of these waves, facilitating the efficient handling of the increasing data traffic and the provision of high-quality, low-latency services, are promoting the millimeter wave technology demand.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest millimeter wave technology market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for millimeter wave technology.

North America holds the largest segment in the millimeter wave technology industry due to its early adoption and continuous advancement of 5G technology. Moreover, the rising focus on enhancing network capacities and data transmission speeds that are essential for meeting the surging demand for high-speed internet and data-intensive applications is catalyzing the market growth. Furthermore, the strong focus on technological innovation and research and development (R&D) as it contributes to its applications across various industries, including telecommunications, automotive, healthcare, and defense, is enhancing the millimeter wave technology market revenue.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the millimeter wave technology industry include Aviat Networks Inc., AXXCSS Wireless Solutions Inc., Farran Technology Ltd., Fastback Networks Inc., Keysight Technologies Inc., L3 Technologies Inc., Millimeter Wave Products Inc., Mistral Solutions Pvt. Ltd. (AXISCADES Engineering Technologies Ltd.), NEC Corporation, Siklu Communication Ltd., Smiths Group Plc, Vubiq Networks Inc., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The major millimeter-wave technology companies are focusing on innovation, strategic partnerships, and expanding their product portfolios to maintain and enhance their market positions. They are investing in research and development (R&D) to advance their 5G capabilities and deliver ultra-fast and reliable connectivity solutions. Moreover, several key players are collaborating with telecommunications operators and infrastructure providers to accelerate the deployment of 5G networks across the globe. Additionally, these players are exploring new applications of the technology, such as automotive radar systems, healthcare imaging, and security screening, to diversify their offerings.

Millimeter Wave Technology Market News:

- In June 2023, Aviat Networks announced a new 11 GHz indoor microwave radio, IRU600 UHP Radio, with the highest transmitter power. It allows more capacity and longer links and provides operators with an alternative to deploy long-distance links without the potential risk of interference in the 6 GHz band.

- In April 2023, Keysight Technologies, Synopsys, Inc., and Ansys Inc. collaborated to accelerate the development of advanced radio frequency (RF) and millimeter wave (mmWave) designs with high reliability. They announced the availability of the new 79GHz millimeter wave (mmWave) radio frequency (RF) design reference flow for the TSMC 16nm FinFET Compact Technology (16FFC). The mmWave design reference flow enables the implementation of reliable, 79-GHz transceiver integrated circuits (ICs) for advanced autonomous systems that require independent operation without human intervention such as automotive radar, 5G connectivity, security applications and environmental monitors.

Millimeter Wave Technology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Antennas and Transceivers, Amplifiers, Oscillators, Control Devices, Frequency Converters, Passive Components, Others |

| Products Covered | Telecommunication Equipment, Imaging and Scanning Systems, Radar and Satellite Communication Systems, Services |

| Frequency Bands Covered | 30 GHz - 57 GHz, 57 GHz - 96 GHz, 96 GHz -300 GHz |

| License Types Covered | Light Licensed Frequency Millimeter Wave, Unlicensed Frequency Millimeter Wave, Fully Licensed Frequency Millimeter Wave |

| Applications Covered | Telecommunication, Military and Defense, Automotive and Transport, Healthcare, Electronics and Semiconductor, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aviat Networks Inc., AXXCSS Wireless Solutions Inc., Farran Technology Ltd., Fastback Networks Inc., Keysight Technologies Inc., L3 Technologies Inc., Millimeter Wave Products Inc., Mistral Solutions Pvt. Ltd. (AXISCADES Engineering Technologies Ltd.), NEC Corporation, Siklu Communication Ltd., Smiths Group Plc, Vubiq Networks Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the millimeter wave technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global millimeter wave technology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the millimeter wave technology industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global millimeter wave technology market was valued at USD 3.1 Billion in 2024.

We expect the global millimeter wave technology market to exhibit a CAGR of 17.58% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in delay in the launch of 5G networks, which relies on millimeter wave technology.

The rising demand for bandwidth and speed-boosting technologies, along with the increasing number of telecom infrastructural deployments, is primarily driving the global millimeter wave technology market.

Based on the component, the global millimeter wave technology market can be segmented into antennas and transceivers, amplifiers, oscillators, control devices, frequency converters, passive components, and others. Currently, antennas and transceivers hold the majority of the total market share.

Based on the product, the global millimeter wave technology market has been bifurcated into telecommunication equipment, imaging and scanning systems, radar and satellite communication systems, and services, where telecommunication equipment currently exhibits a clear dominance in the market.

Based on the frequency band, the global millimeter wave technology market can be segregated into 30 GHz-57 GHz, 57 GHz-96 GHz, and 96 GHz-300 GHz. Currently, 57 GHz-96 GHz holds the largest market share.

Based on the license type, the global millimeter wave technology market has been divided into light licensed frequency millimeter wave, unlicensed frequency millimeter wave, and fully licensed frequency millimeter wave. Among these, fully licensed frequency millimeter wave currently exhibits a clear dominance in the market.

Based on the application, the global millimeter wave technology market can be categorized into telecommunication, military and defense, automotive and transport, healthcare, electronics and semiconductor, and others. Currently, the telecommunication sector accounts for the majority of the global market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global millimeter wave technology market include Aviat Networks Inc., AXXCSS Wireless Solutions Inc., Farran Technology Ltd., Fastback Networks Inc., Keysight Technologies Inc., L3 Technologies Inc., Millimeter Wave Products Inc., Mistral Solutions Pvt. Ltd. (AXISCADES Engineering Technologies Ltd.), NEC Corporation, Siklu Communication Ltd., Smiths Group Plc, and Vubiq Networks Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)