Millet Market Report by Product Type (Pearl Millet, Finger Millet, Proso Millet, and Others), Application (Infant Food, Bakery Products, Beverages, and Others), Distribution Channel (Supermarket and Hypermarkets, Traditional Grocery Stores, Online Stores, and Others), and Region 2026-2034

Millet Market Size:

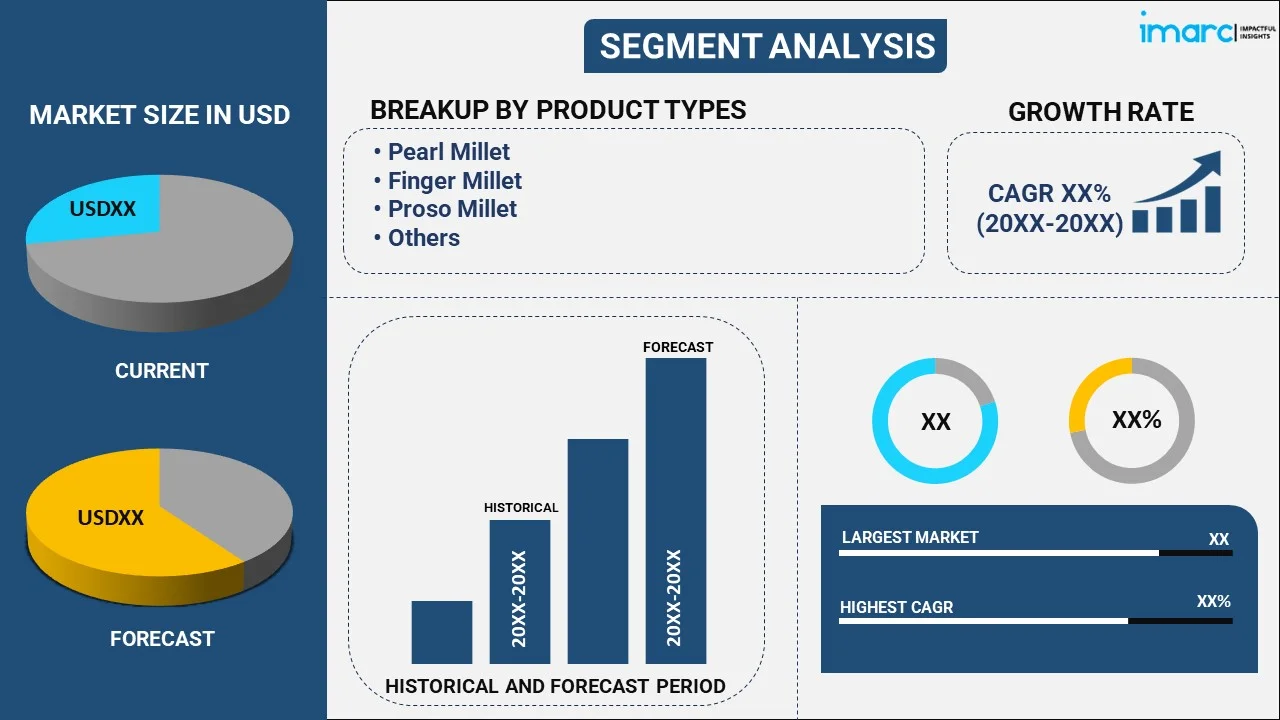

The global millet market size reached USD 14.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.7 Billion by 2034, exhibiting a growth rate (CAGR) of 3.78% during 2026-2034. Asia Pacific currently leads the market owing to strong government support, the growing health-conscious populations, diverse dietary habits, and large-scale millet production across India and China driving the demand and exports. The increasing government support, rising demand for sustainable and healthy food options, growing export demand for millet, and significant expansion of organic and sustainable farming are the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 14.0 Billion |

|

Market Forecast in 2034

|

USD 19.7 Billion |

| Market Growth Rate 2026-2034 | 3.78% |

Millets refer to the small-seeded grasses that yield cereal grains and are cultivated globally in semi-arid regions. They are rugged crops that can flourish in adverse soil and water-scarce environments, making them a sustainable crop choice for dry, semi-arid, and sub-humid agricultural areas with diverse climates. Millets can be utilized in a wide range of dishes, such as porridges, bread, soups, stews, and beer, and are also used as a source of animal feed, particularly for poultry and livestock. Due to their high fiber, protein, vitamin, and mineral content, gluten-free and hypoglycemic properties, millets are suitable for people with gluten intolerance or celiac disease. In addition, they also offer several health advantages, including improved digestion, decreased cholesterol levels, and better control of blood sugar levels. Furthermore, millets are more cost-effective compared to other cereal grains, making them an ideal option for individuals on a tight budget, thus influencing the millet market growth.

Millet Market Trends:

Rising Health Awareness and Nutritional Benefits

Individuals are becoming more aware about diet-related issues like obesity, diabetes, and heart disease, with millets being seen more as a natural solution. They are abundant in fiber, proteins, vitamins, and vital minerals, and being gluten-free makes them appropriate for various dietary requirements. This increasing health consciousness is causing consumer choices to move from highly processed grains to nutrient-rich substitutes. The designation of millet as a superfood enhances its reputation among urban and rural communities alike. The growing attention from nutritionists and wellness supporters is supporting this trend, allowing millet to become recognized as a staple that promotes overall health. This health-focused viewpoint is not only increasing household needs but also encouraging key players to innovate to cater to the changing consumer demand. In 2024, Marico launched Saffola Masala Millets, expanding its millet range with two flavors, including Masala Delight and Tomato Delight. The product offered a nutritious, tasty, and affordable snack option. The launch aimed to make millets a staple in Indian households, aligning with the growing shift towards healthier eating.

Government Initiatives and Policy Support

The millet market is also gaining traction as a result of active government initiatives aimed at enhancing both production and consumption. Policymakers across various regions are acknowledging millet's ability to tackle food security, climate adaptability, and sustainable farming. Initiatives promoting millet cultivation among farmers through subsidies, technical support, and minimum price guarantees are leading to an increased land area and production. For example, in 2024, the Government of India announced the Production Linked Incentive Scheme for Millet-Based Products (PLISMBP) with an ₹800 crore budget to promote millet use and boost local farming. The scheme supported branded ready-to-eat (RTE) and ready-to-cook (RTC) millet products with over 15% millet content. Many governing bodies are advocating for millet in school meals, nutritional initiatives, and public food distribution programs. Global organizations are also recognizing millet’s contribution to meeting nutrition and sustainability objectives, thereby strengthening national initiatives. Promotional campaigns supported by policies are increasing awareness among urban buyers, bringing millet into the mainstream of retail markets.

Improved Supply Chain and Distribution Networks

Improvements in logistics and supply chain management are bolstering the growth of the millet market by guaranteeing products arrive to consumers more quickly, with better quality and reliability. Improved storage systems, featuring scientifically engineered warehouses and silos, are minimizing post-harvest losses and preserving grain quality for extended periods. Additionally, contemporary transportation networks are facilitating effortless connections between distant rural producers and growing urban markets, closing gaps that once limited millet's commercial opportunities. The incorporation of millet into structured retail channels, wholesale systems, and digital platforms is expanding its accessibility among various consumer segments and pricing tiers. Additionally, cold chains, uniform grading protocols, and traceability technologies are enhancing quality assurance, fostering increased consumer trust. The emergence of supermarkets, hypermarkets, and e-commerce is increasing the visibility and shelf presence of millet products, turning them into a dependable and easily accessible commodity that fosters ongoing market growth.

Millet Market Growth Drivers:

Rising Demand for Natural and Clean-Label Foods

A major factor influencing the millet market is the growing consumer inclination towards natural, clean-label, and minimally processed food items. Contemporary shoppers are increasingly scrutinizing ingredient labels, favoring products without artificial additives, preservatives, and chemical enhancements. This demand is not only rooted in health consciousness but also in a broader awareness about sustainability and ethical sourcing. Millet, naturally rich in nutrients and suitable for clean-label product formulations, fits perfectly with this change. Food brands are utilizing millet’s nutritious reputation to attract health-oriented consumers while also targeting eco-aware market segments. Millet's association with the clean-label movement boosts its value proposition, creating novel opportunities for both conventional producers and contemporary food companies to expand their reach. In 2024, Ramoji Group launched 'Sabala Millets,' offering 45 millet-based products that promote local farmers and eco-friendly agriculture. The brand focused on preservative-free, nutrient-rich foods blending tradition with innovation.

Growing Role of Media and Awareness Campaigns

Health organizations, non-governmental organizations (NGOs), and food councils are conducting awareness campaigns to inform people about the importance of millets in combating lifestyle diseases and promoting dietary diversity. For instance, in 2025, the Agriculture Department of Kashmir launched a millet promotion drive in Pulwama district to revive millet cultivation under the National Food Security Mission (NFSM). The campaign, aimed at educating farmers about the nutritional benefits and climate resilience of millets, saw participation from 200 local farmers. The drive focused on crops like Pearl millet, Sorghum, and Finger millet, highlighting their role in combating malnutrition and their suitability for regions prone to drought. Moreover, social media is also playing a crucial role in spreading creative recipes, product reviews, and sustainable eating trends featuring millet. The ongoing media attention is turning millet from a conventional staple into a popular ingredient, creating interest and acceptance among various consumer groups.

Technological Advancements in Farming and Processing

Contemporary technologies are essential for impelling the millet market growth by enhancing production and post-harvest effectiveness. Automated farming methods, improved seed types, and precise agricultural technologies are enabling farmers to obtain greater outputs using reduced inputs. Innovations in post-harvest processes, such as enhanced milling, storage, and packaging methods, are decreasing waste and prolonging shelf life, thereby increasing the commercial viability of millet. The technology of food processing is facilitating the creation of items with improved flavor, texture, and nutritional preservation, thus making millet attractive to a wider array of consumers. Digital platforms link farmers directly to markets, offering improved price realization and broader distribution. These technological advancements are not only increasing supply but also boosting the appeal of millet in both local and global markets. The integration of science and technology in the millet value chain is transforming it into a modern, competitive segment of the global food industry.

Millet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global millet market, along with forecasts at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on product type, application and distribution channel.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Pearl Millet

- Finger Millet

- Proso Millet

- Others

The report has provided a detailed breakup and analysis of the millet market based on the product type. This includes pearl millet, finger millet, proso millet, and others. According to the report, pearl millet represented the largest segment.

Application Insights:

- Infant Food

- Bakery Products

- Beverages

- Others

The report has provided a detailed breakup and analysis of the millet market based on the application. This includes infant food, bakery products, beverages, and others. According to the report, infant food represented the largest segment.

Distribution Channel Insights:

- Supermarket and Hypermarkets

- Traditional Grocery Stores

- Online Stores

- Others

A detailed breakup and analysis of the millet market based on the distribution channel has also been provided in the report. This includes supermarket and hypermarkets, traditional grocery stores, online stores, and others. According to the report, traditional grocery stores accounted for the largest market share.

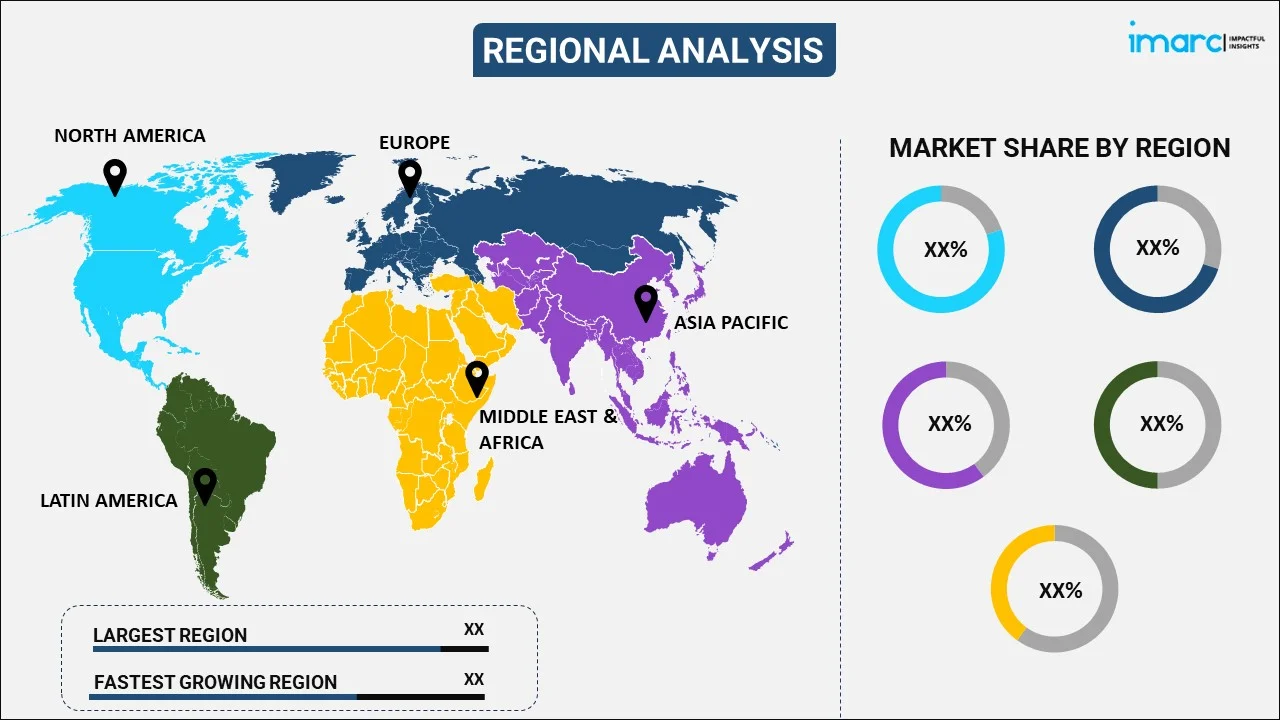

Regional Insights:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest regional market for millet. Some of the factors driving the Asia Pacific millet market included considerable growth in the agriculture industry, rising sales of millet-based snack foods, easy product availability across online and offline retail channels, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global millet market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- Archer-Daniels-Midland Company

- Bayer AG

- Brett-Young Seeds Limited

- Cargill Incorporated

- Ernst Conservation Seeds

- Roundstone Native Seed Company

- Seedway LLC

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Millet Market News:

- In July 2025, Sabala Millets launched its millet-based food products on Zepto in Hyderabad and Bengaluru, offering fast delivery in just 10 minutes. The brand's ready-to-cook range includes items like Multi Millet Pongal, Khichdi, and Bisibele Bhath, aiming to make nutritious meals convenient for urban families. This move marks a significant step in making millets more accessible and mainstream in India.

- In June 2025, the Jindal Foundation launched the 'Jindal Krishi Seva' program in Angul, Odisha, aimed at promoting natural farming and millet cultivation. The initiative includes training farmers in eco-friendly practices, mobile soil testing, and the use of organic inputs to improve soil health. Over 2,000 farmers in the district will benefit in the first phase, with plans for expansion across Odisha.

- In April 2025, the Odisha government launched a program to distribute nutrient-rich Mandia millet ladoos and provide mid-day meals to Class 9 and 10 students. The initiative aims to improve nutrition and foster the mental growth of students. School and Mass Education Minister Nityananda Gond launched the program at schools in Umarkote, Nabarangpur district.

- In February 2025, the Gujarat government organized the 'Millet Mahotsav 2025' on February 8-9 in seven cities, including Ahmedabad, Surat, and Vadodara, to promote millet consumption. The two-day event features 125 state-level stalls and panel discussions on millet's benefits and natural farming.

- In January 2025, the Millet Feeding Pilot was launched in Udalguri, Assam, under the Anemia Mukta Bharat campaign to combat Anemia among children and adolescents. The initiative will provide millet-based foods to 2,465 children and 755 adolescent girls, evaluating both their nutritional benefits and acceptability. The program aims to incorporate millets into future state nutrition schemes.

- In January 2024, India and the US launched the Indo-US Millets Initiative to promote the production and consumption of nutrient-rich millets. The collaboration involved key organizations like Sorghum United and the India Millet Initiative, focusing on education, research, and policy advocacy. The initiative aimed to raise awareness about millets' nutritional benefits and their potential for sustainable food production.

- In September 2024, McDonald's India (West & South), managed by Westlife Foodworld, has teamed up with CSIR-Central Food Technological Research Institute (CFTRI) to launch a new multi-millet bun, announced during National Nutrition Week. This collaboration leverages CFTRI’s scientific expertise and McDonald’s commitment to nutritious offerings. The bun features a blend of five nutrient-dense millets Bajra, Ragi, Jowar, Proso, and Kodo sourced from various parts of India, enhancing its nutritional value with essential vitamins, minerals, and dietary fiber.

- On 25 January 2023, ITC introduced mission millet by integrating its agriculture, food, and hospitality divisions to strongly promote millet. The company plans to expand its assortment of millet-based items, introducing new products such as millet noodles, pasta, dosa and idli mixes, ragi vermicelli, and a variety of millet-based cookies, confectioneries, and snacks. Through its mission millet, ITC aims to raise awareness about millet, strengthen millet supply chains, and introduce advanced technology to create appealing and flavorful millet-based foods.

Millet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pearl Millet, Finger Millet, Proso Millet, Others |

| Applications Covered | Infant Food, Bakery Products, Beverages, Others |

| Distribution Channels Covered | Supermarket and Hypermarkets, Traditional Grocery Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer-Daniels-Midland Company, Bayer AG, Brett-Young Seeds Limited, Cargill Incorporated, Ernst Conservation Seeds, Roundstone Native Seed Company, Seedway LLC., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the millet market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global millet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the millet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global millet market was valued at USD 14.0 Billion in 2025.

We expect the global millet market to exhibit a CAGR of 3.78% during 2026-2034.

The rising demand for organic, natural, and gluten-free products, such as millets, as they offer improved digestion, decreased cholesterol levels, and better control of blood sugar levels, is primarily driving the global millet market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of millets.

Based on the product type, the global millet market can be segmented into pearl millet, finger millet, proso millet, and others. Currently, pearl millet holds the majority of the total market share.

Based on the application, the global millet market has been divided into infant food, bakery products, beverages, and others. Among these, infant food currently exhibits a clear dominance in the market.

Based on the distribution channel, the global millet market can be categorized into supermarket and hypermarkets, traditional grocery stores, online stores, and others. Currently, traditional grocery stores account for the largest market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global millet market include Archer-Daniels-Midland Company, Bayer AG, Brett-Young Seeds Limited, Cargill Incorporated, Ernst Conservation Seeds, Roundstone Native Seed Company, Seedway LLC., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)