Milk Packaging Market Size, Share, Trends and Forecast by Product Type, Material Type, and Region, 2025-2033

Milk Packaging Market Size and Share:

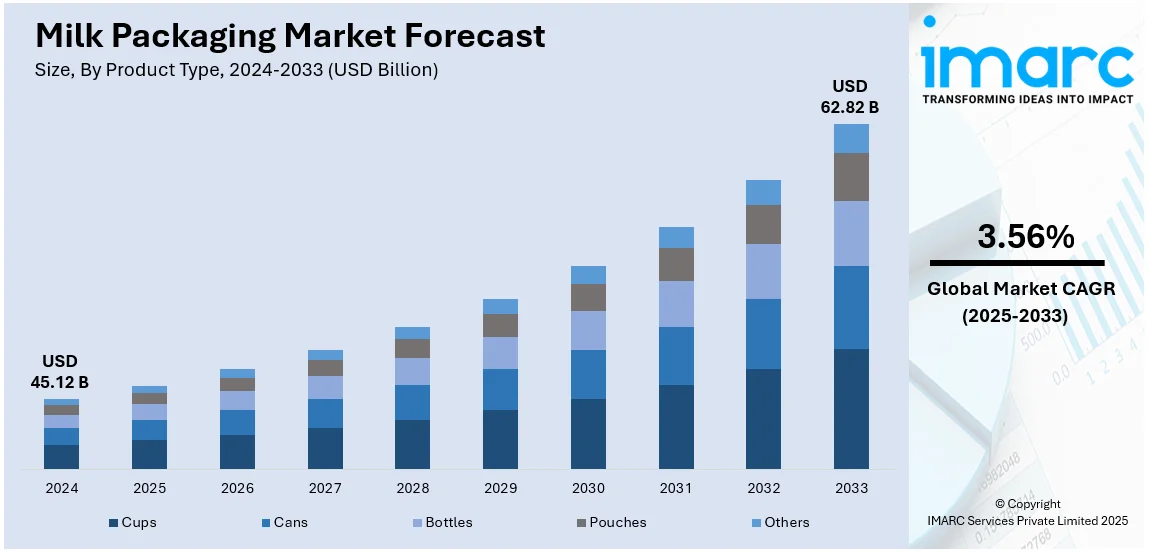

The global milk packaging market size was valued at USD 45.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.82 Billion by 2033, exhibiting a CAGR of 3.56% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 45.0% in 2024. The increasing demand for plant-based plastics, the incorporation of smart packaging and quick response (QR) codes, and the implementation of several regulations regarding food safety, labeling, and packaging materials are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 45.12 Billion |

|

Market Forecast in 2033

|

USD 62.82 Billion |

| Market Growth Rate (2025-2033) | 3.56% |

Milk packaging refers to the materials and methods used to store and transport milk from the dairy farm to the consumer. It is essential in preserving the freshness, quality, and safety of milk. Some commonly available milk packaging formats include cartons, bottles, pouches, and tetra packs. These packaging options are typically made of materials, such as plastic, glass, or paperboard, with various layers or coatings to provide protection against light, oxygen, and contamination. For instance, in July 2024, Berry Global Group and Abel & Cole launched reusable polypropylene milk bottles, reducing packaging waste by 23 tonnes annually and carbon emissions, achieving 20% sales growth and 64% return rates. Additionally, milk packaging is designed to ensure proper sealing, prevent leakage, and maintain the nutritional integrity and shelf life of the milk until it is consumed.

The market is primarily driven by the increasing demand for milk. The boosting benefits of milk, such as being rich in vitamins, minerals, proteins, and fatty acids is influencing the market growth. In line with this, growing milk consumption maintains healthy bones, improves the immune system, and prevents conditions such as hypertension thus contributing to the market growth. Moreover, manufacturers are recognizing the growing environmental awareness among consumers and their preference for eco-friendly packaging materials and are investing in research and development (R&D) activities to introduce innovative packaging solutions that are more sustainable, representing another major growth-inducing factor. For example, in January 2023, Overherd launched powdered oat milk in recyclable pouches, reducing packaging waste by 90% and transport emissions. The product provides eight liters of instant oat milk, enhancing sustainability and convenience. Furthermore, the escalating demand for single-serve milk packs driven by the growing global population, rising income levels, and amplifying number of health-conscious consumers is accelerating the product adoption rate. Furthermore, the availability of flavored milk variants in the market is creating a positive market outlook.

Growth in milk packaging market drives the US with a share of 83.20% on growing convenience, sustainability, and innovative aspects of packaging that consumers seek from their packaged good. Single-serve and on-the-go options seem to dominate growth in milk consumptions. Single-serve consumption is now most popular with different formats, be it carton, bottle, or pouch; sustainability drives companies to produce more eco-friendly recyclable and biodegradable materials keeping in line with growing environmental concerns. In addition, new technologies in packaging such as smart packaging with freshness indicators and tamper-proof seals enhance the safety and shelf life of the product, hence building consumer confidence. Increasing preference for plant-based milk alternatives also affects packaging design to address this growing market. Additionally, brand differentiation and attention to aesthetics and functionality have increased appeal among health-conscious and eco-conscious consumers. These factors together push the U.S. milk packaging market forward.

Milk Packaging Market Trends

The Increasing Consumption of Milk

The increasing demand for milk is significantly impacting the milk packaging market, driving various changes and trends within the industry. This surge in demand can be attributed to several factors, including population growth, changing dietary preferences, and the rising awareness of the nutritional benefits of milk. According to the World Health Organization, world milk production is expected to increase by 177 million tonnes by 2025 at a compounded average growth rate of 1.8% per annum. Such growing demand highlights the need for more efficient packaging solutions. Moreover, there is an increased focus on maintaining the freshness and integrity of the product throughout its shelf life. Packaging plays a vital role in preserving the quality of milk by protecting it from external factors such as light, air, and microbial contamination. As a result, packaging solutions with advanced barrier properties are being adopted to extend the shelf life of milk and minimize the risk of spoilage.

The Escalating Demand for Convenient and User-Friendly Packaging Formats

The rising demand for convenient and user-friendly packaging formats is significantly impacting the market. Nowadays, convenience has become a key consideration for consumers, driven by busy lifestyles, on-the-go consumption habits, and the need for hassle-free packaging solutions. This shift in consumer preferences has prompted significant developments in milk packaging to cater to these evolving needs. Moreover, consumers are seeking milk products that can be easily consumed outside of traditional settings, such as at work, during travel, or while engaging in recreational activities. As a result, milk packaging solutions like single-serve cartons, pouches, and resealable bottles have gained popularity. These formats offer convenience, portion control, and the ability to consume milk without the need for additional utensils or refrigeration. In line with this trend, the United Kingdom-based milk and grocery supplier, Milk & More, launched reusable packaging for milk products to promote easy delivery solutions. The company plans to reuse up to 3 million packages in the coming years. Besides, packaging solutions with ergonomic designs, such as spouts, flip caps, and easy-grip handles, are being introduced to enhance usability and minimize spillage or wastage, thus contributing to market growth.

The Implementation of Government Policies

Global milk production in 2023 increased by 2.2%, according to International Fact Checking Network (IFCN). This rise in production indicates the growing demand for effective and sustainable packaging solutions. The implementation of government regulations regarding food safety, labeling, and milk packaging materials for ensuring consumer protection, promoting transparency, and maintaining the quality and integrity of milk products is escalating the demand for milk packaging. In addition, it establishes standards and guidelines to ensure the safety of milk products. Besides, governments are imposing restrictions and guidelines on the use of certain materials in milk packaging to protect consumer health and the environment. This is encouraging the manufacturers to shift toward alternative packaging materials that meet the regulatory requirements, such as BPA-free plastics or alternative packaging materials like paperboard or glass. Moreover, government regulations also focus on the environmental impact of milk packaging materials. There are regulations are aimed at reducing the use of non-recyclable or non-biodegradable materials, encouraging the use of sustainable packaging options, and promoting recycling and waste management practices, this propelling the market growth.

Milk Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global milk packaging market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product type and material type.

Analysis by Product Type:

- Cups

- Cans

- Bottles

- Pouches

- Others

Pouches leads the market in 2024as they have gained dominance in the market due to several advantages they offer over other packaging formats such as being lightweight, convenient, and flexible making them easy to handle and transport. They can be easily carried, stored, and poured without the need for additional tools or utensils and are particularly popular for on-the-go consumption, as they are portable and require minimal space. Additionally, they offer excellent barrier properties, protecting milk from exposure to light, oxygen, and moisture which helps to preserve the freshness, flavor, and nutritional value of the milk over a longer period. Moreover, pouches are considered environmentally friendly compared to other packaging formats, such as plastic bottles or cartons. They generally require less material and energy during production, resulting in lower carbon emissions. Additionally, pouches are lightweight, which reduces transportation costs and energy consumption. Some pouches are also recyclable, further enhancing their sustainability profile.

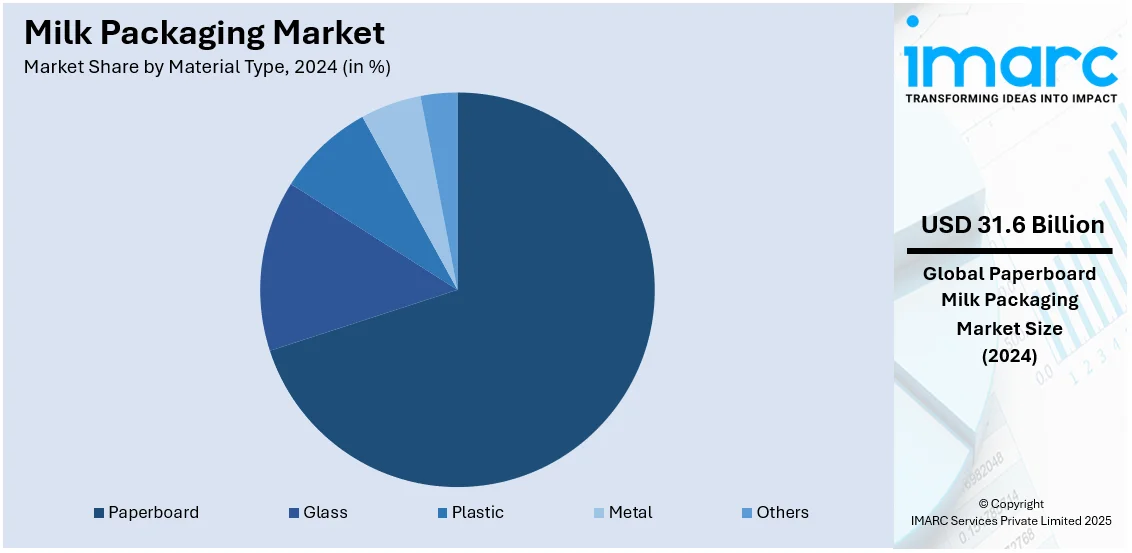

Analysis by Material Type:

- Glass

- Plastic

- Metal

- Paperboard

- Others

Paperboard leads the market with around 70.0% of market share in 2024. The major driving factors of this segment are sustainability because paperboard is seen to be an environmental-friendly packaging material, derived from renewable resources primarily wood pulp harvested from sustainably managed forests. Additionally, it's recyclable and biodegradable. Its carbon footprint is lesser in comparison with many other packaging material options. For milk packaging demand for paperboard is spurred by surging consumer requirements for sustainable package types. The milk pack is designed with paperboard, which can produce beautiful designs and can create an eye-catchy aspect. As it has good printability, colorful graphics, logos, nutrition facts, and brand elements in the packaging attract customers to the pack. Hence, this packaging will be used as a promotion tool for a brand and also used as a point of differentiation for a product in the supermarket. Moreover, paperboard is very easy to handle and also convenient for customers. It often comes with easy-to-open spouts, closable reseal, and ergonomic shapes for pouring, which enhance the user experience and make paperboard milk packages more user-friendly and convenient.

Regional Analysis:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 45.0%. The region accounts for the highest market share, with rapid urbanization and growing population, especially in China and India. This boost in population and change in lifestyle resulted in a growing consumption of milk. Therefore, the demand for milk packaging in the region is highly on the rise to cater to the increasing consumer base. Furthermore, high growth of the modern retail structure, comprising supermarkets, hypermarkets, and convenience stores, throughout the Asia-Pacific region has triggered the growth of demand for packaged milk. Such modern retail channels necessitate packaging solutions with high quality to ensure shelf life and convenience during consumption. Subsequently, growth in milk packaging demand has gained momentum as retail has grown considerably. Asia Pacific is also considered to be a very favorable business environment for milk packaging manufacturers with supportive government policies, investment incentives, and favorable trade regulations. Additionally, the region has manufacturing capabilities, cost advantages, and supply chain infrastructure, making it a desirable place for the production and distribution of milk packaging.

Key Regional Takeaways:

North America Milk Packaging Market Analysis

The North American milk packaging market is growing based on the changes in consumer preferences toward sustainable, convenient, and innovative packaging formats. Ready-to-drink (RTE), single-serve milk products form a major force behind the usage of innovative cartons, plastic bottles, or flexible pouches. Sustainability drives the focus to recyclable and biodegradable materials that would be lightweight. Manufacturers are inclined toward such forms of packaging formats to meet regulatory standards and customer concerns about environment. Advances in packaging technology, such as extended shelf life, fresh indicators, tamper-evident seals, among others, ensure the safety of the product while enhancing consumer confidence. High demand for plant-based and organic milk is driving designs in packaging. A high level of emphasis on branding and aesthetic appeal appeals to a health-conscious, environmentally conscious audience, where the packaging itself becomes an integral marketing tool. This gives rise to new trends shaping the North America milk packaging market towards conformance with new consumer demands and sustainability goals.

United States Milk Packaging Market Analysis

According to the FAO, the United States produced 54.14 million metric tons of wrapping and packaging paper and paperboard in 2023. Such a massive increase in production will further fuel growth in the U.S. milk packaging market. Environmental concerns and more preferable paper and paperboard as an alternative to plastic are thereby enhancing the demand for sustainable and eco-friendly packaging solutions. Heightening awareness, governmental regulations to minimize plastic waste and improve recycling behavior, all drive the increasing use of paper-based packaging in the dairy industry. Moreover, such packaging products safeguard the integrity of milk products by offering stronger external contaminant protection. More new products from high-quality recyclable paper materials will be used to phase in the more sustainable packaging. Consumer preferences that are going to favor the purchase of environment-friendly products which will be advantageous to the U.S. milk packaging market in the rising trend toward the production of paper and paperboard packaging, both influenced by environmental concerns and acceptance from the regulatory authorities.

Europe Milk Packaging Market Analysis

According to European Commission data, the raw milk production in EU farms was estimated to reach 160.8 million tonnes in 2023. This is a boost of 0.8 million tonnes from the previous year. Higher levels of milk production will increase the demand for packaging in Europe. Since milk production increases, there is also an intense demand for packaging the milk based on their parameters which are reliable, efficient, and sustainable. Growing concern with the quality of milk and shelf life leads to an increase in the need for packaging solutions that provide increased protection against contaminants, light, and air. Governments in Europe also have been encouraging the use of recyclable and environmentally friendly packaging material, again creating more speed in this regard. This has further increased the demand for innovative packaging, such as portion-controlled formats, carry bottles, and flexible cartons, that are more convenient and sustainable for the consumer. Therefore, the rising milk output is expected to propel the milk packaging market in Europe.

Asia Pacific Milk Packaging Market Analysis

As per estimates by the USDA, in 2023, India's total domestic consumption of milk had surged to 207 million metric tons, from the 202 million metric tons it recorded in the previous year. Such growing consumption has been boosting the Asia-Pacific milk packaging market due to the efficiency and scalability such packaging solutions ensure. Moreover, according to the National Bureau of Statistics of China, processed paper and cardboard production in China amounted to about 13.17 million metric tons in July 2024. The rise in this production indicates a high increase in the adoption of sustainable and recyclable packaging materials in the region. Increasing consumption of milk in Asia-Pacific, especially in countries like India, necessitates new packaging solutions that can be both convenient for the consumer and preservative for the product. With a focus on durability, sustainability, and extended shelf life, the demand for packaging formats such as cartons, pouches, and bottles is expected to rise. As a result, the growing milk consumption and the shift toward eco-friendly packaging materials are propelling the Asia-Pacific milk packaging market's growth.

Latin America Milk Packaging Market Analysis

The USDA reported that Uniom, one of the second biggest milk-producing companies in Brazil, has produced 2,861 liters of milk per day per producer and is scheduled to open its high-tech cheese factory soon. This is a clear indicator of increasing demand for dairy products in Brazil. The fluid milk production also recorded a growth, amounting to about 27.5 million metric tons in 2023, from 26.6 million metric tons last year. This growth in milk production drives the demand for advanced milk packaging solutions in Latin America. Milk output increases and requires packaging formats that ensure the safety of the product, its shelf life, and consumer preferences regarding convenience and sustainability. In addition, it is observed that with increased levels of dairy production, the requirements for packaging are more stringent due to environmental demands and regulatory policies. For example, cartons that are recycle-friendly and green plastics are part of the emerging demand. Increased production and growth in demand lead to the expanding Latin American market for milk packaging.

Middle East and Africa Milk Packaging Market Analysis

Saudi Arabia is the fastest growing dairy market. Behind this, Al-Safi Dairy Farm-the largest dairy farm in the world-was established during the oil embargo in the 1970s and grew to be a home to 37,000 cows and an annual output of over 58 million gallons of milk, according to CSIS. Such a burgeoning dairy industry increases demand for modern packaging solutions of milk in the Middle East and Africa. As milk production increases, it becomes more crucial to ensure that packaging is efficient, sustainable, and innovative to provide the quality and safety of dairy products. Packaging extends shelf life, prevents contamination, and gives convenience to consumers. Sustainable packaging materials such as recyclable plastics and paperboard are driving the market. In the Middle East and Africa milk packaging market, increases in milk production and consumption are likely to expand it highly, with drivers that result from both the needs of the producers and those of the consumers.

Competitive Landscape:

The present competitive market landscape is dynamic, diverse, and highly competitive due to many companies competing for market share. Presently, it competes with rivals due to innovations in product, technology of packaging, environmentalism, cost-effectiveness, and customers' facility. Presently, manufacturers are also introducing aseptic packaging systems, such as cartons and pouches, which help milk retain its freshness and nutritional value. Besides this, few players are coming up with variety of packaging option such as paperboard cartons, trays for dairy industry and in their solutions emphasis is on sustainability and shelf appeal. They also invest in capacity expansion and merger and acquisition M&As that strengthen their ground in the marketplace.

The report provides a comprehensive analysis of the competitive landscape in the milk packaging market with detailed profiles of all major companies, including:

- Amcor Limited

- Indevco

- Evergreen Packaging

- Stanpac Inc.

- Elopak AS

- Ball Corporation

- Graham Packaging Company Inc

- SF Holdings Group Inc.

- RPC Group Plc

- Blue Ridge Paper Products

- Crown Holdings

- CkS Packaging

Recent Developments:

- July 2024: Berry Global is partnering with sustainable food delivery company Abel & Cole to supply bottles for the Club Zero Refillable Milk service. The new polypropylene (PP) bottles will be recyclable up to 16 times before entering the recycling pool. As the bottles are made of widely recyclable PP, they generate less carbon footprint in transportation and processing compared to the traditional glass bottles. The bottles would, therefore challenge the traditional use of glass for home milk deliveries.

- March 2024: Norway-based food packaging manufacturer Elopak started the construction of its first US production facility at Little Rock Port Authority. The plant will produce cartons for products such as milk, juices, plant-based beverages, and liquid eggs, after a USD 70 million investment. The commissioning of the production machinery is expected in the fourth quarter of 2024, while the plant is aiming to be in full operation from the first quarter of 2025.

- March 2021: Evergreen Packaging rolled out its PlantCarton milk product packaging in the United States. PlantCarton is a renewable, plant-based packaging material that is produced from paperboard from sustainably managed forests.

- September 2020: Ball Corporation is to invest in the building of a new aluminum beverage packaging plant in Pittston, Pennsylvania, United States. It is likely that the facility will cater for its growing needs of sustainable aluminum packaging, especially on milk products.

- August 2020: RPC Group issued a statement of its acquisition by Berry Global Group, the leader in global packaging solutions. The combination of the companies would create an enhanced company that has better packaging industry capabilities.

Milk Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cups, Cans, Bottles, Pouches, Others |

| Material Types Covered | Glass, Plastic, Metal, Paperboard and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amcor Limited, Indevco, Evergreen Packaging, Stanpac Inc., Elopak AS, Ball Corporation, Graham Packaging Company Inc, SF Holdings Group Inc., RPC Group Plc, Blue Ridge Paper Products, Crown Holdings and CkS Packaging |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the milk packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global milk packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the milk packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The milk packaging market was valued at USD 45.12 Billion in 2024.

IMARC Group estimates the market to reach USD 62.82 Billion by 2033, exhibiting a CAGR of 3.56% during 2025-2033.

The milk packaging market is driven by increasing demand for sustainable, recyclable materials, advancements in packaging technology enhancing shelf life and safety, rising preference for single-serve options, and the growing popularity of plant-based milk alternatives. Branding and convenience further propel the adoption of innovative packaging solutions.

Asia Pacific currently dominates the market due to apid urbanization, population growth, and lifestyle changes in China and India. Expanding modern retail, including supermarkets and convenience stores, fuels demand for high-quality packaging ensuring shelf life and convenience. Favorable policies, cost advantages, and robust infrastructure further attract manufacturers.

Some of the major players in the milk packaging market include Amcor Limited, Indevco, Evergreen Packaging, Stanpac Inc., Elopak AS, Ball Corporation, Graham Packaging Company Inc, SF Holdings Group Inc., RPC Group Plc, Blue Ridge Paper Products, Crown Holdings and CkS Packaging, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)