Milk Chocolate Market Size, Share, Trends and Forecast by Distribution Channel and Region, 2025-2033

Milk Chocolate Market Size and Share:

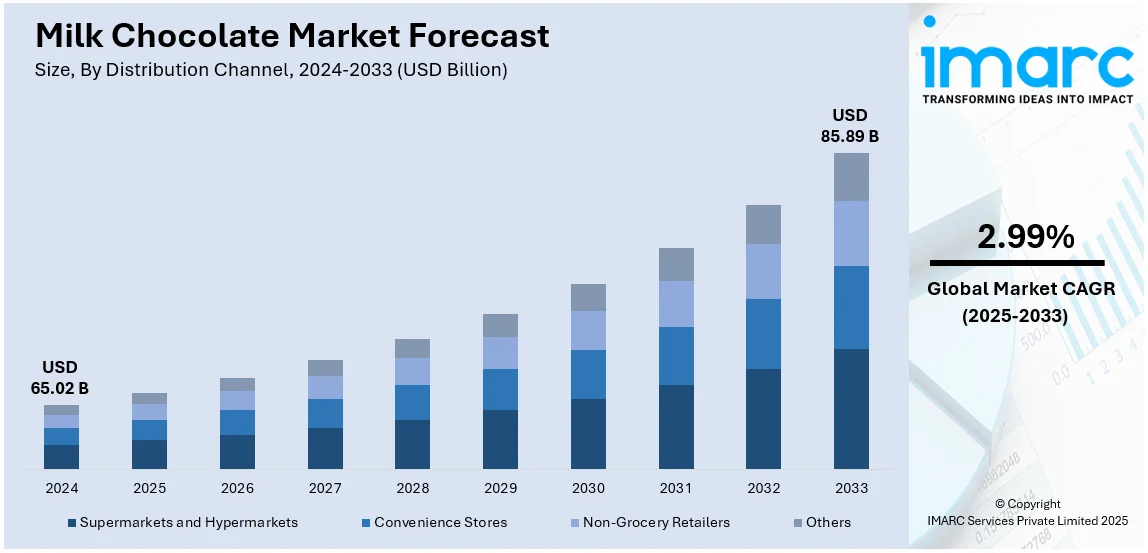

The global milk chocolate market size was valued at USD 65.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 85.89 Billion by 2033, exhibiting a CAGR of 2.99% from 2025-2033. Western Europe currently dominates the market, driven by the growing health and wellness trends, ongoing product innovations, rising middle-class population, and escalating e-commerce sector are surging the milk chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 65.02 Billion |

|

Market Forecast in 2033

|

USD 85.89 Billion |

| Market Growth Rate (2025-2033) |

2.99%

|

The milk chocolate market is driven by increasing consumer preference for indulgence and comfort foods, with 85% of individuals satisfying over half of their cravings through such treats. Chocolate is widely associated with pleasure and stress relief, leading to heightened demand during festive seasons, celebrations, and daily snacking. The emotional connection to milk chocolate, alongside evolving flavor innovations and premium offerings, fuels market growth. Manufacturers are responding by introducing reduced-sugar and organic options to cater to health-conscious consumers while preserving indulgence. The rising demand for premium and artisanal chocolates further strengthens milk chocolate’s global market presence, reinforcing its status as a preferred choice for both enjoyment and emotional satisfaction.

The U.S. milk chocolate market is driven by high consumer demand for indulgent confectionery, strong brand presence, and continuous product innovations with a market share of 85.80%. Leading manufacturers focus on premiumization, offering organic, sugar-free, and ethically sourced variants to cater to evolving consumer preferences. Seasonal sales, including holidays like Halloween and Valentine's Day, significantly boost demand. Additionally, the expansion of e-commerce and convenience stores enhances product accessibility. Marketing strategies emphasizing nostalgia, comfort, and gifting traditions further reinforce market growth. Rising health awareness has also led brands to introduce fortified and functional chocolates, ensuring continued market expansion despite growing competition from dark and alternative chocolates.

Milk Chocolate Market Trends:

Rising Gifting Trend

The increasing gifting trend is a significant driver of milk chocolate market growth, as chocolates are widely associated with celebrations, special occasions, and expressions of appreciation. With 67% of consumers viewing chocolate as a gift and 77% of millennials favoring it for gifting, demand continues to rise. The universal appeal of milk chocolate makes it a preferred choice for holidays, corporate gifts, and personal celebrations. Seasonal events such as Valentine’s Day, Christmas, and birthdays further amplify sales. Additionally, attractive packaging, limited-edition offerings, and personalized chocolate gifts enhance consumer interest. As gifting remains integral to cultural and social traditions, these factors are expected to boost milk chocolate sales and strengthen its market position in the coming years.

Emergence of E-Commerce Sector

The emergence of the e-commerce sector is one of the prominent factors propelling the market’s growth. For instance, according to IMARC, the global e-commerce market size reached USD 21.1 Trillion in 2023. Looking forward, IMARC Group expects the market to reach USD 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032. E-commerce platforms make it incredibly easy for consumers to purchase milk chocolate products from the comfort of their homes. Shoppers can browse through a wide range of products, compare prices, and make purchases anytime, without needing to visit a physical store. These factors further positively influence the milk chocolate market forecast.

Product Innovations

The growing demand for premium, artisanal, and handcrafted chocolates is driving the milk chocolate market as consumers seek high-quality ingredients and unique flavors. Brands are capitalizing on this trend by offering luxury chocolates featuring organic, fair-trade, and sustainably sourced ingredients. In January 2024, KOHO, a luxury artisanal chocolate brand from Hawai'i, introduced its Spring Collection, featuring seasonal flavors like Hibiscus Caramel and Vanilla Kona Latte, enhancing market revenue. Such innovations cater to evolving consumer preferences for gourmet experiences and ethical sourcing. Limited-edition offerings, creative packaging, and premium pricing strategies further boost sales. As demand for indulgence and exclusivity grows, the premium milk chocolate segment is expected to expand significantly in the coming years.

Milk Chocolate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global milk chocolate market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on distribution channel.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

Supermarkets and hypermarkets dominate the milk chocolate market share of 42.0% due to their extensive product variety, strong consumer reach, and convenient shopping experience. These retail channels offer a wide selection of milk chocolate products, including premium, mass-market, and private-label brands, catering to diverse consumer preferences. Bulk purchasing options and promotional discounts further attract buyers, making them a preferred choice. Additionally, strategic product placements, seasonal displays, and impulse-buy sections near checkout counters enhance sales. Their ability to offer fresh stock, competitive pricing, and in-store sampling also strengthens consumer engagement. The increasing footfall in supermarkets and hypermarkets, driven by one-stop shopping convenience, further reinforces their dominance in milk chocolate distribution.

Analysis by Region:

- Western Europe

- North America

- Eastern Europe

- Asia

- Latin America

- Middle East and Africa

- Australasia

Western Europe leads the milk chocolate market due to strong consumer demand, a rich chocolate-making heritage, and the presence of renowned confectionery manufacturers. The region's preference for high-quality, artisanal, and premium milk chocolate products drives continuous milk chocolate market growth. Consumers in Europe have a well-established culture of chocolate consumption, with high per capita intake and strong demand for organic, ethically sourced, and innovative flavors. Seasonal festivities, such as Christmas and Easter, significantly boost sales. Additionally, the expansion of specialty chocolate stores, supermarkets, and online retail channels enhances accessibility. The region's strict quality standards and sustainability initiatives, including fair-trade certifications and reduced sugar formulations, further strengthen its position as the dominant market for milk chocolate globally.

Key Regional Takeaways:

United States Milk Chocolate Market Analysis

In the U.S., the milk chocolate market continues to thrive, driven by consumers’ deep emotional connection to the product. According to a new report from the National Confectioners Association, chocolate achieved a record high, accounting for USD 21.4 Billion in confectionery sales over the past year. Approximately 65% of consumers turned to chocolate as an affordable indulgence, reinforcing its widespread appeal as a go-to treat. The demand for premium and artisanal milk chocolate options is also on the rise, with consumers seeking unique flavors and high-quality ingredients. The market is further fueled by the growing popularity of healthier alternatives, such as organic and dairy-free milk chocolates, to cater to health-conscious consumers. Additionally, the increasing trend of gifting, especially during holidays and special occasions, drives seasonal sales. E-commerce platforms are enhancing accessibility to a broader range of milk chocolate products, providing convenience to consumers. Strong marketing campaigns, celebrity endorsements, and innovative product offerings, such as functional chocolates with added health benefits, are also boosting demand. The U.S. market is expected to continue growing steadily, with milk chocolate maintaining its status as a beloved and versatile treat across various consumer demographics.

Asia Pacific Milk Chocolate Market Analysis

The milk chocolate market in APAC is driven by rising disposable income, urbanization, and an expanding middle class, fostering increased consumption. According to World Bank, East Asia and the Pacific is the world’s most rapidly urbanizing region, with an average annual urbanization rate of 3%. This rapid urbanization is contributing to shifts in consumer preferences and the growing demand for milk chocolate products, particularly in metropolitan areas. The rising trend of Westernized diets, combined with greater exposure to international brands, is further accelerating the market’s expansion. Additionally, the younger demographic in countries like India and China is increasingly attracted to milk chocolate as a snack, driving growth. The surge in e-commerce platforms is making milk chocolate more accessible, helping expand its reach across the region. Manufacturers are also catering to local tastes by introducing innovative variations, including regional flavors, to appeal to diverse consumer preferences.

Europe Milk Chocolate Market Analysis

In Europe, the milk chocolate market benefits from both a rich tradition of consumption and continuous innovation. According to industry reports, the European Union's urban population reached 337,610,183 in 2022, a 0.4% increase from 2021, highlighting the ongoing urbanization that drives demand for convenient, high-quality indulgent products like milk chocolate. The European market is characterized by a strong preference for premium and high-quality chocolates, with consumers increasingly seeking artisanal and unique flavor experiences. Additionally, sustainability has become a key driver, with ethical sourcing and fair-trade certifications becoming significant purchasing factors. Consumers are more conscious of their food choices, pushing brands to introduce organic, sugar-reduced, and functional variants of milk chocolate. The gifting culture in Europe, particularly during holidays such as Easter and Christmas, also plays a crucial role in market dynamics, with consumers regularly purchasing premium milk chocolate products for celebrations. As health-conscious trends continue to evolve, the demand for milk chocolate with added functional benefits, such as vitamins or probiotics, is increasing. The rise of dark milk chocolate blends further caters to changing preferences, creating new growth avenues for the market. With a growing appetite for innovation and quality, the European milk chocolate market remains diverse, competitive, and resilient.

Latin America Milk Chocolate Market Analysis

In Latin America, the milk chocolate market is driven by a growing middle class and increased disposable incomes. According to IMARC Group, Mexico's e-commerce market size reached USD 47.5 Billion in 2024 and is projected to grow to USD 176.6 Billion by 2033, with a CAGR of 14.5% from 2025-2033. This surge in online retail is enhancing accessibility to milk chocolate products, particularly in urban areas. Additionally, the increasing popularity of premium chocolate and regional innovations in flavor are contributing to steady market growth across the region. Changing consumer preferences further bolstering the milk chocolate market demand for indulgent treats.

Middle East and Africa Milk Chocolate Market Analysis

In the Middle East and Africa, the milk chocolate market is expanding due to urbanization and rising disposable incomes. The Middle East's e-commerce market size was valued at USD 1,888 Billion in 2024, contributing significantly to the accessibility of milk chocolate products. Online retail platforms are increasingly offering a wider range of chocolate options, making it easier for consumers to access premium and artisanal products. As milk chocolate becomes a luxury indulgence, particularly in affluent regions, the growing e-commerce sector helps meet the rising demand. This trend, combined with regional flavor innovations, further drives milk chocolate market outlook.

Competitive Landscape:

The milk chocolate market is highly competitive, characterized by the presence of established brands, emerging artisanal producers, and private-label offerings. Companies focus on differentiation through innovative flavors, healthier formulations, and sustainable sourcing practices to appeal to diverse consumer segments. Premiumization is a key strategy, with brands emphasizing high-quality ingredients, organic certifications, and ethical sourcing to attract health-conscious and environmentally aware consumers. Pricing strategies vary, with mass-market options dominating retail shelves, while luxury variants target niche markets. Marketing plays a crucial role, leveraging nostalgia, gifting traditions, and festive promotions to boost sales. The rise of e-commerce and direct-to-consumer channels has intensified competition, enabling smaller players to challenge established brands through unique product offerings and personalized customer engagement.

The report provides a comprehensive analysis of the competitive landscape in the milk chocolate market with detailed profiles of all major companies, including:

Latest News and Developments:

- August 2024: Jimmy John's introduced their new Pumpkin White Chocolate Cookie. This delightful dessert combines the warm flavors of pumpkin with sweet white chocolate chips to wonderfully capture the spirit of the season.

- June 2024: Arla Foods has signed a licensing agreement with Mondelēz International to produce, distribute, and market Milka chocolate milk in Germany, Austria, and Poland. This collaboration aims to leverage Milka's strong brand recognition and consumer loyalty while utilizing Arla’s expertise in dairy innovation. The move comes as part of Arla's strategy to expand its portfolio in the mature chocolate milk category.

- June 2024: Nestlé Confectionery UK & Ireland launched a new KitKat Chunky Crunchy Double Chocolate bar. The new limited-edition bar has a chocolate crispy wafer wrapped in smooth milk chocolate.

- January 2024: KOHO, a luxury line of artisanal chocolates created in Hawai'i, launched its Spring Collection. The collection includes seasonal flavors such as Hibiscus Caramel (white chocolate with hibiscus caramel filling) and Vanilla Kona Latte (white chocolate with Big Island coffee).

- December 2023: Oobli has expanded its product portfolio with the introduction of milk chocolate bars and an expanded range of dark chocolate bars, powered by sweet proteins. These proteins, derived from rare fruits near the Equator, provide sweetness with 70% less sugar than traditional milk chocolate, containing only 1g of added sugar per serving. Unlike alternative sweeteners, sweet proteins do not impact blood sugar, insulin levels, or the gut microbiome, offering a healthier option for consumers.

Milk Chocolate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, Others |

| Regions Covered | Western Europe, North America, Eastern Europe, Asia, Latin America, Middle East and Africa, Australasia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the milk chocolate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global milk chocolate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the milk chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The milk chocolate market was valued at USD 65.02 Billion in 2024.

The milk chocolate market was valued at USD 85.89 Billion in 2033, exhibiting a CAGR of 2.99% during 2025-2033.

The milk chocolate market is driven by rising consumer preference for indulgent confectionery, increasing disposable income, product innovations like sugar-free variants, and expanding retail channels. Growing demand for premium and organic chocolates, along with festive and gifting trends, further boosts market growth, supported by aggressive marketing and brand differentiation strategies.

Europe dominates the milk chocolate market due to high consumer demand, a strong chocolate-making heritage, and a preference for premium, organic, and ethically sourced products. Seasonal festivities, innovative flavors, and widespread retail availability further boost sales, while sustainability initiatives and strict quality standards reinforce the region’s leading position in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)