Middle East Physical Security Market Report by Component (System, Services), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), Industry Vertical (Retail, Transportation, Residential, IT and Telecom, BFSI, Government, and Others), and Country 2026-2034

Market Overview:

Middle East physical security market size reached USD 6,193.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 10,751.8 Million by 2034, exhibiting a growth rate (CAGR) of 6.32% during 2026-2034. The heightened security concerns due to geopolitical tensions, the proliferation of technology and digital transformation, and significant growth in the oil and gas industry represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6,193.6 Million |

|

Market Forecast in 2034

|

USD 10,751.8 Million |

| Market Growth Rate 2026-2034 | 6.32% |

Access the full market insights report Request Sample

Physical security refers to the measures and practices designed to protect individuals, property, and assets from physical threats such as theft, vandalism, natural disasters, and terrorism. This aspect of security is crucial for businesses, institutions, and residential areas, ensuring the safety and integrity of physical assets, including buildings, equipment, and personnel. Physical security encompasses a wide range of strategies and technologies designed to prevent unauthorized access to facilities, equipment, and resources and to protect personnel and property from damage or harm. Key components of physical security include access control systems, surveillance cameras, alarm systems, and physical barriers such as fences and security gates. It also involves policies and procedures that establish how these tools are used and how security is maintained on a day-to-day basis. This includes security personnel training, emergency response planning, and regular security audits to assess and improve the effectiveness of the security measures in place.

Middle East Physical Security Market Trends:

The heightened security concerns due to geopolitical tensions and the need to protect critical infrastructure are driving the market in the Middle East. This has led to increased investments in physical security solutions, including surveillance systems, access control, and perimeter security, to safeguard against potential threats. Furthermore, the rapid urbanization and development of smart cities in the region are supporting the growth of the market. Various countries are investing heavily in building smart, sustainable cities. These projects inherently require advanced physical security systems to ensure the safety of residents and infrastructure. The integration of technology into urban planning is, therefore, a significant driver for the physical security market. Besides, significant growth in the oil and gas industry is creating a positive market outlook. There is a substantial demand for robust physical security measures to protect against sabotage, theft, and terrorism. This demand extends to extraction sites and to transportation and storage facilities. Moreover, the region's growing emphasis on tourism, particularly in countries, necessitates enhanced security measures. As these countries diversify their economies and attract international visitors, ensuring the safety of tourists and tourism infrastructure becomes paramount, thereby augmenting the demand for physical security solutions. Also, the proliferation of technology and digital transformation is providing an impetus to the market. Additionally, the adoption of advanced technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) in security systems is enhancing the effectiveness and efficiency of physical security measures. These technologies enable real-time monitoring, predictive analytics for threat assessment, and integrated security management systems, offering sophisticated solutions to complex security challenges. Additionally, the regulatory environment in the Middle East is contributing to the market's growth. Governments are implementing strict regulations and standards for security practices across various industries, compelling organizations to upgrade their physical security infrastructures to comply with these regulations.

Middle East Physical Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2026-2034. Our report has categorized the market based on component, enterprise size, and industry vertical.

Component Insights:

To get detailed segment analysis of this market Request Sample

- System

- Physical Access System

- Video Surveillance System

- Perimeter Intrusion and Detection

- Physical Security Information Management

- Others

- Services

- System Integration

- Remote Monitoring

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes system (physical access system, video surveillance system, perimeter intrusion and detection, physical security information management, and others) and services (system integration, remote monitoring, and others).

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

Industry Vertical Insights:

- Retail

- Transportation

- Residential

- IT and Telecom

- BFSI

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes retail, transportation, residential, IT and telecom, BFSI, government, and others.

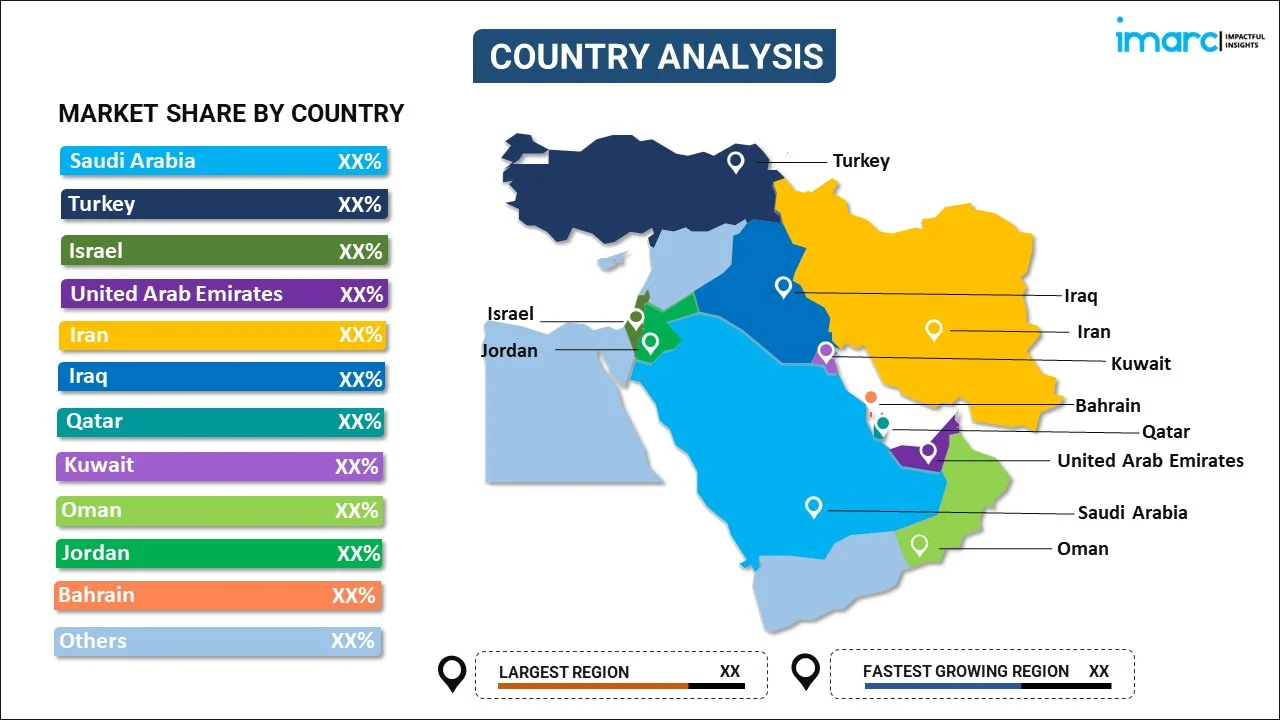

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Middle East Physical Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | Retail, Transportation, Residential, IT and Telecom, BFSI, Government, Others |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Middle East physical security market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Middle East physical security market?

- What is the breakup of the Middle East physical security market on the basis of component?

- What is the breakup of the Middle East physical security market on the basis of enterprise size?

- What is the breakup of the Middle East physical security market on the basis of industry vertical?

- What are the various stages in the value chain of the Middle East physical security market?

- What are the key driving factors and challenges in the Middle East physical security?

- What is the structure of the Middle East physical security market and who are the key players?

- What is the degree of competition in the Middle East physical security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East physical security market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Middle East physical security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East physical security industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)