Middle East Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Country, 2025-2033

Middle East Online Grocery Market Size and Share:

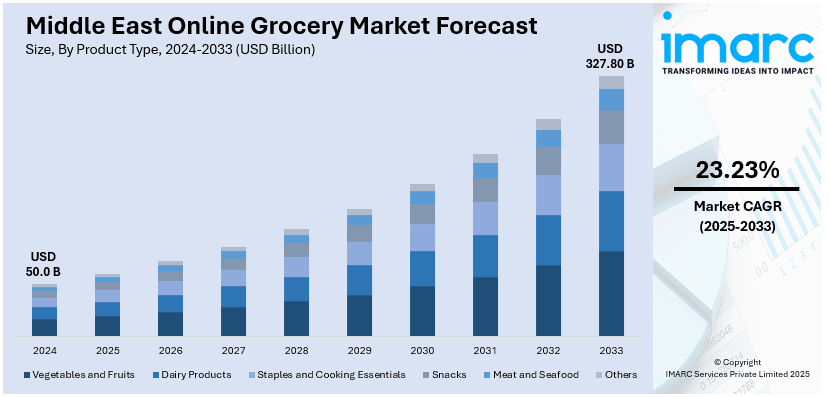

The Middle East online grocery market size was valued at USD 50.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 327.80 Billion by 2033, exhibiting a CAGR of 23.23% from 2025-2033. The market is primarily driven by the rapid AI and ML integration enhancing customer experience and operational efficiency, the growth of subscription-based services offering convenience and loyalty rewards, and a heightened focus on sustainability through eco-friendly practices and reduced carbon emissions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 50.0 Billion |

|

Market Forecast in 2033

|

USD 327.80 Billion |

| Market Growth Rate (2025-2033) | 23.23% |

The main driver in the Middle East market is the booming e-commerce sector as people are resorting to the online platforms as a time-saving activity. This is supported by further increased smartphone penetration and internet connectivity. According to the GSMA's Mobile Economy Middle East & North Africa 2024 report, mobile technologies accounted for 5.5 percent of MENA's GDP in 2023, generating USD 310 Billion and supporting 1.3 million jobs. Towards the end of 2023, 427 million people, or 64 percent of the population, subscribed to mobile services, while 49percent used mobile internet, more than threefold over a decade ago. Increasing disposable income, changes in lifestyle, and preference for home delivery and contactless transactions are further enhancing the Middle East online grocery market demand, with platforms offering variety, flexibility, and convenience.

Additionally, the growing urbanization is significantly driving the market, with large city population increasingly seeking convenient and efficient grocery shopping solutions. Similarly, the rising number of working professionals along with increase in the number of dual-income households further fuels demand, offering flexibility and time savings. Furthermore, the emerging health-conscious trend among consumers, particularly those seeking organic and specialized products, promotes the growth of online platforms that cater to these niche needs. For example, on January 22, 2025, Deliveroo UAE expanded its HOP service to Abu Dhabi in partnership with Choithrams, offering a wide range of fresh food as well as household essentials, focusing on freshness and quick delivery. The service also gives consumers with a 50% discount and free delivery on their first order. Moreover, ongoing improvements to app interfaces, loyalty programs, and personalized services by various players are enhancing customer engagement and expanding Middle East online grocery market share.

Middle East Online Grocery Market Trends:

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

One of the major Middle East online grocery market trends is that it involves more incorporation of artificial intelligence and machine learning to improve the experiences both for consumers and in operations. E-commerce sites are using AI to render individualized product recommendations, enable just-in-time inventory management, and discover consumer purchasing patterns. This leads to a more personalized shopping experience, higher stock accuracy, and faster delivery. Most notably, in 2025, Zoovu formed a deal with Euronics to deliver its AI-based search and product discovery platform across 35 countries. This cooperation improves the product data management, stimulates the customer experience, and aids in the increase of conversion rates. Zoovu's AI offerings have triggered significant augmentation in customer engagement and revenue as well as a reduction in cart abandonment. Moreover, nowadays, people increasingly search for AI-powered chatbots and virtual assistants that can help customers in real-time while ordering.

Rise of Subscription-Based Services

The rise of subscription-based services is significantly influencing the Middle East online grocery market outlook, driven by consumers' growing demand for convenience and automated shopping. Numerous shoppers now prefer subscription models that offer regular deliveries of essential products, reducing the need for frequent orders. For instance, on February 26, 2024, Tabby unveiled Tabby+, a monthly subscription service in the UAE. This service allows users to render purchases anywhere VISA is accepted with a “Pay in 4” option, free of hidden fees and interest. Tabby+ costs AED 49 per month with the first month free, offering 1% cashback and priority support. Subscription services like Tabby+ not only save time but also provide exclusive offers, discounts, and loyalty rewards. As convenience-driven consumer behavior grows, subscription-based grocery delivery services are likely to gain further popularity across the region.

Growing Focus on Sustainability

Sustainability is increasingly dictating consumer behavior in the market, from a focus on green packaging to responsible sourcing and reduction of waste. Consumers are more interested in buying products from those brands that maintain environmentally responsible practices, forcing the online grocery store to adapt their offerings. It is doing this by adopting recyclable or biodegradable packaging, as well as improving delivery by using electric vehicles or optimizing routes to minimize carbon emissions. This transition is in line with the expectations of consumers and regional sustainability objectives. For example, on November 26, 2024, Al-Futtaim Electric Mobility joined forces with Parkin PJSC to electrify Parkin's fleet, launching 40 BYD Song Plus plug-in hybrid vehicles and expanding EV infrastructure in Dubai. This collaboration supports the UAE's Green Mobility Strategy 2030 and Net Zero 2050 goals, which indicate a massive shift toward more sustainable practices in various sectors that push the Middle East online grocery market growth.

Middle East Online Grocery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Middle East online grocery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, business model, platform, and purchase type.

Analysis by Product Type:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Vegetables and fruits are crucial components in the Middle East online grocery market, propelled by heightened health awareness among consumers. The region has seen a rise in demand for fresh produce, as people become more focused on healthy eating and maintaining balanced diets. Urbanization and the growing number of working personnel have resulted in a higher demand for convenient shopping options, with online grocery services offering time-saving solutions. The ease of accessing fresh fruits and vegetables through digital platforms, combined with fast delivery services, is fueling this growth. Moreover, the improvement in logistics and packaging technologies ensures freshness and quality, further encouraging consumer trust in online grocery shopping.

The use of dairy products is supported in the sector due to their nutritional advantages as well as cultural importance. With healthy eating trend awareness, the demand for dairy products, including milk, yogurt, and cheese, has also increased. People are increasingly shopping online for their groceries, hence, greater range and convenience are now accessible by online purchase for dairy products. Organic, fortified and lactose-free dairy products are part of the broader movement toward healthier options. These shifts help create further opportunities for growth within the industry. In terms of the Middle East's increased interest in convenience, the development of subscription models and home delivery services bodes well for maintaining dairy's importance within this region's market.

Staples and cooking essentials are fundamental to the market, fueled by their essential role in daily meals. As the region embraces home cooking, especially among busy families and young professionals, the demand for staples like rice, flour, and pulses has increased. Online grocery platforms cater to this need by offering easy access to these items, enabling consumers to shop quickly and efficiently. Additionally, consumers are increasingly looking for bulk-buying options, which further drives sales in the staple category. The convenience of home delivery, combined with the ability to easily restock pantry items, is making purchasing cooking essentials online an attractive option for many in the Middle East.

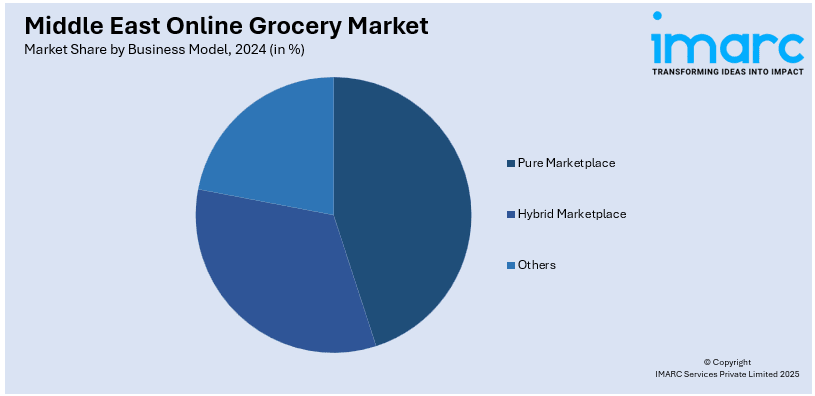

Analysis by Business Model:

- Pure Marketplace

- Hybrid Marketplace

- Others

Pure marketplaces have become one of the prominent players in the online grocery business in the Middle East, giving multiple vendors the platform to offer their products. These platforms have become very popular lately given the growing demand for variety and competitive pricing, which are very essential factors to attract the consumer who prefers to shop with convenience and compares the different offers at one place. In addition, the greater shift towards shopping through digital mediums combined with improved logistics for delivering these products has heavily augmented pure marketplace growth. Being able to quickly scale to handle a broad product range-from niche and local to everything else, has helped satisfy all the region's diversified needs for such consumers.

Hybrid marketplaces, which combine elements of pure marketplaces and direct sales models, have gained significant traction in the market. This model enables grocery platforms to offer a mix of third-party vendor products alongside their own private-label offerings, appealing to a wider range of customers. The growth of hybrid marketplaces has been driven by the region’s growing internet penetration and the need for a seamless shopping experience. The ability to offer a combination of fresh produce, pantry essentials, and specialty items on one platform enhances consumer convenience. Additionally, hybrid models allow businesses to leverage data insights for personalized marketing, fostering customer loyalty and contributing to sustained growth.

Analysis by Platform:

- Web-Based

- App-Based

Web-based platforms are crucial to the growth of the Middle East online grocery market, as they offer an accessible and user-friendly way for consumers to shop for groceries from the comfort of their homes. The increasing use of smartphones and laptops across the region, along with improving internet infrastructure, significantly expanded the reach of web-based platforms. These platforms are mostly the initial point of contact for customers, providing a detailed, easy-to-navigate catalog of products. As the demand for convenience grows, web-based grocery services are able to meet consumers' expectations by offering detailed product information, promotions, and flexible payment options, further enhancing the overall shopping experience.

App-based grocery platforms have gained remarkable popularity in the Middle East due to their convenience and enhanced user experience. With the region's high smartphone penetration and a preference for mobile-first services, grocery apps offer a seamless shopping experience with personalized features like order tracking, quick reordering, and loyalty programs. These platforms also allow for better customer engagement through push notifications, providing users with timely updates on promotions or order statuses. The growth of app-based services is driven by the need for quick and efficient grocery shopping, further propelled by the increasing reliance on delivery services and the growing expectation of fast, flexible, and efficient grocery delivery solutions.

Analysis by Purchase Type:

- One-Time

- Subscription

One-time purchases are a significant driver in the Middle East online grocery market, particularly for customers seeking flexibility and convenience. As consumers become more accustomed to e-commerce, they prefer the ability to buy groceries on-demand without being tied to long-term commitments. The growth of one-time purchases is driven by the increasing demand for convenience, as busy lifestyles, especially in urban areas, render it difficult to visit physical stores regularly. Additionally, the broadening of product offerings, coupled with user-friendly platforms, allows customers to easily order a wide variety of items without the need for subscriptions. As a result, many online grocery platforms are prioritizing seamless, quick, and efficient one-time shopping experiences to cater to these consumer preferences.

Subscription models are emerging as a key growth driver in the market, offering consumers consistent access to essential products while enhancing customer loyalty. As the convenience economy continues to grow, many consumers prefer subscription-based services for regular deliveries of groceries, reducing the need to reorder frequently. This model is particularly attractive to households that value the convenience of having staple items like milk, bread, and vegetables automatically delivered on a set schedule. The rising popularity of subscription services is further fueled by attractive discounts, exclusive offers, and personalized features, making it an appealing option for time-sensitive customers. With consumers seeking hassle-free, automated shopping solutions, subscription-based services are expected to become an integral part of the online grocery landscape.

Country Analysis:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Saudi Arabia is one of the most important markets in the Middle East online grocery sector, driven by the country's significant investment in digital infrastructure and growing consumer demand for convenience. As the largest economy in the region, Saudi Arabia’s shift towards e-commerce has accelerated, with a notable rise in online grocery shopping, particularly in major cities like Riyadh and Jeddah. Increasing smartphone penetration and the popularity of home delivery services are major growth factors. Additionally, Saudi Arabia’s young and tech-savvy population is more inclined to embrace digital shopping, fueling further growth. Government initiatives helping in digital transformation and financial diversification also provide a favorable outlook for online grocery retailers to expand their presence in the market.

Turkey's online grocery market is rapidly expanding, largely driven by the country’s strong digital adoption and the increasing preference for convenient shopping solutions. Urbanization in cities like Istanbul, Ankara, and Izmir created a large base of busy professionals and families seeking time-saving services such as online grocery delivery. The rise of e-commerce platforms offering extensive product ranges, along with secure and efficient payment options, is attracting a wide demographic of consumers. As Turkey’s tech infrastructure improves and mobile internet usage continues to grow, more consumers are adopting online grocery shopping. Competitive pricing, discounts, and the growing availability of organic and healthy food options also contribute to the market’s rapid growth.

Israel's online grocery market is experiencing robust growth, propelled by a combination of technological innovations, and growing need for convenience. With a high internet penetration rate and widespread smartphone use, Israeli consumers are increasingly turning to digital platforms for their grocery needs. Busy professionals, particularly in metropolitan areas such as Tel Aviv, are seeking quick and efficient solutions for their grocery shopping, contributing to the popularity of online grocery services. Additionally, the growing focus on health and wellness is prompting consumers to seek out organic and specialized food items, which online platforms can offer in abundance. As Israel’s tech-savvy population continues to embrace e-commerce, the online grocery market is poised for significant expansion.Top of FormBottom of Form

Competitive Landscape:

The Middle East online grocery market is highly competitive, fueled by the rapid escalation of e-commerce and changing consumer preferences. Prominent players lead with extensive offerings, including farm-fresh items, household necessities, and instant delivery. Local platforms attract customers through personalized services and competitive pricing. Global companies are expanding aggressively, leveraging advanced technologies like AI-driven recommendations, and streamlined payment solutions to gain market share. Strategic investments in logistics, innovative marketing, and warehousing strengthen the competitive landscape. Notably, on June 6, 2024, Majid Al Futtaim partnered with Checkout.com to enhance payment experiences for 15 million monthly online shoppers, ensuring seamless, secure transactions across platforms, including Carrefour, to boost satisfaction and operational efficiency.

The report provides a comprehensive analysis of the competitive landscape in the Middle East online grocery market with detailed profiles of all major companies.

Latest News and Developments:

- January 28, 2025: Expert App Devs, a Dubai-based mobile app development company, empowers UAE grocery businesses with tailored app solutions. Their user-friendly, scalable grocery delivery apps feature real-time order tracking and secure payments, catering to the growing demand for online grocery shopping while enhancing customer experiences and business growth in the region’s competitive digital marketplace.

- December 17, 2024: Meituan’s Xiaoxiang Supermarket launched globally in Saudi Arabia, entering the rapidly expanding online grocery market. Leveraging its dark store model and Keeta’s success, the venture capitalizes on rising demand for instant deliveries, supported by favorable Middle Eastern policies and growing e-commerce adoption in the region.

- December 16, 2024: Careem launched its ultra-fast delivery service for groceries in Abu Dhabi, offering 20-minute deliveries of fresh essentials, premium goods, and household items. Careem Plus members enjoy exclusive savings and benefits, enhancing the convenience of the Everything App for Abu Dhabi residents.

- March 11, 2024: Talabat partners with EazyPay, enhancing secure, swift card payments for online grocery orders and other deliveries, ensuring a seamless experience for customers in Bahrain's dynamic e-commerce landscape.

Middle East Online Grocery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East online grocery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Middle East online grocery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East online grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Middle East online grocery market was valued at USD 50.0 Billion in 2024.

The growth of the Middle East market is primarily driven by increasing e-commerce adoption, rising smartphone penetration, improved internet connectivity, urbanization, and the preference for convenience through home delivery. Additionally, health-conscious trends, subscription services, eco-friendly practices, advanced technologies like AI, and growing disposable incomes significantly contribute to market expansion.

The Middle East online grocery market is projected to reach a value of USD 327.80 Billion by 2033, growing at a CAGR of 23.23% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)