Middle East Health Insurance Market Report by Provider (Private Providers, Public Providers), Type (Life-Time Coverage, Term Insurance), Plan Type (Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, and Others), Demographic (Minor, Adults, Senior Citizen), Provider Type (Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs)), and Country 2026-2034

Market Overview:

Middle East health insurance market size reached USD 89,406.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,21,507.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.47% during 2026-2034. The launch of numerous favorable policies by government bodies that assist in empowering policyholders to select the most suitable coverage based on their unique needs and preferences is primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 89,406.1 Million |

| Market Forecast in 2034 | USD 1,21,507.5 Million |

| Market Growth Rate 2026-2034 | 3.47% |

Access the full market insights report Request Sample

Health insurance functions as a financial agreement designed to offer individuals and families protection against medical expenses. This arrangement constitutes a contractual relationship involving an individual (referred to as the policyholder) and either an insurance company or a healthcare provider. In return for regular premium payments, the insurance company commits to assuming a portion or the entirety of the eligible medical costs incurred by the policyholder, contingent on the stipulations outlined in the policy. The policy explicitly outlines the scope of medical services and expenses covered, encompassing various aspects such as doctor's visits, hospitalization, prescription medications, preventive care, surgeries, and more. Depending on the specifics of the policy, coverage might extend to additional healthcare needs like dental and vision care, mental health services, and other relevant medical services. Through this contractual arrangement, health insurance serves as a crucial financial tool, offering individuals and families a means to manage and mitigate the financial burden associated with medical care.

Middle East Health Insurance Market Trends:

The Middle East health insurance market stands as a pivotal player in the region's evolving healthcare landscape, reflecting a burgeoning awareness of the importance of financial protection against medical expenses. This market is characterized by a diverse array of offerings, providing individuals and families with coverage for a broad spectrum of healthcare needs. Besides this, operating within a contractual framework between policyholders and insurance companies or healthcare providers, the Middle East health insurance market hinges on regular premium payments in exchange for comprehensive coverage, which is acting as another significant growth-inducing factor. Moreover, the policies delineate the specifics of covered medical services, encompassing vital aspects such as doctor's visits, hospitalization, prescription medications, preventive care, and surgical interventions. Notably, the market also addresses an expanding array of healthcare needs, extending coverage to dental and vision care, mental health services, and other specialized treatments, dependent on the policy terms. As the region places increased emphasis on healthcare accessibility and quality, the Middle East health insurance market will play a pivotal role in offering financial security for individuals and families, over the forecasted period.

Middle East Health Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on provider, type, plan type, demographics, and provider type.

Provider Insights:

To get detailed segment analysis of this market Request Sample

- Private Providers

- Public Providers

The report has provided a detailed breakup and analysis of the market based on the provider. This includes private providers and public providers.

Type Insights:

- Life-Time Coverage

- Term Insurance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes life-time coverage and term insurance.

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes medical insurance, critical illness insurance, family floater health insurance, and others.

Demographics Insights:

- Minor

- Adults

- Senior Citizen

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes minor, adults, and senior citizen.

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs).

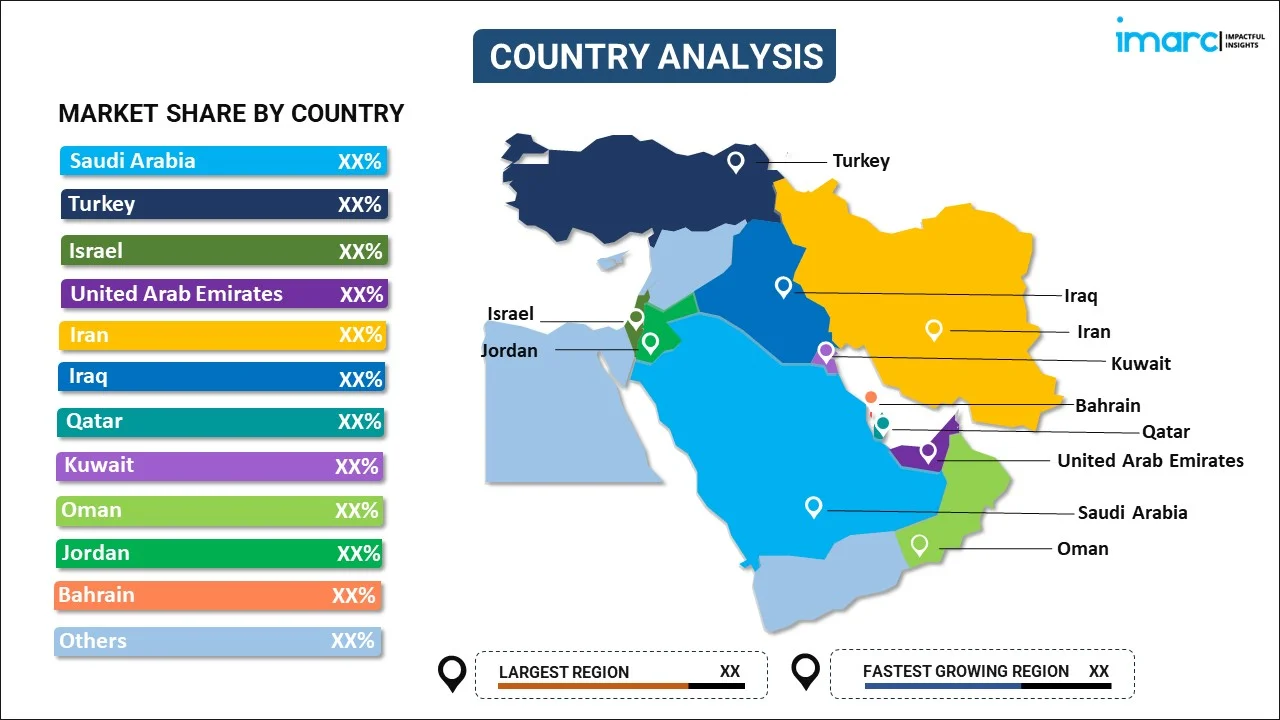

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Middle East Health Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Middle East health insurance market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Middle East health insurance market?

- What is the breakup of the Middle East health insurance market on the basis of provider?

- What is the breakup of the Middle East health insurance market on the basis of type?

- What is the breakup of the Middle East health insurance market on the basis of plan type?

- What is the breakup of the Middle East health insurance market on the basis of demographics?

- What is the breakup of the Middle East health insurance market on the basis of provider type?

- What are the various stages in the value chain of the Middle East health insurance market?

- What are the key driving factors and challenges in the Middle East health insurance?

- What is the structure of the Middle East health insurance market and who are the key players?

- What is the degree of competition in the Middle East health insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East health insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Middle East health insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East health insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)