Middle East Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue, Type, Age Group, and Country, 2025-2033

Middle East Gaming Market Size and Share:

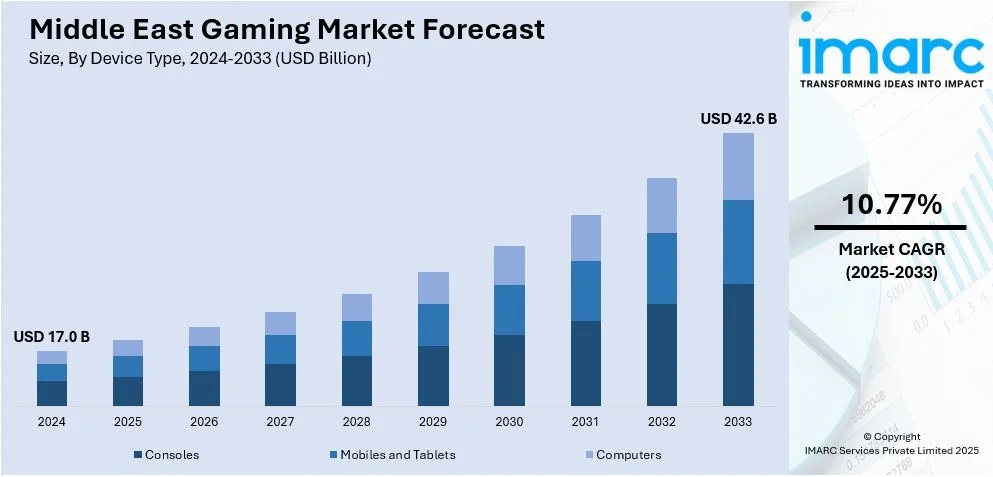

The Middle East gaming market size was valued at USD 17.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.6 Billion by 2033, exhibiting a CAGR of 10.77% from 2025-2033. The market is driven by the growing youth population in the Middle East who are demanding games for entertainment and digital experiences. Smartphone penetration is fueling the Middle East gaming market by making gaming accessible to a wider audience with affordable, high-performance devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.0 Billion |

|

Market Forecast in 2033

|

USD 42.6 Billion |

| Market Growth Rate (2025-2033) | 10.77% |

The growing youth demographic in the Middle East is a key factor driving the gaming market. With a considerable proportion of the population under 30, there is high demand for entertainment and gaming. Young people are tech-savvy and eager to embrace new gaming experiences, contributing to rapid market expansion. As a result, mobile gaming is experiencing growth, with smartphones being considered a preferred device for gaming. This demographic also drives demand for online multiplayer games and eSports, as they seek social interaction. The rise of competitive gaming and eSports events further captures the attention of youth, creating a thriving ecosystem. Local tournaments, along with international events, provide platforms for young players to showcase their talents.

Smartphone penetration in the Middle East is expanding gaming accessibility. Affordable smartphones with advanced features are making games available to a broader population across different income levels. With better processors and enhanced graphics, mobile gaming is now on par with console experiences. This affordability and convenience are encouraging casual gamers to embrace mobile platforms for entertainment. As internet connectivity improves, particularly with the rollout of 5G networks, mobile gaming experiences are becoming smoother. Players can now enjoy high-quality multiplayer games and real-time interactions, contributing to expanding demand across gaming community. Mobile gaming is particularly appealing in regions with limited access to high-end consoles or computers, making it a dominant platform.

Middle East Gaming Market Trends:

Growing eSports

The growth of eSports in the Middle East is driving the market by fostering engagement and competition. Governing agencies are investing in eSports infrastructure, recognizing its potential to expand economic growth. Countries like Saudi Arabia and the UAE are hosting large-scale tournaments and building dedicated eSports arenas, attracting global attention. In July, the International Olympic Committee (IOC) declared the Olympic Esports Games, set for 2025 in Saudi Arabia. The event aims to enhance the esports industry, projected to reach $1 trillion by 2032. Saudi Arabia’s tech-savvy youth and government support will strengthen the region’s global esports position. The region’s young as well as tech-savvy population is engaged in eSports, creating a vibrant gaming community. Esports events draw significant audiences, both in-person and through digital platforms, enhancing gaming visibility. Local teams and players are competing at international levels, contributing to the growing influence of Middle East in global eSports. The rise of streaming platforms has made eSports more accessible. Viewership and fan engagement are increasing, with communities supporting local talent and teams. Companies are capitalizing on this trend through sponsorships, advertising and merchandising.

Government initiatives

Growth government initiatives drive the market, and countries such as Saudi Arabia and the UAE have invested largely in gaming and eSports infrastructure. They are building special eSports arenas to host tournaments and creating policies to promote digital entertainment. For instance, in April 2024, Abu Dhabi stated plans to turn into the first world esports island rivaling Saudi Arabia. The project aimed to enhance the region’s gaming infrastructure and position Abu Dhabi as a gaming hub. These government-backed projects aim to develop local talent by offering training programs and scholarships in game development. These initiatives help build a sustainable ecosystem and reduce reliance on foreign game developers. For example, the Saudi Vision 2030 focuses on diversifying the economy and positioning the country as a global gaming hub. Investments in advanced technologies like 5G networks, enhance the gaming experience and facilitate faster and smoother connections.

Technological innovations

Gaming innovations are driving the market by enhancing user experiences and engagement. Advancements in mobile technology like better processors and high-quality graphics are elevating gaming quality. The augmented reality (AR) and virtual reality (VR) experiences have further captured players’ attention, providing immersive worlds. In October 2024, Ericsson and KACST launched Blink Lab in Saudi Arabia to drive gaming innovations. The collaboration aimed to advance gaming technologies, supporting the growing gaming market in the region and improving its digital entertainment ecosystem. Titles utilizing these technologies offer new dimensions to gameplay, attracting both casual and hardcore gamers. Cloud gaming is another innovation reshaping the market, allowing players to access games without high-end hardware. This innovation reduces the need for physical storage and enables instant play across devices.

Middle East Gaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Middle East gaming market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on device type, platform, revenue, type, and age group.

Analysis by Device Type:

- Consoles

- Mobiles and Tablets

- Computers

Gaming consoles attract professional gamers because of improved graphics, unique games and engaging visuals. As console technology progresses, attributes, such as 4K support, VR integration and online multiplayer options draw a dedicated user community.

Mobile and tablet provide ease of access, affordability and a broad selection of games. The rising reliance on smartphones, in confluence with the popularity of casual gaming, has rendered this segment the most accessible.

Computer gaming thrives due to its flexibility in providing advanced hardware customization and access to a wide range of games. It caters to competitive gamers who prefer precise controls, modding capabilities and superior graphics. The emergence of digital platforms like Steam and Epic Games Store enhances the accessibility and availability of video games.

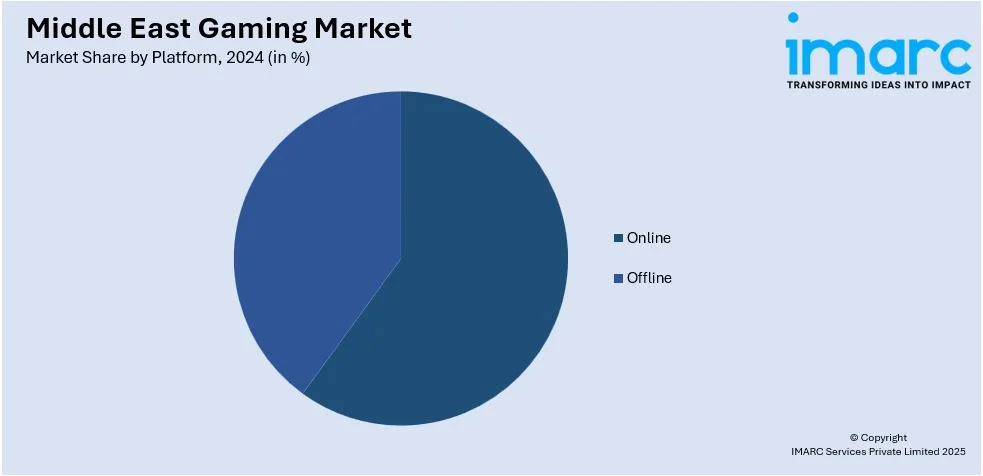

Analysis by Platform:

- Online

- Offline

Online gaming is becoming more popular due to improvements in internet infrastructure, cloud gaming technology and multiplayer features. It facilitates worldwide connections, eSports involvement and offers a large game library without needing physical copies. Subscription based models and microtransactions act as significant revenue drivers for online gaming.

Offline gaming continues to be significant for players looking for immersive experiences without requiring internet access. Single-player games on consoles, computers and mobile devices appeal to gamers through story-focused narratives and challenges. In areas with restricted internet connectivity or expensive data charges, offline platforms are favored that promotes greater accessibility.

Analysis by Revenue:

- In-Game Purchase

- Game Purchase

- Advertising

In-game revenue generate income by providing gamers with extra content like virtual items, characters, and skins. The rise of free-to-play games has established microtransactions as a leading model, particularly in mobile gaming. This model enables players to improve their gaming experience without initial expenses. Seasonal passes, loot boxes and customizable features create ongoing income and enhance player involvement.

Traditional game purchases involve one-time payments for physical or digital copies of games. This model prevails in both console and computer markets, especially for AAA games that possess significant production value. Exclusive launches, special editions and premium game features contribute to revenue generation. Even with the trend of subscriptions and free-to-play formats, game purchases continue to be a significant category for dedicated gamers.

Advertising revenue is generated by incorporating advertisements into games, especially on mobile platforms. Incentivized advertisements, banners and video advertisements enable developers to earn revenue from free games without directly charging players. The growth of programmatic advertising and user targeting enhances its efficiency, establishing it as a vital income source for mobile gaming developers.

Analysis by Type:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

Adventure and RPGs appeal to players seeking immersive storytelling, character growth and exploration. These games often feature expansive worlds and intricate narratives, keeping players engaged for extended periods. Popular among console and computer users, this genre thrives on high production values and innovation.

Social games enable interaction with friends or communities, often leveraging platforms like Facebook or mobile apps. These games thrive on multiplayer elements, creating a sense of connection and competition.

Strategy games challenge players to think critically and plan, appealing to competitive gamers. Turn-based or real-time strategy games attract players who enjoy tactical decision-making. This genre thrives on mobile and computers, often monetized through in-game purchases for resources or upgrades.

Simulation games replicate real-world activities, allowing players to manage resources, build or simulate experiences. This genre’s appeal lies in creativity and realistic experiences, attracting both casual and dedicated players.

Analysis by Age Group:

- Adult

- Children

The adult gaming segment dominates the market due to the broader age range in this group. Adults gravitate toward immersive games like RPGs, strategy and first-person shooters, which offer complex gameplay and advanced graphics. This group also contributes significantly to in-game purchases and subscriptions, particularly in competitive gaming and online multiplayer platforms.

This segment focuses on educational, creative and family-friendly games. These titles often prioritize simple mechanics, vibrant visuals and non-violent content that appeals to both children and parents. Games that foster creativity and learning while promoting safe online environments are preferred by parents. This segment thrives on mobile platforms and consoles, with revenue driven by game purchases and subscriptions tailored for younger audiences.

Country Analysis:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Saudi Arabia dominates the Middle east market through high investments in gaming and eSports infrastructure. Saudi Vision 2030 is the government's program, which targets economic diversification, as well as digital entertainment development. Demand for consoles, mobile gaming, and eSports tournaments are driven by region's young population.

Turkey plays a significant role because of increased internet penetration and its large youth population. Mobile gaming is predominant, with a strong popularity for casual and strategy games. Regional game development studios and increased gaming exports also contribute significantly to this market.

Gaming market in the Israel benefits from its strong technology sector and innovative game development studios. Mobile gaming is prominent, and the country exports many globally successful titles. A highly skilled workforce and focus on digital entertainment drive Israel’s position in the regional market.

The UAE is a hub for gaming and eSports, supported by its advanced digital infrastructure. The country hosts international gaming events and has an expanding community of competitive gamers. Mobile gaming and virtual reality (VR) experiences are particularly popular among its diverse population.

Despite economic sanctions, Iran’s gaming market thrives due to a large, youthful population and widespread mobile usage. Localized content and mobile games dominate, catering to cultural preferences. Domestic game developers play a significant role in meeting demand.

Iraq’s gaming market is emerging, driven by increasing internet penetration and a growing interest in mobile gaming. Infrastructure development and rising smartphone adoption are key the key factors offering a favorable market outlook.

Qatar’s gaming market benefits from growing focus on digital entertainment. The government supports gaming and eSports events and the young population shows strong engagement with mobile and console gaming.

Affluent population in Kuwait drives the demand for premium gaming experiences, including consoles and computers. High internet penetration is favoring the growth of online gaming, while mobile gaming remains a key segment.

Due to affordability and accessibility the gaming market is expanding gradually in Oman. Investments in internet infrastructure and increased awareness of gaming potential contribute to its development.

Jordan’s gaming market benefits from a young, tech-savvy population and its emerging game development industry. Mobile gaming is becoming popular, with local developers creating culturally relevant content.

High smartphone reliance and strengthened internet infrastructure is facilitating the market growth in Bahrain. Mobile and online gaming dominate the market share. Growth of the industry is backed by the initiative in digital entertainment, which is supported by the Government of Bahrain.

Competitive Landscape:

Major players in the Middle East are shaping the gaming ecosystem through investment and innovation. International gaming firms are implementing cutting-edge technologies, high-quality games and region-specific content to broaden their audience. Local developers create region specific games that resonate with the audiences, promoting cultural representation and diversity. These initiatives promote a vibrant, inclusive gaming atmosphere that attracts both international and local players. For instance, in August 2024, Xsolla and Savvy Games Group have entered into a memorandum of understanding (MoU) to promote game development in the Middle East. The collaboration sought to enhance game development, distribution and sector expansion in the area. Key players invest into eSports, organizing tournaments and events that improve the competitiveness of gaming. They work alongside government and private entities to create infrastructure, including gaming centers. Besides this, collaborations with telecom companies enhance internet connectivity, improving the overall gaming experience.

The report provides a comprehensive analysis of the competitive landscape in the Middle East gaming market with detailed profiles of all major companies, including:

- Tencent

- Microsoft Corporation

- Electronic Arts Inc.

- Nintendo Co., Ltd.

- Apple Inc.

- Google LLC.

- NVIDIA Corporation

- Rovio Entertainment Ltd.

- SEGA Corporation

- Tamatem Inc.

Latest News and Developments:

- November 2024: Yalla Esports announced to allocate $125 million to accelerate expansion in the Middle East and North Africa region within two years. The funding was intended to improve esports infrastructure, boost local experiences, and address the increasing demand in the area.

- September 2024: Majid Al Futtaim introduced "Activate," the world’s first active gaming experience, in the Middle East. The initiative aimed to blend physical activity with gaming, offering a unique entertainment experience in the region.

- July 2024: Muller Phipps fully acquired Power League Gaming, strengthening its position in the Middle East gaming market. The acquisition aimed to expand esports operations and increase investment in regional gaming and esports activities.

Middle East Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenues Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Companies Covered | Tencent, Microsoft Corporation, Electronic Arts Inc., Nintendo Co., Ltd., Apple Inc., Google LLC., NVIDIA Corporation, Rovio Entertainment Ltd., SEGA Corporation, Tamatem Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East gaming market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Middle East gaming market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Gaming constitutes the act of playing electronic games on different platforms like consoles, computers, mobile devices, or arcade systems. It encompasses a wide range of genres, including action, strategy, simulation and puzzles, providing entertainment, cognitive challenges and social interaction for players of all ages.

The Middle East gaming market was valued at USD 17.0 Billion in 2024.

IMARC estimates the Middle East gaming market to exhibit a CAGR of 10.77% during 2025-2033.

The gaming market in the Middle East is fueled by widespread smartphone usage, which makes mobile gaming easily accessible. Young and tech-savvy demographic is catalyzing the overall demand for engaging and socially interactive gaming experiences. Government programs encourage the growth of gaming infrastructure and draw international investments in eSports. Localized content and culturally relevant games enhance player engagement and appeal to regional preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)