Middle East Engineering Plastics Market Report by Resin Type (Fluoropolymer, Liquid Crystal Polymer (LCP), Polyamide (PA), Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polyether Ether Ketone (PEEK), Polyethylene Terephthalate (PET), Polyimide (PI), Polymethyl Methacrylate (PMMA), Polyoxymethylene (POM), Styrene Copolymers (ABS and SAN)), End Use Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, and Others), and Country 2026-2034

Market Overview:

Middle East engineering plastics market size reached USD 6,161.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,194.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.86% during 2026-2034. Numerous product innovations and extensive research and development (R&D) activities conducted by leading players represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6,161.6 Million |

|

Market Forecast in 2034

|

USD 11,194.2 Million |

| Market Growth Rate 2026-2034 | 6.86% |

Access the full market insights report Request Sample

Engineering plastics are commonly employed in the production of mechanical components, containers, and packaging materials. Their lightweight nature positions them as a favorable alternative to both metal and ceramics. Moreover, they present notable advantages such as exceptional load capacity, mechanical strength, thermal stability, and durability, all while offering considerable design flexibility. Among the frequently utilized variants of engineering plastics are polyamides (PA), polycarbonates (PC), nylon 6, acrylonitrile butadiene styrene (ABS), and polysulphone (PSU). These materials find widespread application in various sectors, contributing to the manufacturing of items such as car bumpers, dashboard trims, ski boots, helmets, and optical discs. The versatility of engineering plastics makes them integral in diverse industries where their unique combination of properties meets the stringent requirements for various mechanical and design applications.

Middle East Engineering Plastics Market Trends:

The Middle East's engineering plastics market is witnessing substantial growth, driven by the region's expanding industrial landscape and a growing demand for lightweight, durable materials in various sectors. Engineering plastics have emerged as key components in the manufacturing of mechanical parts, containers, and packaging materials across industries such as automotive, electronics, and consumer goods. Their adoption is notably fueled by the preference for these plastics as a viable alternative to traditional materials like metal and ceramics due to their advantageous lightweight properties. In addition to their reduced weight, engineering plastics in the Middle East offer excellent load capacity, mechanical strength, thermal stability, and design flexibility. Common variants such as polyamides (PA), polycarbonates (PC), nylon 6, acrylonitrile butadiene styrene (ABS), and polysulphone (PSU) play pivotal roles in the production of diverse items, including car components, electronic casings, and consumer product components. The automotive sector, in particular, relies on engineering plastics for applications such as car bumpers and dashboard trims. Moreover, the construction industry benefits from their durability and versatility in applications like pipes and fittings. With an increasing emphasis on sustainable practices, the Middle East's engineering plastics market is expected to drive over the forecasted period.

Middle East Engineering Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on resin type and end use industry.

Resin Type Insights:

To get detailed segment analysis of this market Request Sample

- Fluoropolymer

- Ethylenetetrafluoroethylene (ETFE)

- Fluorinated Ethylene-Propylene (FEP)

- Polytetrafluoroethylene (PTFE)

- Polyvinylfluoride (PVF)

- Polyvinylidene Fluoride (PVDF)

- Others

- Liquid Crystal Polymer (LCP)

- Polyamide (PA)

- Aramid

- Polyamide (PA) 6

- Polyamide (PA) 66

- Polyphthalamide

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polyether Ether Ketone (PEEK)

- Polyethylene Terephthalate (PET)

- Polyimide (PI)

- Polymethyl Methacrylate (PMMA)

- Polyoxymethylene (POM)

- Styrene Copolymers (ABS and SAN)

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes fluoropolymer (ethylenetetrafluoroethylene (ETFE), fluorinated ethylene-propylene (FEP), polytetrafluoroethylene (PTFE), polyvinylfluoride (PVF), polyvinylidene fluoride (PVDF), and others), liquid crystal polymer (LCP), polyamide (PA) (aramid, polyamide (PA) 6, polyamide (PA) 66, and polyphthalamide), polybutylene terephthalate (PBT), polycarbonate (PC), polyether ether ketone (PEEK), polyethylene terephthalate (PET), polyimide (PI), polymethyl methacrylate (PMMA), polyoxymethylene (POM), and styrene copolymers (ABS and SAN).

End Use Industry Insights:

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes aerospace, automotive, building and construction, electrical and electronics, industrial and machinery, packaging, and others.

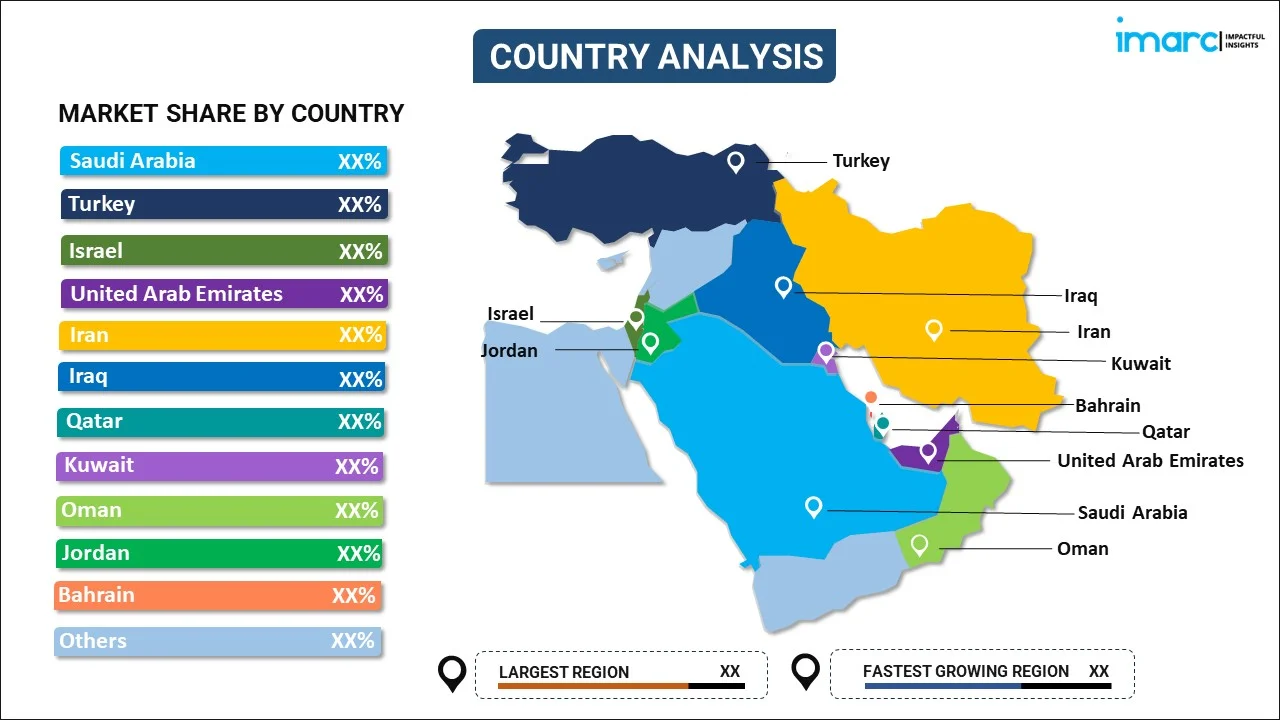

Country Insights:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Middle East Engineering Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Resin Types Covered |

|

| End Use Industries Covered | Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Others |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Middle East engineering plastics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Middle East engineering plastics market?

- What is the breakup of the Middle East engineering plastics market on the basis of resin type?

- What is the breakup of the Middle East engineering plastics market on the basis of end use industry?

- What are the various stages in the value chain of the Middle East engineering plastics market?

- What are the key driving factors and challenges in the Middle East engineering plastics?

- What is the structure of the Middle East engineering plastics market and who are the key players?

- What is the degree of competition in the Middle East engineering plastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East engineering plastics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Middle East engineering plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East engineering plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)