Middle East Edtech Market Report by Sector (Preschool, K-12, Higher Education, and Others), Type (Hardware, Software, Content), Deployment Mode (Cloud-based, On-premises), End User (Individual Learners, Institutes, Enterprises), and Country 2026-2034

Middle East Edtech Market Size:

Middle East edtech market size reached USD 12.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 27.3 Billion by 2034, exhibiting a growth rate (CAGR) of 9.25% during 2026-2034. The increasing internet penetration, rising demand for personalized learning, government initiatives to enhance education, the widespread adoption of artificial intelligence (AI) and digital tools, the shift toward remote learning, and increasing investments in edtech startups are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.3 Billion |

| Market Forecast in 2034 | USD 27.3 Billion |

| Market Growth Rate (2026-2034) | 9.25% |

Access the full market insights report Request Sample

Middle East Edtech Market Analysis:

- Major Market Drivers: The expanding Internet and smartphone penetration, enable broader access to digital education which represents the major driver of the market. Government initiatives prioritizing educational technology including national strategies and funding are crucial in fostering the growth of the market. The demand for personalized and flexible learning solutions is rising, propelled by artificial intelligence (AI) and advanced digital tools.

- Key Market Trends: The proliferation of e-learning platforms and virtual classrooms is driven by the need for remote education solutions which represents the key trends of the Middle East edtech market growth. There is a notable increase in the employment of AI and machine learning to deliver personalized learning experiences, alongside a growing focus on mobile education. The emphasis on STEM education and coding skills is intensifying, supported by gamification techniques to boost engagement.

- Competitive Landscape: The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market faces several challenges such as disparities in internet access, resistance to change in traditional educational institutions, and varying levels of digital infrastructure. However, the market also faces various opportunities including the growing youth population eager for digital learning solutions and government support for educational reform.

Middle East Edtech Market Trends:

Growing Government Policies and Initiatives

Governments of various countries in the Middle East region are actively promoting education technology through national strategies, policies, and funding aimed at integrating digital tools into the education system to improve quality and accessibility. For instance, the Mohammed bin Rashid Smart Learning Programme was launched aiming to shape a new learning environment and culture in government schools in Dubai and the Northern Emirates. The government promoted technology in schools to foster future employment, which is in line with its strategy to introduce computers and tablets in all schools. Similarly, in February 2022, under the umbrella of the “Future Partnerships” initiative, the UAE Government Development and the Future Office launched the “Building Future Talents” initiative, in partnership with Ernst and Young (EY), and the Emirates Schools Establishment (ESE), to build 10,000 UAE public school female students’ skills in the field of science, technology, engineering, and mathematics. This is further boosting the Middle East edtech market revenue.

Increasing Need for Personalized Learning

The rising demand for flexible and personalized learning solutions is driven by advanced technologies such as machine learning and artificial intelligence, catering to individual learning needs and styles. For instance, in March 2024, PowerSchool, a leading provider of cloud-based education software for education, hosted the first edition of its ‘Innovation in Education: UAE Schools’ Summit at Dunecrest American School in Dubai. Sumit focused on key points such as security, data access, responsible use of AI, elevated personalized education, and overall life readiness and workforce development. Firsthand insights and findings about UAE schools and AI-based edtech were revealed during the summit. Specifically designed to help unite the education sector’s thought leaders and schools from across the Emirates, the summit aims to chart a course towards a brighter future. This is further fueling the Middle East edtech market growth.

Increasing Smartphone and Internet Penetration

The rising availability and the widespread adoption of the smartphones and internet are facilitating access to digital education platforms, enabling a broader reach and more effective learning experiences. According to an article by the Gulf News, the UAE ranked 1st globally in terms of mobile internet speed, with the average internet speed in the country being 134.48 megabytes per second (Mbps) while the global average is 30 Mbps. 13th globally in terms of home internet speed, with the average internet speed in the country reaching 124.7 Mbps compared to the global average of 53.46 Mbps. Second globally in terms of Internet usage at the rate of 99% as compared to the global average of 62.5%. The number of Internet users in the UAE stood at 9.935 million. This is influencing the Middle East edtech market statistics significantly.

Middle East Edtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on sector, type, deployment mode, and end user.

Breakup by Sector:

To get detailed segment analysis of this market Request Sample

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. this includes preschool, k-12, higher education, and others.

The demand for edtech in preschool is driven by unique interactive and engaging learning experiences that capture young children's attention. Early exposure to technology helps develop digital literacy skills, while personalized learning paths cater to individual developmental needs. Parental demands for at-home educational tools have increased, especially with the shift to remote learning.

The demand for edtech in the K-12 sector is driven by the need for personalized and adaptive learning experiences, facilitating individual student progress. Enhanced engagement through interactive content and gamification, coupled with increased access to quality education resources, are key factors. The shift to hybrid and remote learning models, accelerated by the COVID-19 pandemic, further fuels demand.

The demand for edtech in higher education is driven by the need for personalized and flexible learning experiences that accommodate diverse student needs and schedules. The growing significance of online courses and degree programs offers increased accessibility and affordability. Advanced technologies such as artificial intelligence (AI), virtual reality (VR), and data analytics enhance learning outcomes and engagement.

Breakup by Type:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

The demand for hardware in the market is driven by the increasing need for reliable and advanced devices to support digital marketing. The shift to online and hybrid education models requires tablets, laptops, and interactive whiteboards for effective learning and teaching. The widespread adoption of technologies such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) necessitates specialized hardware.

The demand for software in the market is driven by the increasing need for flexible and scalable online learning platforms that support remote and hybrid education models. Both nice learning solutions using artificial intelligence (AI) and data analytics enhance student engagement and outcomes. The integration of interactive content, gamification, and collaborative tools fosters a more engaging learning environment.

The demand for content in the market is driven by the rising need for high-quality, culturally relevant, and multilingual educational materials that cater to diverse student populations. The shift to online and hybrid learning models has increased the demand for engaging digital content, including videos, interactive lessons, and e-books. Personalized learning paths and adaptive content powered by AI enhance student engagement and outcomes.

Breakup by Deployment Mode:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

The demand for edtech in cloud-based deployment mode is driven by the need for scalable and flexible solutions that can be accessed anywhere, anytime. Cloud-based platforms support remote and hybrid learning models, offering seamless updates and integrations. They provide cost-effective infrastructure, reducing the need for extensive on-premises hardware. Enhanced data security, storage, and management capabilities appeal to educational institutions.

The demand for edtech in on-premises deployment mode is driven by institutions' need for greater control over their data and systems, ensuring data security and compliance with local regulations. On-premises solutions offer customization to meet specific institutional requirements and provide reliable performance without dependency on internet connectivity. Some educational institutions prefer the predictability of owning and managing their infrastructure.

Breakup by End User:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

The demand for edtech among individual learners is driven by the need for flexible, personalized learning experiences, access to diverse educational resources, and the ability to learn at one's own pace. The convenience of online and mobile learning platforms, coupled with the pursuit of new skills and career advancement, further propels this demand.

The demand for edtech among institutes is driven by the need for scalable and flexible learning solutions, enhanced student engagement, and improved learning outcomes. Institutes seek to integrate advanced technologies like AI and data analytics, support remote and hybrid learning models, and comply with government initiatives and standards for digital education.

The demand for edtech among enterprises is driven by the need for scalable employee training and development solutions, the desire to upskill and reskill the workforce, and the convenience of online learning platforms. Enterprises also seek to enhance productivity, support continuous learning, and leverage advanced technologies like AI for personalized training experiences.

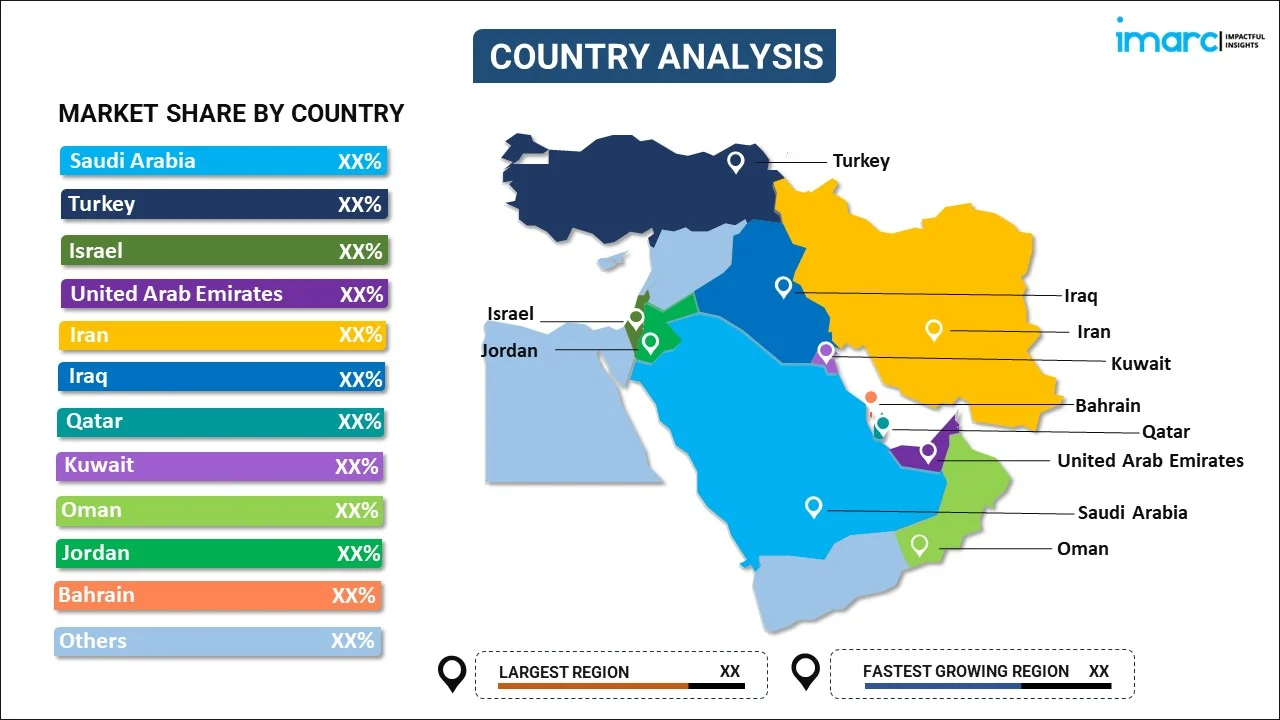

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, and Others.

The demand for edtech in Saudi Arabia is driven by Vision 2030 initiatives promoting digital transformation, government investments in education technology, a young and tech-savvy population, the need for remote and hybrid learning solutions, and a focus on improving STEM education and workforce skills through advanced, personalized learning tools.

The demand for edtech in Turkey is driven by government initiatives to modernize education, increasing internet and smartphone penetration, the need for remote learning solutions, and a focus on enhancing digital literacy. Additionally, investments in STEM education and personalized learning technologies are pivotal in addressing the evolving educational needs of a young, tech-savvy population.

In Israel, the demand for edtech is driven by a strong innovation ecosystem, government support for digital education, high internet, and technology adoption rates, and a focus on STEM education. The country's emphasis on personalized learning and the integration of advanced technologies, such as AI and VR, further propel edtech demand.

The demand for edtech in the United Arab Emirates is driven by government initiatives for digital transformation, high internet penetration, and a tech-savvy population. The focus on personalized and remote learning solutions, significant investments in educational technology, and the need to enhance STEM education and workforce readiness further boost edtech adoption.

The demand for edtech in Iran is driven by the need for accessible remote learning solutions, increasing internet penetration, and government efforts to modernize education. Additionally, a young population eager for digital skills, a focus on STEM education, and the challenges posed by the COVID-19 pandemic have accelerated the adoption of educational technology.

The Iraq edtech market is driven by the need to overcome educational disruptions due to conflict, increasing internet and mobile penetration, and government efforts to rebuild and modernize the education system. Additionally, the push for remote learning solutions, digital literacy, and access to quality education resources further accelerates edtech adoption.

In Qatar, the demand for edtech is driven by government initiatives to enhance digital education, high internet and smartphone penetration, and a focus on personalized and remote learning. Significant investments in technology infrastructure, the emphasis on STEM education, and the need to prepare a tech-savvy workforce also contribute to edtech adoption.

The demand for edtech in Kuwait is driven by government efforts to modernize education, high internet, and technology adoption rates, and the need for remote and hybrid learning solutions. Additionally, a focus on enhancing STEM education, personalized learning experiences, and significant investments in digital infrastructure contributes to the growing market in Kuwait.

In Oman, the market is driven by government initiatives to modernize education, increasing internet and technology adoption, and the need for remote learning solutions. Emphasis on enhancing STEM education, fostering digital literacy, and significant investments in educational technology infrastructure further contribute to the growing market in the country.

The market in Jordan is driven by government initiatives to enhance digital education, high internet penetration, and the need for remote learning solutions. Emphasis on improving STEM education, addressing educational inequalities, fostering digital literacy and significant investments in technology infrastructure further fuel the market's growth.

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The competitor landscape of the Middle East edtech market includes key players such as Alef Education, Noon Academy, and Edraak leading the way. These companies leverage artificial intelligence (AI), personalized learning, and comprehensive digital platforms to attract users. The market is characterized by rapid innovations, strategic partnerships, significant investments with educational institutions and governments, driving competition, and fostering growth in digital education solutions. For instance, in October 2022, UAE-based global education provider Alef Education partnered with Syncogated Edtech, a digital education technology company for a 5-year agreement to provide technical expertise and knowledge in the global education and technology sector. The agreement will mainly allow the two companies to work together to meet the rising demand for digital education by providing students with a holistic digital learning capability.

Middle East Edtech Market News:

- In May 2024, Alef Education planned to offer a 20% stake on the Abu Dhabi Stock Exchange, becoming the first edtech - education technology - company to list in the UAE. The selling shareholders, Tech Nova Investment, Sole Proprietorship, and Kryptonite Investments will offload 1.4 billion shares.

- In January 2024, iStoria, a specialized application for teaching the English language, announced that it had raised $1.3 million in a seat round led by notable investors, including Nama Ventures، Classera, Flat6Labs, BIM Ventures, and several prominent angel investors. With the new financing, the startup plans to enhance the English language learning platform, accelerate innovation, and reach learners worldwide. This recent investment marks a significant milestone in establishing iStoria as a leader in English language education, providing even more value to its consumers.

- In March 2024, Kazakh Ed-Tech startup CodiPlay signed a memorandum of strategic partnership with Artificially Intelligent Learning Assistant (AILA) to integrate advanced CodiPlay educational solutions into 200 schools in Saudi Arabia.

Middle East Edtech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Middle East edtech market performed so far, and how will it perform in the coming years?

- What is the breakup of the Middle East edtech market on the basis of sector?

- What is the breakup of the Middle East edtech market on the basis of type?

- What is the breakup of the Middle East edtech market on the basis of deployment mode?

- What is the breakup of the Middle East edtech market on the basis of end user?

- What are the various stages in the value chain of the Middle East edtech market?

- What are the key driving factors and challenges in the Middle East edtech market?

- What is the structure of the Middle East edtech market, and who are the key players?

- What is the degree of competition in the Middle East edtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East edtech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Middle East edtech market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East edtech industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)