Middle East E-Commerce Market Size, Share, Trends and Forecast by Type, Transaction, and Country, 2025-2033

Middle East E-Commerce Market Size and Share:

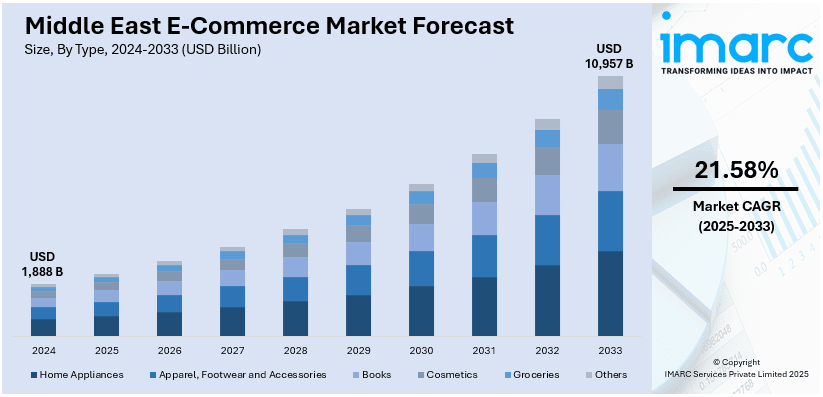

The Middle East e-commerce market size was valued at USD 1,888 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,957 Billion by 2033, exhibiting a CAGR of 21.58% from 2025-2033. The market is driven by rapid digital transformation, high internet and smartphone penetration, and improved digital infrastructure. Government initiatives, such as Saudi Arabia's Vision and UAE's digital innovation strategy, enhance the growth of e-commerce.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,888 Billion |

| Market Forecast in 2033 | USD 10,957 Billion |

| Market Growth Rate (2025-2033) | 21.58% |

The rapid digital transformation in the Middle East is a significant driver of e-commerce growth. High internet penetration, widespread smartphone usage, and improved digital infrastructure are creating a fertile environment for online retail. Along with this, governments in the region are investing heavily in digital economies, fostering innovation and entrepreneurship. For instance, initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s focus on digital innovation are encouraging businesses to adopt e-commerce strategies. Additionally, the growing tech-savvy youth population is driving demand for online shopping platforms, particularly in categories including fashion, electronics, and groceries. Cross-border e-commerce is also flourishing as regional customers increasingly seek diverse and high-quality products, further accelerating the Middle East E-commerce market share.

Consumer preferences in the Middle East are rapidly changing, emphasizing convenience and variety. The proliferation of digital payment systems, such as mobile wallets and contactless payment options, has enhanced consumer confidence in online transactions. On 15th August 2024, Mastercard partnered with Scale to drive fintech growth across Africa and the Middle East by addressing technical and commercial barriers for payment programs. The partnership will simplify the processes of fintechs, telcos, and PSPs by offering BIN sponsorships, payment program design, and card issuing capabilities. Together, they focus on improving financial inclusion, smooth operation, and long-term growth for players within the ecosystem. In addition, logistics advancements, including faster delivery networks and last-mile fulfillment, address the traditional challenges of e-commerce in the region. Social media platforms significantly influence purchasing behavior through localized content and targeted advertising, boosting consumer engagement. Additionally, the COVID-19 pandemic accelerated e-commerce adoption, as consumers turned to online shopping for safety and convenience, establishing it as a key component of the Middle East e-commerce market outlook.

Middle East E-Commerce Market Trends:

Growth of Mobile Commerce (M-Commerce)

Mobile commerce is becoming a leading trend in the Middle East's e-commerce market, driven by high smartphone penetration, especially in countries like the UAE and Saudi Arabia, where consumers increasingly favor mobile platforms for shopping. E-commerce platforms are optimizing mobile-friendly websites and apps to enhance user experiences, catering to tech-savvy shoppers. Along with this, the integration of advanced features such as AI-powered product recommendations, voice search, and seamless payment gateways is further fueling this trend. Mobile wallets, such as Apple Pay and STC Pay, are gaining traction, simplifying transactions and building trust in digital payments. On 30th September 2024, Mastercard and Amazon Payment Services teamed up to digitize payment acceptance in Africa and the Middle East, including UAE, Egypt, and South Africa. The partnership will roll out Mastercard Gateway across 40 markets, enabling faster and more secure transactions for merchants. The solution also introduces new features such as Secure Card on File and token authentication, in response to growing demand in the region for digital payment options. This mobile-first approach is reshaping the e-commerce landscape, making shopping more accessible and convenient for Middle Eastern consumers.

Rise of Social Commerce

Social commerce is revolutionizing the Middle East e-commerce sector, leveraging platforms such as Instagram, Snapchat, and TikTok for direct product sales. Influencer marketing has become a powerful tool, thereby driving engagement and enhancing online shopping through personalized recommendations. Social media platforms now offer integrated shopping features, such as shoppable posts and in-app checkouts, enabling consumers to discover and purchase products seamlessly. This trend is particularly popular among younger demographics who spend significant time on social media and value authenticity in brand interactions. Therefore, this is positively influencing the Middle East e-commerce market growth. On 6th September 2024, Ooredoo Kuwait and Alshaya Group introduced Aura Mobile, a new mobile service that brings together Ooredoo's advanced telecom capabilities with Alshaya's Aura loyalty program. Subscribers in Kuwait can enjoy premium mobile services, 5G connectivity, and exclusive rewards across 50+ Alshaya brands, including H&M and The Cheesecake Factory. Additionally, brands are also utilizing localized content and targeted advertising to cater to the region’s diverse cultures and preferences, fostering deeper connections with their audiences and driving sales through social platforms.

Focus on Hyper-Personalization

Hyper-personalization is becoming a key driver of e-commerce success in the Middle East. E-commerce companies are leveraging artificial intelligence and big data analytics to deliver tailored shopping experiences, from personalized product recommendations to dynamic pricing. This trend is especially impactful in the Middle East, where consumers value premium services and customized solutions. On 25th January 2024, the Cairo- and Dubai-based conversational AI startup DXwand, focused on customer service as well as support to employees in the Middle East, announced $4 million in Series A investment headed by Algebra Ventures and Shorooq Partners. This funding will help DXwand accelerate its rollout across MENA and enhance its offerings of generative AI and multilingual conversational tools. In addition, retailers are increasingly adopting tools such as chatbots, loyalty programs, and email marketing to engage customers on a more personal level. Hyper-personalization also extends to regional preferences, such as language localization, culturally appropriate marketing, and customized payment options. By understanding individual shopper behaviors, brands are building stronger customer relationships, fostering loyalty, and driving higher conversion rates.

Middle East E-Commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Middle East e-commerce market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and transaction.

Analysis by Type:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

The home appliances segment is the growth sector of the market and is growing, enhanced by increasing urbanization and rapidly rising disposable incomes. The demand for convenience and efficiency also increases more for smart appliances, such as robotic vacuum cleaners, air purifiers, and smart refrigerators. Additionally, seasonal sales and attractive offers make online purchases rise on e-commerce platforms. Online shopping has become the preferred choice for modern households in the region, as delivery has become faster due to improvements in logistics networks.

The apparel, footwear, and accessories segment is driven by a fashion-conscious population and the growing influence of social media. Brands utilize online platforms to promote the latest trends, thereby catering to the varied tastes of customers. Low prices, seasonal discounts, and easy return policies have attracted a large customer base. Additionally, regional and international brands are using digital platforms to cater to the increasing demand for luxury and athleisure products among the tech-savvy youth.

Books have witnessed a rise in the market due to a rise in literacy rates and the increasing interest of individuals in reading digital books. The online market offers a variety of genres that range from religious texts to fiction, and even academic materials that cater to varied tastes. Digital books and audiobooks are now being read for their convenience and affordability. Further, discounts, bundled offers, and regional language options make online book purchases all the more appealing throughout the region.

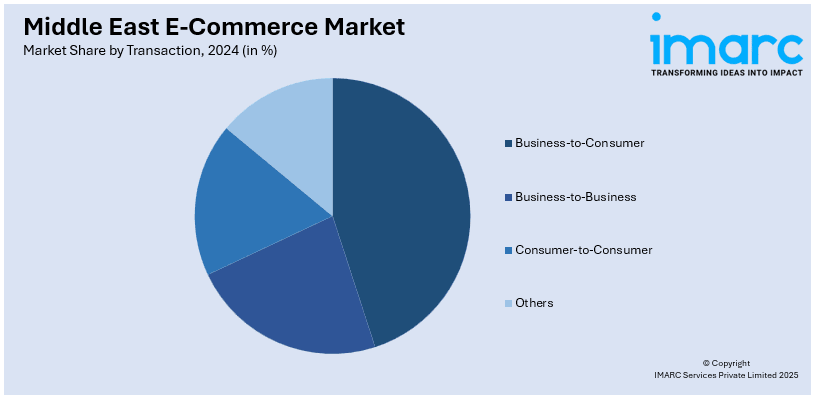

Analysis by Transaction:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

The B2C market area is highly dependent on the developing use of Internet-based retail solutions. Convenience and competitive prices provided by online malls attract the large customer base offered by the sales platforms. Among them are categories such as fashion, electronics, and food products. Easy mobile apps along with delivery were also added points that helped B2C sell online more in an area to comfort-oriented and digital-obsessed customers.

The B2B segment is gaining momentum in the Middle East as businesses increasingly turn to digital platforms for procurement. E-commerce solutions streamline the supply chain by offering transparent pricing, bulk order discounts, and efficient logistics. Industries such as construction, healthcare, and hospitality are prominent users of B2B e-commerce. Additionally, regional initiatives promoting digital transformation and government support for SMEs drive growth in this sector, modernizing traditional business operations.

The C2C segment is expanding in the Middle East, driven by platforms that facilitate peer-to-peer transactions. Online marketplaces and social media provide opportunities for everyone to sell their pre-owned, used, refurbished, or even new products directly to other consumers, including handmade and second-hand crafts. Increased awareness regarding the environment and sustainability can also be seen to contribute to selling second-hand goods. Social commerce trends, easier interfaces, and secure payment avenues are also working in favor of the C2C segment within the region.

Country Analysis:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Saudi Arabia is a leading player in the Middle East e-commerce market, driven by high internet penetration and a tech-savvy population. Government initiatives such as Vision 2030 emphasize digital transformation, encouraging e-commerce adoption. Popular categories include electronics, fashion, and groceries, supported by efficient logistics and payment systems. Rising disposable incomes and a young demographic further fuel demand for online shopping, making Saudi Arabia a hub for regional and international e-commerce platforms.

Turkey's e-commerce market is thriving with a high population and geo-location advantage to Europe and Asia. With strong logistics infrastructure and extensive smartphone penetration, Turkish shoppers increasingly prefer shopping online for clothes, electronics, and cosmetics. Incentives by the government and digital payments adoption are some factors that further push the market growth. In addition, cross-border e-commerce also flourishes since Turkish portals have international customers buying from Turkish portals, with their local production capabilities and aggressive pricing to support the sales growth.

Israel’s e-commerce market is characterized by its tech-savvy population and advanced digital infrastructure. Consumers prefer online platforms for electronics, books, and niche products including high-tech gadgets. Startups and innovation hubs further propel the e-commerce sector with cutting-edge solutions. High smartphone penetration and digital payment adoption enhance the online shopping experience. Cross-border shopping is also prevalent, as Israelis seek diverse product options from international retailers, contributing to market expansion.

Competitive Landscape:

In the competitive landscape of Middle East e-commerce, leading companies are focusing on investing in greater technology and innovations to further improve the overall customer experience. Companies have invested more into perfecting their logistics network, especially to help increase the delivery rates, mitigating the problem in the last mile of delivery. In addition, AI and machine learning are advanced technologies where they apply personalized recommendation in pricing strategies in order to gain better decisions over their mechanisms on pricing. Integration of digital payment options, such as wallets and buy-now-pay-later services, aims to make customers trust it. The platforms also offer local content, multilingual interfaces, and products relevant to the regional population's culture. Promotions, loyalty schemes, and exclusive offers are indispensable for maintaining user acquisition as well as retention. The niche players are capturing market share by offering specific solutions to specific consumer needs.

The report provides a comprehensive analysis of the competitive landscape in the Middle East e-commerce market with detailed profiles of all major companies.

Latest News and Developments:

- December 11, 2024: Worldline partnered with Telr to launch the UAE's latest e-commerce payment solution, aimed at improving efficiency in transactions online in the region. This partnership comes fresh from Worldline's multi-year agreement with Garanti BBVA International on cloud-based instant payments, the move that strengthens digital transformation and compliance in real-time payment.

- November 29, 2024: MyFatoorah, the only licensed PSP across all GCC countries, partnered with Mastercard to launch a new digital payment gateway powered by Mastercard Gateway. The two partners aim to enhance e-commerce through enhanced secure and seamless transactions, improved customer experience, and decreased fraud in the Middle East through serving more than 75,000 merchants.

- August 27, 2024: Apparel Group, opened over 100 new stores in the Middle East and Asia, bringing on board brands such as ASICS, Dune London, and Beverly Hills Polo Club. It expanded its presence in important markets such as India, the UAE, and Saudi Arabia and now runs 2,200 stores around the world. In March 2024, it collaborated with Nykaa to launch the first Nysaa beauty store in Dubai.

- March 6, 2024: SaaS unicorn Zoho announced investing Rs 1,100 crore in Saudi Arabia to strengthen digital infrastructure and support Saudi Vision 2030 through partnerships with local entities. The company is also committing Rs 221 crore annually for 10 years to help SMEs access its 55+ cloud applications. Zoho, with two data centers in Jeddah and Riyadh, 83% of its Saudi team being nationals, and global expansions including Mexico and India, reported a 29% revenue growth, crossing Rs 9,158 crore in FY23.

Middle East E-Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East e-commerce market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Middle East e-commerce market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

E-commerce, or electronic commerce, refers to the buying and selling of goods and services through online platforms. Applications include retail shopping, digital marketplaces, and online banking, with consumers accessing products such as apparel, electronics, and groceries via mobile apps, websites, and social media channels.

The Middle East e-commerce market was valued at USD 1,888 Billion in 2024.

IMARC estimates the Middle East e-commerce market to exhibit a CAGR of 21.58% during 2025-2033.

Rapid digital transformation, high internet and smartphone penetration, improved digital infrastructure, government initiatives such as Saudi Arabia's Vision 2030, and the growing tech-savvy youth population are key drivers of the Middle East e-commerce market, fostering innovation, entrepreneurship, and consumer demand for diverse online shopping experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)