Microwave Devices Market Size, Share, Trends and Forecast by Product Type, Frequency, Application, and Region, 2025-2033

Microwave Devices Market Size and Share:

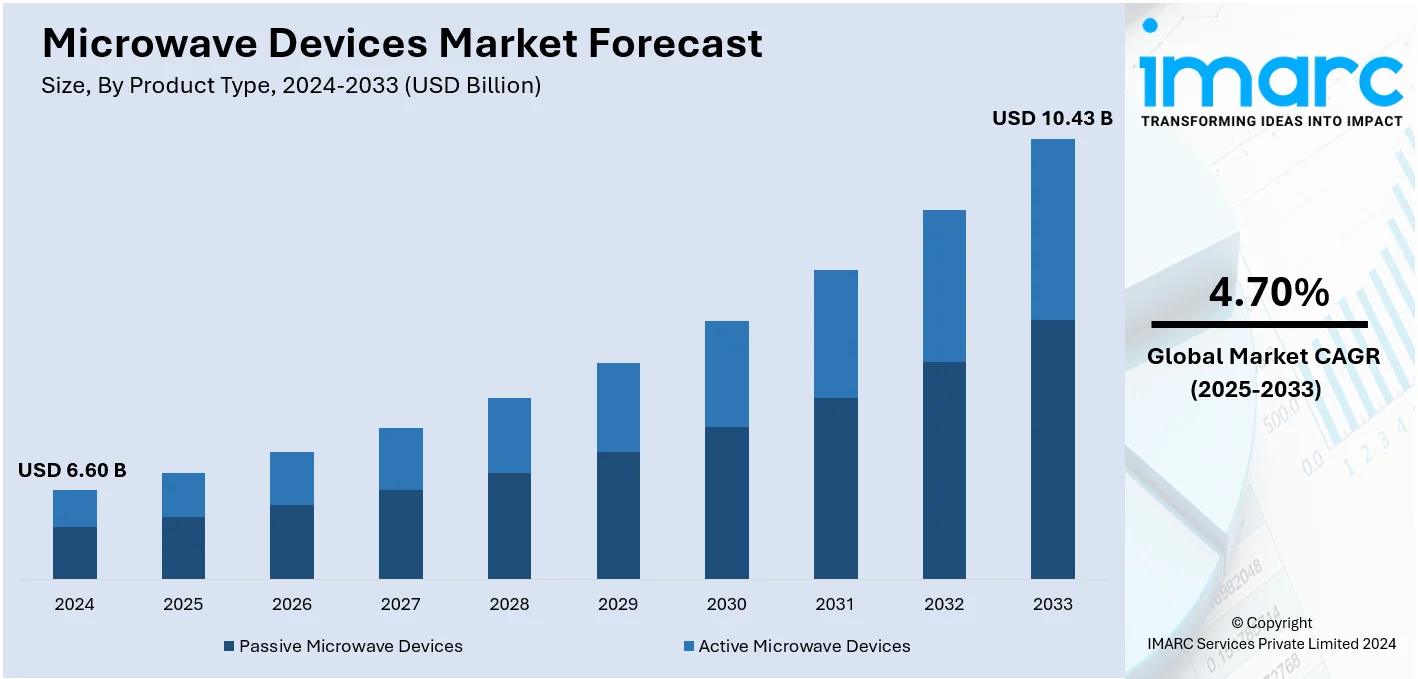

The global microwave devices market size was valued at USD 6.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.43 Billion by 2033, exhibiting a CAGR of 4.70% from 2025-2033. North America currently dominates the market, holding a market share of over 40.2% in 2024. The market is propelled by the increasing demand for advanced communication technologies, rapid growth in satellite communication and space exploration sectors, rise in military and defense expenditures globally, and expansion of radar and security systems applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.60 Billion |

|

Market Forecast in 2033

|

USD 10.43 Billion |

| Market Growth Rate 2025-2033 | 4.70% |

The microwave devices market is experiencing substantial growth, attributed to advancements in communication technologies, defense applications, and industrial automation. The rising global deployment of technologies like 5G networks has heightened demand for high-frequency microwave devices to support seamless data transmission and network efficiency. Additionally, the expanding use of radar systems for military and aviation purposes has significantly contributed to market growth. Innovations in semiconductor technology, such as gallium nitride (GaN) and silicon carbide (SiC), are enabling the production of compact, energy-efficient microwave devices with enhanced performance. The market is further bolstered by applications in healthcare, including diagnostic imaging and non-invasive treatments, showcasing its broad utility across sectors.

In the United States, the microwave devices market is driven by substantial investments in defense and aerospace industries, as well as the growing adoption of 5G infrastructure. The country’s strategic focus on strengthening national security has accelerated the deployment of advanced radar and electronic warfare systems, fueling demand for sophisticated microwave technologies. For instance, in August 2024, Japan and the United States collaborated to develop high-power microwave weapons to disable enemy drones. The partnership combines technical expertise and uses U.S. test sites to accelerate development and reduce operational costs. Moreover, the rise of autonomous vehicles and smart city projects is promoting the use of microwave devices for high-speed communication and sensor integration. With continuous innovation and government support, the U.S. remains a key player in shaping the global microwave devices landscape.

Microwave Devices Market Trends:

Growing Adoption of Microwave Technology in Healthcare

Microwaves are gaining prominence in medical applications, particularly in cancer detection and treatment. Technologies such as microwave imaging enable non-invasive and accurate detection of tumors by differentiating between healthy and malignant tissues based on their dielectric properties. In cancer treatment, microwave ablation is widely utilized to destroy cancerous cells with minimal damage to surrounding healthy tissues. These advancements address the growing demand for efficient, safe, and precise medical solutions. Additionally, the rising prevalence of cancer globally, coupled with the increasing focus on early detection and minimally invasive treatment options, is boosting the adoption of microwave-based medical devices. In 2024, The Medical City (TMC) in the Philippines was recognized for its innovative healthcare initiatives, which led to a 9.2% revenue increase compared to 2022. TMC advanced AI integration in imaging services, introduced minimally invasive treatments like microwave ablation, and excelled in cardiovascular and neurological care. The hospital also won multiple awards, including "Hospital of the Year" at the Healthcare Asia Awards 2024.

Significant Advancements in Radar and Security Systems

Microwave devices play a vital role in modern radar and security systems used in various applications from aviation and maritime navigation to border security and weather forecasting. According to the IMARC GROUP, the global radar system market reached USD 35.0 Billion in 2023, and is expected to reach USD 47.4 Billion by 2032, exhibiting a CAGR of 3.3% during 2024-2032. This growth is fueled by heightened global security concerns and increasing investments in defense infrastructure. Microwave technology is integral in these systems for its ability to provide precise and reliable real-time data. Advancements in this area include the development of more compact and energy-efficient microwave radar devices that can be integrated into various platforms, enhancing detection capabilities and operational readiness in military and civilian sectors.

Rise in Space Exploration and Satellite Communication

The resurgence of interest in space exploration and the expanding capabilities of satellite communications are significantly driving the demand for microwave devices. These devices are essential for communication between spacecraft and Earth stations, as well as for the operation of satellites. As per a report by the IMARC GROUP, the global satellite communication market has reached USD 85.3 Billion in 2023, and is projected to reach USD 171.0 Billion by 2032, exhibiting a CAGR of 8.03% during 2024-2032. This growth is propelled by the increasing number of satellites launches for communication, Earth observation, and navigation purposes. Microwave devices are crucial in enabling high-frequency, long-distance communication required in space missions, making them indispensable for the ongoing expansion and development of global satellite networks, thereby directly influencing the microwave devices market size.

Microwave Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global microwave devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, frequency, and application.

Analysis by Product Type:

- Passive Microwave Devices

- Active Microwave Devices

Active microwave devices hold the largest microwave devices market share due to their critical role in generating, amplifying, and manipulating microwave signals, which are essential functions in a wide range of modern communication and radar systems. Unlike passive microwave devices, which only filter or attenuate signals, active devices actively contribute to signal processing, making them indispensable for high-performance applications that require signal amplification and frequency conversion. These include radar systems used in military, aviation, and weather monitoring, as well as in telecommunications infrastructure for data transmission over long distances without significant loss of signal integrity, shaping the microwave devices market outlook positively.

Analysis by Frequency:

- L Band

- X Band

- S Band

- C Band

- Ku Band

- Ka Band

- Others

Ku bands leads the market with around 30.3% of market share in 2024. This is due to its optimal balance between cost, performance, and application versatility. Operating in the 12-18 GHz range, the Ku band offers significant advantages in terms of transmission range and signal penetration, making it highly suitable for satellite communications, which is a major application area. Its relatively shorter wavelengths allow for smaller antennas with high gain and directivity, which are ideal for both terrestrial and satellite broadcasts. This is particularly beneficial in densely populated urban areas where space is a premium.

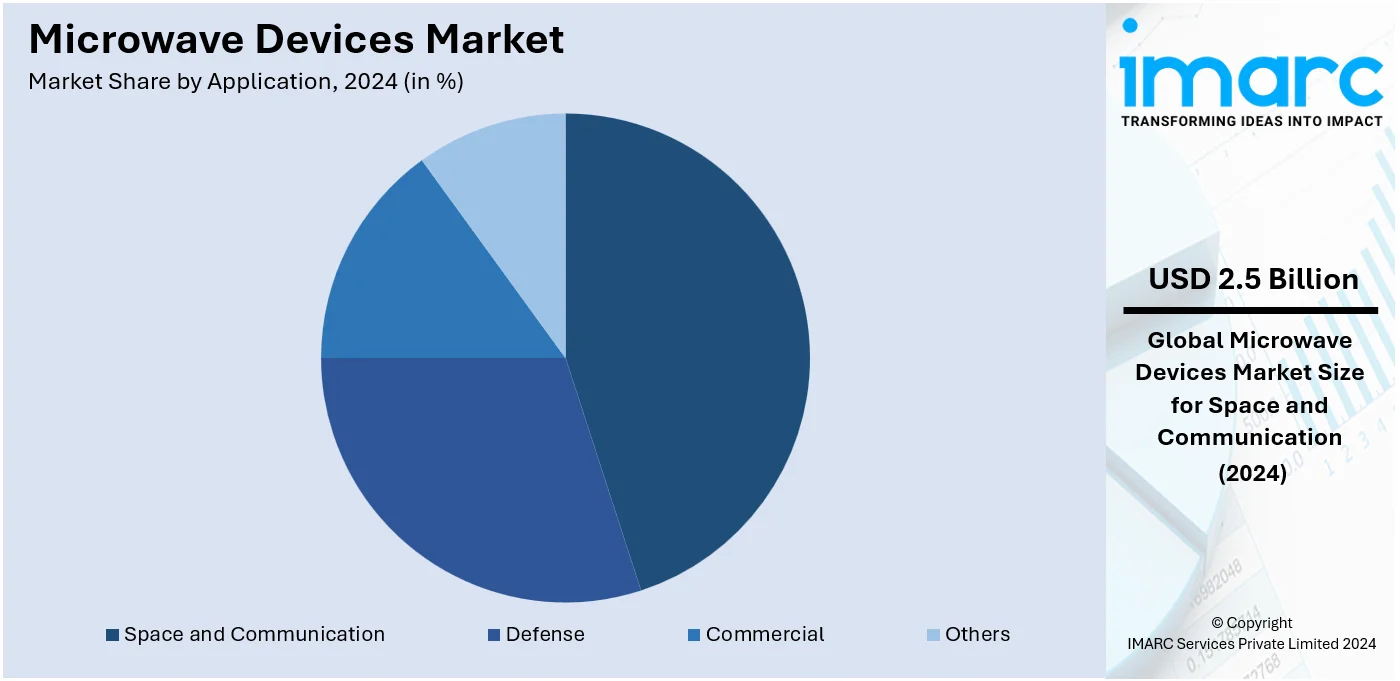

Analysis by Application:

- Defense

- Commercial

- Space and Communication

- Others

Space and communication lead the market with around 37.6% of market share in 2024. The space and communication segment has emerged as the largest in the market breakup by application for microwave devices primarily due to the vital role these devices play in enabling and enhancing communication capabilities across vast distances in outer space environments. Microwave technology is indispensable for satellite communication, which includes transmitting and receiving signals for navigation, data transfer, and connectivity services spanning the globe. The continuous expansion of global satellite networks, driven by the needs of GPS technologies, broadband internet, and mobile connectivity, heavily relies on microwave devices for their efficiency and reliability in high-frequency data transmission. Furthermore, the rise in space exploration missions by governmental and private entities necessitates robust communication systems to ensure successful operation and data exchange between spacecraft and earth stations.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.2%. The region is home to some of the global leading technology and defense companies, which are pivotal in driving innovation and deployment of state-of-the-art microwave technologies. Furthermore, the United States, as the dominant country in this region, maintains one of the highest defense budgets globally, consistently allocating substantial resources toward modernizing its military capabilities, including radar, communication, and electronic warfare systems that extensively utilize microwave devices. This focus, coupled with the presence of a robust aerospace industry, drives microwave devices market growth, supporting demand for solutions in satellite communication and space exploration endeavors.

Key Regional Takeaways:

United States Microwave Devices Market Analysis

In 2024, United States accounted for 80.00% of the market share in North America. The U.S. Department of Defense's (DoD) FY 2024 budget is one of the most important growth drivers for the United States microwave device market. Having allocated USD 145.0 Billion towards Research, Development, Test, and Evaluation, or RDT&E, up 4.0% from FY 2023, the U.S, according to the US department of Defense, is pushing the focus forward on defense innovation and modernization. A significant share of this budget is allocated to the development of improved technologies in communications, radar systems, and electronic warfare, which are based primarily on microwave devices. As military applications like radar, surveillance, and advanced communications systems continue to gain greater prominence in terms of advanced microwave technology, this demand for the most modern solutions will continue to grow. With more investments in high-tech defense systems and a continuing effort to boost the capabilities of operations, the microwave devices market in defense is expected to grow substantially in the future, thereby furthering the long-term growth of the U.S. microwave device market.

Europe Microwave Devices Market Analysis

The defense fund of the European Union for the period 2021-2027, worth nearly Euro 8 Billion (USD 8 Billion), is the main growth enabler for the Europe microwave devices market. Euro 2.7 Billion (USD 2.8 Billion) has been allocated for collaborative defense research, and Euro 5.3 Billion (USD 5.4 Billion) for capability development projects, furthering innovation in defense technologies, according to European commission. Such projects, including advanced communications, radar systems, and electronic warfare, are supported through grants, with up to 100% of eligible costs funded. The focus on small and medium-sized enterprises, mid-caps, and projects linked to the Permanent Structured Cooperation program is further driving innovation and adoption of cutting-edge microwave technologies. As these projects enable improved capabilities of the European defense forces, the demand for advanced microwave systems will increase, ensuring that the Europe microwave devices market will expand significantly over the next few years due to government-backed initiatives and strategic defense partnerships.

Asia Pacific Microwave Devices Market Analysis

China has set a target of deploying over 4.5 million 5G base stations by 2025, along with unveiling new policies and financial initiatives to support sectors anticipated to drive growth over the next decade. This announcement was made by the Ministry of Industry and Information Technology (MIIT) during its annual work conference, as highlighted in industry reports. It will be expected to increase demand for microwave devices in the Asia Pacific region due to this great thrust for 5G infrastructure since these technologies form the heart of 5G communication systems. The base station installation, growing day by day, demands microwave solutions to upgrade signal transmission, data processing, and network optimization.

Furthermore, as mentioned by PIB, the defence production value for FY 2022-23 stood at INR 1,08,684 Crore (USD 1.31 Billion) in India. Defense spending expansion will continue to increase the microwave device demand due to communication, radar technologies, and electronic warfare. These remain some of the prominent drivers for this market in Asia Pacific. Expansions on 5G and investments within the defense sectors are key drivers for the microwave devices market within Asia Pacific.

Latin America Microwave Devices Market Analysis

Defense expenditure in Brazil's 2025 budget proposals is expected to go up by 5.9%, according to industry reports. The anticipated rise in defense expenditures is another factor driving the growth of this market. Going forward, communications systems, radar technologies, electronic warfare, and surveillance applications used in microwave devices will continue gaining a higher demand since Brazil is committed to enhancing its defense capabilities. Advanced defense systems require microwave devices, and Brazil's expanding defense budget is expected to drive demand for high-performance microwave solutions. Brazil's modernization of the defense industry and its need for secure, reliable communication networks will further fuel microwave technologies. Development in 5G networks, including communication infrastructures in Brazil and the greater Latin American continent, is projected to accelerate further demand from the military as well as other industries for microwave devices, supporting further growth for this market.

Middle East and Africa Microwave Devices Market Analysis

Estimated military expenditure in the Middle East alone skyrocketed by a significant 9.0% to USD 200 Billion in 2023, which is the highest annual growth rate in the region since the last decade, according to SIPRI. This increase in defense budgets, particularly in countries such as Saudi Arabia and Israel, is expected to drive demand for advanced technologies, including microwave devices, used in defense applications such as communication systems, radar, and electronic warfare. According to an industry report, military spending increased by 24% to hit USD 27.5 Billion in 2023, coming in second for the region following Saudi Arabia; Israel is very keen on ensuring its military takes the front-line position with upgrading and improving it, further straining the needs for more refined microwave devices in the region. The Middle East and Africa microwave devices market will see significant growth due to growing investments in defense technologies, especially as regional defense expenditures are on the rise.

Competitive Landscape:

Leading companies in the microwave devices market are actively pursuing growth by leveraging strategic partnerships, advancing technological developments, and expanding their presence across diverse regions. Companies are investing heavily in research and development to advance microwave technology, focusing on enhancing efficiency, reducing size, and improving the thermal management of devices. This push toward innovation is particularly evident in the development of GaN-based microwave devices, which offer superior performance over traditional technologies. For instance, in November 2024, MACOM Technology Solutions Inc. announced its selection to lead a CHIPS Act-funded project, developing advanced GaN-on-SiC process technologies for RF and microwave applications, supporting defense, radar, and next-generation telecommunications networks. Additionally, in accordance with the microwave devices market forecast, they are focusing on forming strategic partnerships and acquisitions to broaden their technological capabilities and market reach, driven by growing microwave devices market demand across various applications.

The report provides a comprehensive analysis of the competitive landscape in the microwave devices market with detailed profiles of all major companies, including:

- Analog Devices Inc.

- CPI International Inc.

- Kratos Defense & Security Solutions Inc.

- L3Harris Technologies Inc.

- Littelfuse Inc

- MACOM Technology Solutions

- Microchip Technology Inc.

- Qorvo Inc

- Teledyne Technologies Incorporated

- Thales Group

- Toshiba Corporation

Latest News and Developments:

- October 2024: The Indian Army initiated a tech initiative to combat drone dangers by obtaining high-power microwave (HPM) systems. These systems utilize electromagnetic waves to interfere with drone electronics, providing a non-kinetic approach to incapacitate smaller, nimble drones. This effort additionally backs India's Aatmanirbharta initiative, requiring 50% domestic manufacturing of components for the systems.

- April 2024: BAE Systems has successfully deployed its Weather System Follow-on Microwave (WSF-M) satellite from Vandenberg Space Force Base. The satellite will deliver up-to-the-minute information on environmental elements such as ocean winds and soil moisture to improve US military safety. A second WSF-M satellite is anticipated to be launched in 2026 under a subsequent contract.

- April 2024: SpaceX targeted the launch of the USSF-62 mission, which includes the Weather System Follow-on–Microwave (WSF-M) satellite, from Vandenberg Space Force Base. The satellite will provide critical environmental data, including ocean winds and tropical cyclone intensity, to support military operations. BAE Systems is the prime contractor responsible for the satellite's development and integration.

- February 2024: Anton Paar launched the Multiwave 7101/7301/7501 microwave acid digestion series on January 24, 2025. These instruments use innovative pressure vessel technology to streamline sample digestion, reduce consumable costs, and ensure safety with automated workflows. The series is designed for efficient and compliant digestion in laboratory and regulated environments.

- April 2024: Samsung unveiled the Bespoke AI innovation phase, as well as an array of new products that would be released in India. Among them are the AI-powered air conditioners, microwaves, washing machines, and refrigerators.

- February 2024: Bluefors launched the Microwave Readout Module, which hosts a traveling wave parametric amplifier (TWPA). This technology can provide nearly noise-free, near-quantum signal amplification at millikelvin temperatures and multiplexed readings over a wide frequency range.

- October 2023: CML MICRO, a global leader in communication semiconductors, has successfully completed the acquisition of Microwave Technology, Inc. (MwT), a prominent compound semiconductor company known for its expertise in GaAs and GaN-based MMICs, Discrete Devices, and Hybrid Amplifier Products.

Microwave Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Passive Microwave Devices, Active Microwave Devices |

| Frequencies Covered | L Band, X Band, S Band, C Band, Ku Band, Ka Band, Others |

| Applications Covered | Defense, Commercial, Space and Communication, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., CPI International Inc., Kratos Defense & Security Solutions Inc., L3Harris Technologies Inc., Littelfuse Inc, MACOM Technology Solutions, Microchip Technology Inc., Qorvo Inc, Teledyne Technologies Incorporated, Thales Group, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the microwave devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global microwave devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the microwave devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The microwave devices market was valued at USD 6.60 Billion in 2024.

IMARC estimates the microwave devices market to exhibit a CAGR of 4.70% during 2025-2033.

The market is driven by advancements in communication technologies, increasing demand for radar systems in defense and aviation, and the expansion of 5G networks. Growing applications in satellite communication, weather monitoring, and medical diagnostics further boost demand. Innovations in materials like GaN and SiC enhance performance, supporting market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the microwave devices market include Analog Devices Inc., CPI International Inc., Kratos Defense & Security Solutions Inc., L3Harris Technologies Inc., Littelfuse Inc, MACOM Technology Solutions, Microchip Technology Inc., Qorvo Inc, Teledyne Technologies Incorporated, Thales Group, Toshiba Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)