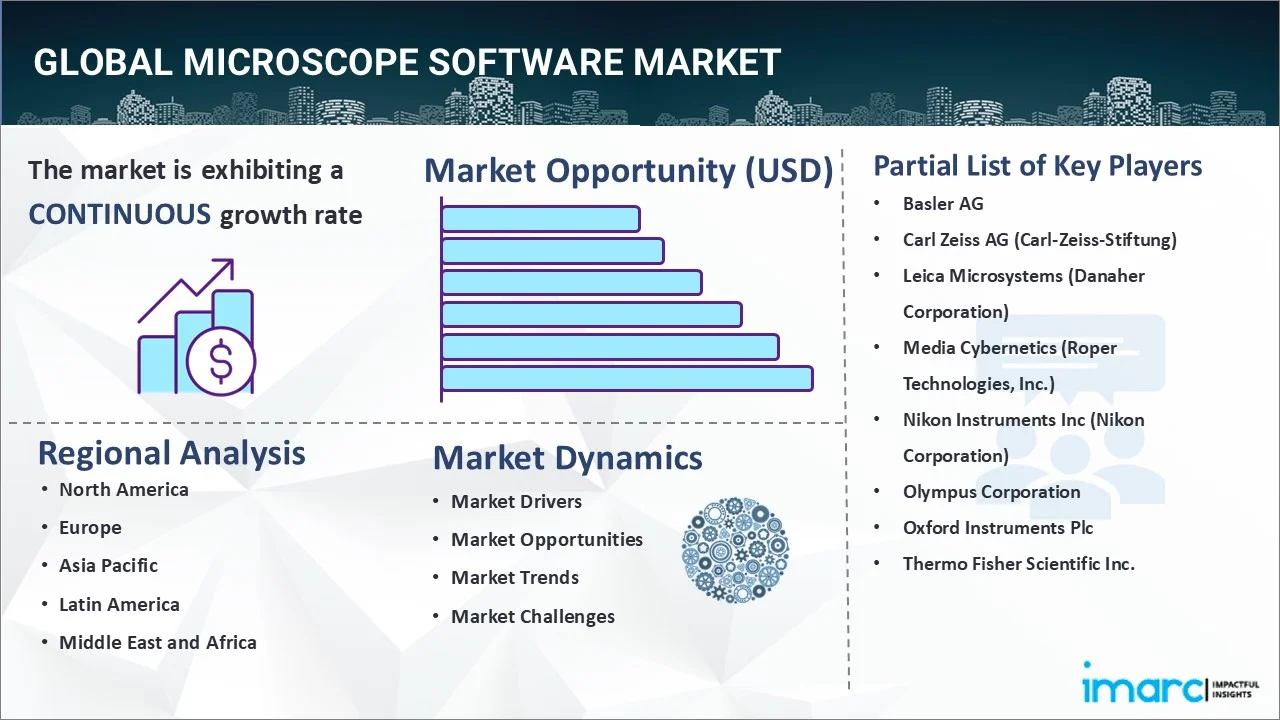

Microscope Software Market Report by Type of Software (Integrated Software, Standalone Software), Type of Microscope (Optical Microscopes, Electron Microscopes, Scanning Probes Microscopes, and Others), Application (Material Science, Nanotechnology, Life Science, Semiconductor, and Others), Region 2025-2033

Microscope Software Market Size:

The global microscope software market size reached USD 897.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,294.8 Million by 2033, exhibiting a growth rate (CAGR) of 10.44% during 2025-2033. The ongoing advancements in imaging technology, extensive research and development (R&D) activities, growing demand for precision diagnostics, product integration with artificial intelligence (AI) and machine learning (ML), and rising investments in life sciences and healthcare sectors are some of the key factors contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 897.8 Million |

| Market Forecast in 2033 | USD 2,294.8 Million |

| Market Growth Rate 2025-2033 | 10.44% |

Microscope Software Market Analysis:

- Major Market Drivers: Continuous improvements in imaging capabilities enhancing resolution and analysis precision is primarily driving the demand for advanced microscope software. In line with this, growing investments in life sciences and healthcare research necessitate sophisticated software solutions for high-resolution imaging and data management, thus supporting the market expansion.

- Key Market Trends: The integration of AI and ML into microscope software, automating complex image analysis, and improving accuracy and efficiency are strengthening the market growth. Moreover, there is a growing need for high-resolution and three-dimensional (3D) imaging capabilities to support detailed research and diagnostic applications, which is fostering the market expansion.

- Geographical Trends: The microscope software market overview shows that North America leads the market due to its advanced research infrastructure, high investment in life sciences, and significant adoption of cutting-edge technology. Furthermore, the life sciences sector is also a major driver in North America, with increasing demand for sophisticated microscope software for research and diagnostics.

- Competitive Landscape: Some of the major market players in the microscope software industry include Basler AG, Carl Zeiss AG (Carl-Zeiss-Stiftung), Leica Microsystems (Danaher Corporation), Media Cybernetics (Roper Technologies, Inc.), Nikon Instruments Inc (Nikon Corporation), Olympus Corporation, Oxford Instruments Plc, Thermo Fisher Scientific Inc., among many others.

- Challenges and Opportunities: The microscope software market forecast highlights the complexity and high cost of electron microscopy as a barrier to widespread product adoption. Meanwhile, rapid technological advancements and the emergence of new players drive innovation, offering opportunities for software developers to create advanced solutions with AI, cloud capabilities, and enhanced data management, thereby bolstering the market growth.

Microscope Software Market Trends:

Integration of AI and ML

The integration of AI and ML into microscope software is revolutionizing the field by enhancing image analysis and processing capabilities is one of the key microscope software market trends propelling the market growth. AI algorithms can automate complex image analysis tasks, such as identifying and quantifying cellular structures or anomalies, with a high degree of accuracy. This reduces the time required for manual analysis and minimizes human error, leading to more reliable and efficient results. Moreover, AI-driven software can learn from vast datasets, improving its performance over time and enabling sophisticated tasks such as pattern recognition and predictive analytics. The growing adoption of AI and ML is also facilitating real-time imaging and decision-making, which is particularly valuable in high-throughput environments like pharmaceutical research and clinical diagnostics, thereby impelling the microscope software market growth.

Rising demand for high-resolution imaging and 3D visualization

The demand for high-resolution imaging and advanced 3D visualization capabilities is leading to the development of more sophisticated microscope software. Software developers are working to improve depth perception and resolution as research and diagnostic applications demand ever-more precise and detailed images. Applications like cancer research, neurobiology, and materials science depend on the ability of scientists and clinicians to see minute structures and minute changes within samples, which is made possible by high-resolution imaging. Moreover, 3D visualization enables users to construct detailed models of biological specimens or materials, providing deeper insights into their spatial relationships and behaviors. Furthermore, the development of software that can handle large volumes of high-resolution data and provide powerful tools for image reconstruction and analysis is contributing to the surging microscope software demand.

Growth in digital pathology and remote access

The expansion of digital pathology and remote access capabilities is also influencing the market growth. The process of digital pathology entails scanning microscope slides into digital images that can be shared, examined, and preserved electronically. This approach facilitates telepathology, where pathologists can review and diagnose cases remotely, improving access to expert opinions and enabling collaboration across geographic boundaries. The demand for remote access, driven by the need for more flexible and efficient workflows, especially in the context of telemedicine and remote diagnostics is aiding in market expansion. Besides this, the integration of software tools for automated slide scanning, image analysis, and data management further enhances the efficiency and accuracy of pathological assessments, providing an impetus to the market growth.

Microscope Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type of software, type of microscope, and application.

Breakup by Type of Software:

- Integrated Software

- Standalone Software

Integrated software accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type of software. This includes integrated software and standalone software. According to the report, integrated software represented the largest segment.

The increasing demand for integrated software due to its comprehensive functionality and enhanced user convenience is boosting the microscope software market share. Integrated software provides a unified platform that combines image acquisition, processing, analysis, and management, in contrast to standalone applications. This integration streamlines workflows, reduces the need for multiple software systems, and minimizes compatibility issues. Users benefit from seamless data transfer and real-time analysis, which is particularly valuable in research and clinical environments requiring precise and efficient results. Additionally, integrated solutions often include advanced features such as automation, AI-driven analysis, and extensive data storage, making them highly attractive for institutions and laboratories aiming for optimized performance and productivity.

Breakup by Type of Microscope:

- Optical Microscopes

- Electron Microscopes

- Scanning Probes Microscopes

- Others

Electron microscopes hold the largest share of the industry

A detailed breakup and analysis of the market based on the type of microscope have also been provided in the report. This includes optical, electron, scanning probes, and other microscopes. According to the report, electron microscopes accounted for the largest market share.

Based on the microscope software market research reports, the rising popularity of electron microscopes owing to their unparalleled resolution and imaging capabilities is positively impacting the market growth. These microscopes use electron beams instead of visible light, allowing them to observe structures at the atomic level, which is crucial for advanced research in materials science, nanotechnology, and biology. Complex software is needed to process data, adjust imaging parameters, and examine high-resolution images due to the intricacy of electron microscopy. As the demand for more detailed insights and precision rises, the reliance on electron microscopes grows, driving the demand for specialized software that enhances their functionality.

Breakup by Application:

- Material Science

- Nanotechnology

- Life Science

- Semiconductor

- Others

Life science represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes material science, nanotechnology, life science, semiconductor, and others. According to the report, life science represented the largest segment.

The widespread product utilization across life science applications like biological research and medical diagnostics is contributing to the market growth. In life sciences, advanced microscopy techniques are essential for studying cellular processes, molecular interactions, and tissue structures. The software used with microscopes in this field enables high-resolution imaging, detailed analysis, and data management, which are crucial for research, drug development, and disease diagnostics. Features such as image quantification, 3D reconstruction, and real-time analysis are particularly important for applications in genomics, proteomics, and pathology. Consequently, the rising demand for precision in biological research and healthcare is bolstering the microscope software market value.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest microscope software market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for microscope software.

North America enjoys the leading position, accounting for the highest microscope software market revenue due to its advanced research infrastructure, significant investment in life sciences, and high adoption of cutting-edge technologies. The region hosts numerous research institutions, biotechnology companies, and healthcare facilities that drive demand for sophisticated microscope software. Additionally, North America benefits from strong technological innovation, with many leading software developers and manufacturers based in the region. Furthermore, high funding for R&D, coupled with a strong emphasis on precision medicine and advanced diagnostics, further propels the growth of the microscope software market. Apart from this, the presence of established market players and a well-developed healthcare system is positively impacting the microscope software market outlook.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the microscope software industry include Basler AG, Carl Zeiss AG (Carl-Zeiss-Stiftung), Leica Microsystems (Danaher Corporation), Media Cybernetics (Roper Technologies, Inc.), Nikon Instruments Inc (Nikon Corporation), Olympus Corporation, Oxford Instruments Plc, Thermo Fisher Scientific Inc., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The competitive landscape is characterized by a mix of established industry players and emerging innovators, each striving to advance microscopy technology and software solutions. Manufacturers leverage their extensive experience and technological expertise to offer comprehensive software that integrates with their high-end microscope systems. Microscope software companies focus on enhancing functionality, such as high-resolution imaging and real-time analysis, to maintain their market leadership. Simultaneously, newer entrants and technology startups are driving innovation by incorporating advanced features like AI, ML, and cloud-based solutions into their software. Competitive dynamics are further influenced by rapid technological advancements, growing research and healthcare demands, and the need for software that can handle increasingly complex data. Strategic partnerships, acquisitions, and investments in R&D are common strategies used to gain a competitive edge and expand its market presence.

Microscope Software Market News:

- In May 2024, Hitachi High-Tech Corporation launched the SU3900SE and SU3800SE High-Resolution Schottky Scanning Electron Microscopes. These new models feature a redesigned specimen stage capable of handling specimens up to 5 kg and 300 mm in diameter, enhancing efficiency and reducing preparation needs. They also include a camera navigation function for comprehensive specimen imaging. The environmentally friendly design cuts CO2 emissions by 50% while delivering high performance.

- In May 2024, Oxford Instruments Andor launched two new benchtop microscopes, expanding its BC43 range. These benchtop microscopes are designed to provide high-performance imaging with cost efficiency and accessibility, offering advanced capabilities typically found in larger, more expensive systems. This expansion aims to broaden access to high-quality microscopy across diverse research fields.

- In April 2023, Nikon Corporation launched the ECLIPSE Ui, Japan’s first digital imaging microscope for medical use. This innovative microscope, distributed through Nikon Solutions Co., Ltd., features a unique eyepiece-free design that enhances pathologist comfort and allows for easy image sharing. Nikon will showcase the ECLIPSE Ui at the Japanese Society of Pathology meeting and plans to expand its availability to the U.S. and Europe, aiming to improve pathological diagnosis workflows.

Microscope Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Softwares Covered | Integrated Software, Standalone Software |

| Type of Microscopes Covered | Optical Microscopes, Electron Microscopes, Scanning Probes Microscopes, Others |

| Applications Covered | Material Science, Nanotechnology, Life Science, Semiconductor, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Basler AG, Carl Zeiss AG (Carl-Zeiss-Stiftung), Leica Microsystems (Danaher Corporation), Media Cybernetics (Roper Technologies, Inc.), Nikon Instruments Inc (Nikon Corporation), Olympus Corporation, Oxford Instruments Plc, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global microscope software market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global microscope software market?

- What is the impact of each driver, restraint, and opportunity on the global microscope software market?

- What are the key regional markets?

- Which countries represent the most attractive microscope software market?

- What is the breakup of the market based on the type of software?

- Which is the most attractive type of software in the microscope software market?

- What is the breakup of the market based on the type of microscope?

- Which is the most attractive type of microscope in the microscope software market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the microscope software market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global microscope software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the microscope software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global microscope software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the microscope software industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)