Micro-Mobility Market Size, Share, Trends and Forecast by Type, Propulsion Type, Sharing Type, Speed, Age Group, Ownership, and Region, 2025-2033

Micro-Mobility Market 2024, Size and Trends:

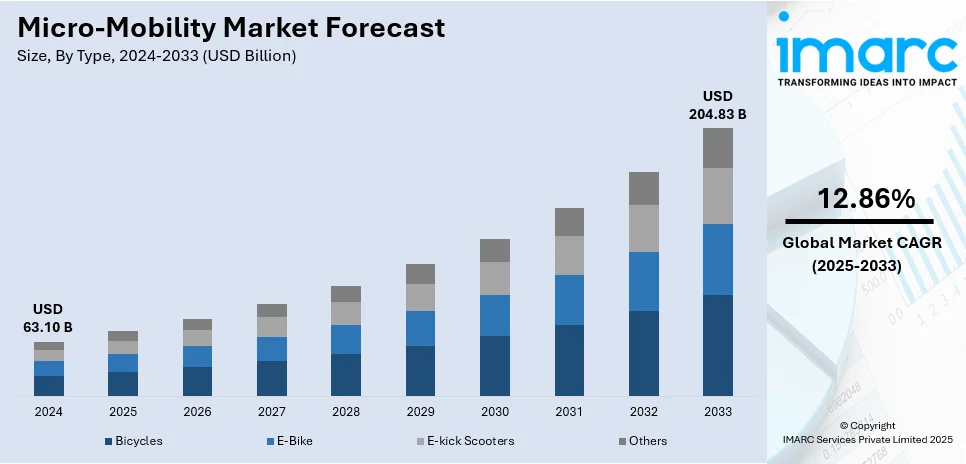

The global micro-mobility market size was valued at USD 63.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 204.83 Billion by 2033, exhibiting a CAGR of 12.86% from 2025-2033. Asia Pacific currently dominates the market with a total micro-mobility market share of 45.0%. The micro-mobility market share in the region is driven by rapid urbanization, increasing traffic congestion, supportive government policies promoting eco-friendly transportation, and the growing adoption of shared mobility services in densely populated cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 63.10 Billion |

| Market Forecast in 2033 | USD 204.83 Billion |

| Market Growth Rate (2025-2033) | 12.86% |

The global micro-mobility market demand is driven by rapid urbanization as it is increasing traffic congestion, pushing commuters toward compact, flexible transport solutions. In addition, rising environmental concerns and government initiatives promoting eco-friendly transportation encourage adoption, aiding the market growth. For example, technological advancements like Google’s project Green Light are enhancing traffic flow, and minimizing pollutants from vehicles that are often parked, further supporting environmental goals. Besides this, ongoing advancements in battery technology enhance the performance and range of e-scooters and bikes, making them more appealing, which is providing an impetus to the market. Moreover, the surge in shared mobility platforms offers affordable and accessible options for users, boosting the market demand. Furthermore, escalating fuel prices drive demand for cost-efficient alternatives, contributing to the market expansion. Also, the growing popularity of connected technologies and app-based services improves user experience, enhancing the micro-mobility market outlook.

The United States micro-mobility market growth is driven by unique factors tailored to its urban and economic landscape. The increased investment in dedicated bike lanes and micro-mobility infrastructure enhances safety and usability, impelling the market demand. In line with this, the rise of multimodal commuting, integrating micro-mobility with public transit, appeals to urban professionals, which is strengthening the micro-mobility market share. For instance, in 2025, The U.S. Department of Transportation revealed new rail projects of $2.4 billion especially for battery electric locomotives to mitigate carbon pollution, further emphasizing the shift towards sustainable transportation. Concurrently, the growing interest in fitness and wellness promotes demand for active mobility options like e-bikes, acting as another growth-inducing factor. Additionally, tech-savvy populations embrace app-based rentals and subscription services, which is contributing to the market expansion. Moreover, strong consumer interest in reducing personal vehicle ownership costs supports the shift, fueling the market demand. Apart from this, seasonal tourism in major cities drives demand for convenient, short-distance travel solutions, thereby propelling the market forward.

Micro-Mobility Market Trends:

Urbanization and Traffic Congestion

The increasing rate of urbanization and the subsequent rise in traffic congestion are transforming the micro-mobility market trends. According to the International Transport Forum, traffic congestion costs cities approximately 1-2% of their GDP annually. With more consumers moving into cities, traditional modes of transportation such as cars are becoming less efficient due to overcrowded roads and limited parking spaces. In many urban environments, short car trips often take longer than expected due to traffic, and finding parking can be time-consuming and expensive. These solutions, including e-scooters or bicycles, provide a quick, convenient, and cost-effective alternative for these shorter trips, often covering the last mile more efficiently than cars. These factors have driven an increasing number of urban dwellers to adopt these solutions, significantly impacting the growth of the market.

Sustainability and Environmental Concerns

There is growing awareness about the environmental impact of our transportation choices, with greenhouse gas emissions from vehicles contributing significantly to global warming. As a response, many consumers are seeking more sustainable alternatives, driving the demand. The European Environment Agency reports that transport contributes 25% of the EU's total greenhouse gas emissions, with road transport being the most significant contributor. Electric bikes and scooters produce no emissions during operation, and even when considering the emissions from electricity generation, they are typically much cleaner than conventional vehicles. Furthermore, these options often replace car trips, they can contribute to improved air quality in urban environments. This drive towards sustainability and increased environmental consciousness among consumers has a considerable impact on the expansion of the micro-mobility market share.

Regulatory Support and Infrastructure Development

Governments and city authorities across the globe are recognizing the potential of micro-mobility in reducing congestion, improving air quality, and creating more livable urban spaces. As such, they are providing more approvals of the solutions, such as establishing specific corridors for the e-scooters and bicycles and changing traffic rules. In addition to policy support, there is an increased emphasis on developing the necessary infrastructure, such as dedicated bike lanes, parking docks, and charging stations. These governmental actions are instrumental in promoting the adoption of micro-mobility and are crucial drivers of the market. As per an industry report, the majority of nations permit e-bikes in bike lanes, with restrictions of 250 W and 25 km/h.

Market Challenges

Bike theft and vandalism are significant challenges for micro-mobility services in many cities. Issues like stolen batteries, helmets, and components such as motors and tires are common. Some providers have had to shut down due to these problems, such as Salem’s bike share program and Voi’s services in Peterborough. In 2019, Mobike lost over 200,000 bikes, and Cardiff’s bike-share program was discontinued after hundreds of thefts and acts of vandalism. Additionally, e-bikes and scooters are often discarded in canals and bins, creating hazards. Weather conditions in Europe also pose a risk, as extreme weather can force companies to pull fleets off the road, impacting profits.

Market Restraints

Advancements in technology and operational efficiency are crucial for the success of micro-mobility platforms. A strong telecom infrastructure is vital for services like navigation, payments, and parking. However, many developing regions, such as parts of Asia Oceania, the Middle East & Africa, and Latin America, lack essential telecom and networking infrastructure, limiting their ability to implement smart projects. While 5G is available in countries like South Korea, Germany, and the US, many developing nations still rely on underdeveloped 4G networks. Budget constraints and low literacy rates further hinder micro-mobility growth, limiting the market's potential.

Micro-Mobility Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global micro-mobility market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, propulsion type, sharing type, speed, age group, and ownership.

Analysis by Type:

- Bicycles

- E-Bike

- E-kick Scooters

- Others

As per the latest micro-mobility market forecast, bicycles have emerged as a prominent mode of transportation, with a share of 85.0% driven by the increasing emphasis on sustainable and eco-friendly modes of commuting. This is leading to a rise in the adoption of bicycles as a clean and green alternative to traditional vehicles. Additionally, growing urbanization and traffic congestion have prompted individuals and cities to seek efficient and flexible means of transportation, with bicycles offering a practical solution for short-distance travel. Along with this, the accelerating health consciousness among consumers has influenced the demand for bicycles, as they not only facilitate physical activity but contribute to improved overall well-being. Moreover, the advancements in technology and the integration of smart features in modern bicycles have further bolstered their appeal to tech-savvy commuters. As these market drivers continue to gain traction, the industry is witnessing a significant expansion, and bicycle types remain at the forefront of this positive transformation.

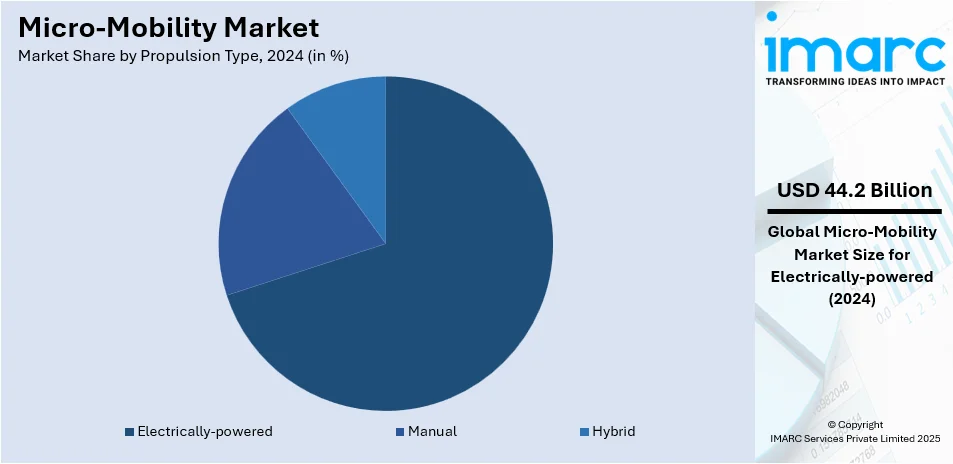

Analysis by Propulsion Type:

- Manual

- Electrically-powered

- Hybrid

The electrically-powered propulsion types are driven by the increasing concern for environmental sustainability. They currently dominate the market with a share of 70.0% as this is encouraging consumers and cities alike to seek greener transportation options. Electrically-powered devices, such as e-scooters and e-bikes, offer emission-free alternatives that align with the growing demand for eco-friendly commuting solutions. Secondly, the convenience and cost-effectiveness of electric propulsion systems appeal to urban dwellers looking for efficient ways to navigate congested city centers. With reduced operational expenses and minimal maintenance requirements, electric micro-mobility options present an attractive choice for both consumers and fleet operators. Additionally, advancements in battery technology have extended the range and improved the performance of electric vehicles, further enhancing their appeal. As these market drivers continue to influence the industry, the adoption of electrically powered propulsion types is poised to expand, reshaping urban transportation landscapes in a sustainable and forward-thinking manner.

Analysis by Sharing Type:

- Docked

- Dock-less

The need for organized and systematic mobility solutions in urban areas has led to the popularity of docked sharing systems exhibiting a share of 54.5%. By providing designated docking stations, these services offer a reliable and convenient means for users to access and return their vehicles efficiently. In addition, the partnership opportunities between several leading companies and city authorities have facilitated the establishment of well-placed docking infrastructure, fostering a seamless integration with existing transportation networks. Moreover, the predictability and accessibility offered by docked sharing systems have garnered trust among users, assuring them of vehicle availability and reducing concerns related to parking and security. Additionally, the potential reduction in sidewalk clutter, compared to dockless models, has gained favor from city planners and residents alike. As these market drivers continue to shape the market landscape, the docked sharing type is poised to play a pivotal role in transforming urban transportation, enhancing efficiency, and contributing to sustainable urban mobility solutions.

Analysis by Speed:

- Less than 25 Kmph

- Above 25 Kmph

The 25 kmph speed limitation has become a significant market driver in the industry due to its alignment with safety and regulatory considerations. Several cities and countries have imposed speed restrictions on micro-mobility devices to ensure the well-being of riders and pedestrians in shared spaces. By capping the speed at 25 kmph, vehicles strike a balance between being fast enough to provide efficient transportation for short-distance trips and being slow enough to mitigate the risk of accidents and collisions. In addition, this speed limitation promotes responsible riding behavior, reducing the likelihood of reckless maneuvers and enhancing overall road safety. Moreover, adhering to such speed limits helps these service providers comply with local regulations, fostering a positive relationship with city authorities and gaining broader acceptance within communities. As a result, the 25 kmph speed limit serves as a crucial market driver, supporting the sustainable growth and integration of these solutions in urban environments.

Analysis by Age Group:

- 15-34

- 35-54

- 55 and Above

The 15-34 age group dominates the market with a share of 65.0% as it is characterized by a strong inclination towards urban living, seeking convenient and flexible transportation options to navigate bustling cityscapes. These services such as e-scooters and bike sharing are ideally suited to their needs for first and last-mile transport needs offering a cost-effective and sustainable means of transport. Additionally, the tech-savvy nature of this age group aligns with the smart and connected features often integrated into vehicles, enhancing their appeal. Also, the 15-34 age group has been very receptive to the changing mobility circumstances owing to their environmentally friendly nature and the spontaneous access to new technologies. As a result, catering to the needs and preferences of this demographic remains crucial for sustained success and expansion within the market.

Analysis by Ownership:

- Business-To-Business

- Business-To-Consumer

The business-to-consumer (B2C) ownership model serves as a prominent market driver in the micro-mobility industry, propelled by the desire for personalized mobility solutions. It encourages individuals to seek ownership of devices such as e-scooters and e-bikes, providing them with greater control over their transportation options. B2C ownership allows users to have unrestricted access to their preferred vehicle whenever needed, enhancing convenience and reducing reliance on other transportation modes. Besides this, another advantage of owning a car is that the total expense per year is less than the repeated rental bills. By investing in their micro-mobility device, consumers can benefit from long-term affordability and avoid recurrent rental expenses. In addition, owning a vehicle empowers individuals to customize and maintain their rides according to their preferences, contributing to a sense of ownership and attachment. As B2C ownership models continue to gain popularity, they play a pivotal role in shaping the market and fostering sustainable and efficient urban transportation solutions for consumers across the globe.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The industry in the Asia Pacific region exhibits a share of 45.0% as is driven by its rapid growth and expansion. Additionally, the region's growing population, along with increasing urbanization and traffic congestion, has created a pressing need for efficient and sustainable transportation solutions. Micro-mobility services, such as bike-sharing and e-scooters, offer a practical and eco-friendly option for short-distance commutes, appealing to the growing number of urban dwellers. In addition, the prevalence of smartphones and the widespread adoption of digital payment systems in Asia Pacific have facilitated seamless access to services through user-friendly mobile applications. This tech-savvy demographic is receptive to app-based mobility solutions, contributing to the industry's success. Apart from this, favorable government policies and initiatives promoting cleaner transportation alternatives have further boosted the sector's prospects in the region. For example, India’s Cabinet has cleared an electric vehicle incentive plan worth $1.3bn to ensure that electric cars will account for 30% of total car sales by 2030, reinforcing the region’s commitment to green transportation. These market drivers are quickly growing, and the micro-mobility industry in the Asia Pacific is now an innovative power that alters urban transport and encourages sustainable mobility.

Key Regional Takeaways:

North America Micro-Mobility Market Analysis

The North America micro-mobility market is witnessing robust growth due the rising urbanization, increasing demand for sustainable transport, and the growth in micro-mobility-related technologies. The possession of urban bicycles has increased in number in cities such as New York, Los Angeles, and Toronto owing to increased investment in bike lanes and micro-mobility infrastructure in the United States and Canada. This is because consumers are increasingly looking for e-scooters, e-bikes, and shared mobility services. Apart from this, government initiatives supporting environmental means of transportation and incentives for EVs form part of it. For example, The US government backed the shift to clean energy with a large amount of funds and $1.3 billion for EV charging and hydrogen refueling, driving the shift to cleaner energy solutions. Furthermore, major players are increasing the number of their vehicles to meet the demand for environmentally friendly personal transportation in urban areas, thereby impelling the market growth.

United States Micro-Mobility Market Analysis

The US micro-mobility market is rapidly growing as people urbanize, become conscious of environmental needs, and opt for more sustainable modes of transport. In 2022, the U.S. sold more than one million e-bikes, and in 2023, North America sold 1.1 million e-bikes, which constituted 8% of the total sales volume, the Department of Energy stated. As the U.S. Department of Transportation claims, this growth displays a preference shift towards micro-mobility. Ride-sharing services, including those from Lime and Bird, now offer larger-scale fleets to cater to this rise in demand. Cities such as San Francisco and New York further boost adoption as they focus efforts on dedicated infrastructure for micro-mobility as a way of reducing carbon footprint. Increased city traffic congestion raises the need to seek more eco-friendly and time-efficient alternatives as opposed to personal vehicles. Government regulations, safety standards, and technological advancements, such as AI-powered navigation, are supporting continued growth. The leading companies are also expanding into new cities, pushing the U.S. market to the forefront of global micro-mobility innovation.

Europe Micro-Mobility Market Analysis

The European micro-mobility market is growing at a tremendous rate, mainly due to increasing urban mobility challenges, environmental sustainability, and government-backed initiatives. As per the data from the European Commission, the European Union registered a 35% increase in micro-mobility vehicle registrations in 2023. Cities like Berlin, Paris, and Amsterdam are the leaders in adopting e-scooters and e-bikes, with over 1.5 million vehicles now in use across the region. Polishing the European Market: Policies, especially on lessening carbon dioxide emissions, with increasing cycling, and pedestrian-infrastructure expansion form the bed for this market to flourish. Recently, according to a 2023 report by the EU allocated EUR 500 million for this micro-mobility ecosystem and has increased since then, growing electric vehicles among others, countries have also increased since the advancements within battery technology; hence, using electric scooters and bikes prove more efficient within countries like Germany and the UK. European manufacturers are strengthening their global presence by exporting their products to international markets.

Asia Pacific Micro-Mobility Market Analysis

The Asia Pacific micro-mobility market is developing at a high rate due to factors such as urbanization, increased disposable income, and a preference for eco-friendly modes of transport. For instance, electric two-wheeler sales in India increased to more than 1.5 million units in 2023, a testament to the growth in the electric mobility segment, as per reports. As per an industry report, currently, China still occupies the lion's share in this region, holding over 20 million e-scooters and e-bikes in use, dating back to 2023. Fast-growing cities, such as Tokyo and Seoul in the region, are making sizeable investments in the micro-mobility infrastructure needed to satisfy their growing need for urban transport efficiency solutions. Due to congestion and pollution-related issues, micro-mobility is now in the mainstream across governments worldwide. Innovation is now being spurred through partnerships between local startups and global players, and technological advancements in AI, battery technology, and IoT are all improving the performance of micro-mobility vehicles.

Latin America Micro-Mobility Market Analysis

The micro-mobility market in Latin America is expanding, driven by rapid urbanization, increasing traffic congestion, and growing environmental awareness. According to an industry report, Brazil is the leader in the region, having sold over 600,000 electric bikes and scooters in 2023. Tembici, one of the major micro-mobility companies in Latin America, reported over 250 million bike journeys across the continent, which translates to a very large number of users. Mexico and Argentina also see significant development, with government policies that advocate for clean sources of energy that can reduce harmful emissions. Micro-mobility service providers like Grin and Lime are multiplying their fleets within the major cities of São Paulo in Brazil and Buenos Aires in Argentina. With 1.8 million people taking micro-mobility services around the region, the market grows gradually. The development of infrastructure for these vehicles is also being concentrated on, and Chile has even set aside funds for dedicated lanes. Partnerships between local operators and international manufacturers are encouraging technological advancements and affordability in the market.

Middle East and Africa Micro-Mobility Market Analysis

The micro-mobility market is gaining momentum in the Middle East and Africa with support from the growth of urbanization, development of infrastructure, and environmental concerns. An industry report suggests that the e-scooter-sharing market in Saudi Arabia is projected to reach 267,100 users by 2029, with user penetration expected to grow from 0.6% in 2025 to 0.7% by 2029. The region is experiencing rising demand for e-bikes and e-scooters, where investments in infrastructure and government initiatives on cleaner transportation have been on the rise. Lime and Circ, among other major players, have been increasing their presence in the cities of Dubai and Cairo and are serving more and more users. There are also new policies in countries such as the UAE that support sustainable urban mobility solutions. Though still an emerging market, the entire market is looking to grow very well in the coming years because the region is becoming greener and moving towards more environment-friendly transport modes.

Competitive Landscape:

The global micro-mobility market is experiencing significant growth due to the incorporation of GPS tracking, mobile apps, and IoT devices to provide users with real-time vehicle location, convenient booking options, and seamless user experiences. Along with this, the escalating number of strategic partnerships with cities, transportation authorities, and private entities to establish mutually beneficial relationships is positively influencing the market. These collaborations often aim to integrate these services into existing public transportation networks and improve last-mile connectivity. In response to growing environmental awareness, several companies are emphasizing sustainability. They are adopting eco-friendly practices such as using renewable energy for charging, utilizing recyclable materials in vehicle construction, and implementing recycling programs for end-of-life vehicles. Apart from this, adhering to local regulations is crucial for micro-mobility companies to maintain a positive relationship with cities and governments. They are actively engaging with policymakers to influence regulations and ensure compliance with local laws, creating a positive market outlook.

The report provides a comprehensive analysis of the competitive landscape in the micro-mobility market with detailed profiles of all major companies, including:

- Accell Group N.V.

- Beam Mobility Holdings Pte. Ltd.

- Bird Rides Inc.

- CycleHop LLC

- Dott

- Lime (Neutron Holdings, Inc)

- Micro Mobility Systems AG

- Neuron Mobility

- Segway Discovery Inc.

Latest News and Developments:

- October 2024: TIER merged with Dott to create a unified micromobility service operating under the Dott brand across 427 cities. The merger integrates 250,000 electric scooters and e-bikes into the Dott app, with rebranding efforts and the transition to Dott expected to be completed by early 2025.

- August 2024: According to The Australian, Beam Mobility secretly deployed hundreds of "phantom" e-scooters in Australia and New Zealand to avoid vehicle registration fees. The company provided false data to understate scooter numbers in cities like Brisbane and Auckland, aiming to boost profits by $150,000.

- July 2024: Neuron announced the installation of AI-powered cameras across its entire fleet of 1,250 e-scooters in Melbourne to detect footpath riding. The ScootSafe Vision system issues real-time warnings and can adjust speed. Developed in-house, the system enhances safety and may eventually collect data to improve city planning.

- June 2024: Segway introduced Segway Care Commercial, a new after-sale service designed for shared micromobility. The initiative offers an extended 12-month warranty covering key components of e-scooters and e-bikes. This service aims to optimize the total cost of ownership and promote sustainability, enhancing profitability for shared mobility providers.

- May 2023: Bird Rides Inc. stated that it would begin offering service in eight additional cities in the US, Canada, and Australia. The company's well-liked micromobility products, including its e-scooters and e-bikes, will reach even more users in these new markets when they launch over the coming spring and summer months, giving more communities access to sustainable and reasonably priced transportation options.

Micro-Mobility Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bicycles, E-Bike, E-kick Scooters, Others |

| Propulsion Types Covered | Manual, Electrically-powered, Hybrid |

| Sharing Types Covered | Docked, Dock-less |

| Speeds Covered | Less than 25 Kmph, Above 25 Kmph |

| Age Groups Covered | 15-34, 35-54, 55 and Above |

| Ownerships Covered | Business-To-Business, Business-To-Consumer |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accell Group N.V., Beam Mobility Holdings Pte. Ltd., Bird Rides Inc., CycleHop LLC, Dott, Lime (Neutron Holdings, Inc), Micro Mobility Systems AG, Neuron Mobility, Segway Discovery Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the micro-mobility market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global micro-mobility market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the micro-mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The micro-mobility market was valued at USD 63.10 Billion in 2024.

IMARC estimates the micro-mobility market to exhibit a CAGR of 12.86% during 2025-2033, reaching USD 204.83 Billion in 2033.

Key factors driving the micro-mobility market include rapid urbanization, increasing traffic congestion, rising environmental concerns, government support for eco-friendly transport, advancements in battery technology, the growth of shared mobility services, and widespread smartphone adoption, all contributing to the demand for sustainable, efficient transportation solutions.

Micro-mobility market suppliers see opportunities in data monetization and connected ecosystems. Innovations include connected e-bikes with SIM modules for cloud communication, anti-theft systems, and remote diagnostics. Companies like Bosch, Ituran, and Spin are developing solutions like GPS tracking, safety features, and AI-driven technologies, aiming to enhance security and growth amid rising urban congestion.

Asia Pacific currently dominates the market, driven by rapid urbanization, high population density, increasing traffic congestion, and a growing demand for eco-friendly transportation. Additionally, widespread smartphone usage, government support for clean mobility, and the rise of shared services are boosting the market demand in the region.

Some of the major players in the micro-mobility market include Accell Group N.V., Beam Mobility Holdings Pte. Ltd., Bird Rides Inc., CycleHop LLC, Dott, Lime (Neutron Holdings, Inc), Micro Mobility Systems AG, Neuron Mobility, Segway Discovery Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)