Micro-LED Display Market Size, Share, Trends and Forecast by Product, Application, Industry Vertical, and Region, 2025-2033

Micro-LED Display Market Size and Share:

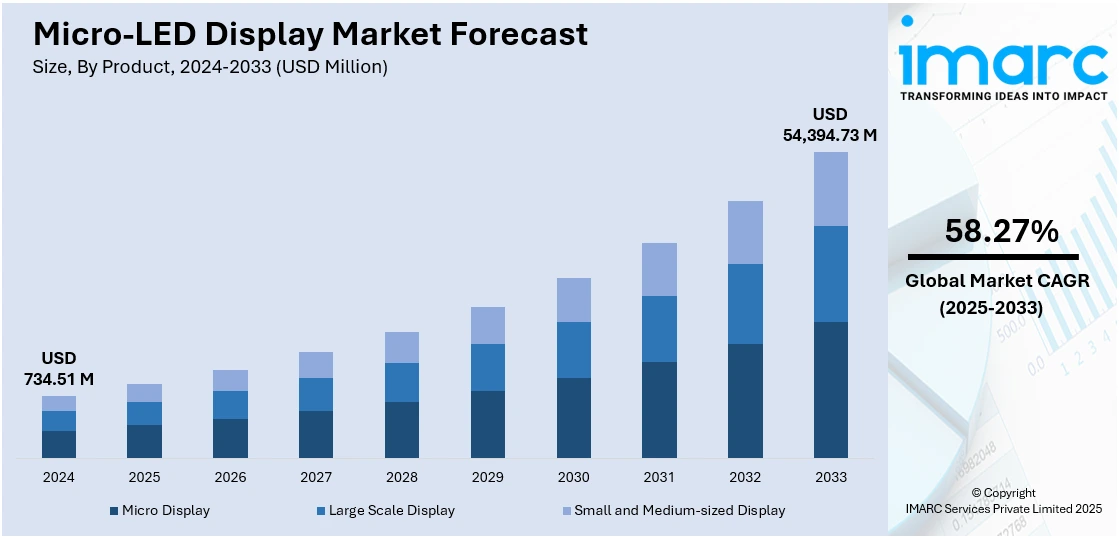

The global Micro-LED display market size was valued at USD 734.51 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 54,394.73 Million by 2033, exhibiting a CAGR of 58.27% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 43.2% in 2024. The dominance of the regions is supported by its advanced infrastructure, strong technological base, and large-scale production capabilities. The Asia Pacific region benefits from concentrated investments in display innovation, efficient component sourcing, and the escalating demand for premium visual technologies. With continuous improvements in fabrication techniques and a highly skilled workforce, the region maintains a competitive edge. This leadership continues to significantly contribute to the expansion of the micro-LED display market share in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 734.51 Million |

|

Market Forecast in 2033

|

USD 54,394.73 Million |

| Market Growth Rate 2025-2033 | 58.27% |

Micro-light emitting diode (LED) technology offers greater brightness, richer blacks, and enhanced contrast ratios in comparison to conventional screens. The quick response time facilitates smoother motion rendering, improving user experience in gaming, video playback, and various high-refresh-rate applications. The precision of colors and broader viewing angles enhance visual quality, positioning micro-LEDs as a favored option for high-end displays. Furthermore, leading tech firms are significantly investing in research and development (R&D) to enhance micro-LED technology. Strategic partnerships, mergers, and licensing agreements for technology are facilitating quicker market entry and enhancing production capabilities. These collaborations additionally facilitate the incorporation of micro-LEDs into a wider variety of products and platforms, enhancing the market's commercial potential.

The United States plays a vital role in the market, fueled by the presence of numerous tech giants and start-ups that are actively investing in micro-LED advancements. Firms are obtaining patents, creating exclusive manufacturing processes, and enhancing mass transfer and chip bonding techniques, which is speeding up commercialization. Moreover, producers are incorporating artificial intelligence (AI) features and broadening content ecosystems to improve user interaction. The combination of intelligent features with high-quality displays is driving innovation in micro-LED technology, fostering wider use in entertainment, lifestyle, and smart home sectors. For example, at CES First Look 2025, Samsung Electronics America launched its AI-driven Vision AI platform across its widest range of TVs, featuring Neo QLED, OLED, QLED, and The Frame. Samsung further extended its Art Store and unveiled micro-LED advancements, featuring access to artwork on micro-LED TVs and the micro-LED Beauty Mirror, integrating smart display technology with personal grooming. These developments emphasize Samsung’s drive for personalized, smart, and interconnected screen experiences.

Micro-LED Display Market Trends:

High brightness and energy efficiency

Micro-LED screens offer greater brightness compared to standard liquid-crystal display (LCD) and organic light-emitting diode (OLED) panels. This proves particularly beneficial for outdoor settings with elevated ambient light, including stadiums and billboards, where visibility is crucial. The European Commission reports that there are approximately 2 to 8 million billboards in Europe at any moment, and this figure continues to rise. Apart from this, the capability to maintain brightness while minimally impacting image quality renders micro-LED displays ideal for individuals that require reliable performance in different lighting situations, thus enhancing the user experience. Micro-LED technology uses less power than conventional display technologies, particularly in bright settings. This is achieved as micro-LEDs emit light directly, eliminating the need for backlighting. Reduced power usage leads to extended battery life in portable gadgets and decreased operational costs in large screens, thus favorably influencing the market growth.

Superior picture quality

Micro-LED technology expands the color range, enabling displays to produce more vibrant and varied colors. This feature enhances the visual experiences of users, particularly in applications that demand color accuracy, such as gaming, films, and photography. For example, it is anticipated that the number of video game players will exceed 3.5 billion active users by 2025. Besides this, micro-LEDs provide uniform color quality across the screen, minimizing color shift and ensuring colors remain accurate from any viewing angle, presenting opportunities for major players. This is crucial for professional uses like graphic design and movie making. Micro-LED screens achieve elevated contrast ratios by activating and deactivating individual pixels. This ability allows for true blacks and vivid highlights, enhancing the overall quality of the image. This enhanced contrast improves the viewing experience, particularly for high dynamic range (HDR) video.

High Scalability

Micro-LED screens are highly scalable, allowing them to be produced in various sizes, ranging from compact wearable displays like smartwatches to large commercial and public screens. As of 2025, there are 454.69 million users of smartwatches globally, representing a 41% rise from the 323.99 million users recorded in 2023. This adaptability allows producers to focus on various market sectors, such as consumer electronics, automotive, retail, and entertainment, which is supporting the market growth. The modular characteristic of Micro-LED technology enables the creation of custom-sized screens without compromising on performance or clarity, making it suitable for unique setups, including art exhibits or expansive digital signage. In contrast to conventional display technologies, micro-LEDs can be scaled without losing high pixel density, enabling large screens to attain ultra-high definition (UHD) or 8K resolution. This ability is essential for uses like home entertainment systems, professional design software, and high-quality monitors that need exact image sharpness.

Micro-LED Display Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Micro-LED display market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and industry vertical.

Analysis by Product:

- Micro Display

- Large Scale Display

- Small and Medium-sized Display

Large scale display holds the biggest share because it is ideal for providing high brightness, seamless scalability, and exceptional image quality across vast viewing areas. This display is perfect for environments that require captivating visual performance, including control centers, public exhibits, commercial promotions, and professional settings. Micro-LED technology facilitates the development of bezel-less modular displays, permitting manufacturers to create tailored screen dimensions without sacrificing resolution or consistency. Its durability against burn-in, extended lifespan, and reduced maintenance needs render it ideal for applications requiring continuous use. Furthermore, the capability to operate consistently in bright ambient light situations enhances its use in both indoor and outdoor settings. Firms are putting resources into perfecting large-panel production and decreasing pixel pitch to improve visual quality and efficiency. These operational and technical advantages are establishing large-scale display as the leading segment in the market.

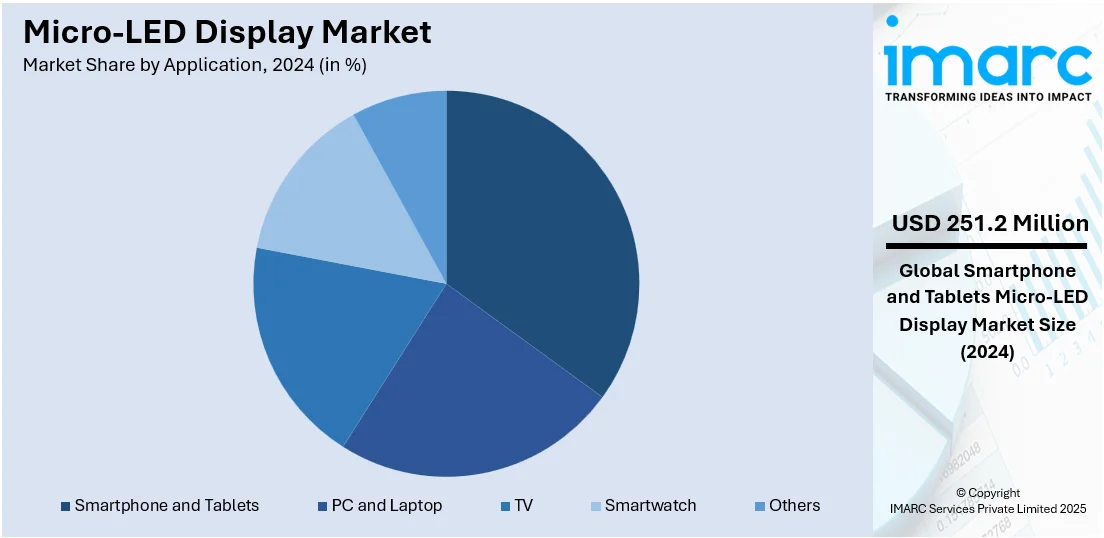

Analysis by Application:

- Smartphone and Tablets

- PC and Laptop

- TV

- Smartwatch

- Others

Smartphone and tablets dominate the market with 34.2%, owing to their extensive usage, demand for high refresh rates, and increasing focus on superior display quality. Individuals value clarity, brightness, and energy efficiency in portable devices, which makes micro-LED technology extremely appealing. Its capability to produce clear images, rich contrast, and minimal power usage greatly improves the user experience in high-performance mobile devices. Device makers are striving to set their products apart by employing cutting-edge display technologies that enhance visibility in different lighting conditions, extend battery life, and create slimmer designs. The compact nature of smartphones and tablets also makes them suitable platforms for early Micro-LED adoption, allowing companies to refine fabrication and integration techniques. Additionally, the quick product upgrade cycles in the mobile device market generate ongoing demand for technological progress. These factors collectively support the leading role of smartphones and tablets in propelling the micro-LED display market growth.

Analysis by Industry Vertical:

- Consumer Electronics

- Entertainment and Sports

- Automotive

- Retail

- Government and Defense

- Others

Consumer electronics represent the largest segment, holding 65.9% of the market share, due to the ongoing need for compact, energy-efficient, and high-resolution display technologies. Users are progressively looking for devices that provide better brightness, contrast, and responsiveness, which micro-LEDs achieve more efficiently than conventional OLED or LCD options. The competition within the consumer electronics industry encourages brands to incorporate cutting-edge display technologies to set their products apart and improve user experiences. Ongoing advancements in product design and form factor, featuring thinner, lighter, and more resilient displays, enhance the adoption of micro-LED technology. The growing emphasis on improving battery longevity and display quality in portable devices corresponds closely with the natural benefits of micro-LEDs. Furthermore, the rising fascination with new technologies like wearable gadgets and immersive screens is driving the need for more sophisticated and tailored display options. As consumer electronics continue to drive the demand for advanced visual technologies, the micro-LED display market forecast reflects strong growth prospects led by innovation in device design, energy efficiency, and display performance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, holding 43.2% market share, because of its robust display technology development ecosystem, established manufacturing infrastructure, and availability of skilled technical talent. For instance, in 2024, South Korea's LG Display unveiled the world’s first 50% stretchable Micro LED display, demonstrated on November 8 in Seoul. The 12-inch RGB screen, made with 40-micron LEDs, stretches to 18 inches with 100 PPI resolution and high durability. The area has transformed into a center for innovation, supported by substantial public and private funding aimed at developing next-generation display technologies. Robust regional interest in high-performance visual technology is propelling the adoption of micro-LED displays in various applications. Moreover, businesses throughout the Asia Pacific region are diligently seeking advancements in miniaturization, energy efficiency, and large-scale production methods, which contribute to lowering the overall cost of micro-LED displays. The area's vertically integrated supply chain, which includes materials, components, and equipment, facilitates quicker turnaround and enhanced quality management.

Key Regional Takeaways:

United States Micro-LED Display Market Analysis

In North America, the market portion held by the United States was 87.50% of the overall total. The United States is experiencing a rise in micro-LED display usage, driven by the growing number of smartwatch users coinciding with the swift expansion of the sports and fitness sector. As per a nationwide health survey carried out in 2024, more than 50 million individuals in America indicated that they frequently use technology to track their health. As users progressively incorporate wearable devices into everyday health tracking and sports performance monitoring, the need for high-quality and efficient displays is rising. Micro-LED display technology provides enhanced brightness, energy efficiency, and durability, meeting user expectations in the sports and fitness sector. This trend is encouraging smartwatch makers to incorporate micro-LED screens into their products to satisfy user demands. The ongoing innovation in the sports and fitness sector and the rising focus on personal wellness are offering positive micro-LED display market outlook. With the rapid increase in smartwatch use among different demographic groups, display manufacturers are leveraging this trend to enhance their market presence.

Europe Micro-LED Display Market Analysis

The micro-LED display market in Europe is experiencing growth attributed to the rising use of personal computing devices, particularly laptops and PCs. For example, in 2024, Germany topped Europe in laptop production sales, totaling 216.85 million euros, with Portugal coming next at 123.74 million euros, and the United Kingdom at 102.11 million euros. With the rise of remote work, digital education, and creative careers requiring excellent screen clarity and effectiveness, micro-LED screens are becoming the ideal display options. Their superior resolution, energy efficiency, and extended lifespan offer significant benefits for prolonged use in professional and educational settings. As manufacturers aim to decrease eye fatigue and improve visual sharpness, micro-LED displays fulfill the changing demands of users in PC and laptop usage. The move toward hybrid work environments is encouraging device makers to focus on advanced display technologies. Moreover, eco-conscious individuals in Europe are leaning towards sustainable and energy-efficient electronics, driving the need for micro-LED solutions. The area's robust technological framework also promotes the quicker integration of these displays into popular devices.

Asia Pacific Micro-LED Display Market Analysis

The Asia-Pacific region is witnessing robust growth in micro-LED display integration fueled by the swift growth of the consumer electronics industry. Reports indicate that the size of the consumer electronics market in India hit USD 83.70 Billion in 2024. IMARC Group anticipates the market to attain USD 152.59 Billion by 2033, showing a growth rate (CAGR) of 6.90% from 2025 to 2033. Rising demand for next-generation display solutions in devices like televisions, gaming consoles, and digital cameras is prompting manufacturers to invest in micro-LED technology. As users in the region demand better image quality, lower power usage, and increased durability, micro-LED displays are emerging as a favored option. The consumer electronics sector is very competitive, leading brands to implement cutting-edge technologies to set their products apart. The capability of Micro-LED to provide ultra-slim, bezel-free designs and exceptional brightness without burn-in problems enhances its growing adoption. Increasing income levels and urban digital lifestyles are further enhancing sales in consumer electronics, establishing micro-LED displays as a crucial facilitator of sophisticated user experiences across diverse product categories in Asia-Pacific.

Latin America Micro-LED Display Market Analysis

Latin America is experiencing a growing adoption of micro-LED display technology, fueled by the increasing number of smartphone and tablet users. For example, Brazil boasts 143.43 million smartphone users, achieving a 66.6% penetration rate among its 215.31 million residents. The increase in mobile device usage is encouraging manufacturers to improve display attributes to meet user expectations for brighter, sharper, and more resilient screens. As smartphones and tablets emerge as key tools for communication, media, and business uses, the uptake of micro-LED displays in this area is speeding up. Micro-LED's capability to provide energy efficiency and vivid visuals aligns perfectly with the growing digital usage trends in Latin America.

Middle East and Africa Micro-LED Display Market Analysis

The demand for micro-LED displays is increasing in the Middle East and Africa due to the expansion of entertainment and sports, as well as advertising billboards, in urban areas. For example, at the start of 2024, there were 294 advertising boards in total, distributed throughout Dubai, including Sheikh Rashid Al Maktoum Road, Al Khail Road, Umm Suqeim Road, and Al Khawaneej Road. Of these, 85 were digital billboards and 209 were static billboards of various kinds and sizes, with the option to convert static into digital formats. Digital billboards are progressively utilizing micro-LED screens for vivid and weatherproof imagery. In sports arenas and entertainment centers, high-definition screens are essential for engaging experiences.

Competitive Landscape:

Major participants in the market are concentrating on improving display resolution, boosting brightness and energy efficiency, and lowering production costs by optimizing processes. They are making significant investments in research operations to tackle issues concerning mass transfer, yield enhancement, and scalability for commercial manufacturing. Strategic alliances, mergers, and acquisitions are being sought to gain access to proprietary technologies, enhance manufacturing capacities, and speed up product development timelines. Initiatives are being implemented to broaden applications in different sectors, such as consumer electronics, automotive screens, and AR and VR interfaces, as companies strive to seize new opportunities and strengthen their standings in the market. In 2025, Plessey Semiconductors and Meta announced the development of the world’s brightest red microLED display for AR glasses with ultra-low power use. This innovation supports Meta’s Orion AR glasses, combining high brightness, resolution, and compact form. The collaboration marks a major step toward mainstream AR adoption.

The report provides a comprehensive analysis of the competitive landscape in the Micro-LED display market with detailed profiles of all major companies, including:

- Aledia

- eLux Inc.

- Innolux Corporation

- Jade Bird Display

- LG Display Co. Ltd. (LG Electronics Inc.)

- Lumens Co. Ltd.

- Nanosys Inc.

- PlayNitride Inc.

- Plessey Semiconductors Ltd.

- Samsung Electronics Co. Ltd.

- Sony Group Corporation

- VueReal

Latest News and Developments:

- April 2025: Samsung announced it would launch a 115-inch RGB micro-LED TV as its new ultra-premium model, distinguishing it from its Neo QLED lineup by using RGB LED backlighting instead of white LED. The RGB micro-LED Display promises higher color purity and contrast, and Samsung plans to release more models following this flagship version.

- March 2025: BOE HC Semi inaugurated a 6-inch micro-LED mass production line in Zhuhai, China, delivering Chip on Wafer (COW) and Micro Pixel Display (MPD) products. The factory aims to produce 24,000 micro-LED wafers and 45,000kk pixel devices annually.

- January 2025: Hisense unveiled its micro-LED TV, the 136-inch 136MX. Featuring over 24.88 million microscopic LEDs, the 136MX delivers exceptional brightness up to 10,000 units and covers 95% of the BT.2020 color space. Its self-emissive pixels also eliminate the need for a traditional backlight, offering near-infinite contrast and deep blacks.

- January 2025: Aledia introduced its micro-LED technology, featuring 3D gallium nitride (GaN) nanowires on silicon. This innovation offers enhanced brightness, energy efficiency, and precise light emission, addressing key challenges in AR hardware.

Micro-LED Display Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Micro Display, Large Scale Display, Small and Medium-sized Display |

| Applications Covered | Smartphone and Tablets, PC and Laptop, TV, Smartwatch, Others |

| Industry Verticals Covered | Consumer Electronics, Entertainment and Sports, Automotive, Retail, Government and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aledia, eLux Inc., Innolux Corporation, Jade Bird Display, LG Display Co. Ltd. (LG Electronics Inc.), Lumens Co. Ltd., Nanosys Inc., PlayNitride Inc., Plessey Semiconductors Ltd., Samsung Electronics Co. Ltd., Sony Group Corporation and VueReal. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Micro-LED display market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Micro-LED display market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Micro-LED display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Micro-LED display market was valued at USD 734.51 Million in 2024.

The Micro-LED display market is projected to exhibit a CAGR of 58.27% during 2025-2033, reaching a value of USD 54,394.73 Million by 2033.

The micro-LED display market is driven by rising demand for high-brightness, energy-efficient screens across consumer electronics, automotive, and wearable devices. Superior contrast, fast response times, and longer lifespan over OLED and LCD technologies are also encouraging investments and accelerating commercialization of micro-LED display solutions globally.

Asia Pacific currently dominates the Micro-LED display market, accounting for a share of 43.2%. The dominance of the region is attributed to advanced manufacturing capabilities, strong supply chain integration, and significant investments in next-generation display technologies. The region’s technological expertise, favorable government support, and increasing demand for high-resolution, energy-efficient displays continue to strengthen its position in the market.

Some of the major players in the Micro-LED display market include Aledia, eLux Inc., Innolux Corporation, Jade Bird Display, LG Display Co. Ltd. (LG Electronics Inc.), Lumens Co. Ltd., Nanosys Inc., PlayNitride Inc., Plessey Semiconductors Ltd., Samsung Electronics Co. Ltd., Sony Group Corporation, VueReal, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)