Micro Learning Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

Micro Learning Market Size and Share:

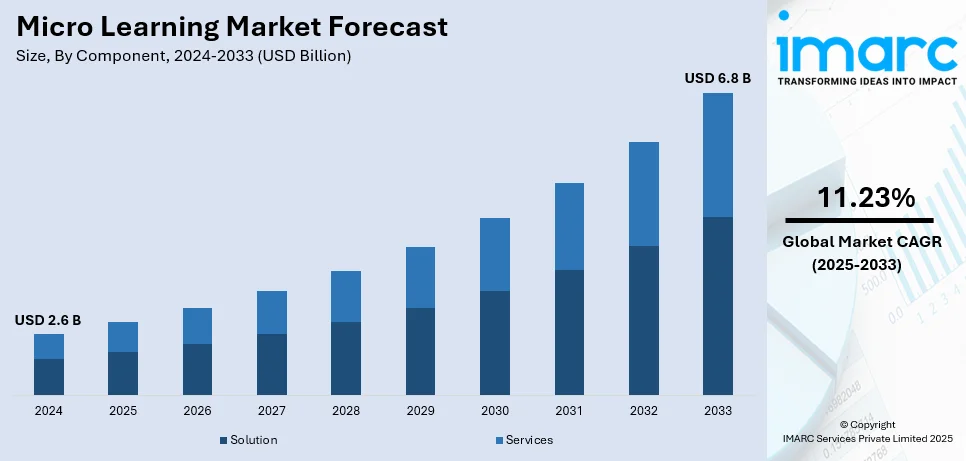

The global micro learning market size was valued at USD 2.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.8 Billion by 2033, exhibiting a CAGR of 11.23% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 32.8% in 2024. The micro-learning market share is driven by rising mobile learning adoption, the need for employee upskilling and reskilling, and advancements in technologies like AI and AR. These factors enhance accessibility, engagement, and efficiency, fueling its widespread adoption across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.6 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Market Growth Rate (2025-2033) | 11.23% |

Several factors drive the micro-learning market, reflecting growing demand for flexible and personalized learning solutions. The fast pace of digital transformation in education and corporate training has increased the adoption of mobile devices and online platforms, thereby making it easier to access bite-sized learning content. The need to acquire new and additional skills that the fast industry requires for sustenance calls on organizations to use micro-learning programs for the creation of targeted training. Changing demographics in the workplace with an ever-increasing prevalence of millennials and Gen Z make this form of learning even more desirable, mainly because it provides engaging, concise, and on-demand learning. Advances in artificial intelligence and learning analytics are also allowing for more customized and adaptive micro-learning experiences, which increase user engagement and retention. Moreover, the cost-effectiveness and scalability of micro-learning solutions make them an attractive choice for businesses and institutions seeking to optimize their training and development strategies.

The United States has emerged as a key regional market for micro-learning due to the demand for suitable and adaptable learning solutions by which organizations and learners are seeking alternative methods for busy times. Apart from this, mobile technology and digital platforms propel the adoption of micro-learning, allowing users to get to the course or micro-learning modules anywhere and anytime. The upskilling and reskilling trends happening constantly within the corporate environment have become very popular with the audience as well since it pushes micro-learning as a new tool that imparts precise knowledge efficiently. This feature in the company sector is one of its major applications. This includes integrating micro-learning for company employees so that the training and development process stays in sync with providing increased productivity and participation. The micro-learning industry, however, is advancing due to the extent to which there is increasing consumer preference for interactive and multimedia-rich content, such as videos, quizzes, and gamified modules.

Micro Learning Market Trends:

Need for advanced learning methods

Traditional learning methods are nowadays considered ineffective as they rely on listening, reading, and observing. As a result, there is a significant need for advanced learning methods, which represents one of the key factors bolstering the growth of the market. Besides this, there is a rise in the demand for high flexibility and variation of jobs, especially among millennials. According to reports, there were 72.7 Million millennials in the US in 2023, constituting 21.7% of the population. This has resulted in half of the workforce consisting of freelancers that work with different projects at different organizations simultaneously, which is contributing to market growth. Approximately 1.57 Billion people in the global workforce are freelancers, according to reports. Furthermore, leading market players are incorporating gamification in micro-learning solutions to increase the overall productivity of employees. They are also using various methods, such as rewards for task completion in case of project management or data contribution or access, which is creating a favorable market outlook. As per reports, 78% of workers work harder and with more drive when their efforts are being rewarded. This can be attributed to the growing adoption of these solutions in schools, universities, and workplaces to continue learning while maintaining social distancing.

Growing adoption of mobile learning platforms

Smartphones and mobile devices revolutionized microlearning hence contributing to the microlearning market growth. As per IMARC Group, the global smartphone market size reached 1,517.0 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 1,998.2 Million Units by 2033, exhibiting a growth rate (CAGR) of 3.08% during 2025-2033. The learning entities and organizations are thus now adopting mobile-friendly learning solutions to cater for short, focused, and on-demand modular contents which can be accessed anytime and anywhere. Modern learners greatly appreciate this since they tend to luxury. They find it streamlined and just in time once any content is made available to them in micro form when compared to traditional course offerings. For instance, m-learning platforms use gamification to allow users interact with learning content, multimedia so that information comes to life, and also tailorable learning paths, all of which will make micro-learning fun and efficient. As the world goes more mobile and remote in working and mobility, plenty of companies are emerging to offer accessible on-the-go learning solutions, pushing the micro-learning market demand.

Technological advancements

The incorporation of advanced technologies such as machine learning, artificial intelligence (AI), and data analytics is revolutionizing the micro-learning landscape. These technologies enable adaptive learning, where content is tailored to the learner's pace, preferences, and performance. AI-powered tools can analyze user behavior and provide real-time feedback, enhancing the overall learning experience. Moreover, immersive technologies like augmented reality (AR) and virtual reality (VR) are being incorporated to create engaging, interactive micro-learning modules. These technological innovations improve learning outcomes and make micro-learning more appealing to diverse audiences, fueling its adoption across industries.

Micro Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global micro learning market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, organization size, and end user.

Analysis by Component:

- Solution

- Services

Solutions stand as the largest component in 2024, holding around 58.8% of the market due to their comprehensive offerings and direct alignment with diverse learning needs. Micro-learning solutions encompass software platforms, learning management systems (LMS), and content development tools, providing organizations with a structured approach to deliver bite-sized, impactful learning experiences. These solutions are often customizable, allowing businesses and educational institutions to tailor content to specific objectives, industries, or learner profiles, making them a preferred choice over standalone services. Furthermore, the growing acceptance of cloud-based programs and mobile-friendly solutions drives this segment's dominance. As per industry reports, over 70% of enterprises will leverage cloud platforms underscoring the growing interest in and importance of industry clouds.

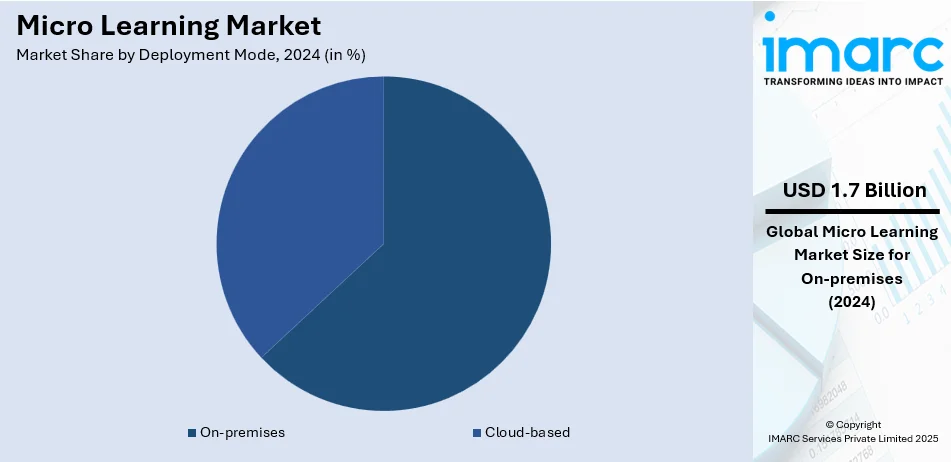

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On premises leads the market with around 63.2% of market share in 2024. The on-premises segment dominates the micro-learning market due to its ability to meet the specific needs of organizations prioritizing data security, customization, and control over learning environments. Many businesses, especially in highly regulated industries like healthcare, finance, and government, require strict compliance with data privacy regulations. On-premises deployment confirms that sensitive data remains within the organization’s infrastructure, minimizing the risk of data breaches and ensuring regulatory obedience. Additionally, on-premises solutions provide greater customization and integration flexibility. Organizations can tailor micro-learning platforms to align with their unique workflows, branding, and training requirements. This level of control is often unavailable in cloud-based models, making on-premises deployment more attractive for businesses with complex or specialized needs.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large companies make up a big part of the micro-learning market as they have a large workforce, solid budgets, and a strong commitment to ongoing employee development. These organizations use micro-learning to provide focused, scalable training solutions that boost productivity and help employees retain skills. The flexible nature of micro-learning allows these companies to create personalized learning paths for various roles, ensuring that employees get the relevant knowledge they need for their jobs. On the other hand, small and medium-sized enterprises (SMEs) are also making their mark in the micro-learning space. They’re finding that micro-learning offers a cost-effective, flexible, and accessible way to train their teams. Since SMEs often work with tighter budgets and fewer resources, micro-learning fits perfectly with their needs, offering both affordability and efficiency. Many SMEs are turning to cloud-based micro-learning platforms, which help them avoid hefty infrastructure costs and make scaling up much easier.

Analysis by End User:

- Retail

- Manufacturing

- Banking, Financial Services and Insurance

- IT and Telecom

- Others

Manufacturing leads the market in 2024. Manufacturing dominates the micro-learning market due to its unique workforce needs and the sector's emphasis on operational efficiency. The manufacturing industry often involves a diverse workforce, ranging from skilled technicians to frontline workers, requiring ongoing training to adapt to rapidly evolving technologies, processes, and compliance standards. Micro-learning meets this need by delivering concise, targeted training modules that fit seamlessly into workers' schedules without disrupting productivity. The rise of Industry 4.0 has further amplified the demand for micro-learning in manufacturing. Advanced technologies like automation, robotics, and IoT necessitate continuous upskilling and reskilling of employees to ensure proficiency in handling complex systems. Micro-learning provides an effective solution to address these needs by offering real-time, role-specific content that can be accessed on mobile devices or augmented reality (AR) platforms, allowing workers to learn on the factory floor.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific leads the market with 32.8% share. The Asia Pacific region has a rapidly growing number of internet users and a high rate of smartphone adoption, especially in countries like China, India, and Southeast Asia. As per ITU, In Asia and the Pacific, internet penetration increased from 61% in 2021 to 64% in 2022, relative to the region's population. These countries have really taken to mobile-first approaches, making micro-learning an easy and effective option for both education and corporate training. Plus, with government support and private investments driving digital transformation initiatives, e-learning platforms are becoming more popular than ever.

Key Regional Takeaways:

United States Micro-Learning Market Analysis

The adoption of micro-learning in the United States is propelled by the growing demand for personalized and flexible learning solutions in corporate and academic settings. Organizations are increasingly turning to micro-learning to address the challenges of employee skill enhancement and knowledge retention. As per reports, 59% of employees say training improves their overall job performance. The integration of advanced technologies, such as artificial intelligence and machine learning, is a key driver in this market. These technologies enable adaptive learning pathways, content personalization, and real-time feedback, enhancing user engagement and learning outcomes. Additionally, the widespread use of smartphones and high-speed internet in the United States supports the seamless delivery of micro-learning content through mobile platforms, catering to the on-the-go learning preferences of the workforce. Besides this, the increasing focus on remote work and hybrid working models is bolstering the market growth. Companies are making investments in e-learning platforms to provide scalable and efficient training solutions to cater to the needs of geographically dispersed teams. Furthermore, the focus on reskilling and upskilling initiatives, driven by technological advancements and shifting job requirements, is amplifying the relevance of micro-learning in workforce development programs. Moreover, the growing emphasis on compliance training in regulated industries such as healthcare, finance, and manufacturing are contributing to the market growth.

Asia Pacific Micro-Learning Market Analysis

The micro-learning market in Asia Pacific is influenced by rapid digital transformation across the region. As per the Ministry of External Affairs Government of India, digital transformation in India is expected to create a USD 1 Trillion economy by 2028. Countries, such as China, India, and Japan, are witnessing significant investments in e-learning infrastructure, driven by the growing need for workforce training and development. The region's high smartphone usage and expanding internet connectivity facilitate the adoption of mobile-based micro-learning solutions, making learning accessible in urban and rural areas alike. In addition, the region’s booming corporate sector, particularly in IT, healthcare, and manufacturing, is a significant contributor to the growth of micro-learning. Companies are leveraging these platforms to address the rising need for continuous skill development and compliance training. The scalability and cost-effectiveness of micro-learning solutions make them particularly appealing to small and medium enterprises (SMEs) in the Asia Pacific region. Furthermore, educational institutions in the region are also embracing micro-learning to supplement traditional teaching methods. This is especially evident in densely populated countries like India, where micro-learning tools help address teacher shortages and provide students with additional learning resources. The increasing popularity of gamified learning experiences is further enhancing the adoption of micro-learning, as it appeals to younger audiences.

Europe Micro-Learning Market Analysis

The rising emphasis on lifelong learning and workforce adaptability is impelling the market growth. Governing agencies and organizations across Europe are prioritizing skill development initiatives to address challenges, such as technological advancements, demographic shifts, and evolving labor market demands. Micro-learning is emerging as a preferred solution due to its ability to deliver targeted and engaging content in a time-efficient manner. Moreover, the increase of digital tools and platforms in Europe is a significant driver. Many companies are integrating micro-learning into their corporate training programs to ensure employees remain competitive in industries undergoing rapid technological change, such as finance, healthcare, and manufacturing. The ability of micro-learning to provide on-demand content aligns with the needs of modern employees. As per reports, in 2023, 30% of EU internet users aged 16 to 74 reported that they had done an online course or used online learning material in the three months prior to the survey. Education systems in Europe are also adopting micro-learning methodologies. Countries like Germany, France, and the UK are incorporating digital learning tools to enhance traditional curricula and make learning more interactive. The focus on STEM education, supported by micro-learning platforms, is helping students acquire essential skills in a modular and engaging manner. Another driver is the rising popularity of gamification and personalized learning experiences. Micro-learning platforms in Europe often employ game-based approaches and data-driven insights to improve learner engagement and retention.

Latin America Micro-Learning Market Analysis

In Latin America, the adoption of micro-learning is influenced by the increasing need for accessible and affordable learning solutions. Many organizations in the region, particularly SMEs, are leveraging micro-learning to address skills gaps and enhance employee productivity without incurring high costs. The expansion of mobile internet and smartphone usage in countries such as Brazil, Mexico, and Colombia play a key role in enabling the widespread use of mobile-based micro-learning platforms. As per reports, the share of smartphones users is 66.6% in Brazil. These tools are particularly effective in reaching remote and underserved communities, addressing regional disparities in education and training access. Additionally, the push for digital transformation by governments and private organizations is fostering the growth of e-learning initiatives, with micro-learning emerging as a critical component. Micro-learning modules, often featuring interactive elements and scenario-based learning, ensure employees can quickly grasp critical compliance requirements, reducing risks and improving performance.

Middle East and Africa Micro-Learning Market Analysis

The Middle East and Africa region is witnessing a growing adoption of micro-learning solutions on account of the need for scalable and efficient training tools in a diverse and geographically dispersed population. The region's improved internet connectivity provide a solid foundation for mobile-first micro-learning platforms. In the MENA region, there were 30 Million 5G connections as of November 2023, as per reports. Industries, such as oil and gas, healthcare, and retail, are adopting micro-learning to deliver compliance training and skill enhancement programs. Apart from this, governing agencies in countries like the UAE and Saudi Arabia are also promoting e-learning initiatives as part of their broader digital transformation strategies, further supporting the adoption of micro-learning. These platforms address the region’s unique challenges by offering flexible, multilingual, and culturally relevant content.

Competitive Landscape:

Key players are following latest micro-learning market trends by creating innovative, engaging, and customizable content tailored to the needs of various industries and learners. They are leveraging cutting-edge technologies like artificial intelligence (AI), machine learning, and augmented reality (AR) to deliver adaptive and immersive learning experiences. For instance, AI-powered tools provide personalized learning paths and real-time feedback, while AR enhances interactivity, making micro-learning more appealing and effective. Besides, market leaders are forming strategic alliances with corporate organizations, educational institutions, and government agencies to expand their customer base and improve market penetration. Collaborations with technology providers also enable them to integrate advanced solutions, such as learning management systems (LMS) and mobile applications, to deliver seamless learning experiences. These partnerships help companies offer holistic solutions and strengthen their competitive edge and create a favorable micro learning market outlook.

The report provides a comprehensive analysis of the competitive landscape in the micro learning market with detailed profiles of all major companies, including:

- Aptara Inc. (Ienergizer)

- Axonify Inc.

- Bigtincan Holdings Limited

- Cornerstone OnDemand Inc.

- Epignosis LLC

- Ispring Solutions Inc.

- Mindtree Limited (Larsen & Toubro Limited)

- Multiversity Pvt. Ltd.

- Neovation Corporation

- Qstream Inc.

- SwissVBS Inn. (BTS Group)

- Tesseract Learning Private Limited

- Valamis Group Ltd.

Latest News and Developments:

- April 2024: Qstream, a leading provider of microlearning and knowledge reinforcement solutions, has launched a new AI-powered Microlearning Content Generator designed to assist training and enablement teams in efficiently creating and delivering engaging microlearning content.

- November 2023: Valamis, a leading innovator in digital learning technology and workforce development, has revealed a strategic partnership with iAM Learning, a renowned provider of engaging and high-quality eLearning solutions. The extensive learning library offered by iAM Learning features a diverse selection of microlearning courses, designed to enable rapid skill enhancement within 5 to 15 minutes.

- September 2023: Axonify, a prominent provider of frontline employee enablement solutions and a Zebra Registered ISV partner, has strengthened its partnership with Zebra Technologies. As one of Zebra's initial co-sales collaborators, Axonify is now working on creating a new learning platform for the company. Together, Axonify and Zebra aim to deliver convenient training solutions directly through the Zebra mobile devices used by frontline employees in their daily tasks. Under this partnership, Zebra will combine its real-time task management features with Axonify's personalized learning and training modules.

- March 2023: Centrical, a performance experience platform designed for frontline employees, has introduced AI Microlearning, a new feature powered by OpenAI's generative AI, ChatGPT. This innovation enables content creators to efficiently produce impactful microlearning materials, including summaries, related Q&A, and knowledge check quizzes.

Micro Learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Users Covered | Retail, Manufacturing, Banking, Financial Services and Insurance, IT and Telecom, and Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aptara Inc. (Ienergizer), Axonify Inc., Bigtincan Holdings Limited, Cornerstone OnDemand Inc., Epignosis LLC, Ispring Solutions Inc., Mindtree Limited (Larsen & Toubro Limited), Multiversity Pvt. Ltd., Neovation Corporation, Qstream Inc., SwissVBS Inn. (BTS Group), Tesseract Learning Private Limited, Valamis Group Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the micro learning market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global micro learning market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the micro learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The micro learning market was valued at USD 2.6 Billion in 2024.

The micro learning market is estimated to exhibit a CAGR of 11.23% during 2025-2033.

The micro-learning market is driven by rising mobile learning adoption, the need for employee upskilling and reskilling, and advancements in technologies like AI and AR. These factors enhance accessibility, engagement, and efficiency, fueling its widespread adoption across industries.

Asia Pacific currently dominates the market due to growing number of internet users and a high rate of smartphone adoption.

Some of the major players in the micro learning market include Aptara Inc. (Ienergizer), Axonify Inc., Bigtincan Holdings Limited, Cornerstone OnDemand Inc., Epignosis LLC, Ispring Solutions Inc., Mindtree Limited (Larsen & Toubro Limited), Multiversity Pvt. Ltd., Neovation Corporation, Qstream Inc., SwissVBS Inn. (BTS Group), Tesseract Learning Private Limited, Valamis Group Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)