Mezcal Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mezcal Market Size and Share:

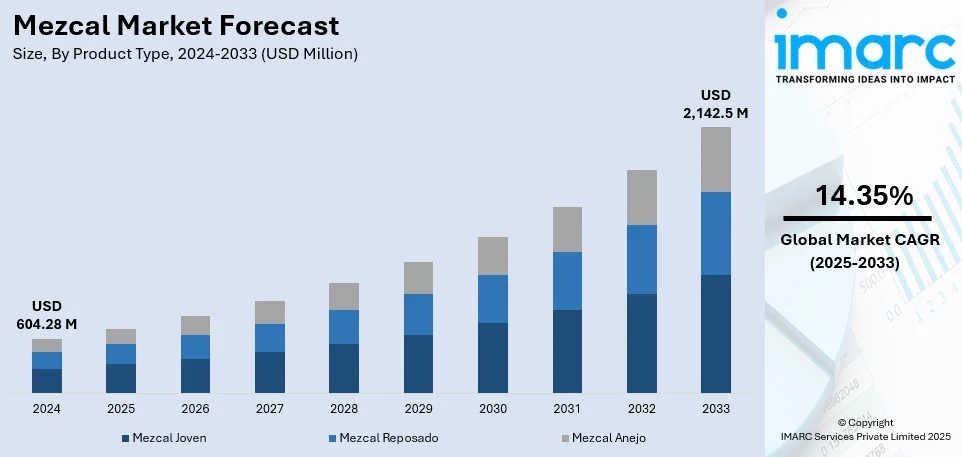

The global mezcal market size was valued at USD 604.28 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,142.5 Million by 2033, exhibiting a CAGR of 14.35% during 2025-2033. North America currently dominates the market, holding a significant market share of 54.7% in 2024. The escalating demand for craft spirits that are carefully crafted through professionals and increasing preferences for unique flavors that provide enhanced taste experience is propelling the market growth. Besides this, the mezcal market share is influenced by rising number of clubs, pubs, resorts, bars, hotels, and other food service establishments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 604.28 Million |

| Market Forecast in 2033 | USD 2,142.5 Million |

| Market Growth Rate (2025-2033) | 14.35% |

Expanding distribution networks are increasing mezcal’s accessibility, thereby propelling market the growth across domestic and international markets. Major spirits companies are investing in mezcal, leveraging extensive supply chains to enhance global reach. Retail availability in premium liquor stores and supermarkets improves visibility, attracting a broader consumer base. Online sales platforms provide direct-to-consumer (D2C) access, allowing brands to reach buyers beyond traditional channels. Duty-free retail in airports exposes international travelers to mezcal, improving brand recognition and export sales. Strategic partnerships with distributors ensure steady supply, maintaining product availability in high-demand regions. Bars and restaurants stock diverse mezcal varieties, promoting trial and repeat purchases among urban consumers. Wholesale expansion into chain retailers introduces mezcal to mainstream buyers, increasing its market penetration. Improved logistics and supply chain efficiencies help maintain consistent quality and inventory levels for global distribution. Mezcal’s presence in subscription-based alcohol services enhances consumer engagement and brand loyalty. Large-scale distributors collaborate with craft producers, helping niche brands scale operations and reach new markets.

Consumers in the United States are shifting towards high-end spirits, fueling mezcal’s premiumization-driven market growth. Artisanal production methods and traditional distillation techniques enhance mezcal’s appeal as a sophisticated, craft spirit choice. Premium mezcal brands emphasize small-batch production, reinforcing authenticity and exclusivity among discerning consumers, which further influences the mezcal market demand across the country. The demand for aged variants increases as consumers seek refined flavor profiles. Luxury positioning allows mezcal producers to command higher price points, improving profitability and brand prestige. High-end cocktail culture integrates premium mezcal, elevating its presence in upscale bars and fine-dining establishments. For example, in June 2024, Viamundi, a Mexican spirits brand, entered the US market with three artisanal offerings, including Raicilla, Sotol, and Mezcal. Co-founded by industry veterans Adam Castelsky and David Weissman, the brand partners with independent Mexican distillers to highlight traditional distillates. Moreover, celebrity-backed mezcal brands contribute to its premium image, attracting affluent consumers and collectors.

Mezcal Market Trends:

Growing demand for craft spirits

The demand for craft spirits is driven by the expansion of the global alcoholic beverages market. Consumers are increasingly preferring unique, artisanal drinks that offer an enhanced tasting experience. In 2024, the market reached USD 1,616.6 Billion, reflecting this evolving trend. Mezcal’s popularity continues to grow because of its traditional production methods and rich, smoky flavor. Skilled artisans carefully roast agave hearts in underground pits, followed by natural fermentation and meticulous distillation. This hands-on approach preserves authenticity and creates complex, distinct flavor profiles. Mezcal’s craftsmanship appeals to consumers seeking high-quality, small-batch spirits with deep cultural heritage. The expanding availability of mezcal in premium bars, restaurants, and retail stores further strengthens its market growth. Additionally, increasing awareness about sustainable and organic production methods enhances its appeal among environmentally conscious buyers.

Increasing preferences for unique flavors

The rising demand for mezcal, driven by evolving consumer preferences, is propelling market growth. Bartenders and mixologists are increasingly using mezcal to craft innovative cocktails with distinctive flavors. Mezcal’s complex profile, ranging from smoky and earthy to fruity and herbal, makes it a preferred ingredient. Reports indicate that 7.4 million people order cocktails at bars, clubs, or restaurants, marking a 13% increase from pre-pandemic levels. Additionally, 43% of cocktail drinkers indulge at least once a week, highlighting consistent demand. Mezcal’s versatility allows bartenders to create signature drinks, attracting consumers seeking unique and adventurous experiences. Expanding cocktail culture and consumer interest in artisanal ingredients continue to drive mezcal’s market expansion. The escalating demand for convenient yet sophisticated alcoholic beverages support mezcal’s position as a key player in the global spirits industry.

Growing Demand for Premium Spirits

The mezcal market outlook is experiencing a significant upturn in demand, fueled by heightened popularity of premium and craft spirits among consumers who are demanding authenticity, heritage, and superior quality ingredients. Mezcal, with its craft production process and distinctive smoky taste, has become a popular brand in the growing premium spirits category. urban consumers are willing to pay a premium for origin-specific and small-batch versions, mirroring a general trend toward alcoholic drinks that are based on story and experience. This is further facilitated by growing awareness of agave spirits, trends in mixology in high-end bars, and celebrity promotions that add prestige to mezcal. Also, export expansion from Mexico to destinations such as the United States and Europe is placing mezcal on the map as a rich, sophisticated spirit. The trend for premiumization will likely continue as distillers get creative with aging processes, organic designation, and small-batch release to address changing consumer tastes.

Thriving travel and tourism industry

The rising demand for mezcal is closely linked to the expansion of the global travel and tourism industry. UN Tourism estimates that international tourist arrivals reached 1.4 billion in 2024, reflecting an 11% increase from 2023. The growing number of clubs, pubs, resorts, bars, and hotels worldwide is further driving the mezcal’s market expansion. Travelers seek immersive and authentic beverage experiences, enhancing their overall relaxation and cultural engagement. Many people visit mezcal-producing regions to witness traditional production methods, interact with local communities, and enjoy mezcal at its source. This firsthand experience deepens appreciation for the spirit and fosters brand loyalty among international consumers. Additionally, tourists share their mezcal experiences through social media and word-of-mouth, increasing product awareness and global sales. The hospitality sector’s focus on offering premium and craft beverages further strengthens mezcal’s position in the global market.

Mezcal Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mezcal market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Mezcal Joven

- Mezcal Reposado

- Mezcal Anejo

Mezcal reposado stand as the largest component in 2024, holding 58.7% of the market. It undergoes oak barrel aging, developing complex flavors that appeal to premium spirit consumers. The aging process mellows the smoky intensity, making it more approachable for mainstream and new drinkers. Consumers appreciate its smoothness and balanced taste, positioning it as a preferred choice over joven mezcal. Bars and restaurants highlight mezcal reposado in premium cocktails, increasing its demand in urban nightlife scenes. The growing premiumization trend encourages consumers to explore aged variants, influencing sales across the globe. Mezcal reposado bridges the gap between joven and añejo, attracting both casual and connoisseur-level drinkers. Higher perceived value and refined taste encourage higher price points, improving profitability for producers and distributors. Craft distilleries emphasize artisanal reposado production, marketing its aging process as a mark of superior quality. Retailers stock mezcal reposado prominently, recognizing its strong consumer preference over unaged alternatives. Aging regulations and controlled production enhance exclusivity, creating a demand for limited-edition releases and collector’s bottles. Whiskey and tequila enthusiasts explore mezcal reposado as a crossover product, expanding its customer base significantly.

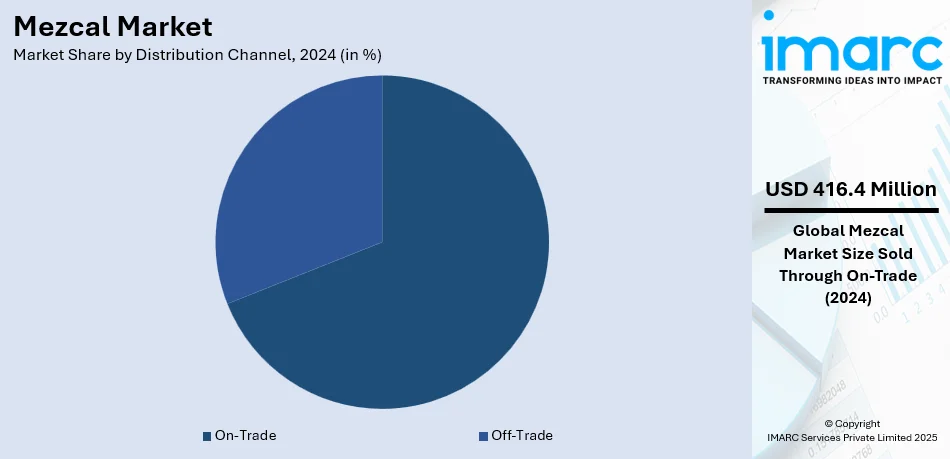

Analysis by Distribution Channel:

- On-Trade

- Off-Trade

On-trade distribution channel leads the market with 68.9% of the overall share in 2024. Bars and restaurants play a crucial role in mezcal’s market expansion through curated tasting experiences. Professional bartenders educate consumers on mezcal’s nuances, increasing awareness and appreciation for the spirit. Cocktail culture drives demand, with mezcal featured in innovative and premium cocktail creations worldwide. High-margin mezcal cocktails encourage bars to stock premium brands, reinforcing its presence in on-trade channels. Social drinking trends and nightlife culture contribute significantly to mezcal’s consumption in urban hospitality venues. The experiential nature of on-premises consumption helps introduce new consumers to mezcal, fueling repeat purchases. Limited-edition and rare mezcal expressions find strong demand in high-end bars, increasing exclusivity appeal. Restaurants pair mezcal with gourmet food, elevating its status as a sophisticated dining accompaniment. Bartender’s recommendation influence purchasing decisions, strengthening brand loyalty and market positioning. Promotional events, tastings, and educational sessions at bars further accelerate mezcal’s on-trade growth. Brand-sponsored collaborations with mixologists create signature drinks, enhancing market penetration through tailored beverage experiences.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 54.7%. The United States serves as the largest export market, driving North America’s dominance in mezcal sales. Consumer demand for craft and artisanal spirits supports sustained growth across key metropolitan areas. The tequila boom in North America fuels crossover interest, introducing new consumers to mezcal’s unique profile. Premiumization trends encourage consumers to explore high-quality spirits, positioning mezcal as an upscale choice. Cocktail culture in the US and Canada incorporates mezcal into contemporary and classic drink recipes. High disposable income enables consumers to afford premium and aged mezcal expressions, expanding market opportunities. Expanding Mexican restaurant chains in North America promote mezcal as an authentic pairing option. Direct-to-consumer (D2C) sales through online platforms further increase accessibility and awareness among US buyers. Celebrity endorsements and influencer marketing significantly impact mezcal’s visibility and desirability in North American markets. For instance, in November 2024, Perro Verde Mezcal, backed by actor Benicio del Toro, debuted in the US market, offering three artisanal expressions, including Espadín, Ensamble, and Tobasiche. Crafted by Oaxacan mezcaleros with over 120 years of tradition, the brand emphasizes sustainability. Moreover, retail distribution is well-developed, with mezcal securing strong placements in liquor stores and duty-free outlets. Sustainability and organic certification trends resonate with North American consumers, reinforcing demand for ethically produced mezcal.

Key Regional Takeaways:

United States Mezcal Market Analysis

The United States hold 83.50% of the market share in North America. The US mezcal market is growing due to increasing consumer demand for artisanal and craft spirits. A survey shows that 62% of US adults consume alcohol, fueling interest in premium beverages. Mezcal’s traditional production methods and complex flavor profiles attract consumers seeking authenticity and quality. Health-conscious drinkers prefer organic or lower-sugar options, reinforcing mezcal’s appeal as a natural alternative. The expanding cocktail culture drives demand, with mezcal-based drinks gaining popularity in bars and restaurants. Rising interest in Mexican heritage and cuisine further strengthens mezcal’s market growth in the US spirit’s market. Celebrity endorsements and influential mixologists elevate mezcal’s status, increases brand awareness. Wider distribution channels and online retail platforms make mezcal more accessible to consumers nationwide. The growing variety of mezcal expressions encourages exploration among enthusiasts and casual drinkers alike. Cultural, social, and economic factors continue to support mezcal’s expansion, bolstering market growth across the region.

Europe Mezcal Market Analysis

The European market is expanding as consumers increasingly seek authentic and artisanal alcoholic beverages. Europe remains the world’s top tourist destination, with 747 million international visits in 2024, an increase of 1% than 2019. Growing exposure to diverse cultures and products including mezcal, is increasing demand across key markets. Premiumization trends encourage consumers to explore high-quality spirits, strengthening mezcal’s position in the industry. The rising popularity of Mexican cuisine, driven by food tourism and culinary events, further improves mezcal’s visibility. Countries like the UK, France, and Germany, known for vibrant cocktail cultures, are incorporating mezcal into innovative drink recipes. Mixologists are increasingly using mezcal to craft unique, smoky cocktails, enhancing its appeal in upscale bars. Consumers are also favoring sustainable, organic, and ethically produced spirits, aligning with mezcal’s artisanal nature. As interest in unique drinking experiences grows, mezcal’s distinct flavors and craftsmanship continue to gain traction. These factors collectively position the European mezcal market for long-term growth.

Asia Pacific Mezcal Market Analysis

The Asia Pacific market for mezcal is expanding as interest in international spirits rises, particularly among the growing middle class. India’s middle class is increasing at 6.3% annually, adding 338 million members between 1995 and 2021. This segment now comprises 31% of the population, projected to reach 38% by 2031 and 60% by 2047. As disposable incomes grow, consumers are more willing to explore premium and niche alcoholic beverages like mezcal. The demand for high-quality, artisanal spirits is rising, supported by the expanding cocktail culture in Japan, South Korea, and China. Bars and restaurants are introducing mezcal-based cocktails, driving awareness and consumer interest in the category. The region’s growing tourism industry further promotes exposure to Mexican culture and its traditional spirits. Increasing accessibility through retail expansion and e-commerce platforms strengthens mezcal’s market presence. With rising affluence and evolving consumer preferences, the Asia-Pacific mezcal market is set for significant growth.

Latin America Mezcal Market Analysis

The Latin American market is expanding, driven by its deep cultural significance and strong Mexican heritage. Urbanization in the region has reached approximately 80%, surpassing most other global regions. Rising urban populations and increasing affluence are driving demand for premium and artisanal spirits like mezcal. The growing middle class is showing greater interest in exploring unique, high-quality alcoholic beverages. Mexican cuisine’s expanding influence across the region further strengthens mezcal’s appeal among consumers. Widespread availability in bars, restaurants, and retail stores is making mezcal more accessible to a broader audience. Cocktail culture in major cities is also influencing demand for mezcal-based drinks. Consumers are increasingly appreciating mezcal’s traditional production methods and distinct flavor profiles. The preference for craft spirits aligns with mezcal’s artisanal nature, supporting its long-term market growth. As cultural and economic factors evolve, mezcal is continuously gaining traction across Latin America’s expanding spirit’s market.

Middle East and Africa Mezcal Market Analysis

The mezcal market in the Middle East and Africa is growing as interest in international spirits increases. The World Bank reports that the Middle East and North Africa (MENA) region is 64% urbanized. Urbanization and rising disposable incomes are driving demand for premium spirits including mezcal. The expanding middle class is becoming more open to exploring unique, high-quality alcoholic beverages. Cocktail culture is gaining popularity in key markets, such as the UAE and South Africa, influencing mezcal’s appeal. Bars, restaurants, and high-end lounges are introducing mezcal-based cocktails, increasing consumer awareness. Retail availability is also expanding, making mezcal more accessible across different sales channels. Consumers are drawn to mezcal’s artisanal production methods and distinctive smoky flavor. The growing influence of western drinking trends further supports mezcal’s market growth.

Mexico Mezcal Market Analysis

The Mexican mezcal industry is transforming fast, fueled by its deep cultural heritage, diversified product array, and increasing home and export demand. Producers are turning increasingly toward artisanal manufacturing processes, using heritage agave species and traditional techniques including clay pot distillation and roasting in earth pits. This focus on authenticity appeals to consumers who want authentic experiences based on Mexican heritage. Market forces are also bolstered by an increasing distribution network that takes mezcal to urban and rural areas equally, enhancing availability and awareness throughout the nation. Furthermore, industry innovation is generating value-added offerings—like flavored offerings, aged styles, and co-branded releases with chefs and artists—widening reach and catering to niche tastes. Regulatory systems have also evolved, with denomination of origin and certification labels assisting in ensuring quality and safeguarding regional identity. Mezcal's future growth will rely on balancing scalable production with artisan heritage while maintaining sustainability and enabling local Mexican communities.

Competitive Landscape:

Leading mezcal producers are expanding global distribution networks, increasing brand visibility across key international markets. Established brands are investing in premiumization, focusing on artisanal production methods and high-quality agave sourcing. Marketing strategies emphasize authenticity, cultural heritage, and sustainability, attracting a diverse consumer base worldwide. Celebrity endorsements and collaborations enhance brand appeal, influencing consumer interest and market growth. Companies are introducing innovative flavors and aging techniques, catering to evolving consumer preferences and mixology trends. Strategic partnerships and acquisition with bars, restaurants, and retailers strengthen market presence and accessibility to new demographics. In September 2023, Bacardi Limited acquired ILEGAL Mezcal, a top super-premium artisanal mezcal brand, after collaborating successfully since 2015. Additionally, digital marketing and e-commerce expansion allow brands to reach consumers directly, influencing sales growth. Investments in sustainable agave farming and eco-friendly production practices improve brand image and industry reputation. Regulatory compliance and certifications help key players gain consumer trust and differentiate themselves in the market. Market leaders collaborate with local communities, ensuring ethical sourcing and fair-trade practices within the supply chain. Continuous product innovation including limited editions and special releases, generates excitement among enthusiasts and collectors.

The report provides a comprehensive analysis of the competitive landscape in the mezcal market with detailed profiles of all major companies, including:

- Bacardi Limited

- Desolas

- Destileria Tlacolula Inc.

- Diageo plc

- Drink Monday

- El Silencio Holdings Inc.

- IZO Spirits

- Lágrimas de Dolores

- Pernod Ricard SA

- Rey Campero

Latest News and Developments:

- March 2025: Tesla introduced a limited-release mezcal produced in collaboration with Nosotros. The spirit is a blend of Espadín and Bicuishe agave in a black lightning-bolt-shaped bottle created by Tesla's Javier Verdura, an extension of Elon Musk's further forays into high-end agave-based drinks following the previous release of Tesla Tequila.

- January 2025: Run the Jewels, the hip-hop duo, launched Juice Runners, their new ready-to-drink cocktail line, including a canned Paloma with mezcal. The brand is drawing on its heritage of beer collaborations with the release, which comes as consumer desire in the mezcal category increases for creative, convenient, and culturally relevant alcoholic drinks.

- October 2024: Erin and Abe Lichy, known from The Real Housewives of New York City, launched their mezcal brand, Mezcalum. Made with all-natural ingredients, Mezcalum is now available in 800 retail and on-trade locations.

- July 2024: Edna's Non-Alcoholic Cocktail Company introduced Mezcalita, a non-alcoholic cocktail replicating the smoky, fruity notes of a traditional mezcalita. This launch meets the rising demand for premium non-alcoholic alternatives. With preorders secured across the USA and Canada, the product aligns with the expanding mezcal market.

- April 2024: The Whisky Exchange is set to host its Tequila and Mezcal Show in London on May 16-17, 2025, following its Welcome to Whisky event in April. Focused on agave spirits, the show reflects the retailer’s growing commitment to tequila and mezcal, which are witnessing a 34% growth.

Mezcal Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mezcal Joven, Mezcal Reposado, Mezcal Anejo |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bacardi Limited, Desolas, Destileria Tlacolula Inc., Diageo plc, Drink Monday, El Silencio Holdings Inc., IZO Spirits, Lágrimas de Dolores, Pernod Ricard SA, Rey Campero, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, mezcal market outlook, and dynamics of the market from 2019-2033.

- The mezcal market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mezcal industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mezcal market was valued at USD 604.28 Million in 2024.

The mezcal market is projected to exhibit a CAGR of 14.35% during 2025-2033, reaching a value of USD 2,142.5 Million by 2033.

The mezcal market growth is driven by rising consumer demand for artisanal and premium spirits. Increasing interest in craft beverages, unique production methods, and sustainable distillation enhances its appeal. Expanding cocktail culture improves mezcal’s presence in bars and restaurants worldwide. Growing tourism in Mexico exposes international consumers to mezcal, fueling global demand. Retail and e-commerce expansion improve accessibility, supporting market growth.

North America currently dominates the mezcal market, accounting for a share of 54.7% in 2024. The United States, the largest export market for mezcal, drives growth with its expanding cocktail culture and interest in agave-based beverages. Rising disposable incomes and a preference for high-quality spirits support premium mezcal consumption. The growing influence of Mexican cuisine and cultural appreciation further drives demand for mezcal. Expanding retail availability, online sales, and celebrity-backed brands enhance market penetration.

Some of the major players in the mezcal market include Bacardi Limited, Desolas, Destileria Tlacolula Inc., Diageo plc, Drink Monday, El Silencio Holdings Inc., IZO Spirits, Lágrimas de Dolores, Pernod Ricard SA, Rey Campero, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)