Mexico Wind Energy Market Report by Component (Turbine, Support Structure, Electrical Infrastructure, and Others), Rating (≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, >12 MW), Installation (Offshore, Onshore), Turbine Type (Horizontal Axis, Vertical Axis), Application (Utility, Industrial, Commercial, Residential), and Region 2025-2033

Mexico Wind Energy Market Overview:

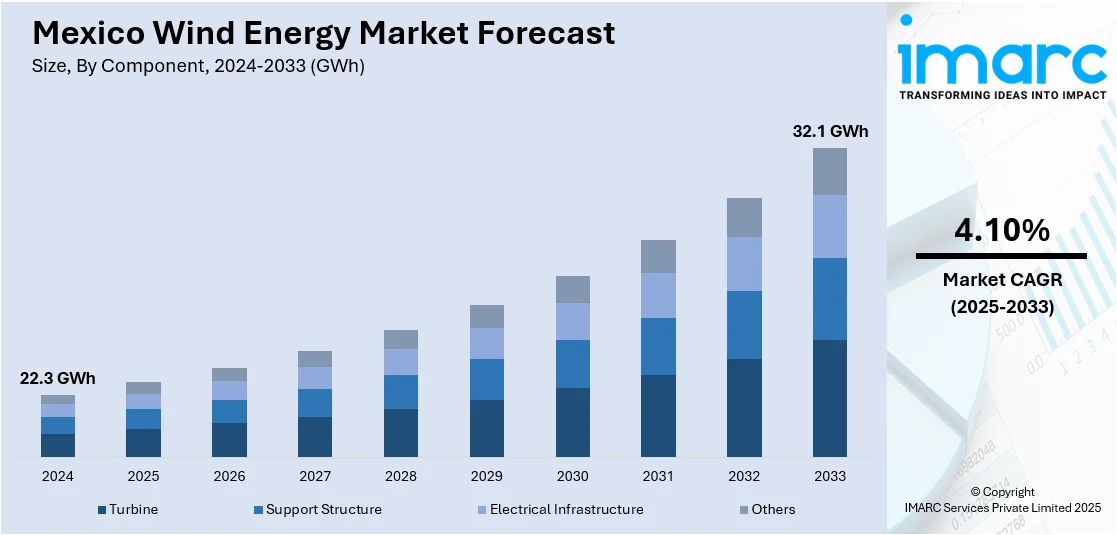

The Mexico wind energy market size reached 22.3 GWh in 2024. Looking forward, IMARC Group expects the market to reach 32.1 GWh by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is driven by the growing incorporation of wind energy into the power generation portfolio to enhance energy security. This, along with the rising awareness among the masses about environmental issues, is supporting the broad climate goals in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 22.3 GWh |

| Market Forecast in 2033 | 32.1 GWh |

| Market Growth Rate 2025-2033 | 4.10% |

Mexico Wind Energy Market Trends:

Advanced Energy Security and Diversification

According to the analysis done in 2023 by the Center for Strategic and International Studies (CSIS), around 1.5 million people lacked access to electricity in Mexico. Incorporating wind energy into the power generation portfolio is enabling the country to enhance its energy security and reduce its reliance on fossil fuels. Wind power is crucial in this transition, as it offers a stable and predictable source of electricity that mitigates risks associated with traditional energy sources, such as price volatility and supply disruptions. As the country is expanding its wind energy capacity, it is strengthening the national grid, improving energy reliability, and working towards closing the electricity access gap. This move aligns with global trends of sustainability and climate resilience, contributing to a more secure and diverse energy framework.

Rising Public Awareness and Support for Renewable Energy

Mexico is actively advancing its environmental and climate goals, which is propelling the growth of the market. The country is focusing on positioning wind energy as its main goal to reduce greenhouse gas emissions. Wind power provides a clean and renewable source of electricity, which reduces the reliance on fossil fuels that are major sources of carbon emissions and pollution. Integrating wind energy into the national power generation mix is enabling Mexico to lower its carbon footprint and enhance air quality. The rising awareness among the masses about environmental issues in Mexico is making people more conscious about their impact, which is driving the demand for cleaner energy solutions. A growing understanding about the benefits of renewable energy is leading to stronger support for policies and investments in green technologies, thereby reinforcing the call for sustainable practices. This transition is supporting the broader climate objectives and demonstrating Mexico’s commitment to a sustainable and cleaner energy future. As per the content published on the website of the United States Agency for International Development (USAID), the Government of Mexico (GOM) set the goal to reduce greenhouse gas emissions by 35 percent and black carbon emissions by 51 percent by 2030.

Mexico Wind Energy Market News:

- April 2024: The Federal Electricity Commission (CFE) of Mexico partnered with the Danish Energy Agency to launch a range of green initiatives aimed at accelerating Mexico’s energy transition, with a strong emphasis on developing wind energy projects.

- March 2024: Vestas, a leading global wind turbine manufacturer, secured a major contract by Sempra Infrastructure, a subsidiary of Sempra, to supply and install turbines for the 319 MW Cimarron wind farm in Tecate, Baja California, Mexico, which will bring the total installed capacity of the project to 582 MW.

Mexico Wind Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, rating, installation, turbine type, and application.

Component Insights:

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes turbine, support structure, electrical infrastructure, and others.

Rating Insights:

- ≤ 2 MW

- >2 ≤ 5 MW

- >5 ≤ 8 MW

- >8 ≤ 10 MW

- >10 ≤ 12 MW

- >12 MW

A detailed breakup and analysis of the market based on the rating have also been provided in the report. This includes ≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, and >12 MW.

Installation Insights:

- Offshore

- Onshore

The report has provided a detailed breakup and analysis of the market based on the installation. This includes offshore and onshore.

Turbine Type Insights:

- Horizontal Axis

- Vertical Axis

A detailed breakup and analysis of the market based on the turbine type have also been provided in the report. This includes horizontal axis and vertical axis.

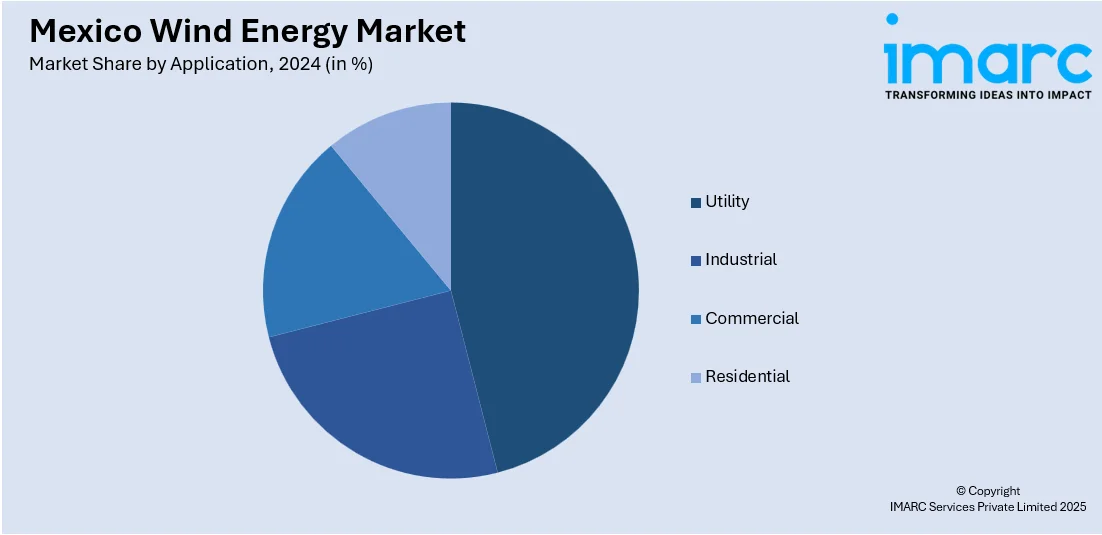

Application Insights:

- Utility

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes utility, industrial, commercial, and residential.

Regional Insights:

- Northern States

- Central States

- Southern States

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern States, Central States, and Southern States.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Wind Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GWh |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Turbine, Support Structure, Electrical Infrastructure, Others |

| Ratings Covered | ≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, >12 MW |

| Installations Covered | Offshore, Onshore |

| Turbine Types Covered | Horizontal Axis, Vertical Axis |

| Applications Covered | Utility, Industrial, Commercial, Residential |

| Regions Covered | Northern States, Central States, Southern States |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico wind energy market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Mexico wind energy market?

- What is the breakup of the Mexico wind energy market on the basis of component?

- What is the breakup of the Mexico wind energy market on the basis of rating?

- What is the breakup of the Mexico wind energy market on the basis of installation?

- What is the breakup of the Mexico wind energy market on the basis of turbine type?

- What is the breakup of the Mexico wind energy market on the basis of application?

- What are the various stages in the value chain of the Mexico wind energy market?

- What are the key driving factors and challenges in the Mexico wind energy?

- What is the structure of the Mexico wind energy market and who are the key players?

- What is the degree of competition in the Mexico wind energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico wind energy market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico wind energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico wind energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)