Mexico Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2026-2034

Mexico Watch Market Overview:

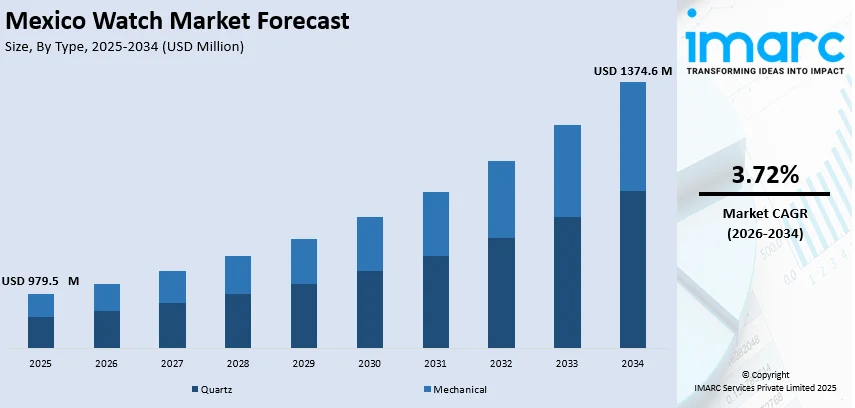

The Mexico watch market size reached USD 979.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1374.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.72% during 2026-2034. The market is driven by the rising up-take of digital platforms and the expansion of e-commerce platforms, increasing role of social media, fashion bloggers, and celebrity endorsements, and heightened high-end shopping experiences within airport and resort environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 979.5 Million |

| Market Forecast in 2034 | USD 1374.6 Million |

| Market Growth Rate 2026-2034 | 3.72% |

Mexico Watch Market Trends:

Expanding E-commerce and Omnichannel Retail Strategies

The swift uptake of digital platforms and the expansion of e-commerce in Mexico are changing the way people buy watches. Online shopping provides exposure to more international and local brands, price comparisons, and peer reviews, all of which improve the purchase experience. Industry players are riding this trend by creating solid digital infrastructure and omnichannel retailing strategies that blend online platforms with physical store experiences. For example, efforts like "click-and-collect," virtual try-ons, and tailored marketing have enhanced customer interaction and conversion rates. Moreover, online platforms enable brands to target consumers in tier-2 and tier-3 cities, wherein physical luxury stores are not available. The ease of home delivery, easy return options, and access to financing further promote online shopping. This development of the retail landscape has brought watches within reach and in favor of a mobile-first, technology-aware consumer market, thereby increasing overall penetration of the market. According to the predictions of the IMARC Group, the Mexico e-commerce market is expected to reach USD 176.6 Billion by 2033.

To get more information on this market Request Sample

Influence of Fashion Trends and Celebrity Endorsements

Mexican watches are being viewed as fashion accessories, and not just simple time-telling devices, due to the change in consumer lifestyle and international fashion trends. The increasing role of social media, fashion bloggers, and celebrity endorsements is pivotal in influencing consumer taste. Designer and luxury watch brands often partner with pop culture influencers and celebrities to introduce limited editions, generating hype and scarcity for their brands. Such an approach not only generates instant sales but also supports brand personality and aspirational value. Furthermore, fashion-forward consumers want watches that coordinate with their lifestyles, encouraging brands to vary designs, materials, and colors to appeal to different tastes. The Salon Internacional Alta Relojeria (SIAR) Mexico celebrated its 18th edition from October 15-17, 2024 at The St. Regis Mexico City with the presence of 49 prestigious brands, CEOs and senior managers, celebrities, media and influencers.

Tourism and Duty-Free Retail Growth

Mexico's robust tourist economy, both foreign and local visitors, plays a significant role in sustaining watch sales, especially for premium and high-end brands. Touristic locations like Cancún, Mexico City, and Playa del Carmen have an enormous number of duty-free and luxury retail spaces featuring a collection of international watches from various brands. Shoppers tend to view watch purchases as good investments or quality souvenirs, particularly in competitive duty-free settings that provide exclusive products and the best prices. The glory of high-end shopping experiences within airport and resort environments contributes to the prominence and allure of luxury watches. In addition, the hotel and travel industries tend to collaborate with luxury retailers to provide experience-driven shopping, facilitating greater shopper interaction and satisfaction. Avolta opened its brand-new renovated 1,600sqm duty free shop in Mexico City International Airport (AICM) in 2024. Offering the entire scope of duty free categories in an innovative open layout, the store provides passengers immersive digital experiences, a vast luxury watch and jewelry boutique complemented by an espresso and beverage bar, boutique store-in-store environments, luxury fashion and beyond.

Mexico Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

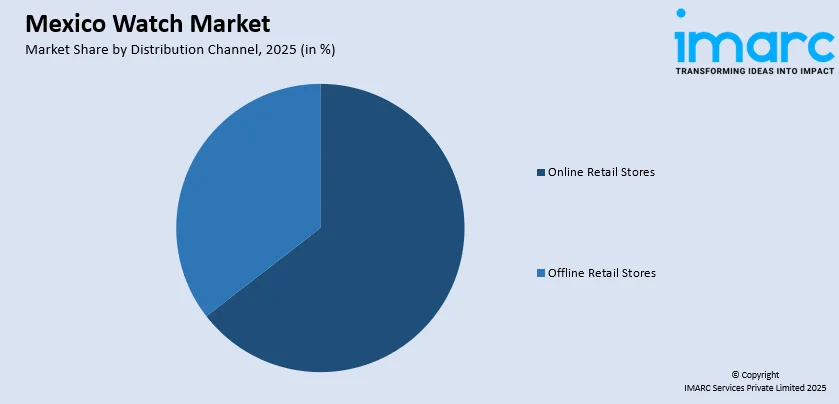

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail Stores

- Offline Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail stores and offline retail stores.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

Regional Insights:

- Northern And Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Low-Range, Mid-Range, Luxury |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico watch market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico watch market on the basis of type?

- What is the breakup of the Mexico watch market on the basis of price range?

- What is the breakup of the Mexico watch market on the basis of distribution channel?

- What is the breakup of the Mexico watch market on the basis of price range end user?

- What is the breakup of the Mexico watch market on the basis of region?

- What are the various stages in the value chain of the Mexico watch market?

- What are the key driving factors and challenges in the Mexico watch?

- What is the structure of the Mexico watch market and who are the key players?

- What is the degree of competition in the Mexico watch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico watch market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico watch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)