Mexico Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Vegan Cosmetics Market Overview:

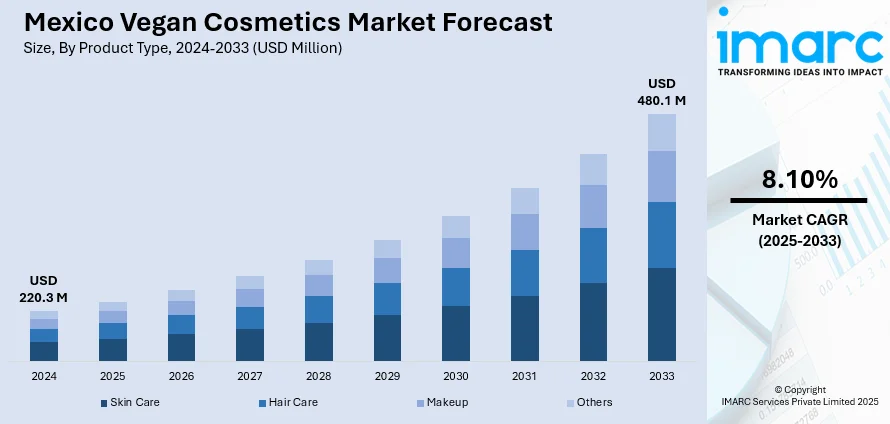

The Mexico vegan cosmetics market size reached USD 220.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 480.1 Million by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. Rising consumer awareness regarding cruelty-free products, growing preference for plant-based and natural ingredients, increasing influence of social media and beauty influencers, expanding vegan population, supportive government regulations, and growing availability of vegan brands across various retail channels are expanding the Mexico vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.3 Million |

| Market Forecast in 2033 | USD 480.1 Million |

| Market Growth Rate 2025-2033 | 8.10% |

Mexico Vegan Cosmetics Market Trends:

Increase in Plant-Based Skincare Drives Vegan Cosmetics Demand in Mexico

The rising consumer preference for natural and chemical-free products is significantly boosting the demand for vegan skincare in Mexico. As awareness around animal cruelty, environmental sustainability, and the benefits of plant-based formulations grows, consumers—particularly millennials and Gen Z—are opting for vegan skincare solutions. For instance, Mexico became the first nation in North America to implement a ban on animal testing for cosmetics and chemicals when its Senate unanimously adopted legislation on September 2, 2024. The regulation, which will go into full force in two years, prohibits the production, importation, and distribution of cosmetics that have undergone animal testing, with some safety studies being an exception. This legislative action reflects Mexico's dedication to ethical standards in the cosmetics business and is in line with the global trend towards cruelty-free and vegan beauty goods. Brands are leveraging this shift by introducing product lines rich in natural extracts, essential oils, and sustainable packaging. The popularity of organic certifications and cruelty-free labels is also propelling Mexico vegan cosmetics market growth. Moreover, dermatologists and beauty influencers are actively promoting the advantages of clean beauty, further fueling the trend. In urban centers such as Mexico City and Guadalajara, the availability of vegan products across specialty stores and online platforms is accelerating. This changing consciousness is expected to strengthen the skincare segment’s dominance in the vegan cosmetics market, creating opportunities for both local and international brands.

Online Retail Accelerates Growth in Mexico’s Vegan Makeup Sector

E-commerce is revolutionizing the distribution landscape of vegan cosmetics in Mexico, with online stores becoming a key growth driver—especially for makeup products. Rising internet penetration and social media influence have transformed consumer buying behavior. For instance, Mexico has more over 96 million internet users as of 2022, up 3.8% from the year before. Fintech and vegan brands have the chance to interact with a wide and growing audience thanks to this changing media ecosystem. Customers are increasingly exploring cruelty-free and vegan options through digital channels, drawn by detailed ingredient transparency, peer reviews, and influencer endorsements. Brands are also utilizing fintech integrations for seamless checkout and offering virtual try-on tools to enhance customer experience. Online platforms are providing niche and indie vegan makeup brands a direct route to consumers, bypassing traditional retail hurdles. This accessibility is driving demand in both urban and semi-urban regions, which is positively influencing Mexico vegan cosmetics market outlook. With Gen Z leading this digital shift and prioritizing sustainability, the vegan makeup segment is poised for significant growth.

Mexico Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

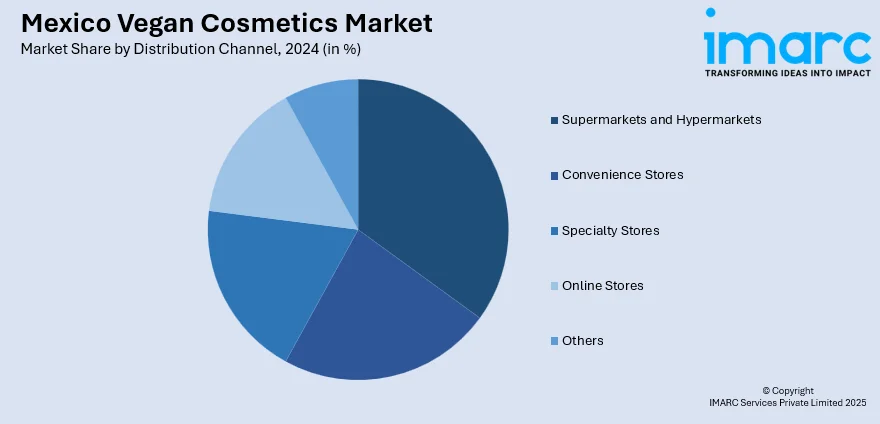

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Vegan Cosmetics Market News:

- On February 18, 2025, the debut of e.l.f. Cosmetics' "Descubre e.l.f.ecto" campaign in Mexico was announced. Sephora Mexico will carry premium vegan beauty products at reasonable costs. Making high-end beauty accessible to a wider audience is the goal of this telenovela-inspired project. In the beauty business, the campaign emphasizes e.l.f.'s dedication to affordability and inclusivity.

Mexico Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Other |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico vegan cosmetics market on the basis of product type?

- What is the breakup of the Mexico vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Mexico vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Mexico vegan cosmetics market?

- What are the key driving factors and challenges in the Mexico vegan cosmetics market?

- What is the structure of the Mexico vegan cosmetics market and who are the key players?

- What is the degree of competition in the Mexico vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)