Mexico Supply Chain Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2026-2034

Mexico Supply Chain Management Market Overview:

The Mexico supply chain management market size reached USD 833.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,318.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.23% during 2026-2034. The Mexico supply chain management market share is expanding due to nearshoring trends, government incentives for manufacturing, rising e-commerce adoption, digital transformation in logistics, increasing trade with the U.S. under USMCA, growing demand for automation, and investments in sustainable supply chain solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 833.5 Million |

| Market Forecast in 2034 | USD 1,318.1 Million |

| Market Growth Rate (2026-2034) | 5.23% |

Access the full market insights report Request Sample

Mexico Supply Chain Management Market Trends:

Growing Adoption of Digital Supply Chain Solutions

The Mexico supply chain management market is witnessing a rapid shift toward digital transformation, with businesses increasingly integrating technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) to enhance efficiency and transparency. Companies are leveraging real-time data analytics to optimize inventory management, reduce operational costs, and mitigate supply chain disruptions. The rise of e-commerce and global trade demands have further accelerated the need for automated logistics and smart warehousing, which in turn is fostering Mexico supply chain management market growth. Additionally, digital freight platforms and cloud-based supply chain solutions are streamlining cross-border trade, particularly with the U.S. and Canada. As regulatory compliance and sustainability concerns grow, digitalization is expected to play a crucial role in ensuring agility, resilience, and competitiveness in Mexico’s supply chain ecosystem. For instance, a government research report published on September 20, 2024, stated that Mexico's digital economy has grown significantly and 81% of the country's population, or over 97 million people, can access the internet. With a 24.6% gain in 2023, the nation leads the world in e-commerce growth, especially in consumer goods, electronics, and fashion. By 2025, the e-commerce market in Mexico is expected to grow to a value of USD 63 Billion.

Strengthening Nearshoring and Regional Trade Integration

Mexico’s strategic location and strong trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), are driving a surge in nearshoring initiatives. For instance, as of February 4, 2025, after conferring with Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau, President Donald Trump postponed the implementation of 25% tariffs on Mexican and Canadian imports for 30 days. In response, Canada pledged to appoint a "fentanyl czar" to bolster its anti-opioid campaign, while Mexico pledged to deploy 10,000 National Guard soldiers to its northern border to combat drug traffickingg. Apart from this, businesses are shifting production closer to North American markets to reduce dependency on Asian supply chains and minimize geopolitical risks. The increasing demand for automotive, electronics, and manufacturing components has further incentivized companies to establish regional supply hubs in Mexico. This trend is also fueled by rising labor costs in Asia and the need for faster delivery times. Additionally, Mexico’s investment in logistics infrastructure, including new industrial parks and expanded port capacities, is enhancing supply chain efficiency, which in turn is having a positive impact on Mexico supply chain management market outlook. As nearshoring continues to expand, Mexico is set to become a key supply chain hub in the Americas.

Mexico Supply Chain Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, deployment mode, enterprise size, and industry vertical.

Component Insights:

To get detailed segment analysis of this market Request Sample

- Solution

- Transportation Management System

- Planning and Analytics

- Warehouse and Inventory Management System

- Procurement and Sourcing

- Manufacturing Execution System

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (transportation management system, planning and analytics, warehouse and inventory management system, procurement and sourcing, and manufacturing execution system) and services (professional services and managed services).

Deployment mode Insights:

- On-premises

- On demand

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on premises and on demand.

Enterprise Size Insights:

- Small and medium enterprises

- Large enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium enterprises and large enterprises.

Industry Vertical Insights:

- Retail and Consumer Goods

- Healthcare and Pharmaceuticals

- Manufacturing

- Food and Beverages

- Transportation and Logistics

- Automotive

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes retail and consumer goods, healthcare and pharmaceuticals, manufacturing, food and beverages, transportation and logistics, automotive and others.

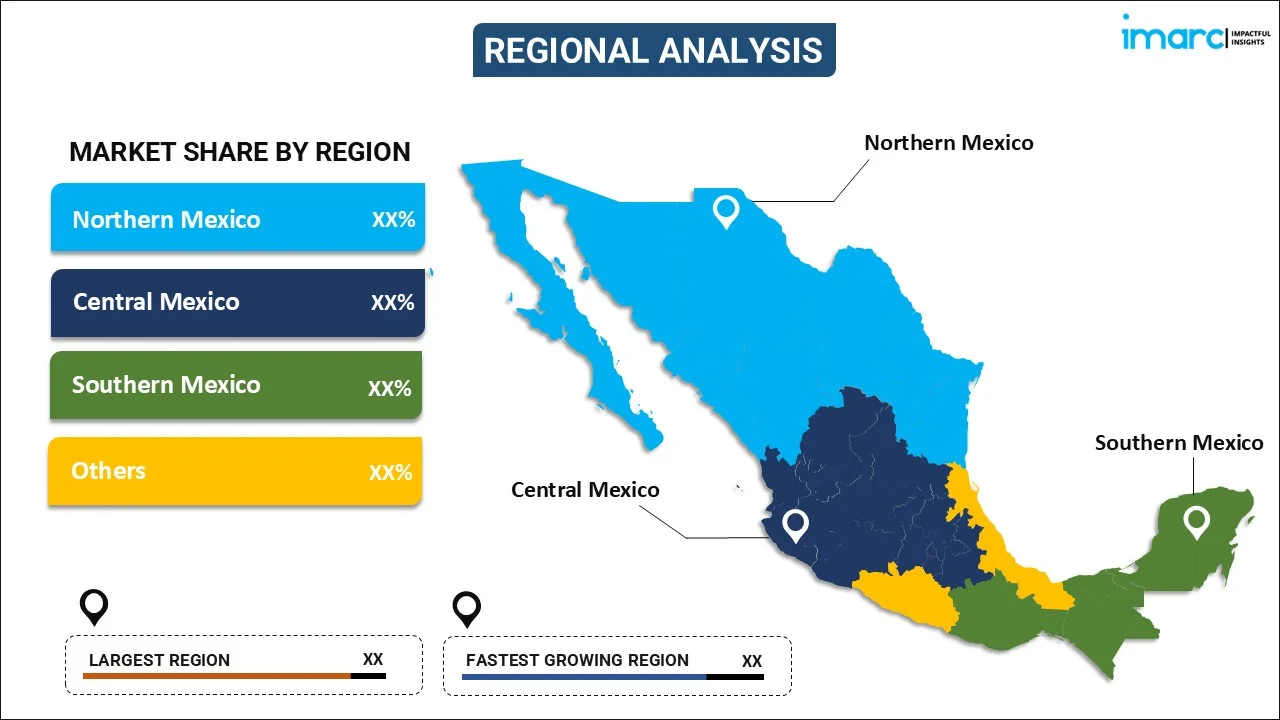

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Supply Chain Management Market News:

- As of December 6, 2024, Prima, situated in Mexico City, has raised USD 23 Million, bringing its total capital to USD 42.5 Million, to strengthen its position as a North American manufacturing and supply chain integrator. Prima uses a technology-driven strategy to manage every facet of large industrial projects and bespoke part manufacture, including design, engineering, sourcing raw materials, factory operations, quality control, and delivery, for 150 North American organizations.

- On August 5, 2024, the first project of a USD 2 Billion sustainable supply chain finance program aimed at emerging markets was launched, when the International Finance Corporation (IFC) and Citi opened a USD 500 Million facility in Mexico. Under IFC's Global Supply Chain Finance Program, which was started in 2022 to address supply chain disruptions worldwide, this project is the biggest one to date. The program's objectives are to improve access to sustainable supply chain financing and close financial gaps for small and medium-sized businesses (SMEs).

Mexico Supply Chain Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | On premises, On demand |

| Enterprise Sizes Covered | Small and medium enterprises, Large enterprises |

| Industry Verticals Covered | Retail and Consumer Goods, Healthcare and Pharmaceuticals, Manufacturing, Food and Beverages, Transportation and Logistics, Automotive and Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico supply chain management market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico supply chain management market on the basis of component?

- What is the breakup of the Mexico supply chain management market on the basis of deployment mode?

- What is the breakup of the Mexico supply chain management market on the basis of enterprise size?

- What is the breakup of the Mexico supply chain management market on the basis of industry vertical?

- What are the various stages in the value chain of the Mexico supply chain management market?

- What are the key driving factors and challenges in the Mexico supply chain management market?

- What is the structure of the Mexico supply chain management market and who are the key players?

- What is the degree of competition in the Mexico supply chain management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico supply chain management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico supply chain management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico supply chain management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)