Mexico Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2026-2034

Mexico Steel Market Overview:

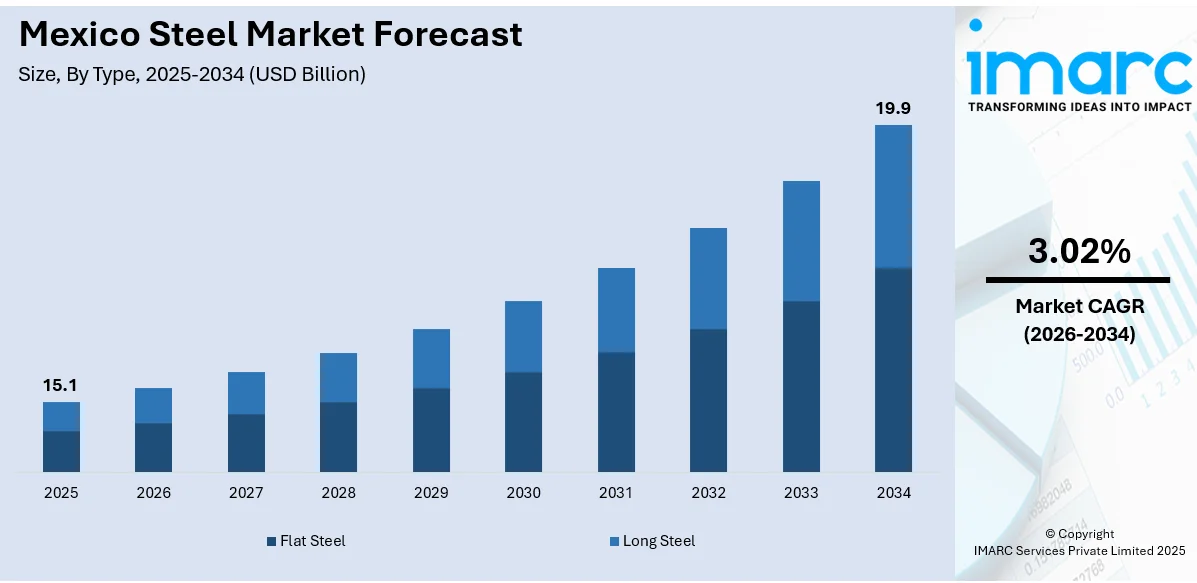

The Mexico steel market size reached USD 15.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.9 Billion by 2034, exhibiting a growth rate (CAGR) of 3.02% during 2026-2034. The economy is boosted by rising infrastructure spending, mainly transportation and construction, which further supports steel demand. The automotive industry, as electric cars gain momentum, also supports the use of steel. Moreover, there are preferential trade ties under USMCA terms favoring exports, making Mexico stronger in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.1 Billion |

| Market Forecast in 2034 | USD 19.9 Billion |

| Market Growth Rate 2026-2034 | 3.02% |

Mexico Steel Market Trends:

Growing Infrastructure Investment:

Mexico's steel industry is witnessing growth with rising infrastructure spending. The government's efforts to upgrade transportation networks, including highways, bridges, and railways, have raised the demand for steel. Furthermore, the growth in residential and commercial building projects necessitates a constant supply of steel. Growth in urban development and public transit projects has also driven steel demand. With industries such as construction, energy, and transportation expanding further, demand for steel continues to be robust. This pattern provides sustained market growth, further enhancing steel's position in Mexico's economic growth and the general development of the country's steel industry.

To get more information on this market Request Sample

Rising Demand from the Automotive Sector

Mexico's automotive sector is a leading driver of the nation's steel market, especially with the growing demand for high-strength steel utilized in automotive bodies, chassis, and engines. The rising production of electric vehicles (EVs) further increased the demand for specialist steel, as automakers make significant investments in EV production facilities and cutting-edge technology. By November 2024, sales of hybrid and electric vehicles increased by 41.1% year-on-year to 12,147 units, indicating robust consumer demand. This transition to EVs has triggered innovation in steel grades and manufacturing technology, with emphasis on lightweight, robust, and energy-efficient materials. Consequently, the automotive industry not only increases steel demand but also propels product development innovation. With increasing production volumes and increasing exports, Mexico's automotive industry is a major driving force behind the steel industry's sustained growth and international competitiveness.

Trade Relations and USMCA Impact:

The USMCA deal has significantly influenced Mexico's steel industry by fortifying trade ties with the U.S. and providing tariff-free access, making Mexico a prominent steel supplier in North America. Although Mexico's steel exports to the U.S. fell by 13% in 2024 to 2015 levels, the deal has still resulted in increased production capacity. Mexico's steel sector has grown, with investment in new plants and production technologies, supported by the elimination of trade barriers. This stable market climate has boosted Mexico's competitiveness on the international stage, supporting investments and growth. Additionally, the USMCA has stimulated innovation in steel grades and processes, enhancing the efficiency of the industry. Overall, the deal continues to be a critical element in ensuring the competitiveness of Mexico's steel industry even during the recent setbacks.

Mexico Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel, and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

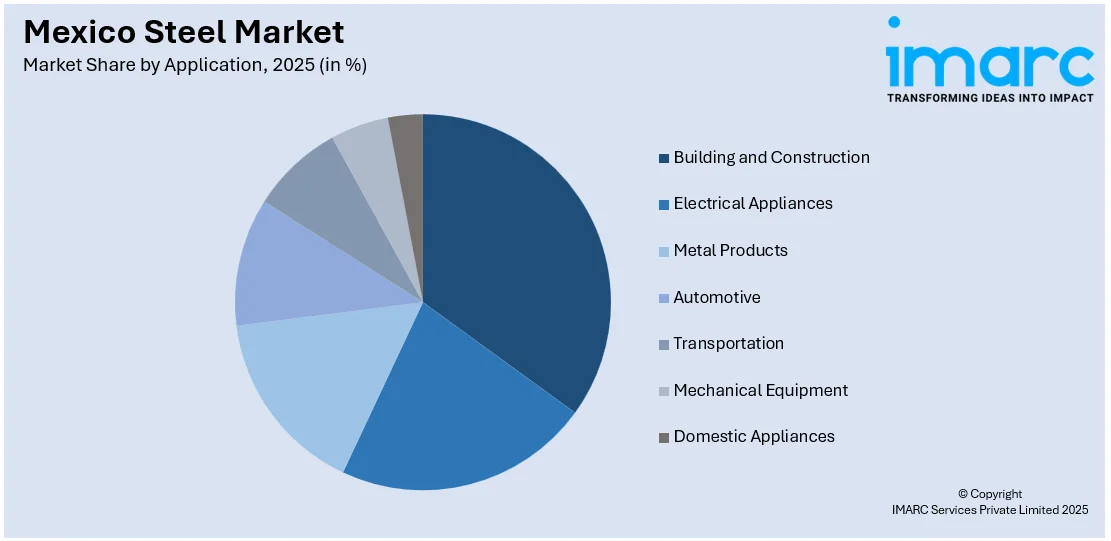

Application Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Steel Market News:

- In March 2025, Mexico’s steel industry announced a US $8.7 billion investment over the next five years to boost domestic production, despite facing a 25% U.S. tariff. Víctor Martínez Cairo, President of the National Steel and Iron Industry Chamber (Canacero) confirmed that the investment will proceed regardless of the tariff situation. The funds will be used to expand facilities, supporting President Sheinbaum’s Plan México to strengthen the country’s steel production capabilities.

- In March 2025, Mexico launched an anti-dumping investigation into hot-rolled steel imports from China and Vietnam, following a request from Ternium Mexico. The company alleges these imports are being sold below fair market value, harming local producers. The investigation, covering September 2023 to August 2024, targets major Chinese and Vietnamese steel exporters, including Ansteel Group, Baosteel, and Formosa Ha Tinh. The move aims to protect Mexico’s steel industry from unfair competition.

Mexico Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico steel market on the basis of type?

- What is the breakup of the Mexico steel market on the basis of product?

- What is the breakup of the Mexico steel market on the basis of application?

- What is the breakup of the Mexico steel market on the basis of region?

- What are the various stages in the value chain of the Mexico steel market?

- What are the key driving factors and challenges in the Mexico steel?

- What is the structure of the Mexico steel market and who are the key players?

- What is the degree of competition in the Mexico steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico steel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)