Mexico Solar PV Inverter Market Size, Share, Trends and Forecast by Technology, Voltage, Application, and Region, 2025-2033

Mexico Solar PV Inverter Market Overview:

The Mexico solar PV inverter market size reached USD 130.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 189.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033. Increasing renewable energy adoption, government incentives, energy independence goals, falling solar PV system costs, growing environmental concerns, and the push for sustainable energy sources, along with advancements in inverter technology and grid modernization, are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 130.1 Million |

| Market Forecast in 2033 | USD 189.6 Million |

| Market Growth Rate 2025-2033 | 4.28% |

Mexico Solar PV Inverter Market Trends:

Push for Distributed Solar and Energy Storage Integration

Mexico is seeing increased efforts to reinforce its clean energy infrastructure through greater integration of distributed generation and storage systems. Recent developments indicate a focus on deploying advanced solar PV inverters and battery energy storage solutions to support the national shift toward low-carbon energy. This movement aligns with broader goals to expand decentralized power systems that enhance grid reliability while reducing emissions. By combining photovoltaic conversion technology with scalable energy storage, the approach aims to improve efficiency and ensure stable electricity supply across urban and rural settings. The shift also reflects rising collaboration between technology providers and local stakeholders to accelerate renewable capacity additions, especially in regions with strong solar potential and limited grid connectivity. For example, in April 2024, Solarever Tecnología de América S.A. de C.V. and Huawei México Digital Power announced a partnership to advance distributed energy generation and storage in Mexico. The collaboration includes the deployment of Huawei’s solar PV inverters and battery energy storage systems (BESS) to strengthen the country's clean energy infrastructure and support its decarbonization goals.

Rising International Interest and Local Engagement

In Mexico, the solar PV inverter market is gaining stronger momentum, marked by rising international participation and growing local engagement. The latest industry event recorded a sharp increase in attendance, signaling deeper interest from developers, suppliers, and investors. A notable influx of manufacturers from China points to the country’s emerging role as a strategic destination for solar technology expansion. This movement reflects Mexico’s appeal as a key market for clean energy deployment, driven by favorable solar resources and policy direction. The expanding presence of global players is expected to boost competition, diversify technology offerings, and drive innovation in inverter and related system components. Increased industry interactions are also fostering collaborations that can accelerate project execution and enhance energy access across the country. For instance, in March 2025, the RE+ México 2025 conference saw increased participation, with visitor numbers rising from 6,500 in the previous year to over 8,500. A significant number of Chinese solar panel manufacturers entered the Mexican market, reflecting growing international interest.

Mexico Solar PV Inverter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology, voltage, and application.

Technology Insights:

- Central Inverters

- String Inverters

- Microinverters

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes central inverters, string inverters, microinverters, and others.

Voltage Insights:

- < 1,000 V

- 1,000 – 1,499 V

- > 1,500 V

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes < 1,000 V, 1,000 – 1,499 V, and > 1,500 V.

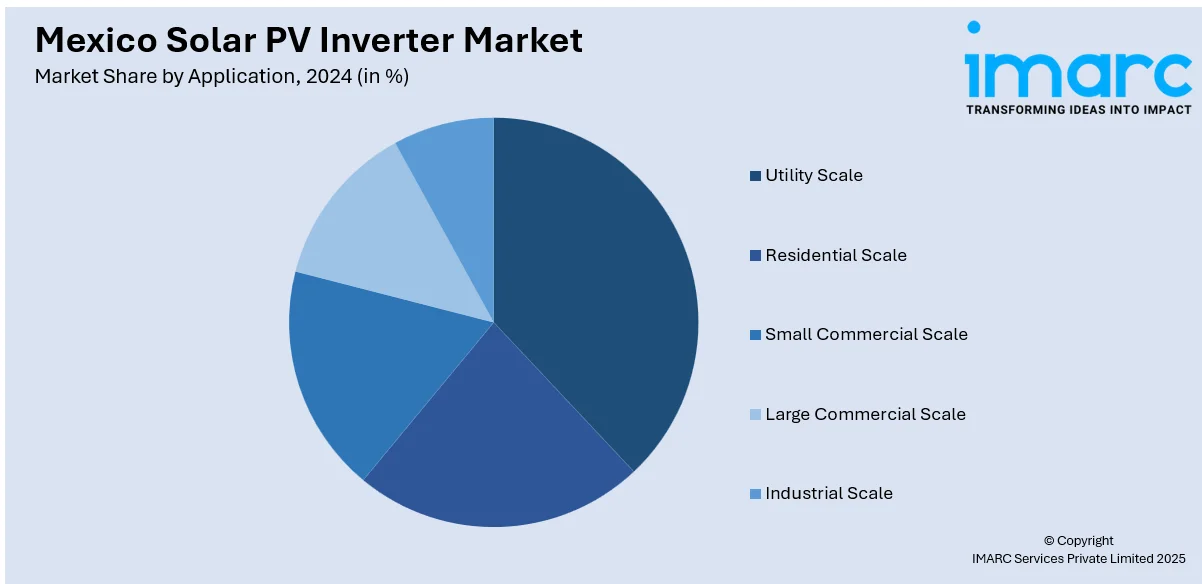

Application Insights:

- Utility Scale

- Residential Scale

- Small Commercial Scale

- Large Commercial Scale

- Industrial Scale

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes utility scale, residential scale, small commercial scale, large commercial scale, and industrial scale.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Solar PV Inverter Market News:

- In April 2024, JA Solar signed a 200MW PV module distribution deal with Exel Solar in Mexico. The agreement is designed to facilitate collaboration between the two firms and assist Mexico in its aim to cut greenhouse gases by 40% by 2030.

Mexico Solar PV Inverter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Central Inverters, String Inverters, Microinverters, Others |

| Voltages Covered | < 1,000 V, 1,000 – 1,499 V, > 1,500 V |

| Applications Covered | Utility Scale, Residential Scale, Small Commercial Scale, Large Commercial Scale, Industrial Scale |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico solar PV inverter market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico solar PV inverter market on the basis of technology?

- What is the breakup of the Mexico solar PV inverter market on the basis of voltage?

- What is the breakup of the Mexico solar PV inverter market on the basis of application?

- What are the various stages in the value chain of the Mexico solar PV inverter market?

- What are the key driving factors and challenges in the Mexico solar PV inverter market?

- What is the structure of the Mexico solar PV inverter market and who are the key players?

- What is the degree of competition in the Mexico solar PV inverter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico solar PV inverter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico solar PV inverter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico solar PV inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)