Mexico Seaweed Market Size, Share, Trends and Forecast by Environment, Product, Application, and Region, 2025-2033

Mexico Seaweed Market Overview:

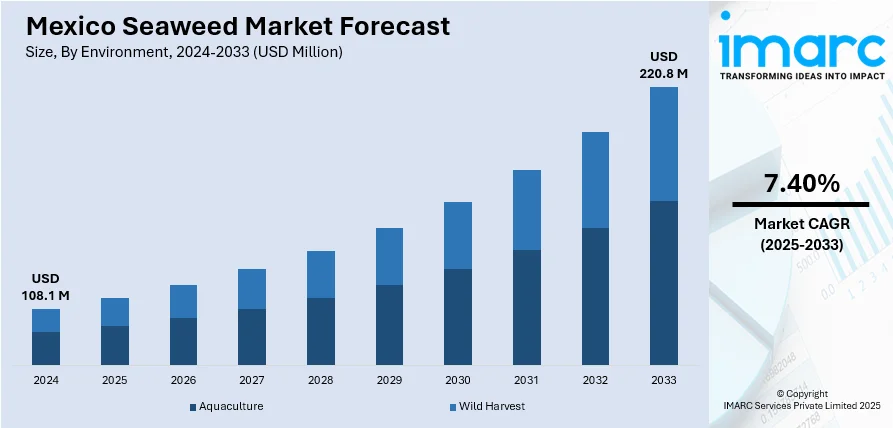

The Mexico seaweed market size reached USD 108.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 220.8 Million by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. Rising demand for plant-based food, increasing use in pharmaceuticals and cosmetics, government support for aquaculture, expanding export potential, and growing awareness of seaweed’s environmental benefits, including carbon sequestration and coastal protection, are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.1 Million |

| Market Forecast in 2033 | USD 220.8 Million |

| Market Growth Rate 2025-2033 | 7.40% |

Mexico Seaweed Market Trends:

Growing Global Interest in Seaweed-Based Agriculture

International players are increasingly investing in Mexico’s seaweed sector, drawn by its potential in sustainable agriculture and food innovation. Strategic partnerships are forming around local producers with strong market-ready product lines, especially those offering biostimulants and organic food derivatives. This movement signals confidence in Mexico’s capacity to become a key supplier of high-value seaweed-based solutions. As ecological farming methods gain momentum worldwide, Mexico is emerging as both a cultivation and innovation hub. The focus is not just on raw material production but on scaling value-added products that meet global demand for natural, regenerative inputs. With access to diverse coastal resources and established regional know-how, Mexico is positioned to benefit from expanding global interest in ocean farming as a viable and environmentally sound resource base. For example, in February 2025, Faroe Islands-based Ocean Rainforest acquired a majority stake in Mexican seaweed company Alamarsa, known for its Algamar brand of biostimulants and food products. This partnership aims to expand sustainable seaweed-based solutions globally, particularly in agriculture.

Commercial Shift toward Sargassum Utilization

There’s a growing shift in Mexico toward transforming sargassum into valuable commercial goods. What was once considered a coastal nuisance is now being reimagined as a raw material for a variety of sectors, including construction, personal care, and industrial manufacturing. Innovation is driving the use of this abundant seaweed in products like cosmetics, paints, sinks, and eco-friendly bricks. This approach not only addresses the ecological burden of massive sargassum influxes along the Caribbean coast but also supports local economies through material diversification. The movement reflects a broader change in how marine biomass is being treated, not as waste, but as a resource with commercial potential. As more permits and investment flow into this space, Mexico’s seaweed market is seeing a pivot from environmental mitigation to product development rooted in circular economy principles. For instance, in June 2024, two companies in Quintana Roo received permits to transform sargassum into commercial products. These firms plan to produce cosmetics, paints, sinks, and building materials like bricks from the seaweed, turning an environmental challenge into an economic opportunity.

Mexico Seaweed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on environment, product, and application.

Environment Insights:

- Aquaculture

- Wild Harvest

The report has provided a detailed breakup and analysis of the market based on the environment. This includes aquaculture, and wild harvest.

Product Insights:

- Red

- Brown

- Green

The report has provided a detailed breakup and analysis of the market based on the product. This includes red, brown, and green.

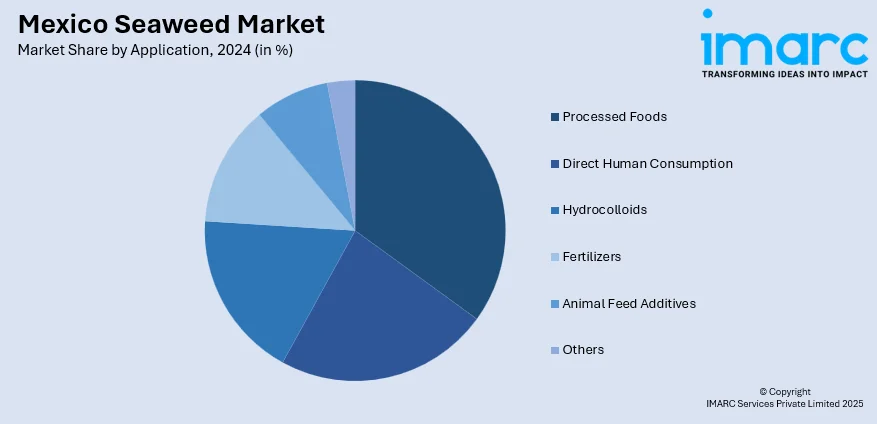

Application Insights:

- Processed Foods

- Direct Human Consumption

- Hydrocolloids

- Fertilizers

- Animal Feed Additives

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes processed foods, direct human consumption, hydrocolloids, fertilizers, animal feed additives, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Seaweed Market News:

- In October 2024, Gimme Seaweed, a leading organic seaweed snack brand, expanded its product line with a new Korean BBQ flavor. Priced at USD 1.98 for a 9g pack, it is available on Amazon and entering major US retailers. While focused on US markets, this launch reflects rising global demand, offering insight into potential growth for Mexico’s emerging seaweed market as consumer interest in seaweed-based snacks continues to grow.

Mexico Seaweed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Foods, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Additives, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico seaweed market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico seaweed market on the basis of environment?

- What is the breakup of the Mexico seaweed market on the basis of product?

- What is the breakup of the Mexico seaweed market on the basis of application?

- What are the various stages in the value chain of the Mexico seaweed market?

- What are the key driving factors and challenges in the Mexico seaweed market?

- What is the structure of the Mexico seaweed market and who are the key players?

- What is the degree of competition in the Mexico seaweed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico seaweed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico seaweed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico seaweed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)