Mexico Reverse Logistics Market Size, Share, Trends and Forecast by Return Type, Service, End User, and Region, 2026-2034

Mexico Reverse Logistics Market Overview:

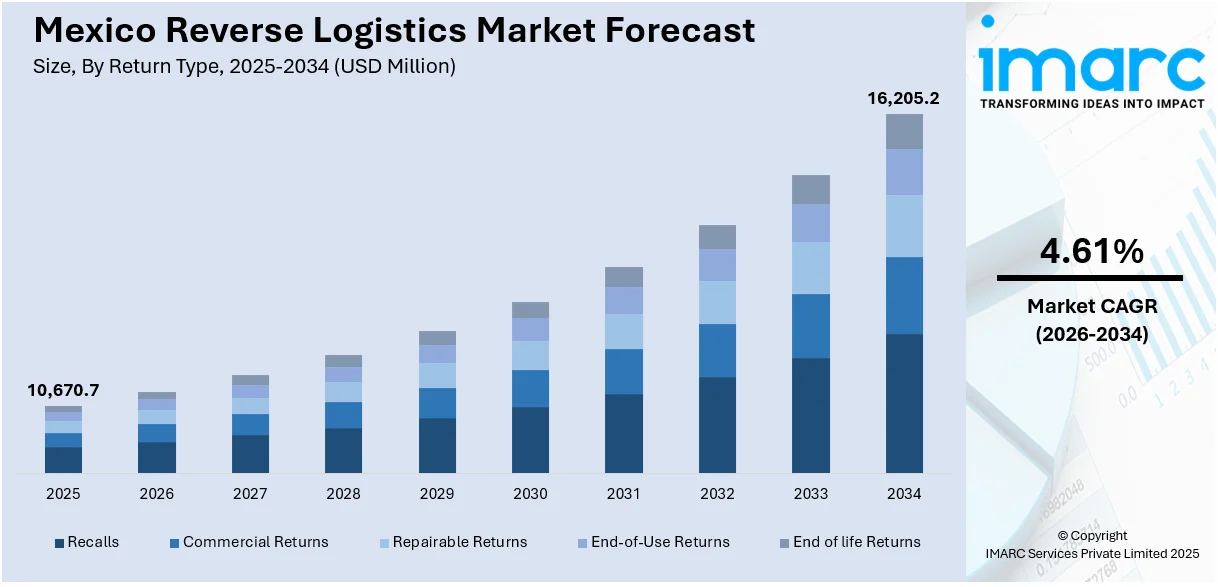

The Mexico reverse logistics market size reached USD 10,670.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 16,205.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.61% during 2026-2034. The market is growing, driven by e-commerce expansion and increasing consumer returns. Additionally, the rising focus on efficiency, sustainability, and technological integration to manage returns, repairs, and recycling is impelling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10,670.7 Million |

| Market Forecast in 2034 | USD 16,205.2 Million |

| Market Growth Rate 2026-2034 | 4.61% |

Mexico Reverse Logistics Market Trends:

Nearshoring and Supply Chain Shifts Drive Growth

Mexico's expanding position as a nearshoring destination is a major force driving growth in its reverse logistics market. Businesses are increasingly bringing manufacturing functions to Mexico to lower the cost of shipping, shorten delivery time, and enhance supply chain resilience. This trend has created increased volumes of goods that need reverse logistics services such as returns, recycling, and refurbishment. The growth of businesses such as automobiles, electronics, and consumer durables also stimulates this demand because these industries generally handle intricate product life cycles and return procedures. Mexico's advantageous trade agreements, like the USMCA, also make seamless cross-border activity easier, as companies can manage product returns easily between North America and Mexico. Investment in infrastructure by the country, including new ports, rail networks, and distribution centers, also facilitates effective reverse logistics. Companies are implementing new warehouse management systems and logistics software to manage higher volumes of returns efficiently. These trends are likely to persist as companies look for cost-effective and environmentally friendly solutions to manage product lifecycles.

To get more information on this market Request Sample

Technology Integration Enhances Reverse Logistics Efficiency

Technological innovations are transforming the reverse logistics in Mexico, playing a major growth driver. Automation, artificial intelligence, and data analytics have made it easier to manage returns, lowering operational expenses and enhancing efficiency. Robotics, for instance, is being used more and more for sorting and handling returned products, while AI platforms optimize inventory levels and forecast return patterns for effective resource allocation. In addition, growth in digital platforms and IoT-based devices improves real-time tracking and transparency across the reverse logistics cycle. The technology allows companies to track product paths from return initiation to ultimate disposition, enhancing customer satisfaction and decreasing delays. Blockchain is also being increasingly used for improving security, guaranteeing product authenticity, and decreasing fraud opportunities in reverse transactions. The online shopping revolution has driven the need for quick, trustworthy, and hassle-free return solutions. To this end, companies are investing in intelligent technologies that help fulfill such expectations at optimal costs. Such technological trends not only fuel process efficiencies but also contribute to sustainability initiatives by making recycling processes efficient and minimizing wastage.

Mexico Reverse Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on return type, service, and end user.

Return Type Insights:

- Recalls

- Commercial Returns

- Repairable Returns

- End-of-Use Returns

- End of life Returns

The report has provided a detailed breakup and analysis of the market based on the return type. This includes recalls, commercial returns, repairable returns, end-of-use returns, and end of life returns.

Service Insights:

- Transportation

- Warehousing

- Reselling

- Replacement Management

- Refund Management Authorization

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes transportation, warehousing, reselling, replacement management, refund management authorization, and others.

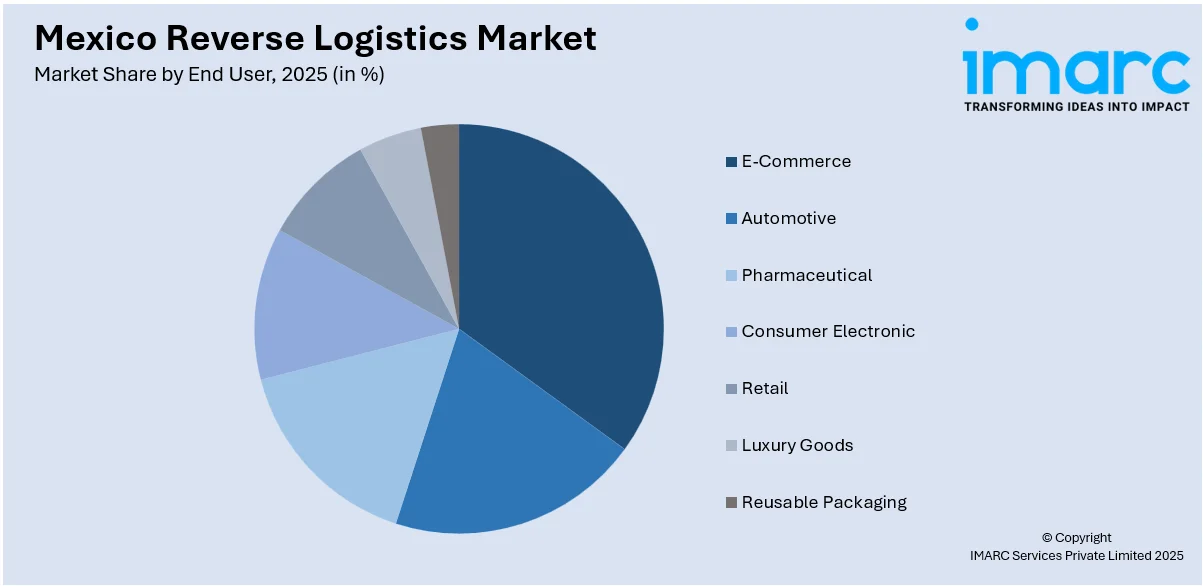

End User Insights:

Access the comprehensive market breakdown Request Sample

- E-Commerce

- Automotive

- Pharmaceutical

- Consumer Electronic

- Retail

- Luxury Goods

- Reusable Packaging

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes e-commerce, automotive, pharmaceutical, consumer electronic, retail, luxury goods, and reusable packaging.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Reverse Logistics Market News:

- June 2024: Ford initiated shipments from Mexico's Guaymas port to Chile, aiming to cut logistics costs by 30%. This move, part of a port revamp, enhanced reverse logistics efficiency, reducing supply chain expenses and boosting Mexico's role in global vehicle distribution.

- December 2023: Promologistics enhanced Mexico's reverse logistics industry by integrating advanced automation and technology. This development improved warehouse efficiency, streamlined returns, and boosted customer satisfaction. Their focus on sustainability and 4PL strategies further optimized supply chains, reducing costs and environmental impact.

Mexico Reverse Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Return Types Covered | Recalls, Commercial Returns, Repairable Returns, End-of-Use Returns, End of Life Returns |

| Services Covered | Transportation, Warehousing, Reselling, Replacement Management, Refund Management Authorization, Others |

| End Users Covered | E-commerce, Automotive, Pharmaceutical, Consumer Electronic, Retail, Luxury Goods, Reusable Packaging |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico reverse logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico reverse logistics market on the basis of return type?

- What is the breakup of the Mexico reverse logistics market on the basis of service?

- What is the breakup of the Mexico reverse logistics market on the basis of end user?

- What are the various stages in the value chain of the Mexico reverse logistics market?

- What are the key driving factors and challenges in the Mexico reverse logistics market?

- What is the structure of the Mexico reverse logistics market and who are the key players?

- What is the degree of competition in the Mexico reverse logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico reverse logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico reverse logistics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico reverse logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)