Mexico Recycled Plastics Market Size, Share, Trends and Forecast by Plastic Type, Raw Material, Application, and Region, 2025-2033

Mexico Recycled Plastics Market Overview:

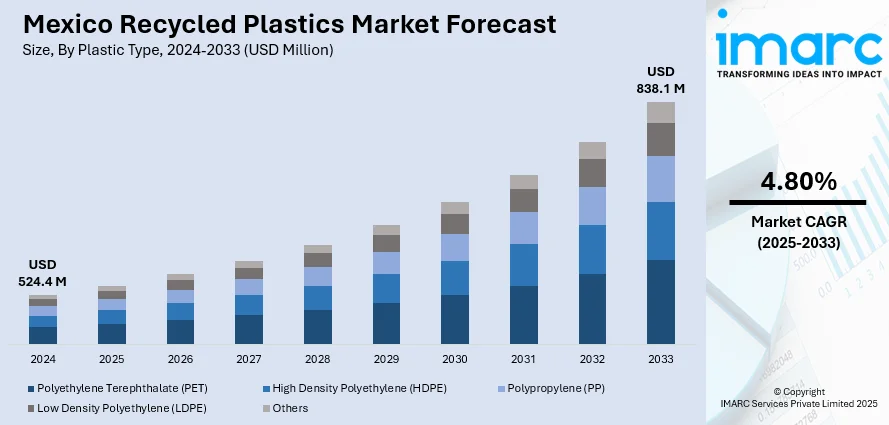

The Mexico recycled plastics market size reached USD 524.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 838.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market share is expanding, driven by the growing consciousness about the long-term effects of plastic pollution, along with increasing investments in large scale infrastructure projects across residential, commercial, and industrial segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 524.4 Million |

| Market Forecast in 2033 | USD 838.1 Million |

| Market Growth Rate 2025-2033 | 4.80% |

Mexico Recycled Plastics Market Trends:

Rising awareness about environmental sustainability

The growing awareness about environmental sustainability is offering a favorable Mexico recycled plastics market outlook. The country is witnessing a steady rise in plastic waste due to the increasing usage across the packaging, retail, and consumer goods sectors. According to industry reports, in 2024, Mexico produced 5.7 Million Tons of improperly handled plastic waste. This rising waste problem is encouraging greater focus on recycling initiatives and the employment of eco-friendly alternatives. Businesses aim to meet sustainability goals by incorporating recycled plastics into their manufacturing processes, which helps reduce their environmental impact. People are also becoming more selective, showing a preference for products made with sustainable materials. Educational campaigns and awareness programs are further boosting the importance of recycling in daily life. Government policies that support waste reduction and recycling are positively influencing the market, making it easier for companies to invest in recycled materials. Industries, such as construction, automotive, and textiles, are adopting recycled plastics more widely, seeing both environmental and economic benefits. As sustainability is becoming a key priority, the demand for recycled plastics is increasing, leading to innovations in recycling technology in Mexico.

Increasing construction activities

Rising construction activities are fueling Mexico recycled plastics market growth. As per industry reports, the construction sector in Mexico was projected to grow by 4.1% in 2024. As infrastructure projects are expanding across residential, commercial, and industrial segments, builders are adopting recycled plastics for applications like piping, insulation, panels, and roofing materials. These materials are lightweight, durable, and resistant to moisture, making them ideal for utilization in various construction environments. The construction sector looks for alternatives that lower environmental impact while meeting safety and performance standards, and recycled plastics fit this need efficiently. Their employment helps lower construction waste and overall project costs, making them attractive to contractors and developers. In urban areas, especially where space is limited, modular construction using plastic-based components is gaining popularity due to its ease of transport and installation. Additionally, government regulations promoting eco-friendly construction practices are also encouraging the inclusion of recycled content in building projects. As urban development is accelerating, the usage of sustainable construction materials is increasing. With the construction industry thriving steadily in Mexico, the demand for recycled plastics is rising, reinforcing their role in shaping modern and sustainable building practices across the country.

Mexico Recycled Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on plastic type, raw material, and application.

Plastic Type Insights:

- Polyethylene Terephthalate (PET)

- High Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- Others

The report has provided a detailed breakup and analysis of the market based on the plastic type. This includes polyethylene terephthalate (PET), high density polyethylene (HDPE), polypropylene (PP), low density polyethylene (LDPE), and others.

Raw Material Insights:

- Plastic Bottles

- Plastic Films

- Rigid Plastic and Foam

- Fibers

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plastic bottles, plastic films, rigid plastic and foam, fibers, and others.

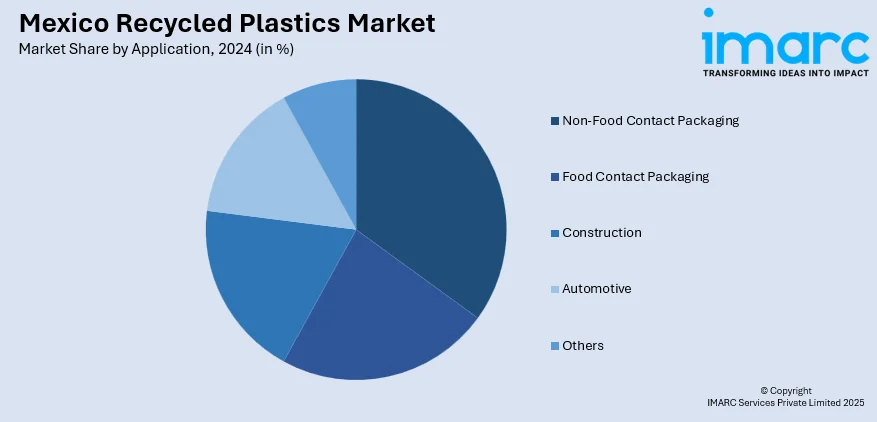

Application Insights:

- Non-Food Contact Packaging

- Food Contact Packaging

- Construction

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes non-food contact packaging, food contact packaging, construction, automotive, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Recycled Plastics Market News:

- In September 2024, IFC, part of the World Bank Group, teamed up with Greenback to enhance plastic recycling efforts in Mexico and Latin America. The project was intended to handle as much as 90,000 Tons of plastic waste each year, utilizing blockchain verification for traceability.

- In September 2024, Centre for Management Technology Private Limited (CMT) revealed the subjects and speakers for the 20th LAPET – Circular Plastics Packaging LATAM conference, set to be held in Mexico City on November 13-14. CMT stated that the two-day event was designed to offer participants insights into the new developments in the circular plastics value chain, updates on plastics recycling projects, technological progress in sorting, collection, and recycling, regulatory advancements, and additional subjects.

Mexico Recycled Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Plastic Types Covered | Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Others |

| Raw Materials Covered | Plastic Bottles, Plastic Films, Rigid Plastic and Foam, Fibers, Others |

| Applications Covered | Non-Food Contact Packaging, Food Contact Packaging, Construction, Automotive, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico recycled plastics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico recycled plastics market on the basis of plastic type?

- What is the breakup of the Mexico recycled plastics market on the basis of raw material?

- What is the breakup of the Mexico recycled plastics market on the basis of application?

- What is the breakup of the Mexico recycled plastics market on the basis of region?

- What are the various stages in the value chain of the Mexico recycled plastics market?

- What are the key driving factors and challenges in the Mexico recycled plastics market?

- What is the structure of the Mexico recycled plastics market and who are the key players?

- What is the degree of competition in the Mexico recycled plastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico recycled plastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico recycled plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico recycled plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)