Mexico Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Mexico Private Equity Market Size and Share:

The Mexico private equity market size reached USD 9.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.2 Billion by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. The market is expanding due to rising investor focus on fintech, digital retail, and industrial assets. Moreover, increased capital flows, regional tech adoption, and nearshoring opportunities are driving deal activity and shaping new investment strategies across multiple high-growth sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.4 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Market Growth Rate 2025-2033 | 8.40% |

Mexico Private Equity Market Trends:

Surge in Consumer Tech Investments

Mexico's private equity market has witnessed growing interest in consumer tech ventures, driven by rising digital adoption and shifting customer preferences across Latin America. Investors are now actively backing platforms that streamline traditional sectors like grocery and retail by leveraging technology to offer greater convenience and efficiency. This shift is reshaping how private equity firms approach portfolio diversification, with a clear move toward supporting scalable, tech-first models that meet evolving market needs. The increased appetite for innovation is also aligned with broader economic trends in the region, including the expansion of the middle class and a demand for better online consumer experiences. In October 2024, Jüsto secured USD 70 Million through a mix of equity and debt financing. The equity portion, led by General Atlantic, totaled USD 50 Million, while HSBC México arranged a USD 20 Million debt facility. This development signaled rising investor confidence in digital-first consumer models. Jüsto's ability to attract major global and regional capital highlighted the strength of Mexico's tech-driven retail sector. The move not only boosted the company's market position but also demonstrated the potential of private equity to accelerate transformation in high-frequency consumer categories across Latin America, making such investments attractive to global funds.

Growth of Fintech-Focused Capital

Private equity interest in Latin America's fintech landscape has accelerated, with Mexico at the center of this shift. The country's large, underbanked population and mobile-first user base have created a strong foundation for digital finance innovation. Investors are actively seeking companies that address financial inclusion, improve digital lending infrastructure, and introduce user-friendly mobile banking tools. This driver has helped redefine investment priorities, pushing capital toward companies with strong scalability and technological depth in financial services. The focus on fintech has also complemented public and private initiatives aimed at modernizing the country's financial ecosystem. In August 2024, Stori, a Mexican fintech unicorn, raised USD 212 Million in a combined equity and debt deal. The USD 105 Million equity portion was led by Notable Capital and BAI Capital, with participation from major global investors. Goldman Sachs and Davidson Kempner arranged USD 107 Million in debt. This marked a major step in private equity engagement with digital finance platforms. Stori used the funding to expand into new markets and enhance its digital offerings, particularly personal loans and deposit services. The investment reflected rising global interest in Mexico's fintech sector and helped reinforce the private equity market's role in promoting financial inclusion across Latin America.

Mexico Private Equity Market Segmentation:

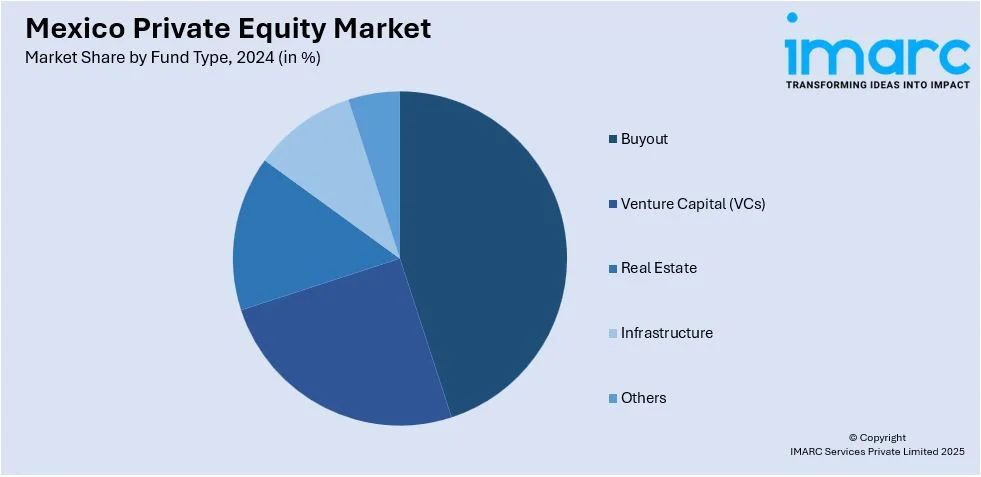

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fund type.

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Private Equity Market News:

- November 2024: IFC invested USD 30 Million in Nexxus Private Debt Fund II, targeting MXN4 billion, to boost SME financing in Mexico. This supported private equity sector growth by enhancing credit access, advancing nearshoring benefits, and strengthening local debt fund development through global institutional backing.

- September 2024: Ares Management acquired Walton Street Mexico, a real estate platform with USD 2.1 Billion in assets. The deal strengthened Mexico’s private equity industry by expanding global investment in industrial real estate and enhancing cross-border capabilities through integration with Ares’ global asset management network.

Mexico Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico private equity market on the basis of fund type?

- What are the various stages in the value chain of the Mexico private equity market?

- What are the key driving factors and challenges in the Mexico private equity market?

- What is the structure of the Mexico private equity market and who are the key players?

- What is the degree of competition in the Mexico private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico private equity market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)