Mexico Power Market Report by Generation Sources (Thermal, Hydro, Renewable, and Others), and Region 2026-2034

Mexico Power Market Size, Share & Trends

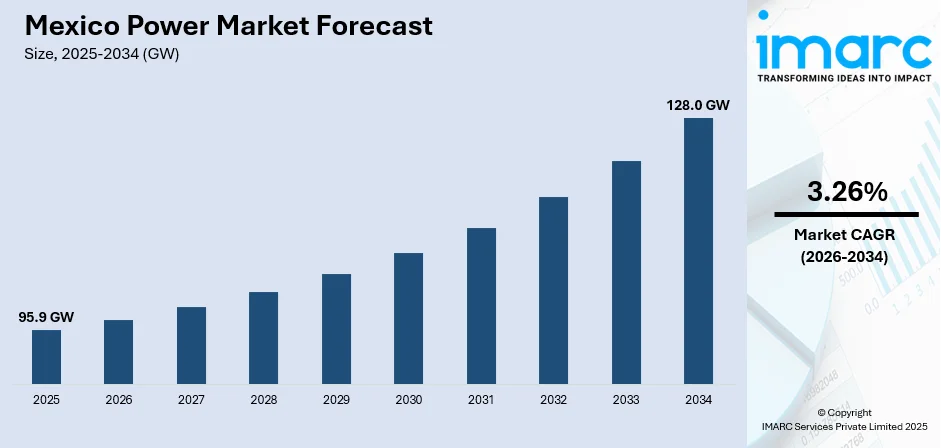

The Mexico power market size reached 95.9 GW in 2025. Looking forward, IMARC Group expects the market to reach 128.0 GW by 2034, exhibiting a growth rate (CAGR) of 3.26% during 2026-2034. The growing shift towards renewable energy sources, increasing adoption of advanced technologies, including smart meters, energy storage systems, and digital management platforms, and rising demand for sustainable energy options are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 95.9 GW |

| Market Forecast in 2034 | 128.0 GW |

| Market Growth Rate 2026-2034 | 3.26% |

Access the full market insights report Request Sample

Mexico Power Market Trends:

Growing Shift Towards Renewable Energy Sources

Mexico has considerable potential for solar, wind, geothermal, and hydroelectric power generation, which is being tapped to diversify the energy mix and enhance sustainability. The efforts of the governing body, such as issuing clean energy certificates and following ambitious renewable energy goals, are encouraging investments in renewable energy projects. Moreover, decreasing prices of sustainable energy technologies, along with the growing consciousness about the environment and the need to achieve worldwide climate targets, are speeding up the shift from fossil fuels. This change not only decreases the carbon footprint but also supports the goal of the country to develop a stronger and more varied energy network. In February 2024, Cubico Sustainable Investments grew its presence in Mexico's renewable energy sector to over 2.2GW through the purchase of Renantis Mexico and collaboration with Sowitec. These deals increased Cubico's development pipeline by over 1.6GW, which includes a minimum of 12 solar and hybrid projects in seven states. This expansion strengthened Cubico’s presence in Mexico’s renewable energy sector, complementing its existing projects like Mezquite and Solem 1 and 2.

To get more information on this market Request Sample

Technological Advancements and Innovation

The adoption of advanced technologies, including smart meters, energy storage systems, and digital management platforms, is enhancing the efficiency and reliability of power generation and distribution. These advancements improve grid control, lower operating expenses, and offer real-time information for enhanced decision-making. Cutting-edge technologies are facilitating the transition to decentralized energy systems, enabling individuals to produce and control their electricity through distributed generation solutions like rooftop solar panels. Additionally, advancements in energy storage technologies, such as batteries, are crucial for stabilizing the grid and ensuring a steady power supply, especially with the increasing share of intermittent renewable energy sources. In 2024, Enphase Energy introduced the IQ Battery 5P in Mexico, a modular home battery with a 5 kWh capacity. It can be combined with IQ8 Microinverters to increase energy production and management, assisting Mexico in transitioning to clean and resilient energy. The app enables homeowners to track and control energy usage, encouraging self-sufficiency and effective energy utilization.

Rising Demand for Cleaner Energy

Individuals and businesses in Mexico are looking for cleaner, more sustainable energy options due to higher environmental awareness. People are becoming more aware about their carbon footprint and are intentionally opting for renewable energy sources like solar and wind power instead of traditional fossil fuels. This change in user preferences is encouraging utility companies and energy providers to broaden their energy portfolios and incorporate more renewable sources. In addition, businesses are adopting sustainability goals, which include sourcing a notable portion of their energy from renewable sources to meet corporate social responsibility (CSR) commitments and to attract environmentally-conscious individuals. In 2024, Mexico City opened the largest solar power plant of its type in the world, situated on the roofs of the Central de Abasto market. The facility, equipped with 32,000 solar panels capable of producing 18 megawatts, is projected to produce 25 GWh of green energy each year, sufficient to supply electricity for 10,000 households and cut down on CO2 emissions by 11,400 tons. The 600 million pesos project aimed to improve sustainability and lower energy expenses within the city.

Mexico Power Market News:

- January 2024: GE Vernova and Iberdrola Mexico introduced the Topolobampo III power plant in Sinaloa, which utilizes GE's H-class combined cycle technology and produces 766 MW, sufficient for more than 1.6 million households. This project represents the initial implementation of GE’s 7HA.01 gas turbine technology in Mexico, aiming to assist the expansion of renewable energy through the provision of dependable and adaptable power generation.

- December 2023: Clir Renewables revealed a collaboration with Grupo México to enhance operations at the El Retiro Parque Eólico (74 MW) and Fenicias (175 MW) wind farms in Mexico. This collaboration aimed to provide Grupo México with better insights and transparency to support its renewable energy growth and meet the increasing demand for clean energy in Mexico.

Mexico Power Market Segmentation:

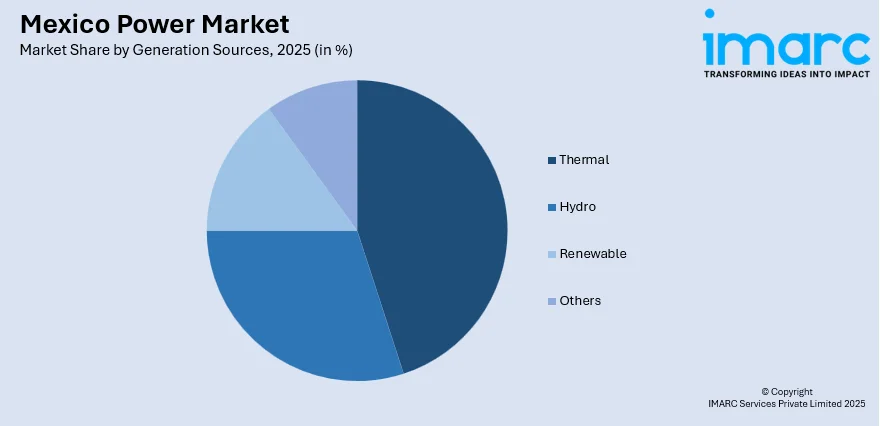

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on generation sources.

Generation Sources Insights:

To get detailed segment analysis of this market Request Sample

- Thermal

- Hydro

- Renewable

- Others

The report has provided a detailed breakup and analysis of the market based on the generation sources. This includes thermal, hydro, renewable, and others.

Regional Insights:

- Northern States

- Central States

- Southern States

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern States, Central States, and Southern States.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Generation Sources Covered | Thermal, Hydro, Renewable, Others |

| Regions Covered | Northern States, Central States, Southern States |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico power market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico power market on the basis of generation sources?

- What are the various stages in the value chain of the Mexico power market?

- What are the key driving factors and challenges in the Mexico power?

- What is the structure of the Mexico power market and who are the key players?

- What is the degree of competition in the Mexico power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico power market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)