Mexico Plastic Caps and Closure Market Size, Share, Trends and Forecast by Product Type, Raw Materials, Container Type, Technology, End Use, and Region, 2025-2033

Mexico Plastic Caps and Closure Market Overview:

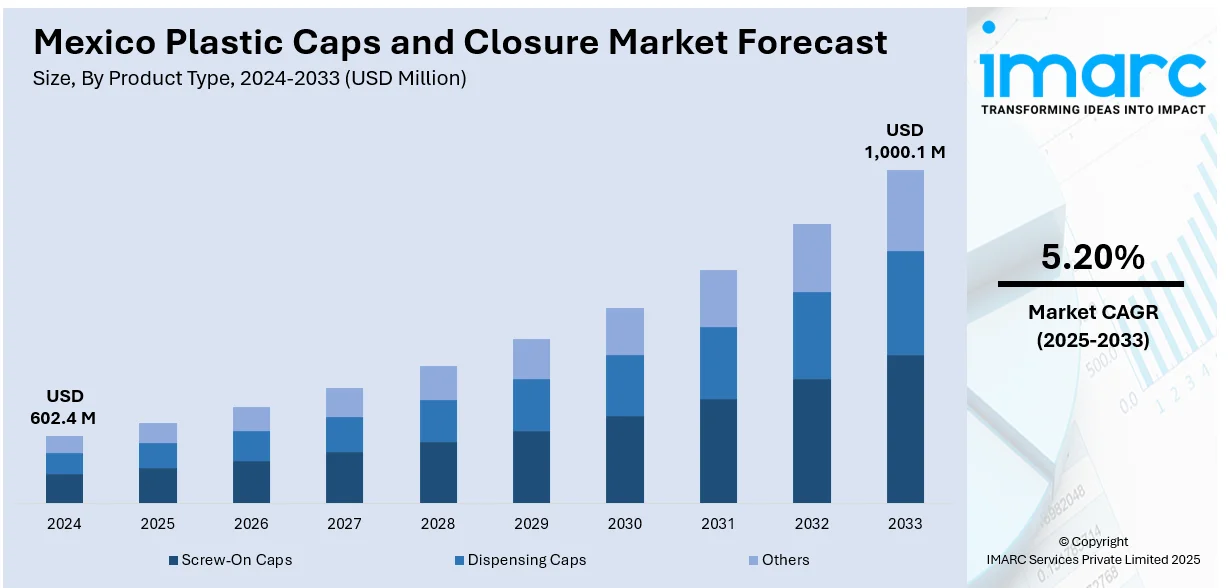

The Mexico plastic caps and closure market size reached USD 602.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,000.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. Growing demand for packaged foods and beverages, advancements in manufacturing technologies, increasing health consciousness among consumers, and a shift toward sustainable packaging solutions are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 602.4 Million |

| Market Forecast in 2033 | USD 1,000.1 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Plastic Caps and Closure Market Trends:

Consolidation Boosting Local Manufacturing Capabilities

In Mexico, the plastic caps and closures market is seeing increased consolidation, with strategic acquisitions enhancing production capacities and supply chain integration. Injection molding facilities dedicated to serving beverage clients are becoming central to scaling operations for larger packaging players. This shift is likely to bring more advanced manufacturing technologies, higher output efficiency, and stronger domestic supply support for fast-moving consumer goods brands. It also signals a broader move toward localization of production in Mexico, helping brands reduce import reliance and improve turnaround times. The increasing presence of global manufacturers through local entities is expected to drive competitive pricing, product innovation, and improved customization to meet client-specific demands across beverages, personal care, and food packaging segments. For example, in October 2024, FEMSA, Mexico’s leading Coca-Cola bottler, sold its plastics manufacturing division to AMMI, a subsidiary of global packaging leader Alpla. The deal includes injection molding facilities that supply caps and closures to beverage companies. This move marks a major consolidation in Mexico’s plastic caps and closures market, positioning AMMI to strengthen its local presence and scale operations to serve key FMCG players with advanced packaging solutions.

Expanding Dispensing Solutions in High-Growth Segments

Mexico is witnessing a rise in specialized closures catering to personal care, healthcare, and cosmetic applications. The growing need for precision dispensing systems, such as pumps and sprayers, is reshaping product portfolios and driving localized expansion of manufacturing and supply infrastructure. As consumer demand for hygienic, convenient, and aesthetically appealing packaging increases, more producers are focusing on high-quality dispensing closures that align with regulatory and brand-specific requirements. This shift supports better market coverage, faster delivery cycles, and stronger relationships with regional clients. Companies with global expertise are deepening their presence by enhancing technical capabilities within Mexico, creating a more responsive ecosystem for sectors that require performance-focused and customized plastic closure solutions across health, beauty, and wellness product categories. For instance, in August 2024, Silgan Holdings’ recent acquisition of Albéa’s dispensing business enhanced its footprint in the global closures market, including Mexico. The move strengthens Silgan’s offering in pumps, sprayers, and dispensing closures used in personal care and healthcare. With this deal, Silgan is expected to expand its supply capabilities in Mexico’s growing plastic caps and closures market, driven by demand from cosmetics, pharmaceuticals, and consumer packaging segments.

Mexico Plastic Caps and Closure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, raw materials, container type, technology, and end use.

Product Type Insights:

- Screw-On Caps

- Dispensing Caps

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes screw-on caps, dispensing caps, and others.

Raw Materials Insights:

- PET

- PP

- HDPE

- LDPE

- Others

A detailed breakup and analysis of the market based on the raw materials have also been provided in the report. This includes PET, PP, HDPE, LDPE, and others.

Container Type Insights:

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the container type. This includes plastic, glass, and others.

Technology Insights:

- Injection Molding

- Compression Molding

- Post-Mold Tamper-Evident Band

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes injection molding, compression molding, and post-mold tamper-evident band.

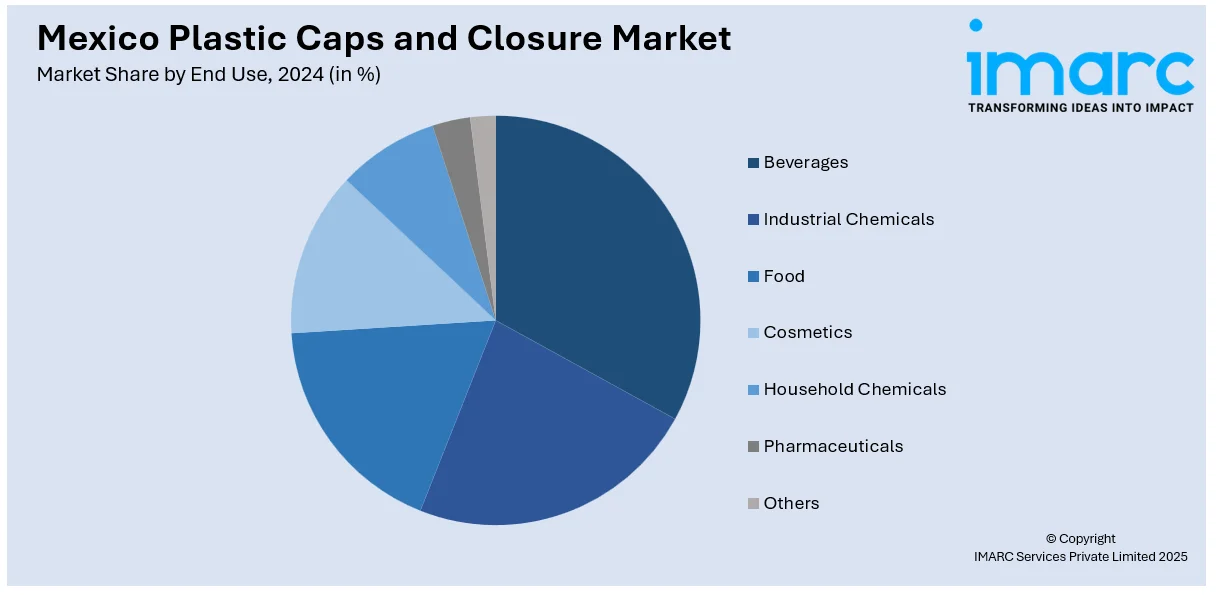

End Use Insights:

- Beverages

- Industrial Chemicals

- Food

- Cosmetics

- Household Chemicals

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes beverages, industrial chemicals, food, cosmetics, household chemicals, pharmaceuticals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Plastic Caps and Closure Market News:

- In January 2025, West Pharmaceutical Services introduced Daikyo PLASCAP RUV closures in a new nested format, targeting advanced therapies like cell and gene treatments. These metal-free polypropylene caps with integrated stoppers offer a one-step, press-fit solution for 13mm and 20mm vial crowns. The 6x8 nested tub configuration is compatible with West's 10 mL nested CZ vials and selected 20mm crown vials. This innovation aims to meet stringent regulatory requirements and enhance containment solutions.

- In March 2024, Corvaglia Group launched its first closure for aseptic carton packaging, expanding its product range beyond PET bottles. The innovation may influence the Mexico plastic caps and closures market as demand rises for hygienic, lightweight, and tamper-evident solutions in the beverage and dairy sectors. With Mexico’s aseptic packaging segment growing, Corvaglia’s entry into this space could spark competition and innovation in local closure manufacturing.

Mexico Plastic Caps and Closure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Screw-On Caps, Dispensing Caps, Others |

| Raw Materials Covered | PET, PP, HDPE, LDPE, Others |

| Container Types Covered | Plastic, Glass, Others |

| Technologies Covered | Injection Molding, Compression Molding, Post-Mold Tamper-Evident Band |

| End Uses Covered | Beverages, Industrial Chemicals, Food, Cosmetics, Household Chemicals, Pharmaceuticals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico plastic caps and closure market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico plastic caps and closure market on the basis of product type?

- What is the breakup of the Mexico plastic caps and closure market on the basis of raw materials?

- What is the breakup of the Mexico plastic caps and closure market on the basis of container type?

- What is the breakup of the Mexico plastic caps and closure market on the basis of technology?

- What is the breakup of the Mexico plastic caps and closure market on the basis of end use?

- What is the breakup of the Mexico plastic caps and closure market on the basis of region?

- What are the various stages in the value chain of the Mexico plastic caps and closure market?

- What are the key driving factors and challenges in the Mexico plastic caps and closure market?

- What is the structure of the Mexico plastic caps and closure market and who are the key players?

- What is the degree of competition in the Mexico plastic caps and closure market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico plastic caps and closure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico plastic caps and closure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico plastic caps and closure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)