Mexico Plant Based Food Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel, and Region, 2025-2033

Mexico Plant Based Food Market Overview:

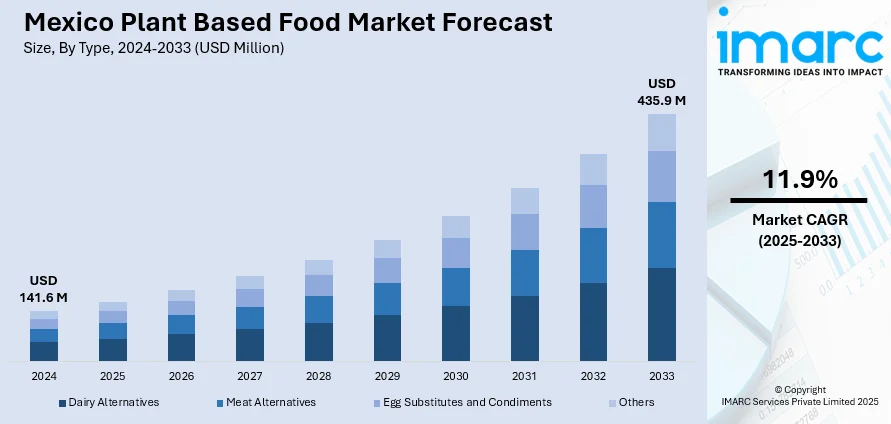

The Mexico plant based food market size reached USD 141.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 435.9 Million by 2033, exhibiting a growth rate (CAGR) of 11.9% during 2025-2033. The market share is expanding due to the rising number of vegans, the growing consumer desire for ethical and sustainable food options, the growing knowledge of the health advantages of plant-based diets, the diversification of products, and robust retail and e-commerce distribution networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 141.6 Million |

| Market Forecast in 2033 | USD 435.9 Million |

| Market Growth Rate 2025-2033 | 11.9% |

Mexico Plant Based Food Market Trends:

Rising Health and Environmental Consciousness Driving Adoption

In Mexico, an increasing number of consumers are transitioning towards plant-based foods due to growing health and environmental concerns. For instance, in an effort to lower greenhouse gas emissions and fight climate change, Mexico's recently elected president, Claudia Sheinbaum, revealed intentions on October 4, 2024, to see 45% of the nation's electricity generation come from renewable sources by 2030. The previous administration's emphasis on fossil fuels, which included spending more than USD 20 Billion on a new oil refinery, has significantly changed from this. The awareness surrounding the health benefits of plant-based diets, such as improved digestion, better weight management, and reduced risk of chronic illnesses, is becoming a key influencer in food choices. Additionally, the perception that plant-based food production is more environmentally sustainable is driving eco-conscious consumers to adopt greener dietary practices, which in turn is fostering the Mexico plant based food market growth. This shift is supported by media campaigns, celebrity endorsements, and broader lifestyle changes that favor holistic wellness and sustainable living. Plant-based food is now seen as not just a dietary preference but a conscious lifestyle choice that aligns with the values of health and environmental stewardship. As this awareness continues to spread across various consumer segments, the plant based food market in Mexico is witnessing increased visibility, acceptance, and long-term growth potential.

Product Innovations and Retail Expansion Accelerating Market Growth

The plant based food industry in Mexico is undergoing a dynamic transformation, driven by rapid product innovations and retail expansion. Food manufacturers are continually experimenting with new ingredients and flavors to cater to evolving consumer tastes, resulting in a diverse and appealing range of plant-based offerings. From dairy alternatives and meat substitutes to plant-based snacks and condiments, the market is seeing an influx of high-quality, consumer-friendly products. Moreover, retailers—both physical stores and online platforms—are dedicating more shelf space and visibility to plant-based options, making them more accessible than ever. The growing availability of these products across supermarkets, specialty stores, and digital marketplaces is significantly boosting consumer adoption, which is positively influencing Mexico plant based food market outlook. The increased investment in packaging, manufacturing, marketing, and branding has also helped reshape the perception of plant-based foods from niche to mainstream. This widespread availability and variety are instrumental in making plant-based food a staple in modern Mexican households.

Mexico Plant Based Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, source, and distribution channel.

Type Insights:

- Dairy Alternatives

- Meat Alternatives

- Egg Substitutes and Condiments

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dairy alternatives, meat alternatives, egg substitutes and condiments, and others.

Source Insights:

- Soy

- Almond

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes soy, almond, wheat, and others.

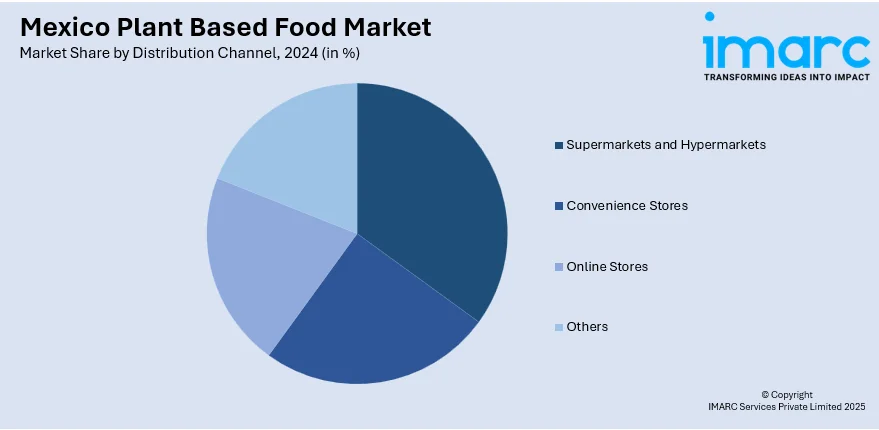

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Plant Based Food Market News:

- On October 2024, NotCo, a plant-based food company, announced the development of a product called NotBurgers that are indistinguishable from real burgers. The company tested these plant-based burgers in Hdalgo, Mexico. This launch is anticipated to gain widespread popularity among consumers helping augment the overall Mexico plant based food market share.

Mexico Plant Based Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Alternatives, Meat Alternatives, Egg Substitutes and Condiments, Others |

| Sources Covered | Soy, Almond, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico plant based food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico plant based food market on the basis of type?

- What is the breakup of the Mexico plant based food market on the basis of source?

- What is the breakup of the Mexico plant based food market on the basis of distribution channel?

- What is the breakup of the Mexico plant based food market on the basis of region?

- What are the various stages in the value chain of the Mexico plant based food market?

- What are the key driving factors and challenges in the Mexico plant based food market?

- What is the structure of the Mexico plant based food market and who are the key players?

- What is the degree of competition in the Mexico plant based food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico plant based food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico plant based food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico plant based food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)