Mexico Pharmaceuticals Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Mexico Pharmaceuticals Market Overview:

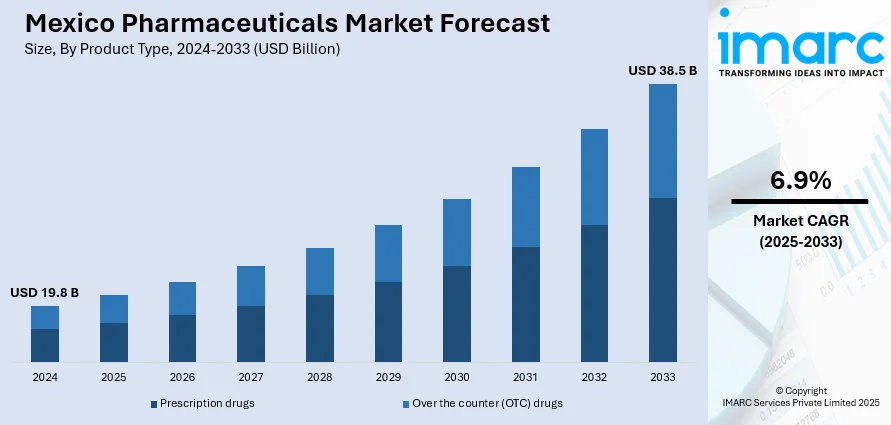

The Mexico pharmaceuticals market size reached USD 19.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.9% during 2025-2033. The market is driven by factors such as an aging population, increasing prevalence of chronic diseases, government initiatives to improve healthcare infrastructure, and foreign investments spurred by trade agreements like the USMCA, which enhances intellectual property protections and data exclusivity for pharmaceutical products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.8 Billion |

| Market Forecast in 2033 | USD 38.5 Billion |

| Market Growth Rate 2025-2033 | 6.9% |

Mexico Pharmaceuticals Market Trends:

Expansion of Healthcare Infrastructure

Mexico is investing in the expansion and modernization of its healthcare infrastructure to meet the growing demands of its population, thus creating a positive Mexico pharmaceuticals market outlook. This includes the construction of new clinics, hospitals, and research facilities, as well as the implementation of advanced healthcare technologies. Improved infrastructure enhances the capacity to deliver medical services and ensures better access to pharmaceutical products across urban and rural areas. The development of healthcare infrastructure also supports clinical research and the adoption of innovative treatments, contributing to the diversification and growth of the pharmaceutical market. These advancements are essential for addressing public health challenges and improving overall healthcare outcomes. For instance, in April 2025, Mexico's Ministry of Health (SSA) launched a new public platform designed to improve transparency in the procurement and distribution of pharmaceuticals and medical supplies. The platform, introduced by Eduardo Clark, Deputy Minister for Sectoral Integration and Coordination of Medical Care Services, enables citizens to monitor essential healthcare resources, such as medications, their quantities, prices, and providers.

Aging Population and Rising Chronic Diseases

Mexico's demographic landscape is shifting, with an increasing proportion of the population entering older age brackets. This aging trend correlates with a higher prevalence of chronic diseases like hypertension, diabetes, and cardiovascular conditions, which is fueling the Mexico pharmaceuticals market share. As these health issues require ongoing medical management, there's a growing demand for pharmaceutical products to address them. The need for long-term medication regimens and specialized treatments is expanding the market for both generic and branded drugs. Healthcare providers and policymakers focus on improving access to essential medications to manage these chronic conditions effectively, thereby driving growth in the pharmaceutical sector. For instance, in March 2025, Eli Lilly (LLY.N) intends to introduce its highly popular diabetes and weight-loss medication in key emerging markets such as India, Brazil, and Mexico during the latter half of 2025 as production capacity expands, stated its finance chief on Monday. Worldwide demand for diabetes and weight-loss medications from Lilly and Danish competitor Novo Nordisk (NOVOb.CO) has been remarkable. The recent introductions offer a significant market potential since they are among the most populated nations experiencing rising obesity levels. Healthcare providers and policymakers focus on improving access to essential medications to manage these chronic conditions effectively, which is further driving the Mexico pharmaceuticals market growth.

Mexico Pharmaceuticals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Prescription drugs

- Branded Drugs

- Generic Drugs

- Over the counter (OTC) drugs

The report has provided a detailed breakup and analysis of the market based on the product type. This includes prescription drugs (branded drugs and generic drugs) and over the counter (OTC) drugs.

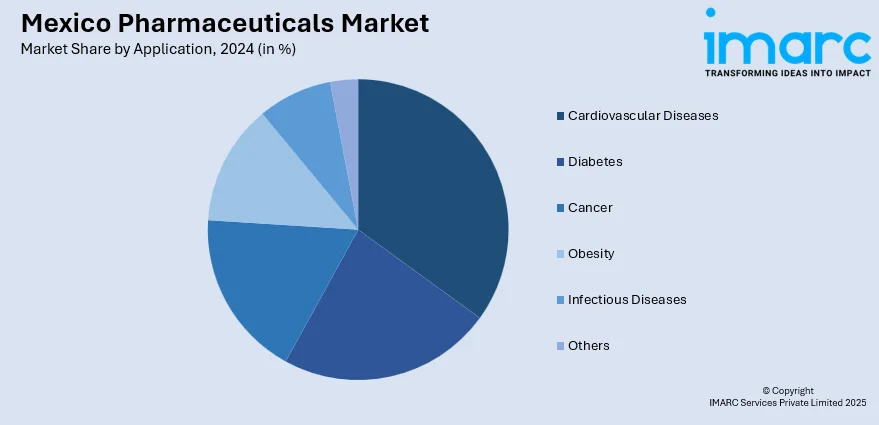

Application Insights:

- Cardiovascular Diseases

- Diabetes

- Cancer

- Obesity

- Infectious Diseases

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiovascular diseases, diabetes, cancer, obesity, infectious diseases, and others.

Distribution Channel Insights:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacy, retail pharmacy, and online pharmacy.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pharmaceuticals Market News:

- In March 2025, Knight Therapeutics Inc., a specialty pharmaceutical firm operating across the Americas (excluding the US), revealed the introduction of Minjuvi® (tafasitamab) by its Mexican branch, Grupo Biotoscana de Especialidad S.A. de C.V. Minjuvi® used with lenalidomide, and then as a standalone treatment, is approved for adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who cannot undergo autologous stem cell transplantation (ASCT).

- In April 2025, Hanmi Pharmaceutical's combination treatment for Obstructive Prostatic Growth (OPG) resulting from Benign Prostatic Hyperplasia (BPH) and Erectile Dysfunction (ED), Gugutams, launched in Mexico under the brand name "Aditams."

Mexico Pharmaceuticals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Cardiovascular Diseases, Diabetes, Cancer, Obesity, Infectious Diseases, Others |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pharmaceuticals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pharmaceuticals market on the basis of product type?

- What is the breakup of the Mexico pharmaceuticals market on the basis of application?

- What is the breakup of the Mexico pharmaceuticals market on the basis of distribution channel?

- What is the breakup of the Mexico pharmaceuticals market on the basis of region?

- What are the various stages in the value chain of the Mexico pharmaceuticals market?

- What are the key driving factors and challenges in the Mexico pharmaceuticals market?

- What is the structure of the Mexico pharmaceuticals market and who are the key players?

- What is the degree of competition in the Mexico pharmaceuticals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pharmaceuticals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pharmaceuticals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pharmaceuticals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)