Mexico On-the-go Healthy Snacks Market Size, Share, Trends and Forecast by Product Type, Nutritional Content, Packaging Type, Distribution Channel, and Region, 2025-2033

Mexico On-the-go Healthy Snacks Market Overview:

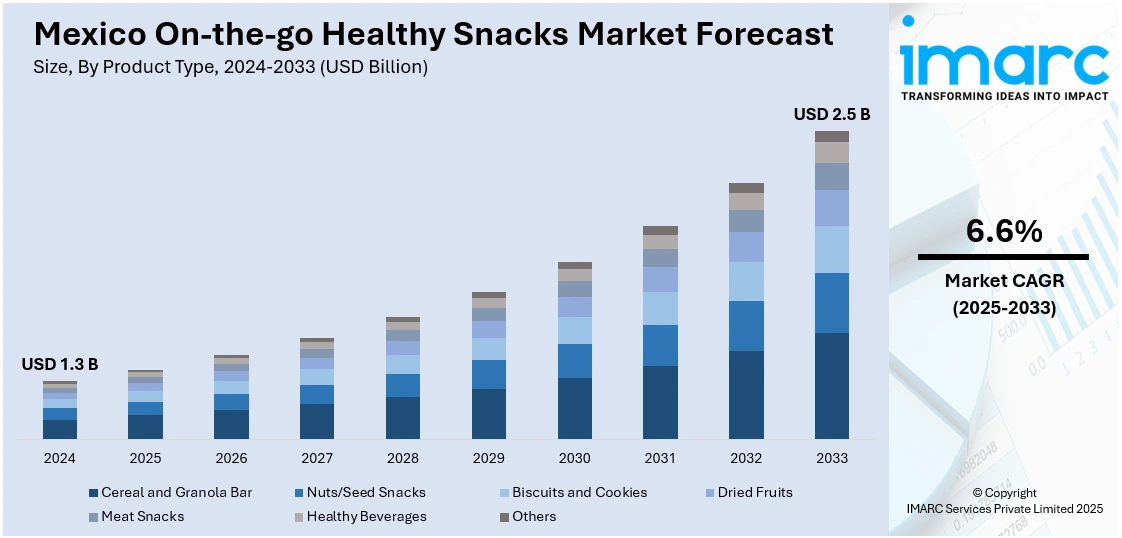

The Mexico on-the-go healthy snacks market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033. The market is growing due to rising urban health awareness, demand for clean-label and plant-based products, and busy lifestyles. Moreover, product innovation, retail expansion, and increasing focus on nutrition and convenience, are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate 2025-2033 | 6.6% |

Mexico On-the-go Healthy Snacks Market Trends:

Growing Health Awareness Among Urban Consumers

Growing health awareness among Mexico’s urban population is a key driver reshaping snack consumption habits. This shift is significantly contributing to Mexico on-the-go healthy snacks market growth, as consumers increasingly prioritize convenience without compromising on nutrition. With a rising focus on fitness, weight management, and preventive health, there’s growing demand for snacks that are low in calories, high in protein, and enriched with functional ingredients like fiber, vitamins, and antioxidants. Young professionals, students, and health-conscious families are actively seeking alternatives to traditional high-fat, high-sugar options. Brands are responding with a variety of better-for-you products, including energy bars, protein-packed bites, and portion-controlled packs that cater to these evolving preferences. Public health campaigns and digital wellness content are further amplifying awareness. As clean eating becomes a lifestyle choice rather than a trend, this consumer shift is expected to boost Mexico on-the-go healthy snacks market share.

Shift Toward Natural and Clean-Label Products

The demand for natural and clean-label snacks is gaining strong momentum in Mexico, as consumers become more ingredient-conscious and cautious about what they eat. Shoppers are increasingly reading nutrition labels and avoiding products that contain artificial flavors, preservatives, colors, or excessive sugars. This trend reflects a broader lifestyle shift toward wellness and transparency, especially among younger and urban demographics who associate clean-label products with quality and trust. Snack makers are adapting by launching options made with whole food ingredients such as nuts, seeds, dried fruits, oats, and natural sweeteners like agave or honey. The appeal of simplicity and authenticity is also driving packaging innovations that highlight clean ingredient lists prominently. As a result, natural and minimally processed snack lines are not only growing in number but are also taking up more shelf space in both modern trade and online retail channels across Mexico.

Expansion of Plant-Based Offerings

The rise in plant-based lifestyles across Mexico is fueling the expansion of vegan and plant-forward snack offerings. Health-conscious consumers, especially Millennials and Gen Z, are increasingly seeking snacks made without animal products, driven by concerns around wellness, sustainability, and animal welfare. This shift is pushing demand for snacks like nut and seed mixes, fruit-based bites, lentil chips, and chickpea puffs that provide clean energy, fiber, and protein. Many of these products also cater to gluten-free and allergen-free preferences, adding to their appeal. Domestic and international brands are capitalizing on this trend by developing innovative flavors and formats using locally relevant ingredients such as amaranth, chia, and tropical fruits. These plant-based options are widely accessible across supermarkets, organic stores, and e-commerce platforms. Their growing popularity and diverse availability create a positive Mexico on-the-go healthy snacks market outlook.

Mexico On-the-go Healthy Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, nutritional content, packaging type, and distribution channel.

Product Type Insights:

- Cereal and Granola Bar

- Nuts/Seed Snacks

- Biscuits and Cookies

- Dried Fruits

- Meat Snacks

- Healthy Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cereal and granola bar, nuts/seed snacks, biscuits and cookies, dried fruits, meat snacks, healthy beverages, and others.

Nutritional Content Insights:

- Gluten-Free

- Low-Fat

- Sugar-Free

- Others

A detailed breakup and analysis of the market based on the nutritional content have also been provided in the report. This includes gluten-free, low-fat, sugar-free, and others.

Packaging Type Insights:

- Boxes

- Pouches

- Wraps

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes boxes, pouches, wraps, and others.

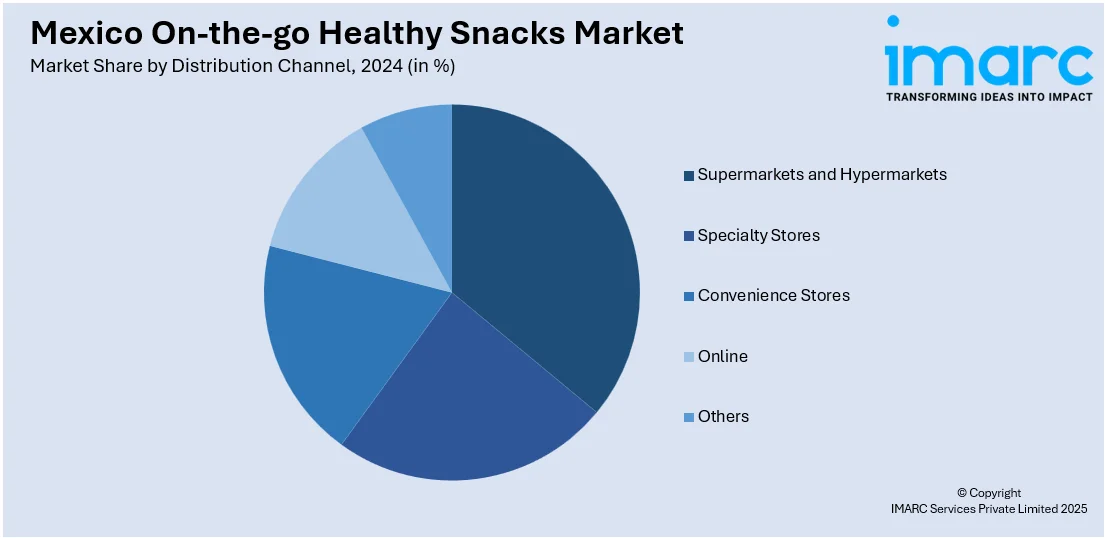

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico On-the-go Healthy Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cereal and Granola Bar, Nuts/Seed Snacks, Biscuits and Cookies, Dried Fruits, Meat Snacks, Healthy Beverages, Others |

| Nutritional Contents Covered | Gluten-Free, Low-Fat, Sugar-Free, Others |

| Packaging Types Covered | Boxes, Pouches, Wraps, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico on-the-go healthy snacks market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico on-the-go healthy snacks market on the basis of product type?

- What is the breakup of the Mexico on-the-go healthy snacks market on the basis of nutritional content?

- What is the breakup of the Mexico on-the-go healthy snacks market on the basis of packaging type?

- What is the breakup of the Mexico on-the-go healthy snacks market on the basis of distribution channel?

- What is the breakup of the Mexico on-the-go healthy snacks market on the basis of region?

- What are the various stages in the value chain of the Mexico on-the-go healthy snacks market?

- What are the key driving factors and challenges in the Mexico on-the-go healthy snacks market?

- What is the structure of the Mexico on-the-go healthy snacks market and who are the key players?

- What is the degree of competition in the Mexico on-the-go healthy snacks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico on-the-go healthy snacks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico on-the-go healthy snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico on-the-go healthy snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)