Mexico Metal Casting Market Size, Share, Trends and Forecast by Process, Material Type, End Use, and Region, 2025-2033

Mexico Metal Casting Market Overview:

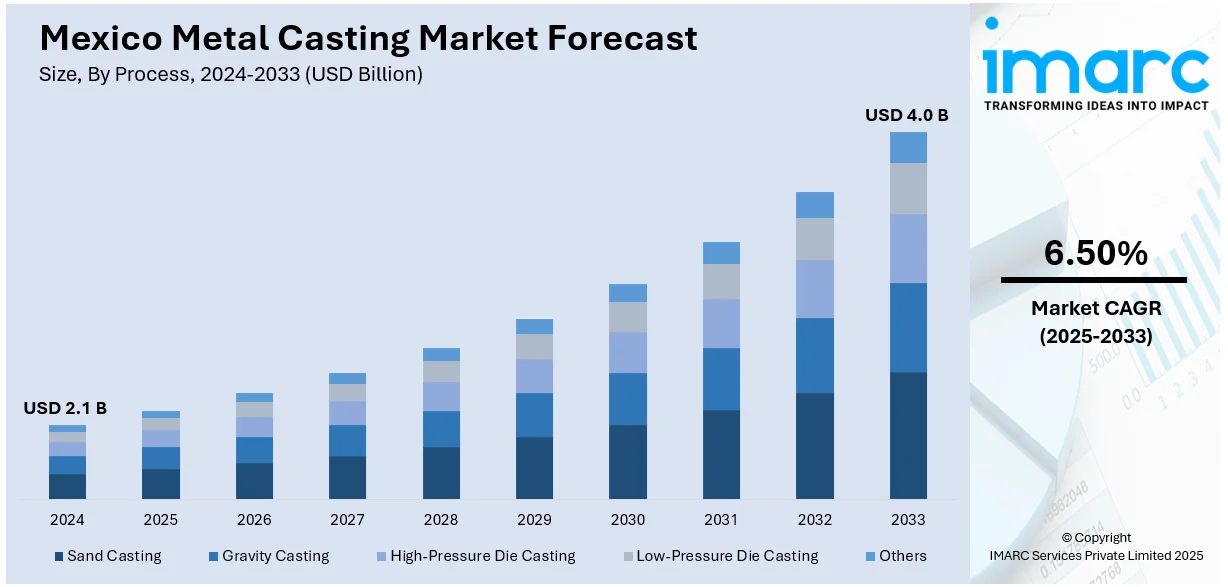

The Mexico metal casting market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is stimulating as a result of expanding production capacity and technological innovation, serving diverse industrial applications. The robust manufacturing infrastructure and skilled workforce drive its growth, making the industry a dominant force in global metal casting supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Market Growth Rate 2025-2033 | 6.50% |

Mexico Metal Casting Market Trends:

Adoption of Advanced Casting Technologies

Mexico metal casting market is going through a steady transition towards more advanced casting technologies like automation, simulation software, and precision tooling. For instance, in November 2023, Messe Düsseldorf announced GIFA Mexico established, in Mexico City, featuring metal casting technologies, leading machinery, and innovations for automotive, construction, and mechanical engineering sectors with participation from global industry. Moreover, these advances are helping foundries to boost production efficiency, minimize material wastage, and address the amplifying demand for high-performance parts. With manufacturers striving more towards weight reduction and intricate geometries, technologies like high-pressure die casting and low-pressure die casting are becoming increasingly popular. The trend holds special relevance to industries like motor vehicles and aeronautic, where reliability and consistent quality and dimensions are required. Further, incorporation of digital solutions to process control as well as monitoring is optimizing both large as well as mid-range foundry processes. Mexico metal casting market outlook shows an equally steady transformation away from conventional modes towards technology-supported systems that promises to make companies more competitive while improving quality outputs. This transformation is fostering the development for a more robust and technologically advanced casting environment in the country.

Rising Demand from Automotive and Transportation Sector

The auto and transportation industry continues to be one of the principal drivers of demand within Mexico's metal casting sector. As a leading center for vehicle assembly and component production in the country, foundries are more concentrated on delivering engine blocks, transmission housings, and suspension parts. For example, in March 2023, EUROGUSS MEXICO opened as a leading show for light metal casting, presenting cutting-edge die-casting technology, mega-casting innovations, and eco-friendly manufacturing technologies in Guadalajara. Furthermore, that effort is complemented by the increased pressure towards electric vehicles, which necessitate a different set of light-weight and heat-conductive metal components. Aluminum and magnesium alloys are gaining use as a result of their weight-to-strength benefits, a goal of the industry's lightweighting effort. The local production capabilities are also being extended to accommodate just-in-time delivery systems and eliminate dependency on foreign-made components. Mexico metal casting growth in this industry is indicative of greater regional integration with North American supply chains. Consequently, the integration between foundries and automotive OEMs is likely to intensify, generating long-term value through innovation and local manufacturing.

Diversification into Construction and Infrastructure Applications

Outside of the conventional manufacturing sectors, Mexico's metal casting sector is experiencing growing involvement in the construction and infrastructure markets. Cast items like pipes, fittings, brackets, and ornaments are being used in residential and commercial developments. As urbanization advances and public infrastructure projects increase, demand for cost-efficient and long-lasting metal components continues to grow. Foundries in Mexico are increasingly offering customized custom solutions and flexible production runs tailored to specialty and small-scale applications. Also, cast iron and steel materials continue to be used in wide application as they are strong and long lasting and hence appropriate for structural elements. The accelerating use of cast metals in city planning and utility installations underpin the Mexico metal casting share across non-industrial end uses. This trend also promotes innovation in alloy design and green practices, as the industry seeks to become aligned with national building standards and environmental objectives in an expanding infrastructure market.

Mexico Metal Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on process, material type, and end use.

Process Insights:

- Sand Casting

- Gravity Casting

- High-Pressure Die Casting

- Low-Pressure Die Casting

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes sand casting, gravity casting, high-pressure die casting, low-pressure die casting, and others.

Material Type Insights:

- Cast Iron

- Aluminum

- Steel

- Zinc

- Magnesium

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes cast iron, aluminum, steel, zinc, magnesium, and others.

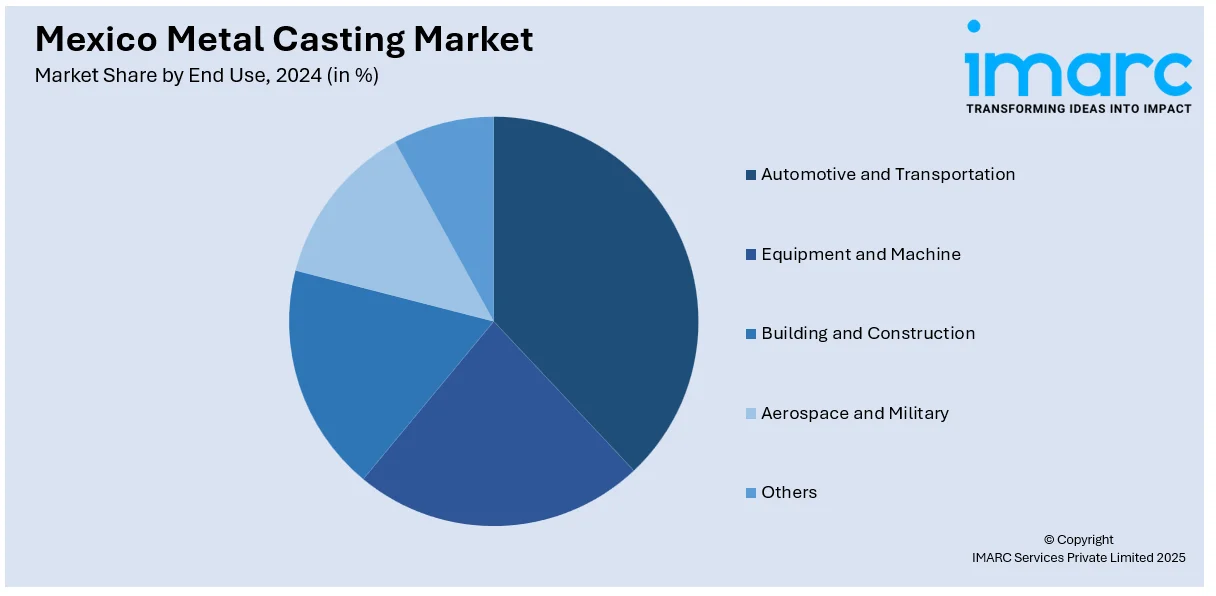

End Use Insights:

- Automotive and Transportation

- Equipment and Machine

- Building and Construction

- Aerospace and Military

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes automotive and transportation, equipment and machine, building and construction, aerospace and military, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metal Casting Market News:

- In January 2025, MAGMA Foundry Technologies, announced the launch of new office in San Pedro Garza García, fortifying its interest in Mexico's growing metal casting industry. The facility will enhance industry knowledge, facilitate digital foundry solutions, and further engage with local manufacturers as Mexico emerges as a regional casting innovation hub.

- In March 2023, Haitian installed almost 700 injection molding machines in Mexico, some of which were assembled at its Jalisco plant. As demand for high-pressure metal casting continues to rise, particularly from the EV industry, Haitian solidifies its presence in Mexico's casting machinery market, emerging as a dominant player in the country's shifting manufacturing landscape.

Mexico Metal Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Sand Casting, Gravity Casting, High-Pressure Die Casting, Low-Pressure Die Casting, Others |

| Material Types Covered | Cast Iron, Aluminum, Steel, Zinc, Magnesium, Others |

| End Uses Covered | Automotive and Transportation, Equipment and Machine, Building and Construction, Aerospace and Military, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metal casting market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metal casting market on the basis of process?

- What is the breakup of the Mexico metal casting market on the basis of material type?

- What is the breakup of the Mexico metal casting market on the basis of end use?

- What is the breakup of the Mexico metal casting market on the basis of region?

- What are the various stages in the value chain of the Mexico metal casting market?

- What are the key driving factors and challenges in the Mexico metal casting?

- What is the structure of the Mexico metal casting market and who are the key players?

- What is the degree of competition in the Mexico metal casting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metal casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metal casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metal casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)