Mexico Luxury Watch Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

Mexico Luxury Watch Market Overview:

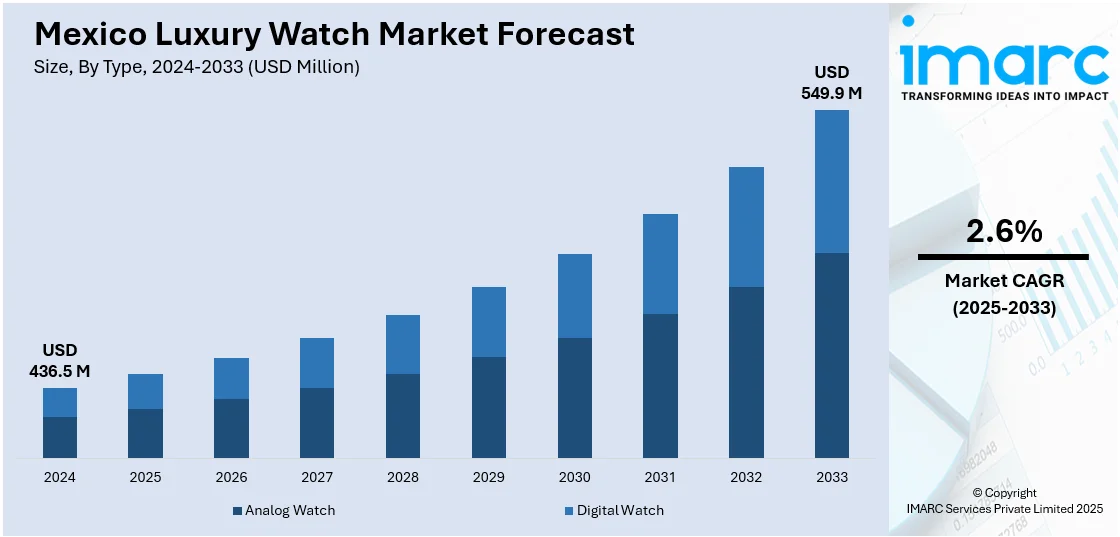

The Mexico luxury watch market size reached USD 436.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 549.9 Million by 2033, exhibiting a growth rate (CAGR) of 2.6% during 2025-2033. The market is driven by rising affluence among the middle and upper classes, increasing brand consciousness, and the appeal of luxury watches as status symbols and investments. Expanding digital platforms and retail presence further fuel demand for high-end timepieces.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 436.5 Million |

| Market Forecast in 2033 | USD 549.9 Million |

| Market Growth Rate 2025-2033 | 2.6% |

Mexico Luxury Watch Market Trends:

Rising Affluence and Middle-Class Expansion

Mexico’s growing economy has led to a steady rise in disposable income, particularly among the expanding middle and upper-middle classes. The improvement of financial stability leads customers to purchase luxury products such as premium watches. The emerging demographic uses luxury watches as tools to symbolize both their achievements and their living status. Younger professionals and entrepreneurs are also emerging as key buyers, fueling the Mexico luxury watch market share. Additionally, urbanization and access to global fashion trends have made aspirational luxury more accessible. With greater financial empowerment, a broader consumer base is now driving steady growth in the country’s premium watch market.

Brand Consciousness and Status Symbolism

In Mexico, brand consciousness has become a powerful consumer motivator, especially in fashion and lifestyle products. Luxury watches from iconic brands like Rolex, TAG Heuer, and Cartier are viewed as symbols of success, sophistication, and social prestige. Exposure to global media, celebrity endorsements, and social platforms has elevated the status value of luxury watches among aspirational buyers, driving the Mexico luxury watch market growth. This desire for brand prestige transcends functionality, making luxury timepieces a visible statement of achievement. As brand heritage and exclusivity grow more important to Mexican consumers, their purchasing decisions increasingly reflect lifestyle aspirations. This cultural shift significantly fuels demand across the luxury watch segment.

Expansion of Digital and Retail Channels

Digitalization has revolutionized luxury retail in Mexico, making premium watch brands more accessible than ever. E-commerce platforms now offer detailed product displays, secure payment options, and international shipping, attracting younger, tech-savvy consumers. Simultaneously, the expansion of physical retail, including flagship stores, brand-exclusive boutiques, and luxury shopping malls, provides in-person service and trust through certified retailers. This omnichannel approach enhances the brand experience and reaches both urban and regional customers, thereby creating a positive impact on the Mexico luxury watch market outlook. The presence of luxury watch brands in key Mexican cities like Mexico City, Guadalajara, and Monterrey is particularly influential in building customer relationships and boosting long-term market engagement.

Mexico Luxury Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, end user, and distribution channel.

Type Insights:

- Analog Watch

- Digital Watch

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog watch and digital watch.

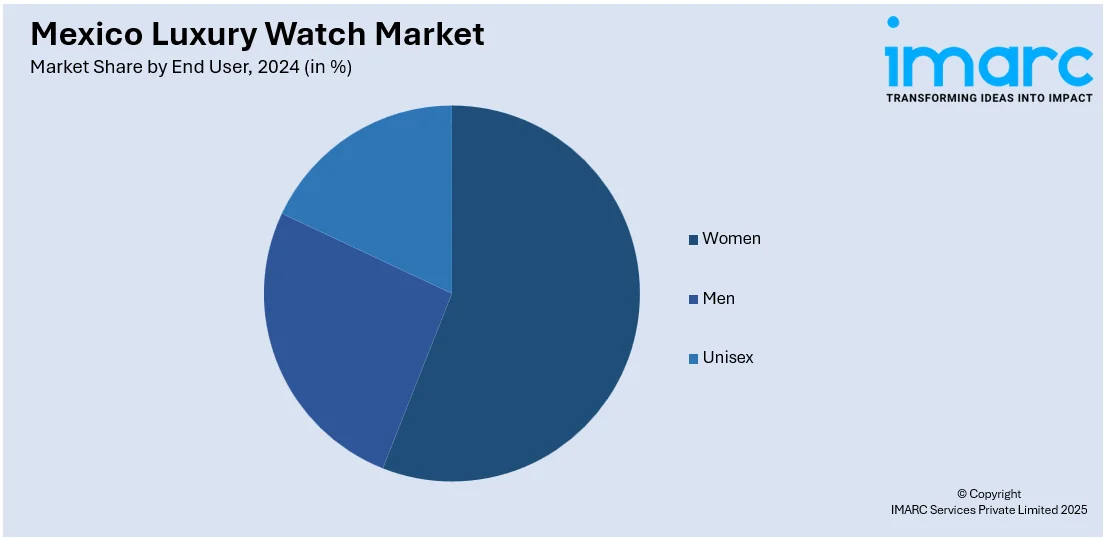

End User Insights:

- Women

- Men

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes women, men, and unisex.

Distribution Channel Insights:

- Online Stores

- Offline Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores and offline stores.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Luxury Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Watch, Digital Watch |

| End Users Covered | Women, Men, Unisex |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico luxury watch market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico luxury watch market on the basis of type?

- What is the breakup of the Mexico luxury watch market on the basis of end user?

- What is the breakup of the Mexico luxury watch market on the basis of distribution channel?

- What is the breakup of the Mexico luxury watch market on the basis of region?

- What are the various stages in the value chain of the Mexico luxury watch market?

- What are the key driving factors and challenges in the Mexico luxury watch market?

- What is the structure of the Mexico luxury watch market and who are the key players?

- What is the degree of competition in the Mexico luxury watch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico luxury watch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico luxury watch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico luxury watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)