Mexico Loan Servicing Software Market Report by Component (Software, Services), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End User (Banks, Credit Unions, Mortgage Lenders and Brokers, and Others), and Region 2026-2034

Market Overview:

Mexico loan servicing software market size reached USD 55.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 132.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.20% during 2026-2034. The inflating need for ensuring data security across financial institutions is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 55.5 Million |

|

Market Forecast in 2034

|

USD 132.9 Million |

| Market Growth Rate 2026-2034 | 10.20% |

Access the full market insights report Request Sample

Loan servicing software is designed to aid lenders in augmenting revenue, elevating customer satisfaction, streamlining portfolio management, and reducing operational costs. It caters to mortgage lenders, banks, and credit unions, enabling them to generate real-time and precise data analyses for setting prices and assessing the credit profiles of potential clients. Loan servicing software plays a pivotal role in automating and overseeing the entire loan lifecycle, encompassing origination, credit evaluations, payment processing, collections, accounting, and reporting. Additionally, it enhances workflow efficiency, enabling internal loan servicing, overseeing customer service operations, and minimizing errors and efforts in loan tracking and reconciliation. The software extends its capabilities to cover various types of loans, including mortgages, home equity, consumer, and business loans. As the integration of loan servicing software with payment gateways and accounting systems becomes more prevalent, it is witnessing a surge in demand, providing a comprehensive solution for both borrowers and lenders.

Mexico Loan Servicing Software Market Trends:

The Mexico loan servicing software market is experiencing substantial growth, propelled by key drivers. Firstly, the increasing need for financial institutions to enhance operational efficiency and reduce costs has led to the growing adoption of advanced loan servicing software. This trend is further underscored by the rising complexity of financial transactions, making streamlined and automated solutions increasingly essential for lenders. Moreover, as financial institutions expand their offerings and cater to a diverse clientele, there is a heightened requirement for enhanced software solutions that can efficiently manage and analyze complex loan portfolios. Additionally, the elevating integration of loan servicing software with emerging technologies like artificial intelligence and data analytics is reshaping the market landscape. These advancements empower lenders with real-time insights, risk assessment capabilities, and improved decision-making processes, also driving the demand for such software. Furthermore, regulatory changes and compliance requirements in the financial sector are encouraging institutions to invest in advanced loan servicing software, which is expected to fuel the market growth over the forecasted period.

Mexico Loan Servicing Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, deployment mode, enterprise size, and end user.

Component Insights:

To get detailed segment analysis of this market Request Sample

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

End User Insights:

- Banks

- Credit Unions

- Mortgage Lenders and Brokers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banks, credit unions, mortgage lenders and brokers, and others.

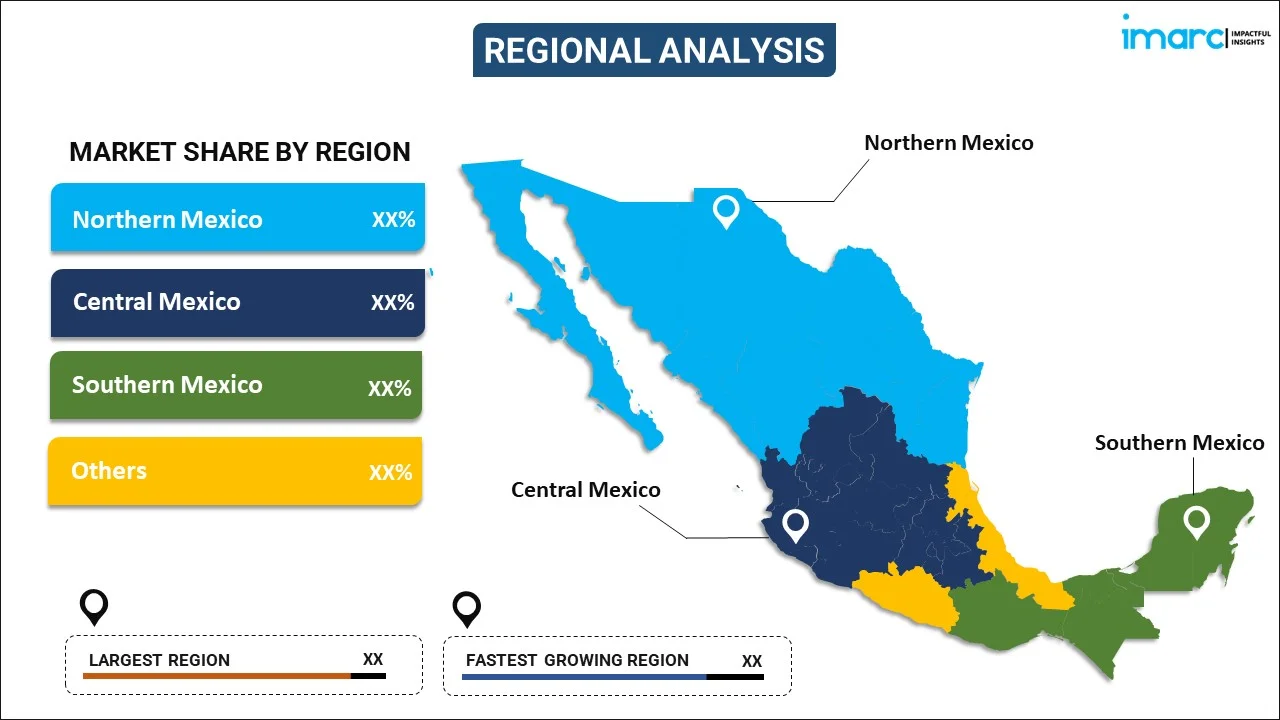

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Loan Servicing Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Users Covered | Banks, Credit Unions, Mortgage Lenders and Brokers, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico loan servicing software market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Mexico loan servicing software market?

- What is the breakup of the Mexico loan servicing software market on the basis of component?

- What is the breakup of the Mexico loan servicing software market on the basis of deployment mode?

- What is the breakup of the Mexico loan servicing software market on the basis of enterprise size?

- What is the breakup of the Mexico loan servicing software market on the basis of end user?

- What are the various stages in the value chain of the Mexico loan servicing software market?

- What are the key driving factors and challenges in the Mexico loan servicing software?

- What is the structure of the Mexico loan servicing software market and who are the key players?

- What is the degree of competition in the Mexico loan servicing software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico loan servicing software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico loan servicing software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico loan servicing software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)