Mexico Lithium-Ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033

Mexico Lithium-Ion Battery Market Overview:

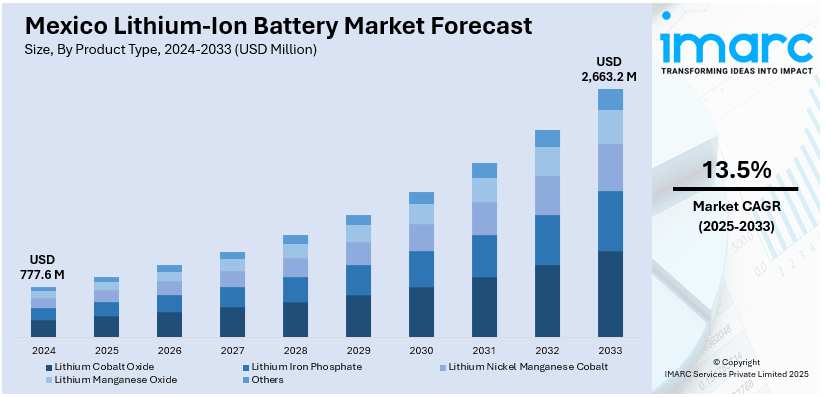

The Mexico lithium-ion battery market size reached USD 777.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,663.2 Million by 2033, exhibiting a growth rate (CAGR) of 13.5% during 2025-2033. The market is driven by rising electric vehicle adoption, growth in renewable energy storage, expanding electronics manufacturing, and government support for sustainable mobility. Strategic location near the U.S., growing lithium exploration activity, and increasing industrial electrification also contribute to demand for advanced battery technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 777.6 Million |

| Market Forecast in 2033 | USD 2,663.2 Million |

| Market Growth Rate 2025-2033 | 13.5% |

Mexico Lithium-Ion Battery Market Trends:

Emergence of Local Lithium Refining and Battery Manufacturing Initiatives

In response to the increasing strategic importance of lithium, Mexico is seeing early-stage development of domestic refining and battery manufacturing infrastructure. Projects in Sonora and other northern states are exploring lithium extraction and processing, aiming to establish a vertically integrated supply chain. Government-backed efforts, including the creation of state-owned company LitioMX, reflect the national agenda to secure and capitalize on lithium resources for domestic value creation. These initiatives are expected to reduce import reliance and attract international partnerships for technology transfer and investment. Although currently limited in output, these steps signal the country’s intent to become a regional player in battery materials and production. This trend could accelerate industrial participation and job creation in battery manufacturing clusters over the coming years. For instance, Cenntro Automotive México, a subsidiary of the U.S.-based Cenntro Electric Group, committed USD 200 Million over a three-year period through 2026 to set up a lithium-ion battery manufacturing plant in Nuevo León. The 10,436-square-meter facility was scheduled to begin operations in the second quarter of 2023. This investment aligns with Cenntro’s efforts to grow its electric vehicle distribution network in Mexico, focusing on government and commercial fleet segments.

Supply Chain Localization Driven by USMCA and Nearshoring

The United States-Mexico-Canada Agreement (USMCA) is influencing automakers and battery suppliers to localize lithium-ion battery production within North America. Mexico, with its strong automotive base, is benefiting from this shift through increased investment in battery pack assembly, module integration, and related logistics. Nearshoring strategies aim to mitigate risks associated with long supply chains and global disruptions, while also meeting regional content requirements for EV incentives. Tier-1 and Tier-2 suppliers are setting up operations in key industrial corridors such as Nuevo León and Guanajuato, often in proximity to major OEMs. This trend supports technology transfer, employment, and supply chain resilience, positioning Mexico as a competitive node in the North American battery ecosystem. For instance, in July 2024, Mexico and Buenos Aires signed a cooperation agreement to advance lithium value chain technologies through joint research. The deal, involving Litio para México (LitioMx) and Buenos Aires' CIC, focuses on lithium extraction from clay and aims to strengthen local capabilities. Supported by CAF and academic institutions like CONICET and Universidad Nacional de La Plata, the initiative includes developing a Renewable Energy Research Center.

Mexico Lithium-Ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt. lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

A detailed breakup and analysis of the market based on the power capacity have also been provided in the report. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

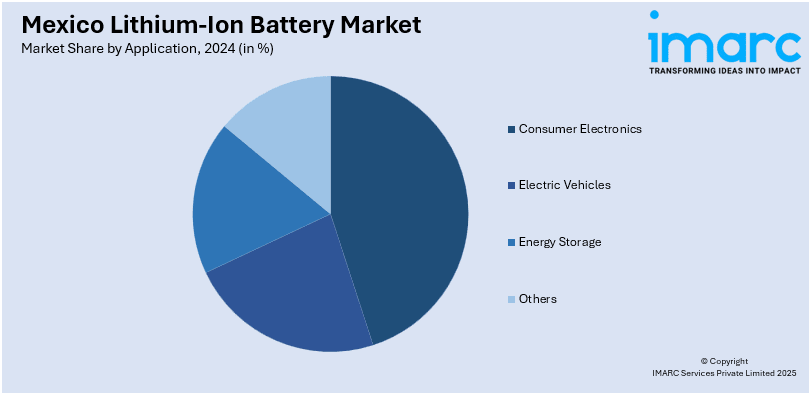

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Lithium-Ion Battery Market News:

- In May 2024, BMW Group began building a battery manufacturing facility next to its San Luis Potosí plant in Mexico to support production of its Neue Klasse electric vehicles starting in 2027. The battery project represents USD 540 Million of a total USD 855 Million investment. Additional upgrades include expanding the assembly and logistics areas by 10,000 sq.m and the body shop to 90,000 sq.m. This development aims to reduce transport emissions and localize EV battery production within North America’s growing electric mobility ecosystem.

- In June 2024, ErgoSolar announced a USD 10 Million investment to establish Mexico’s first lithium and sodium battery factory, likely in Puebla or Jalisco. The facility aims to support energy storage needs across industries like solar energy, telecom, healthcare, and manufacturing.

Mexico Lithium-Ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt. Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico lithium-ion battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico lithium-ion battery market on the basis of product type?

- What is the breakup of the Mexico lithium-ion battery market on the basis of power capacity?

- What is the breakup of the Mexico lithium-ion battery market on the basis of application?

- What are the various stages in the value chain of the Mexico lithium-ion battery market?

- What are the key driving factors and challenges in the Mexico lithium-ion battery market?

- What is the structure of the Mexico lithium-ion battery market and who are the key players?

- What is the degree of competition in the Mexico lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico lithium-ion battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)