Mexico Lighting Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Mexico Lighting Market Overview:

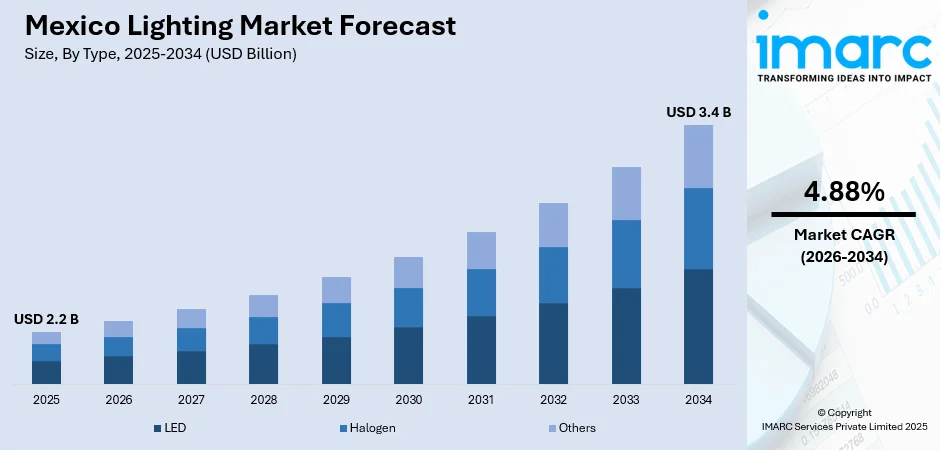

The Mexico lighting market size reached USD 2.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.88% during 2026-2034. Government-led energy efficiency initiatives and the increasing frequency of industry events are contributing to the growth of the market by promoting sustainable infrastructure, encouraging innovation, and creating platforms for collaboration, product showcasing, and market expansion across public and private sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.2 Billion |

| Market Forecast in 2034 | USD 3.4 Billion |

| Market Growth Rate 2026-2034 | 4.88% |

Access the full market insights report Request Sample

Mexico Lighting Market Trends:

Government Policies and Environmental Regulations

The lighting market in Mexico is experiencing consistent growth fueled by robust government efforts to encourage energy-efficient lighting solutions throughout urban and semi-urban areas. Different municipal agencies are progressively shifting from conventional sodium vapor lights to contemporary light-emitting diode (LED) systems, mainly to lower energy usage, decrease maintenance expenses, and enhance public safety. These lighting improvements not only aid in lowering carbon footprints but also correspond with Mexico’s wider sustainability objectives and energy efficiency initiatives. Public infrastructure projects, including roadways, public parks, and heritage sites, are emerging as key areas for implementing cutting-edge LED lighting technologies that provide enhanced visibility, superior color rendering, and extended operational lifetimes. Federal and state initiatives are also promoting public-private collaborations to update obsolete lighting systems. The transition is further supported by financial rewards, tax breaks, and technical assistance offered to municipalities that implement LED retrofitting initiatives. These efforts are gaining traction in medium-sized cities where budget constraints often limit large-scale modernization unless tangible cost savings can be demonstrated. As a result, the growing institutional demand for sustainable lighting solutions is broadening market prospects for lighting manufacturers, component providers, and system integrators in Mexico. In line with this trend, in 2024, Cree LED partnered with IDC Componentes and Ilumiled to upgrade downtown Santiago de Querétaro's lighting with energy-efficient 2200K LED technology. This upgrade replaced 1,600 sodium lamps, improving light uniformity and cutting energy usage by over 50%. The project was expected to save the city approximately $80,000 annually.

To get more information on this market Request Sample

Growing Number of Industry Events

Industry-focused exhibitions and expos are playing an increasingly important role in strengthening the growth of the lighting market in Mexico by fostering collaboration, knowledge-sharing, and business expansion. For example, the National Lighting Expo 2025 took place from April 8 to April 10, 2025, at the WTC in Mexico City. The event offered lighting professionals from various sectors an opportunity to network and expand their reach. Such events provide a centralized platform for manufacturers, designers, distributors, architects, and project developers to showcase innovations, explore new technologies, and discuss trends shaping the lighting landscape. Participation in such gatherings helps local and international companies understand regional preferences, regulatory expectations, and evolving demand across sectors like residential, commercial, industrial, and outdoor lighting. Networking at these events leads to strategic partnerships, product launches, and supply chain improvements, which in turn support faster market penetration and enhanced competitiveness. For emerging and mid-sized lighting firms, expos present an accessible route to connect with procurement decision-makers and build visibility in new regions within Mexico. They also serve as touchpoints for introducing energy-efficient solutions, smart lighting systems, and sustainable materials that meet the country’s growing focus on green infrastructure. Workshops, live demonstrations, and expert panels at these expos further encourage knowledge transfer and technical learning across stakeholders. As these events gain momentum and attendance grows, they are contributing to the development of a more cohesive, innovative, and commercially vibrant lighting ecosystem in Mexico.

Mexico Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- LED

- Halogen

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes LED, halogen, and others.

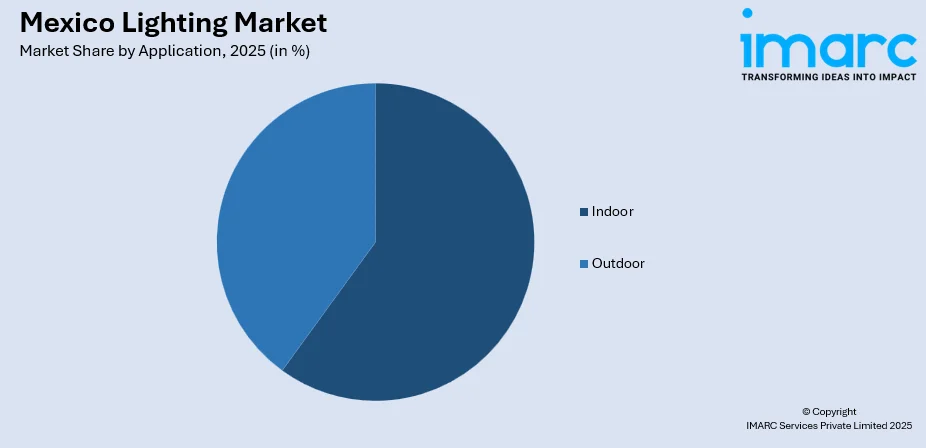

Application Insights:

To get detailed segment analysis of this market Request Sample

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes indoor and outdoor.

End User Insights:

- Residential

- Commercial

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, industrial, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Lighting Market News:

- In January 2025, DarkSky International launched a new Oil and Gas Industry Lighting Program, certifying three Franklin Mountain Energy (FME) sites in New Mexico as the first-ever DarkSky Certified oil and gas locations. The initiative promotes responsible outdoor lighting that reduces skyglow by up to 99% while maintaining operational safety.

- In September 2024, Japan's Koito Manufacturing announced a $234 million investment to expand its automotive lighting production in Mexico and Brazil. The new plant in Mexico was planned to increase output by 60% by April 2026.

Mexico Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | LED, Halogen, Others |

| Applications Covered | Indoor, Outdoor |

| End Users Covered | Residential, Commercial, Industrial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico lighting market on the basis of type?

- What is the breakup of the Mexico lighting market on the basis of application?

- What is the breakup of the Mexico lighting market on the basis of end user?

- What is the breakup of the Mexico lighting market on the basis of region?

- What are the various stages in the value chain of the Mexico lighting market?

- What are the key driving factors and challenges in the Mexico lighting market?

- What is the structure of the Mexico lighting market and who are the key players?

- What is the degree of competition in the Mexico lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico lighting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)