Mexico Implantable Medical Devices Market Size, Share, Trends and Forecast by Product Type, Material, End-User, and Region, 2025-2033

Mexico Implantable Medical Devices Market Overview:

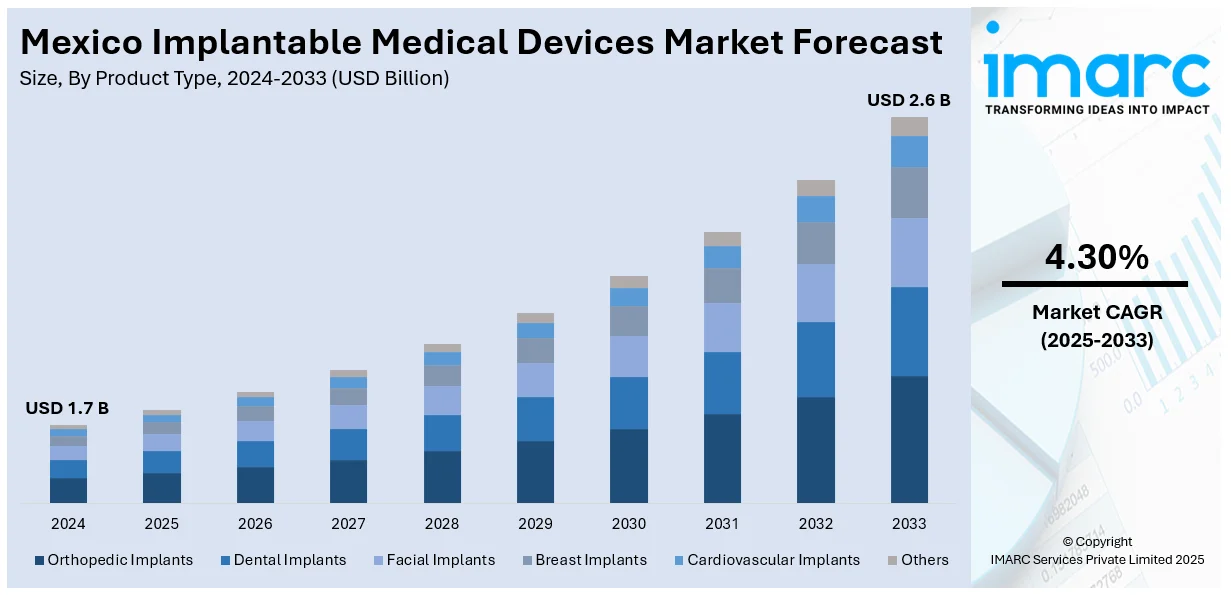

The Mexico implantable medical devices market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. Market drivers include growing demand for healthcare, technological advancements, expansion of the aging population, and growth in chronic diseases. The movement towards minimally invasive surgeries (MIS), personalized care, and the implementation of digital health technologies also increases the growth of the market, improving the care of patients.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Market Growth Rate 2025-2033 | 4.30% |

Mexico Implantable Medical Devices Market Trends:

Integration of Digital Technologies

The incorporation of digital technologies into the devices is one of the key trends in the Mexico implantable medical devices market outlook. Devices are getting smarter with enhanced features like wireless networking and real-time data monitoring as digital health grows. This allows healthcare professionals to remotely monitor patients, enhancing chronic condition management and postoperative care. Consequently, implantable devices not only improve in their basic performance but also give useful information through linked platforms. These developments allow physicians to make more informed choices, which results in enhanced patient outcomes, increased accuracy in treatments, and enhanced healthcare delivery throughout the nation.

Personalized Medicine and Customization

Personalized medicine, in which treatment regimens and devices are customized for each patient, is aiding the Mexico implantable medical devices market growth. The drive for customization has spurred the need for implantable medical devices that can be adapted to suit each patient's individual requirements. These include customized implants, prosthetics, and orthotics. Improvements in technologies like 3D printing have been at the forefront of this revolution, with the ability to create devices specifically tailored for the anatomy and health of a patient. Personalized devices provide increased comfort, greater functionality, and improved success in treatment, enabling patients to have better and tailored care.

Shift Toward Minimally Invasive Procedures

Minimally invasive surgical (MIS) procedures are gaining popularity in Mexico because of the benefits they have over traditional methods, which include quicker recovery, low risk of infection, and minimal body trauma. Therefore, there is increasing demand for implantable medical devices that aid in MIS, including robotic surgery systems, endoscopes, and laparoscopic equipment. These technologies enable surgeons to carry out precise surgeries using smaller incisions, which is particularly useful for patients as it facilitates easy post-surgery recovery. According to a 2024 report by the Mexican Association of Endoscopic Surgery, the adoption of MIS procedures in public and private hospitals has grown by over 35% in the past three years. The growing trend of less invasive techniques is compelling manufacturers to create more sophisticated, smaller, and more effective implantable devices, further increasing the Mexico implantable medical devices market outlook.

Mexico Implantable Medical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, material, and end-user.

Product Type Insights:

- Orthopedic Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Cardiovascular Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes orthopedic implants, dental implants, facial implants, breast implants, cardiovascular implants, and others.

Material Insights:

- Polymers

- Metals

- Ceramics

- Biologics

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes polymers, metals, ceramics, and biologics.

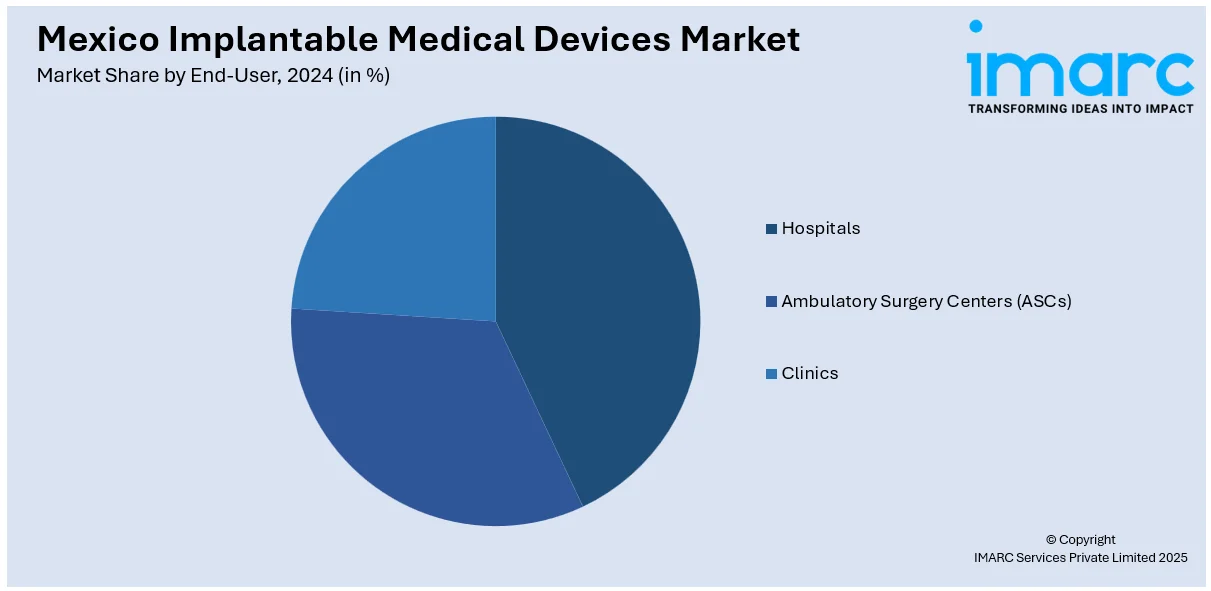

End-User Insights:

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Clinics

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes Hospitals, Ambulatory Surgery Centers (ASCs), and Clinics.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Implantable Medical Devices Market News:

- In April 2025, Mexico's Ministry of Health launched a public platform to enhance transparency in the purchase and distribution of medicines and medical supplies. The platform allows citizens to track medication volumes, costs, and suppliers, improving accountability. It also provides real-time updates on supply orders and vendor performance. The initiative aims to ensure better access to critical treatments and increase public oversight of the healthcare system.

- In March 2025, Boston Scientific announced an agreement to acquire SoniVie Ltd., a medical device company known for its TIVUS™ Intravascular Ultrasound System. The TIVUS system targets renal artery denervation (RDN) to treat hypertension by using ultrasound energy to denervate nerves surrounding blood vessels. This acquisition expands Boston Scientific's offerings in interventional cardiology, providing an alternative therapy for hypertension, with the potential for faster, more effective procedures.

Mexico Implantable Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Orthopedic Implants, Dental Implants, Facial Implants, Breast Implants, Cardiovascular Implants, Others |

| Materials Covered | Polymers, Metals, Ceramics, Biologics |

| End-Users Covered | Hospitals, Ambulatory Surgery Centers (ASCs), Clinics |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico implantable medical devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico implantable medical devices market on the basis of product?

- What is the breakup of the Mexico implantable medical devices market on the basis of material?

- What is the breakup of the Mexico implantable medical devices market on the basis of end-user?

- What is the breakup of the Mexico implantable medical devices market on the basis of region?

- What are the various stages in the value chain of the Mexico implantable medical devices market?

- What are the key driving factors and challenges in the Mexico implantable medical devices market?

- What is the structure of the Mexico implantable medical devices market and who are the key players?

- What is the degree of competition in the Mexico implantable medical devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico implantable medical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico implantable medical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico implantable medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)